Form 8300 Car Dealer

Form 8300 Car Dealer - Web the form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to the internal revenue service and the financial crimes. Web form 8300 compliance for car dealers. Web dealers must report to irs (using irs/fincen form 8300) the receipt of cash/cash equivalents in excess of $10,000 in a single transaction or two or more related. If you buy a car and do not get title at the time of the sale, or if agreed within 60. Web accordingly, when your dealership receives more than $10,000 in cash in one transaction or in two or more related transactions, you must report this by filing the. Dealerships can also call the irs criminal. Web for example, if an automobile dealership sells a car to a customer and receives cash payments from the customer, their mother, and their father, the dealership would: The equifax data breach what dealers should know. Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file form. I have never bought in cash, but made a car down payment for $10,000.

A notice was sent to me that said a. Web automotive dealers are required to file form 8300, report of cash payments over $10,000 received in a trade or business, with the irs when they receive more than $10,000 in. The equifax data breach what dealers should know. File form 8300 by the 15th day after the date the cash was received. If you buy a car and do not get title at the time of the sale, or if agreed within 60. Dealerships can also call the irs criminal. Web what does the irs do with forms 8300 they receive? Web who must file form 8300? Yes, the weekly lease or loan payments constitute payments on the same transaction (the leasing or purchase of the vehicle). A dealership doesn’t file form 8300 if a customer pays with a $7,000 wire transfer and a $4,000 cashier check.

File form 8300 by the 15th day after the date the cash was received. Web who must file form 8300? The equifax data breach what dealers should know. Yes, the weekly lease or loan payments constitute payments on the same transaction (the leasing or purchase of the vehicle). Web form 8300 compliance for car dealers any business or person that receives over $10,000 in cash as part of business transaction must complete a document called form 8300. Any business or person that receives over $10,000 in cash as part of business transaction must complete a document called. If you buy a car and do not get title at the time of the sale, or if agreed within 60. A dealership doesn’t file form 8300 if a customer pays with a $7,000 wire transfer and a $4,000 cashier check. If that date falls on a saturday, sunday, or legal holiday, file the form on the next business day. The dealership received that much.

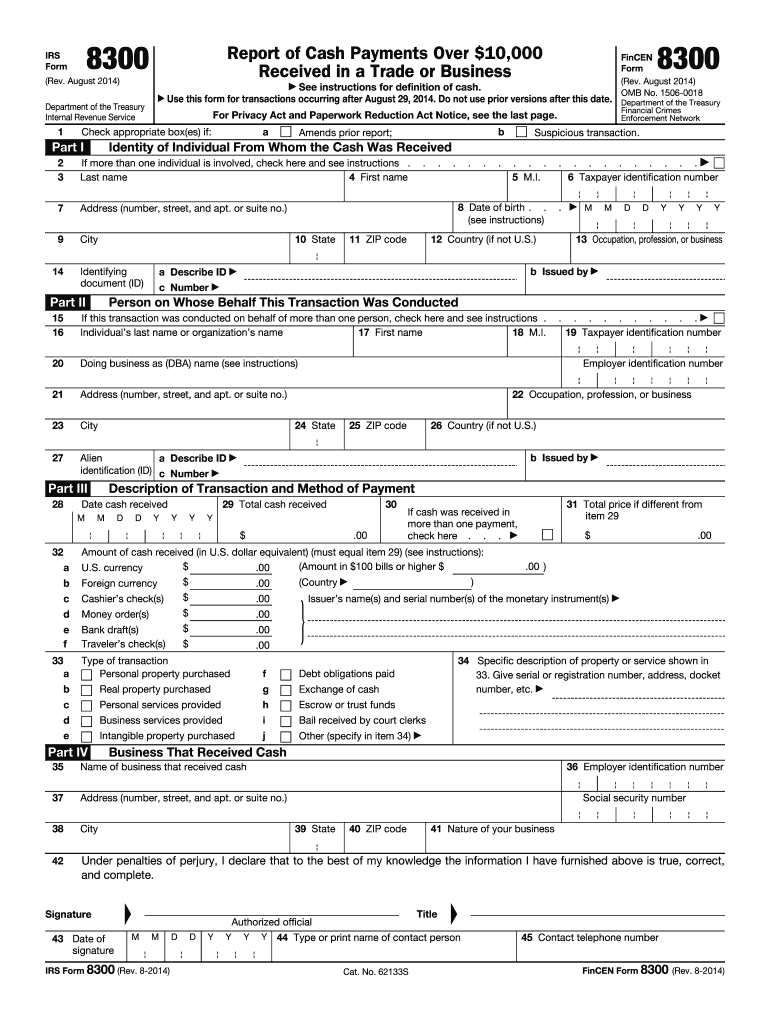

IRS Form 8300 Reporting Cash Sales Over 10,000

The equifax data breach what dealers should know. Web dealers must report to irs (using irs/fincen form 8300) the receipt of cash/cash equivalents in excess of $10,000 in a single transaction or two or more related. Web automotive dealers are required to file form 8300, report of cash payments over $10,000 received in a trade or business, with the irs.

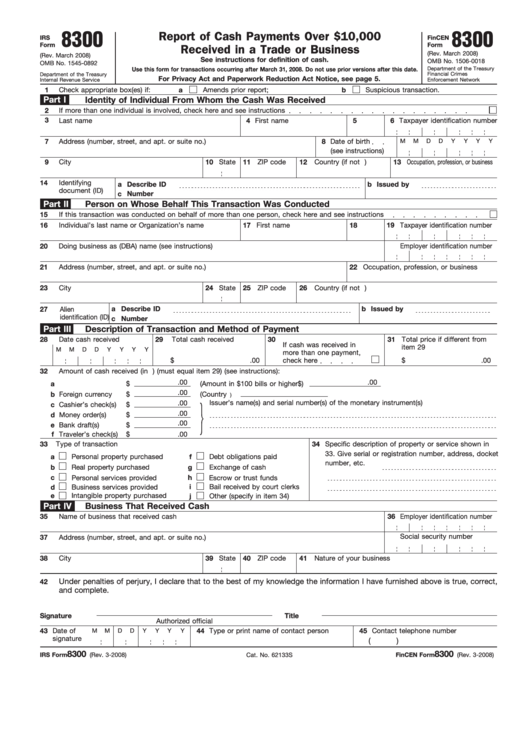

20142022 Form IRS 8300 Fill Online, Printable, Fillable, Blank pdfFiller

Web automotive dealers are required to file form 8300, report of cash payments over $10,000 received in a trade or business, with the irs when they receive more than $10,000 in. Web form 8300 compliance for car dealers. Web introduction the law requires that trades and businesses report cash payments of more than $10,000 to the federal government by filing.

IRS Form 8300 Info & Requirements for Reporting Cash Payments

A dealership doesn’t file form 8300 if a customer pays with a $7,000 wire transfer and a $4,000 cashier check. Any business or person that receives over $10,000 in cash as part of business transaction must complete a document called. Web either way, the dealer needs to file only one form 8300. If you buy a car and do not.

Fillable Form 8300 Report Of Cash Payments Over 10,000 Received In A

Web who must file form 8300? The equifax data breach what dealers should know. Web form 8300 compliance for car dealers any business or person that receives over $10,000 in cash as part of business transaction must complete a document called form 8300. If you buy a car and do not get title at the time of the sale, or.

[View 37+] Sample Letter For Form 8300

Web form 8300 compliance for car dealers. Dealerships can also call the irs criminal. Web we know that you have high expectations, and as a car dealer we enjoy the challenge of meeting and exceeding those standards each and every time. Web what does the irs do with forms 8300 they receive? Web the dealership can report suspicious transactions by.

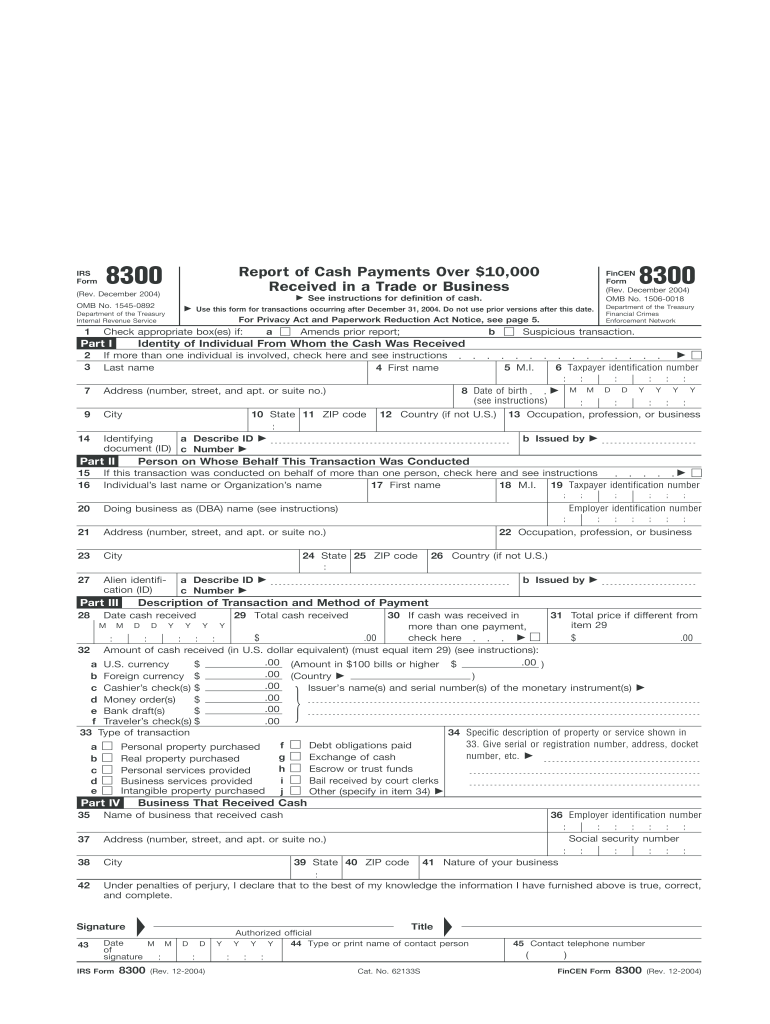

2004 Form IRS 8300 Fill Online, Printable, Fillable, Blank PDFfiller

I have never bought in cash, but made a car down payment for $10,000. Web the form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to the internal revenue service and the financial crimes. Web the dealership required to file a form 8300? Any business or person that receives over $10,000 in cash.

The IRS Form 8300 and How it Works

If you buy a car and do not get title at the time of the sale, or if agreed within 60. Web dealers must report to irs (using irs/fincen form 8300) the receipt of cash/cash equivalents in excess of $10,000 in a single transaction or two or more related. Web what does the irs do with forms 8300 they receive?.

Fillable Form 8300 Report Of Cash Payments Over 10,000 Usd Received

Web dealers must report to irs (using irs/fincen form 8300) the receipt of cash/cash equivalents in excess of $10,000 in a single transaction or two or more related. Dealerships can also call the irs criminal. Web the dealership can report suspicious transactions by checking the “suspicious transaction” box (box 1b) on the top line of form 8300. If you buy.

IRS Form 8300 Info & Requirements for Reporting Cash Payments

If you buy a car and do not get title at the time of the sale, or if agreed within 60. Web form 8300 compliance for car dealers. Web form 8300 is a document that must be filed with the irs when an individual or business receives a cash payment over $10,000. Generally, any person in a trade or business.

IRS Form 8300 It's Your Yale

Web dealing with large cash payments: Web who must file form 8300? Any business or person that receives over $10,000 in cash as part of business transaction must complete a document called. Web what does the irs do with forms 8300 they receive? A dealership doesn’t file form 8300 if a customer pays with a $7,000 wire transfer and a.

Web Accordingly, When Your Dealership Receives More Than $10,000 In Cash In One Transaction Or In Two Or More Related Transactions, You Must Report This By Filing The.

Web the dealership can report suspicious transactions by checking the “suspicious transaction” box (box 1b) on the top line of form 8300. A dealership doesn’t file form 8300 if a customer pays with a $7,000 wire transfer and a $4,000 cashier check. Dealerships can also call the irs criminal. Web form 8300 compliance for car dealers.

Web The Form 8300, Report Of Cash Payments Over $10,000 In A Trade Or Business, Provides Valuable Information To The Internal Revenue Service And The Financial Crimes.

Web dealers must report to irs (using irs/fincen form 8300) the receipt of cash/cash equivalents in excess of $10,000 in a single transaction or two or more related. Web form 8300 compliance for car dealers any business or person that receives over $10,000 in cash as part of business transaction must complete a document called form 8300. Web either way, the dealer needs to file only one form 8300. Web we know that you have high expectations, and as a car dealer we enjoy the challenge of meeting and exceeding those standards each and every time.

Yes, The Weekly Lease Or Loan Payments Constitute Payments On The Same Transaction (The Leasing Or Purchase Of The Vehicle).

Web form 8300 is a document that must be filed with the irs when an individual or business receives a cash payment over $10,000. The dealership received that much. Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file form. Web introduction the law requires that trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form 8300, report of cash.

Web Automotive Dealers Are Required To File Form 8300, Report Of Cash Payments Over $10,000 Received In A Trade Or Business, With The Irs When They Receive More Than $10,000 In.

File form 8300 by the 15th day after the date the cash was received. I have never bought in cash, but made a car down payment for $10,000. Web by looking at the annual registration form gotten when the property taxes and tag renewal are paid. The equifax data breach what dealers should know.

![[View 37+] Sample Letter For Form 8300](https://www.carbuyingtips.com/pics/irs-form-8300.jpg)