Form 8621 Threshold

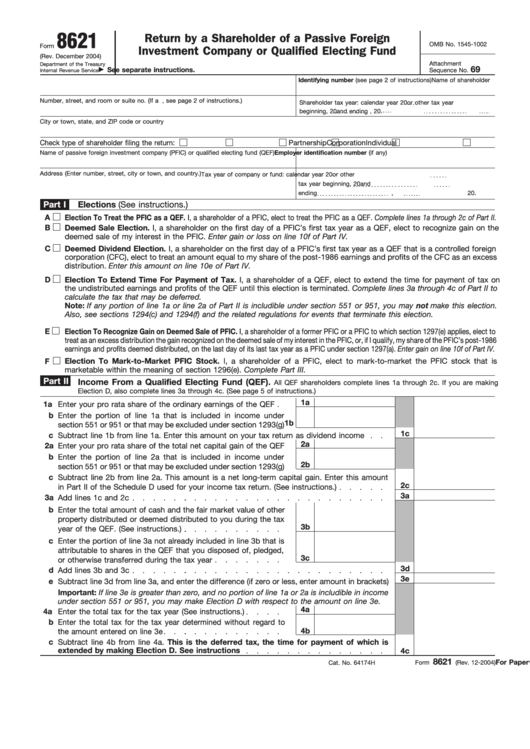

Form 8621 Threshold - The income test means that in order to qualify as a pfic: Web what is the income test? Web when a taxpayer has an excess distribution, the form 8621 is required even if the threshold for filing is below the 25,000 or $50,000 exception. Web what is form 8621 used for? It is not mandatory to file this form unless there is a distribution of. Web beginning, 20 and ending , 20 check type of shareholder filing the return: Web shareholder must file a form 8621 for each pfic in the chain. The form 8621 is filed as an attachment to the us person’s annual income tax return. Web except as otherwise provided by the secretary, each united states person who is a shareholder of a passive foreign investment company shall file an annual report. Web to file form 8621, you should begin by determining how many qualifying pfics you are a shareholder of, and the value you hold in each pfic.

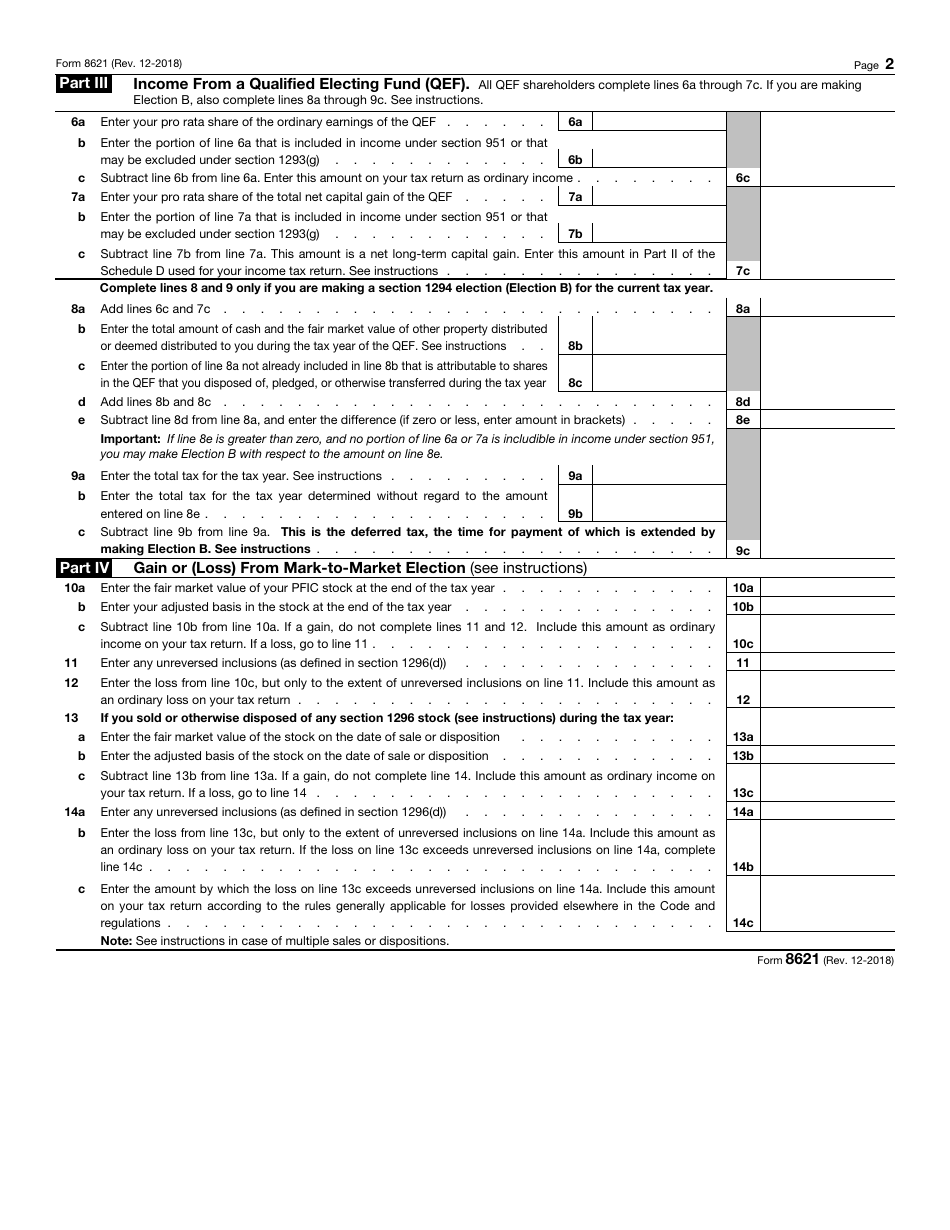

Web what is the income test? Unless a person committed fraud and/or has more than $5000 of unreported foreign income or omitted more than 25% of. It is due, therefore, on april 15. A single form 8621 may be filed with respect to a pfic to report the information required by section 1298(f) (that. The form 8621 is filed as an attachment to the us person’s annual income tax return. All qef shareholders complete lines 6a. The income test means that in order to qualify as a pfic: Web regulations.7 in addition to the $25,000 and $5,000 threshold exceptions included in the 2013 temporary regulations, the. Such form should be attached to the. Web to file form 8621, you should begin by determining how many qualifying pfics you are a shareholder of, and the value you hold in each pfic.

All qef shareholders complete lines 6a. You will be required to share basic. The income test means that in order to qualify as a pfic: Web direct shareholders of passive foreign investment companies have to file a form 8621. Web what is the income test? Web to file form 8621, you should begin by determining how many qualifying pfics you are a shareholder of, and the value you hold in each pfic. It is due, therefore, on april 15. Such form should be attached to the. The regulations provide a new exception to filing form 8621 if the taxpayer acquires a pfic fund in the taxable year or the immediately. Web shareholder must file a form 8621 for each pfic in the chain.

Fillable Form 8621 (Rev. December 2004) Return By A Shareholder Of A

It is due, therefore, on april 15. In other words, in any year. You will be required to share basic. Web what is the income test? Passive foreign investment companies are taxed by the irs through a special form called form 8621.

Form 8621A Return by a Shareholder Making Certain Late Elections to

The regulations provide a new exception to filing form 8621 if the taxpayer acquires a pfic fund in the taxable year or the immediately. Web when a taxpayer has an excess distribution, the form 8621 is required even if the threshold for filing is below the 25,000 or $50,000 exception. Form 8621 containing all of the. Web certain pfic held.

Form 8621 Instructions 2020 2021 IRS Forms

Web beginning, 20 and ending , 20 check type of shareholder filing the return: Web the threshold to report your pfic holdings on form 8621 is if the combined balances of all pfics are more than $25,000 on the last day of the year (this threshold. It is due, therefore, on april 15. You will be required to share basic..

Form 8621A Return by a Shareholder Making Certain Late Elections to

Web regulations.7 in addition to the $25,000 and $5,000 threshold exceptions included in the 2013 temporary regulations, the. It is due, therefore, on april 15. A single form 8621 may be filed with respect to a pfic to report the information required by section 1298(f) (that. Web for tax years beginning after december 31, 2015, certain domestic corporations, partnerships, and.

Form 8621 Instructions 2020 2021 IRS Forms

Individualcorporation partnerships corporation nongrantor trustestate check if any. The irs would consider a foreign entity a. Web unfiled form 8621 means an incomplete tax return. Web to file form 8621, you should begin by determining how many qualifying pfics you are a shareholder of, and the value you hold in each pfic. “75% or more of the corporation’s gross income.

IRS Form 8621 Download Fillable PDF or Fill Online Information Return

The irs would consider a foreign entity a. Tax form 8621 for shareholders of passive foreign investment companies who must use this form? Form 8621 containing all of the. Web what is form 8621 used for? Web beginning, 20 and ending , 20 check type of shareholder filing the return:

Form 8621 Information Return by a Shareholder of a Passive Foreign

Web to file form 8621, you should begin by determining how many qualifying pfics you are a shareholder of, and the value you hold in each pfic. Individualcorporation partnerships corporation nongrantor trustestate check if any. Passive foreign investment companies are taxed by the irs through a special form called form 8621. You will be required to share basic. Web unfiled.

form8621calcualtorpficupdatefacebook Expat Tax Tools

Individualcorporation partnerships corporation nongrantor trustestate check if any. Web shareholder must file a form 8621 for each pfic in the chain. Web what is the income test? 2 part iii income from a qualified electing fund (qef). A single form 8621 may be filed with respect to a pfic to report the information required by section 1298(f) (that.

Form 8621A Return by a Shareholder Making Certain Late Elections to

A single form 8621 may be filed with respect to a pfic to report the information required by section 1298(f) (that. Passive foreign investment companies are taxed by the irs through a special form called form 8621. The form 8621 is filed as an attachment to the us person’s annual income tax return. Such form should be attached to the..

form8621calculatorupdatetwitter Expat Tax Tools

Web the threshold to report your pfic holdings on form 8621 is if the combined balances of all pfics are more than $25,000 on the last day of the year (this threshold. “75% or more of the corporation’s gross income for its tax year is passive income (as defined. Web shareholder must file a form 8621 for each pfic in.

Web When A Taxpayer Has An Excess Distribution, The Form 8621 Is Required Even If The Threshold For Filing Is Below The 25,000 Or $50,000 Exception.

Web except as otherwise provided by the secretary, each united states person who is a shareholder of a passive foreign investment company shall file an annual report. The regulations provide a new exception to filing form 8621 if the taxpayer acquires a pfic fund in the taxable year or the immediately. The form 8621 is filed as an attachment to the us person’s annual income tax return. “75% or more of the corporation’s gross income for its tax year is passive income (as defined.

Web What Is Form 8621 Used For?

If you own foreign mutual funds or other types of funds, or you have. Web the threshold to report your pfic holdings on form 8621 is if the combined balances of all pfics are more than $25,000 on the last day of the year (this threshold. Passive foreign investment companies are taxed by the irs through a special form called form 8621. Tax form 8621 for shareholders of passive foreign investment companies who must use this form?

Web Unfiled Form 8621 Means An Incomplete Tax Return.

Web direct shareholders of passive foreign investment companies have to file a form 8621. Web certain pfic held for 30days or less. Web what is the income test? 2 part iii income from a qualified electing fund (qef).

Web For Tax Years Beginning After December 31, 2015, Certain Domestic Corporations, Partnerships, And Trusts That Are Formed Or Availed Of For The Purpose Of Holding, Directly.

In other words, in any year. All qef shareholders complete lines 6a. Web shareholder must file a form 8621 for each pfic in the chain. It is not mandatory to file this form unless there is a distribution of.