Form 8802 Instructions 2023

Form 8802 Instructions 2023 - Taxes were paid for purposes of claiming a foreign tax credit. Reminders bipartisan budget act of 2015 (bba). Treaty partners require the irs to certify that the person claiming treaty benefits is a resident of the united states for federal tax purposes. Below is guidance on how to file irs form 8802. Residents may need to claim income tax treaty benefit and certain other benefits in foreign countries. Web a revised form 8802, application for united states residency certification, is scheduled to be released july 2005. Grantor (u.s.) grantor (foreign) u.s. The form is used to request a certificate of residency (form 6166) that u.s. You can file irs form 8802 by fax, mail, or private delivery service (i.e. Residency certification for claiming benefits under an income tax treaty or vat exemption.

The irs recommends that you file your completed request no later than 45 days before you need the certification. Web irs form 8802 is also known as the application for united states residency certification. Web how do i file irs form 8802? You cannot use form 6166 to substantiate that u.s. The focus will be for those corporation looking to apply for 2023. Residents may need to claim income tax treaty benefit and certain other benefits in foreign countries. Residency certification for claiming benefits under an income tax treaty or vat exemption. Web the irs temporarily revised its procedures effective monday for some submitters of form 8802, application for united states residency certification, to facilitate applications where the service has not yet completed its processing of the applicant's most recently filed tax return. Tax residency information on completing the form 8802, application for united states residency certification many u.s. Residency certification, including recent updates, related forms, and instructions on how to file.

Taxes were paid for purposes of claiming a foreign tax credit. Residency certification for purposes of claiming benefits under an income tax treaty or vat exemption. You cannot use form 6166 to substantiate that u.s. Web how do i file irs form 8802? Use form 8802 to request form 6166, a letter of u.s. The form is used to request a certificate of residency (form 6166) that u.s. Tax residency information on completing the form 8802, application for united states residency certification many u.s. Residency certification for claiming benefits under an income tax treaty or vat exemption. You can file irs form 8802 by fax, mail, or private delivery service (i.e. Below is guidance on how to file irs form 8802.

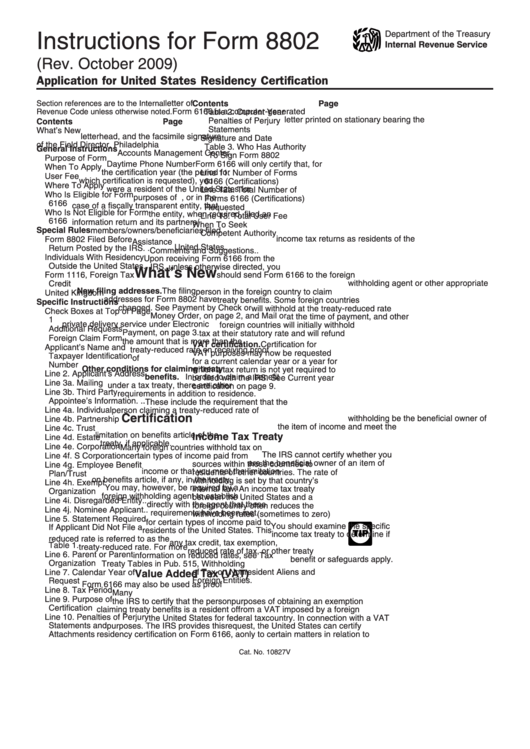

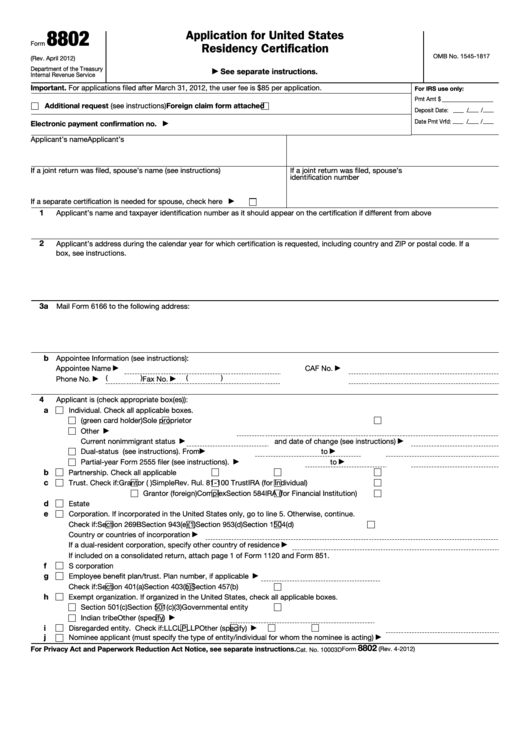

Instructions For Form 8802 Application For United States Residency

Residency certification for purposes of claiming benefits under an income tax treaty or vat exemption. Treaty partners require the irs to certify that the person claiming treaty benefits is a resident of the united states for federal tax purposes. Residency certification for claiming benefits under an income tax treaty or vat exemption. Below is guidance on how to file irs.

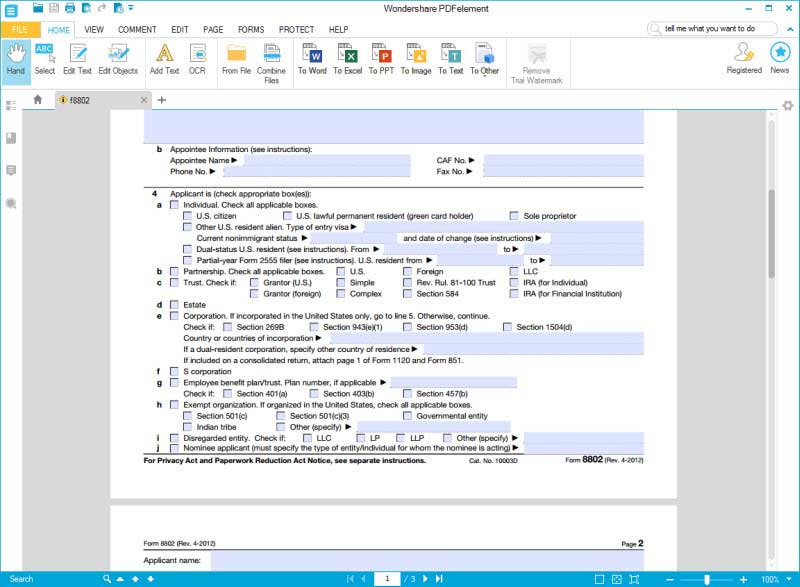

IRS Form 8802 How to Fill it Right

Grantor (u.s.) grantor (foreign) u.s. Residency certification for purposes of claiming benefits under an income tax treaty or vat exemption. Web a revised form 8802, application for united states residency certification, is scheduled to be released july 2005. Web the irs temporarily revised its procedures effective monday for some submitters of form 8802, application for united states residency certification, to.

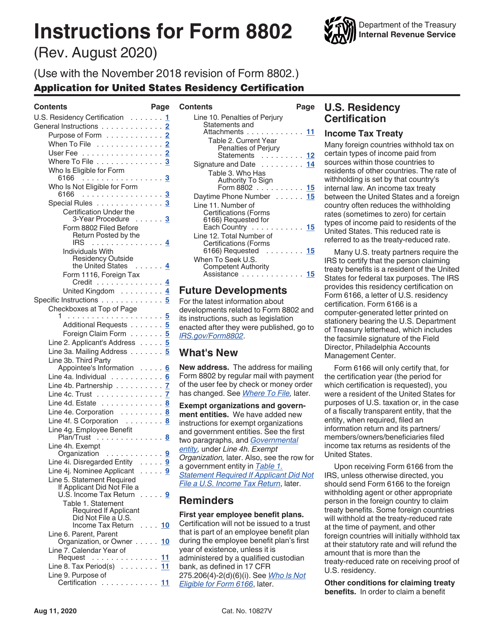

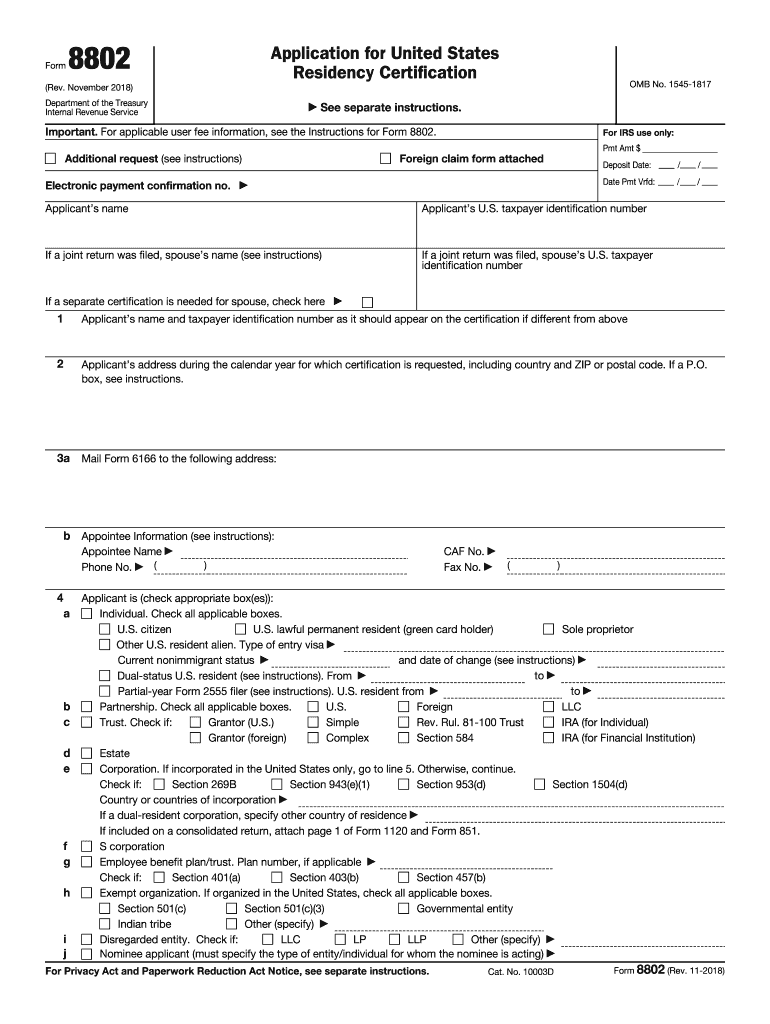

Download Instructions for IRS Form 8802 Application for United States

Web information about form 8802, application for u.s. Residency certification for claiming benefits under an income tax treaty or vat exemption. Residency certification, including recent updates, related forms, and instructions on how to file. Treaty partners require the irs to certify that the person claiming treaty benefits is a resident of the united states for federal tax purposes. The focus.

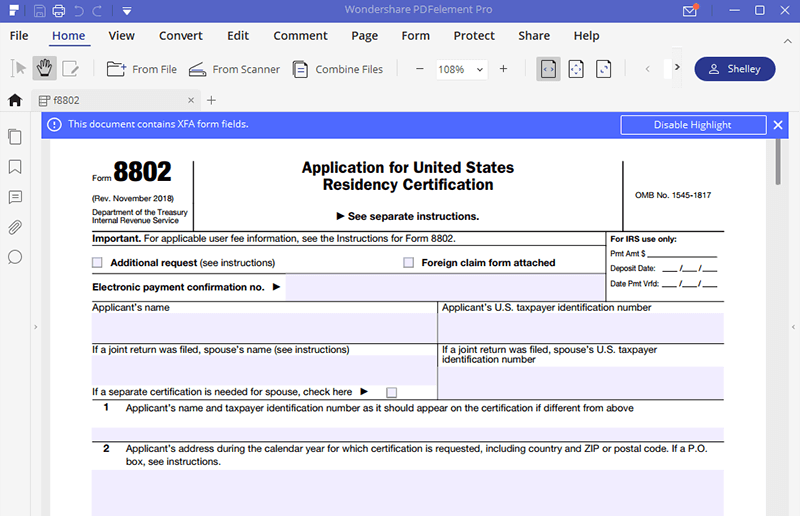

Form 8802 Edit, Fill, Sign Online Handypdf

Tax residency information on completing the form 8802, application for united states residency certification many u.s. You cannot use form 6166 to substantiate that u.s. Web information about form 8802, application for u.s. Treaty partners require the irs to certify that the person claiming treaty benefits is a resident of the united states for federal tax purposes. Web a revised.

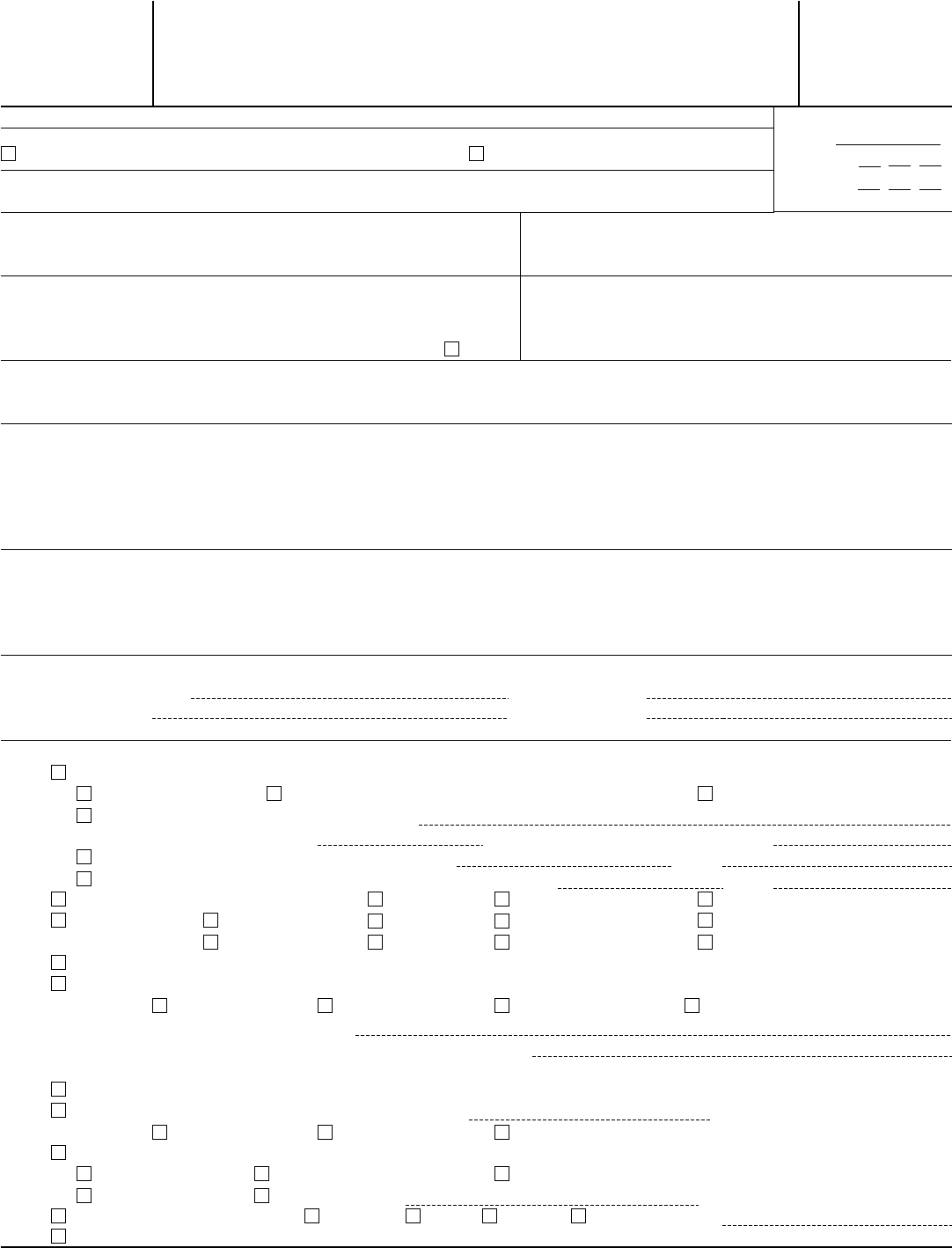

Fillable Form 8802 Application For United States Residency

The form is used to request a certificate of residency (form 6166) that u.s. Residency certification for claiming benefits under an income tax treaty or vat exemption. Residency certification, including recent updates, related forms, and instructions on how to file. Web how do i file irs form 8802? Web a revised form 8802, application for united states residency certification, is.

Form 8802Application for United States Residency Certification

Residency certification, including recent updates, related forms, and instructions on how to file. It allows individuals and companies to claim tax treaty benefits while working or operating in foreign countries by proving their u.s. Web how do i file irs form 8802? Residents may need to claim income tax treaty benefit and certain other benefits in foreign countries. Residency certification.

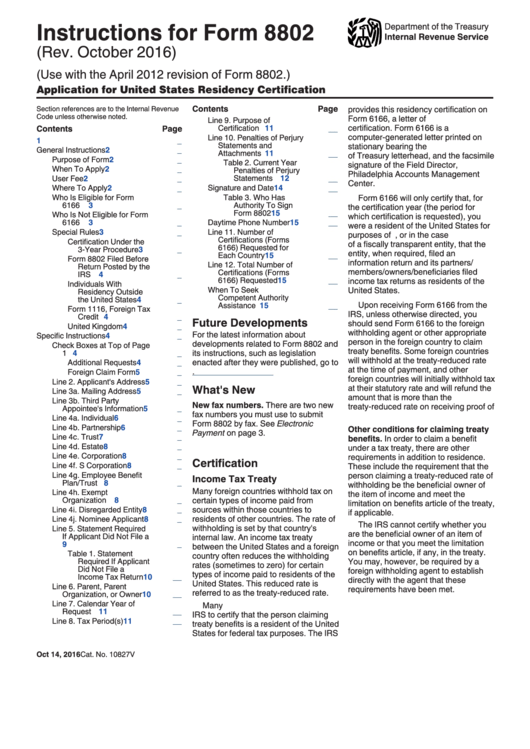

Instructions For Form 8802 2016 printable pdf download

Taxes were paid for purposes of claiming a foreign tax credit. Web irs form 8802 is also known as the application for united states residency certification. Web a revised form 8802, application for united states residency certification, is scheduled to be released july 2005. Reminders bipartisan budget act of 2015 (bba). You can file irs form 8802 by fax, mail,.

20182022 Form IRS 8802 Fill Online, Printable, Fillable, Blank pdfFiller

Tax residency information on completing the form 8802, application for united states residency certification many u.s. Residents may need to claim income tax treaty benefit and certain other benefits in foreign countries. Reminders bipartisan budget act of 2015 (bba). The form is used to request a certificate of residency (form 6166) that u.s. The focus will be for those corporation.

IRS Form 8802 How to Fill it Right

Treaty partners require the irs to certify that the person claiming treaty benefits is a resident of the united states for federal tax purposes. Web this video covers successful completion of form 8802 which is used to obtain the actual residency certification form 6166. You can file irs form 8802 by fax, mail, or private delivery service (i.e. Form 8802.

Form 8802 Sample Glendale Community

Web how do i file irs form 8802? The irs recommends that you file your completed request no later than 45 days before you need the certification. Residents may need to claim income tax treaty benefit and certain other benefits in foreign countries. Web this video covers successful completion of form 8802 which is used to obtain the actual residency.

The Irs Recommends That You File Your Completed Request No Later Than 45 Days Before You Need The Certification.

Taxes were paid for purposes of claiming a foreign tax credit. Web the irs temporarily revised its procedures effective monday for some submitters of form 8802, application for united states residency certification, to facilitate applications where the service has not yet completed its processing of the applicant's most recently filed tax return. Web a revised form 8802, application for united states residency certification, is scheduled to be released july 2005. Tax residency information on completing the form 8802, application for united states residency certification many u.s.

The Form Is Used To Request A Certificate Of Residency (Form 6166) That U.s.

Residency certification for purposes of claiming benefits under an income tax treaty or vat exemption. The focus will be for those corporation looking to apply for 2023. Web irs form 8802 is also known as the application for united states residency certification. Web how do i file irs form 8802?

Below Is Guidance On How To File Irs Form 8802.

Form 8802 is used to request form 6166, a letter of u.s. Grantor (u.s.) grantor (foreign) u.s. Reminders bipartisan budget act of 2015 (bba). Use form 8802 to request form 6166, a letter of u.s.

Residents May Need To Claim Income Tax Treaty Benefit And Certain Other Benefits In Foreign Countries.

Residency certification for claiming benefits under an income tax treaty or vat exemption. Treaty partners require the irs to certify that the person claiming treaty benefits is a resident of the united states for federal tax purposes. You cannot use form 6166 to substantiate that u.s. It allows individuals and companies to claim tax treaty benefits while working or operating in foreign countries by proving their u.s.