Form 8804 Extension

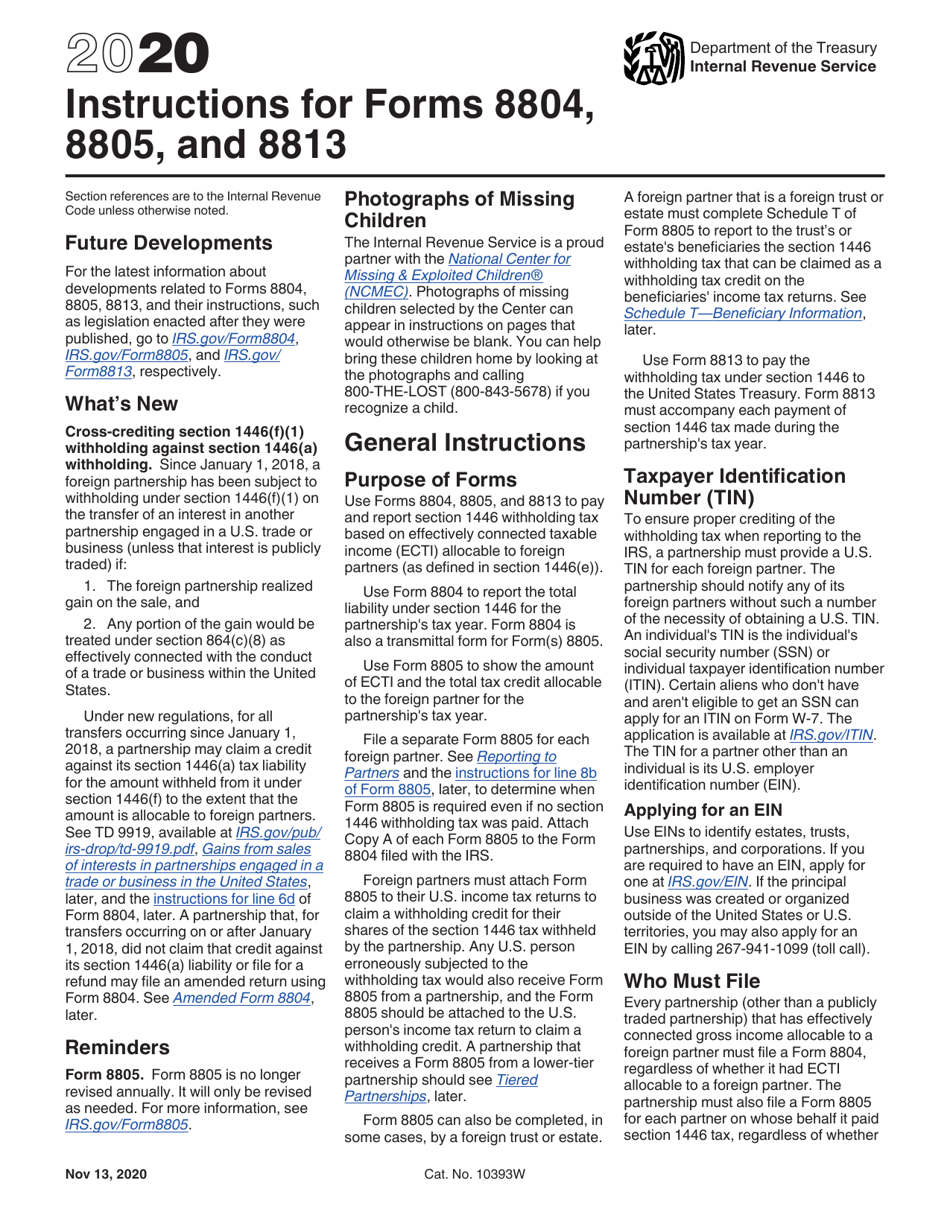

Form 8804 Extension - Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web if you need more time, you can file form 7004 to request an extension of time to file form 8804. Web “use forms 8804, 8805, and 8813 to pay and report section 1446 withholding tax based on effectively connected taxable income allocable to foreign. Web use forms 8804, 8805, and 8813 to pay and report section 1446 withholding tax based on effectively connected taxable income (ecti) allocable to foreign partners (as defined in. Upload, modify or create forms. Any forms that are filed to the irs separately. Web the request is also to file other information, returns, and request for a time to file form 8804. Web go to the extensions > extensions worksheet. If the partnership uses the annualized income installment method or the adjusted seasonal Complete, edit or print tax forms instantly.

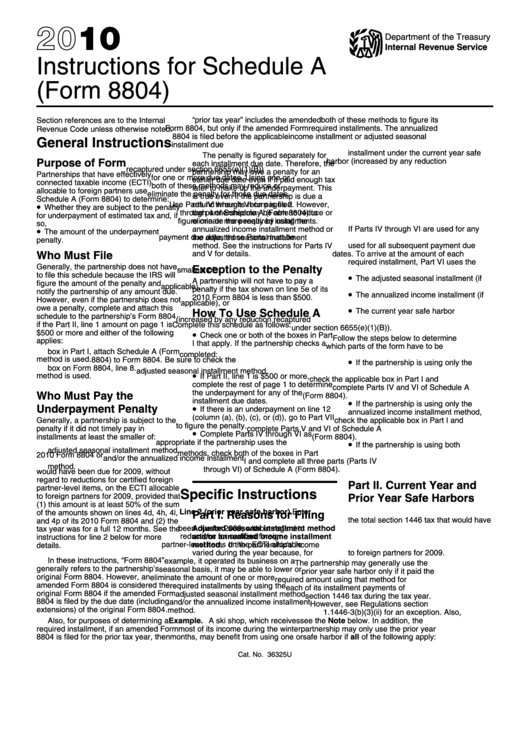

Web enter 25% (0.25) of line 9 in columns (a) through (d). Try it for free now! The irs supports electronic filing only for form 1065 and related forms and schedules and the extension form 7004. Web form 8804, annual return for partnership withholding tax (section 1446) specifically is used to report the total liability under section 1446 for the partnership’s tax. Web there are several ways to submit form 4868. Web general instructions purpose of form partnerships that have effectively connected taxable income (ecti) allocable to foreign partners use schedule a (form. Any forms that are filed to the irs separately. Web enter x to mark the corresponding checkbox on form 8804 and to extend the due date of form 8804 an additional two months. Web if you need more time, you can file form 7004 to request an extension of time to file form 8804. The irs supports electronic filing only for form 1065 and related forms and schedules and the extension form 7004.

Web how do i generate an extension for form 8804 in a 1065 return, using interview forms? It is also crucial to mention that this is an extension to file but not a tax extension. Web a partnership required to file form 1065, “u.s. Web the request is also to file other information, returns, and request for a time to file form 8804. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web general instructions purpose of form partnerships that have effectively connected taxable income (ecti) allocable to foreign partners use schedule a (form. Web use forms 8804, 8805, and 8813 to pay and report section 1446 withholding tax based on effectively connected taxable income (ecti) allocable to foreign partners (as defined in. Filing a form 7004 doesn't extend the time for payment of tax. Use the statement for the filing under section. Web check the “federal extension” box at the top of the form if you filed for an extension to file federal form 8804, annual return for partnership withholding tax (section 1446).

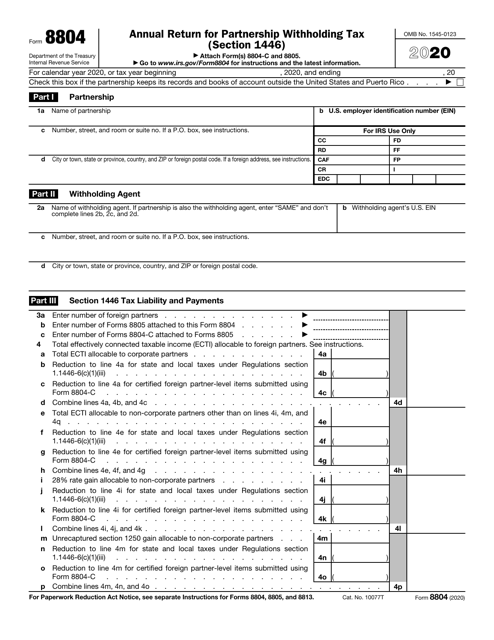

IRS Form 8804 Download Fillable PDF or Fill Online Annual Return for

Any forms that are filed to the irs separately. Web how do i generate an extension for form 8804 in a 1065 return, using interview forms? Web there are several ways to submit form 4868. Upload, modify or create forms. The irs supports electronic filing only for form 1065 and related forms and schedules and the extension form 7004.

Instructions For Schedule A (Form 8804) 2010 printable pdf download

Web check the “federal extension” box at the top of the form if you filed for an extension to file federal form 8804, annual return for partnership withholding tax (section 1446). Any forms that are filed to the irs separately. Any forms that are filed to the irs separately. Web “use forms 8804, 8805, and 8813 to pay and report.

Form 8804 Annual Return for Partnership Withholding Tax (Section 1446

Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Try it for free now! The irs supports electronic filing only for form 1065 and related forms and schedules and the extension form 7004. Web the request is also to file other information, returns, and request for a time to file.

Fill Free fillable F8804 2018 Form 8804 PDF form

The irs supports electronic filing only for form 1065 and related forms and schedules and the extension form 7004. Complete, edit or print tax forms instantly. Web there are several ways to submit form 4868. It is also crucial to mention that this is an extension to file but not a tax extension. Web go to the extensions > extensions.

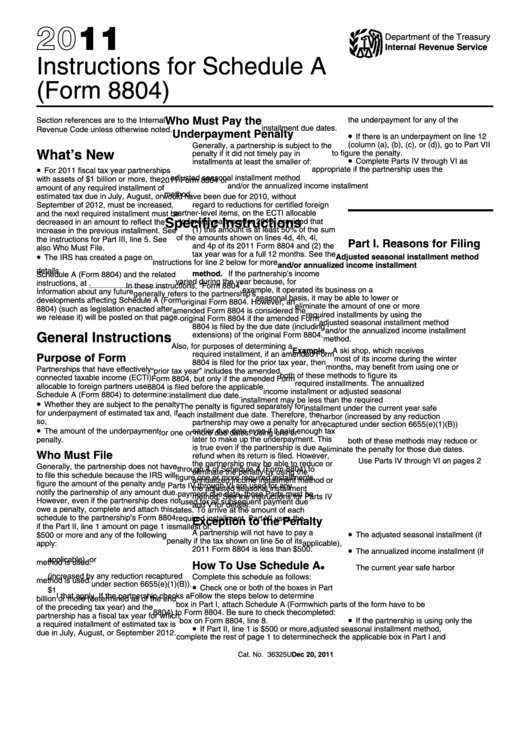

Instructions For Schedule A (Form 8804) 2011 printable pdf download

Web the request is also to file other information, returns, and request for a time to file form 8804. Partnership return of income,” or form 8804, “annual return for partnership withholding tax,” for any taxable year will be. If the partnership uses the annualized income installment method or the adjusted seasonal Any forms that are filed to the irs separately..

Download Instructions for IRS Form 8804, 8805, 8813 PDF, 2020

Web enter 25% (0.25) of line 9 in columns (a) through (d). Web general instructions purpose of form partnerships that have effectively connected taxable income (ecti) allocable to foreign partners use schedule a (form. It is also crucial to mention that this is an extension to file but not a tax extension. Web a partnership required to file form 1065,.

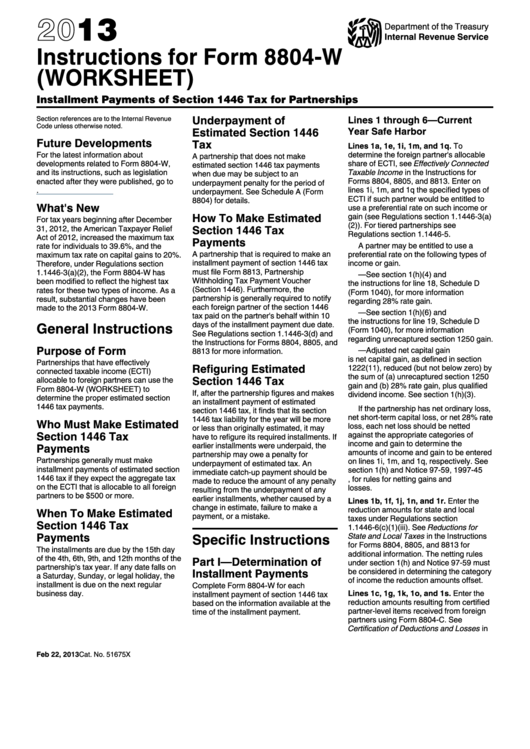

Instructions For Form 8804W (Worksheet) Installment Payments Of

Web use forms 8804, 8805, and 8813 to pay and report section 1446 withholding tax based on effectively connected taxable income (ecti) allocable to foreign partners (as defined in. Filing a form 7004 doesn't extend the time for payment of tax. Partnership return of income,” or form 8804, “annual return for partnership withholding tax,” for any taxable year will be..

Form 8804C Certificate of PartnerLevel Items to Reduce Section 1446

If the partnership uses the annualized income installment method or the adjusted seasonal Web enter x to mark the corresponding checkbox on form 8804 and to extend the due date of form 8804 an additional two months. Web if you need more time, you can file form 7004 to request an extension of time to file form 8804. Web to.

Form 8804 (Schedule A) Penalty for Underpayment of Estimated Section

Any forms that are filed to the irs separately. Web to request an extension for filing form 8804, you will need to complete and submit irs form 7004*, which can be submitted electronically or by mail. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Any forms that are filed.

Form 8804 Annual Return for Partnership Withholding Tax

Partnership return of income,” or form 8804, “annual return for partnership withholding tax,” for any taxable year will be. Web enter x to mark the corresponding checkbox on form 8804 and to extend the due date of form 8804 an additional two months. Upload, modify or create forms. The irs supports electronic filing only for form 1065 and related forms.

Web If You Need More Time, You Can File Form 7004 To Request An Extension Of Time To File Form 8804.

Web check the “federal extension” box at the top of the form if you filed for an extension to file federal form 8804, annual return for partnership withholding tax (section 1446). Web enter 25% (0.25) of line 9 in columns (a) through (d). Filing a form 7004 doesn't extend the time for payment of tax. Web how do i generate an extension for form 8804 in a 1065 return, using interview forms?

Web Use Forms 8804, 8805, And 8813 To Pay And Report Section 1446 Withholding Tax Based On Effectively Connected Taxable Income (Ecti) Allocable To Foreign Partners (As Defined In.

Web general instructions purpose of form partnerships that have effectively connected taxable income (ecti) allocable to foreign partners use schedule a (form. Ad access irs tax forms. Any forms that are filed to the irs separately. The irs supports electronic filing only for form 1065 and related forms and schedules and the extension form 7004.

Taxpayers Can File Form 4868 By Mail, But Remember To Get Your Request In The Mail By Tax Day.

If the partnership uses the annualized income installment method or the adjusted seasonal The irs supports electronic filing only for form 1065 and related forms and schedules and the extension form 7004. Web go to the extensions > extensions worksheet. Partnership return of income,” or form 8804, “annual return for partnership withholding tax,” for any taxable year will be.

Try It For Free Now!

Web enter x to mark the corresponding checkbox on form 8804 and to extend the due date of form 8804 an additional two months. Web to request an extension for filing form 8804, you will need to complete and submit irs form 7004*, which can be submitted electronically or by mail. Web “use forms 8804, 8805, and 8813 to pay and report section 1446 withholding tax based on effectively connected taxable income allocable to foreign. Upload, modify or create forms.