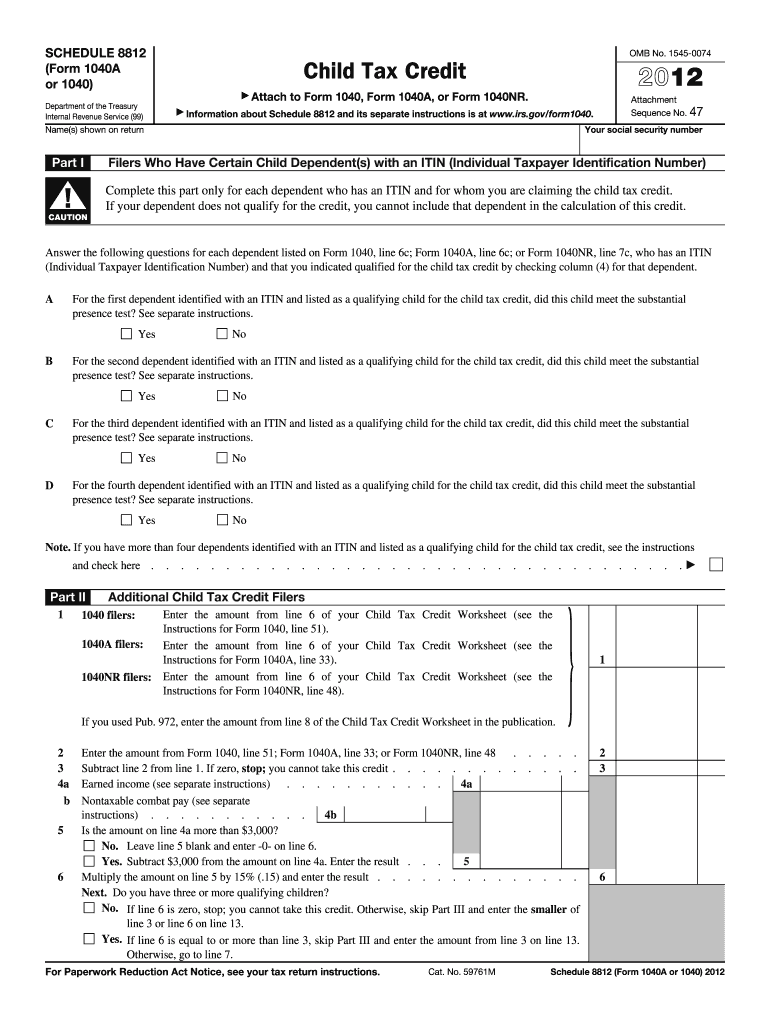

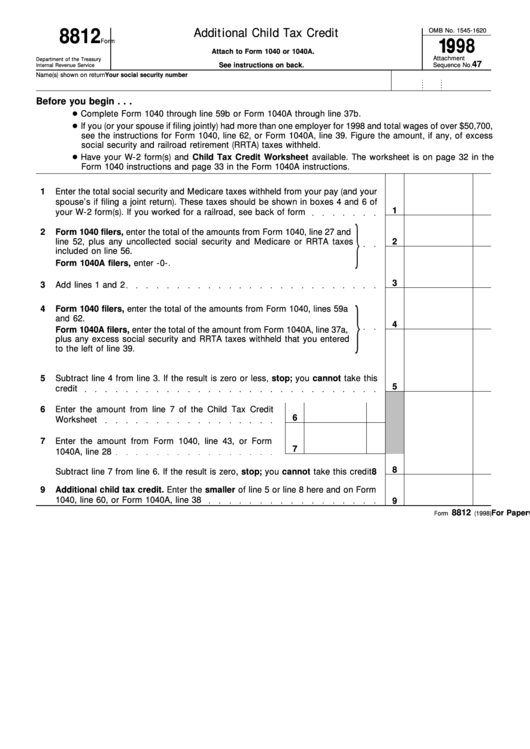

Form 8812 Worksheet

Form 8812 Worksheet - From july 2021 to december 2021, taxpayers may have received an advance payment of the child tax credit equal to 50% of the irs. For 2022, there are two parts to this form: Choose the correct version of the editable pdf. Web irs instructions for form 8812. The additional child tax credit may give you a refund even if you do not owe any tax. Web irs schedule 8812 is the section on form 1040 that needs to be filled out to claim the federal additional child tax credit. Get ready for tax season deadlines by completing any required tax forms today. Web purpose of form use form 8812 to figure your additional child tax credit. Web under file \ print, i selected the option to have turbotax generate tax return, all calculation worksheets. Nontaxable combat pay (from federal.

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Search by form number, name or organization. Web to learn more about schedule 8812. The additional child tax credit may give you a refund even if you do not owe any tax. Web under file \ print, i selected the option to have turbotax generate tax return, all calculation worksheets. Web purpose of form use form 8812 to figure your additional child tax credit. For 2022, there are two parts to this form: Web you'll use form 8812 to calculate your additional child tax credit. From july 2021 to december 2021, taxpayers may have received an advance payment of the child tax credit equal to 50% of the irs. Choose the correct version of the editable pdf.

Some of the worksheets displayed are 2018 schedule 8812 form 1040, 2010 form 8812, work line 12a keep for your records. From july 2021 to december 2021, taxpayers may have received an advance payment of the child tax credit equal to 50% of the irs. Choose the correct version of the editable pdf. Who can claim the child tax credit? Should be completed by all filers to claim the basic. See the instructions for form 1040, line 52; Web completing schedule 8812 may result in a refund even if the taxpayer doesn’t owe any tax. Get ready for tax season deadlines by completing any required tax forms today. Nontaxable combat pay (from federal. Web irs instructions for form 8812.

Publication 972 Child Tax Credit; Child Tax Credit Worksheet

Web enter your earned income from your federal instructions for schedule 8812, earned income worksheet, line 7. Should be completed by all filers to claim the basic. Web purpose of form use form 8812 to figure your additional child tax credit. Web irs schedule 8812 is the section on form 1040 that needs to be filled out to claim the.

Form 8812 Line 5 Worksheet

Web irs schedule 8812 is the section on form 1040 that needs to be filled out to claim the federal additional child tax credit. Choose the correct version of the editable pdf. To be eligible to claim the child tax credit, the. See the instructions for form 1040, line 52; There is no line 5 worksheet to be found.

Irs Credit Limit Worksheet A

Search by form number, name or organization. Get ready for tax season deadlines by completing any required tax forms today. Web irs schedule 8812 is the section on form 1040 that needs to be filled out to claim the federal additional child tax credit. Ad access irs tax forms. Web you'll use form 8812 to calculate your additional child tax.

8812 Schedule Form Fill Out and Sign Printable PDF Template signNow

Get ready for tax season deadlines by completing any required tax forms today. Choose the correct version of the editable pdf. Complete, edit or print tax forms instantly. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax. To be eligible.

Publication 17, Your Federal Tax; Chapter 35 Child Tax Credit

Nontaxable combat pay (from federal. Web enter your earned income from your federal instructions for schedule 8812, earned income worksheet, line 7. Ad access irs tax forms. Web under file \ print, i selected the option to have turbotax generate tax return, all calculation worksheets. The additional child tax credit may give you a refund even if you do not.

Form 8812, Additional Child Tax Credit printable pdf download

Complete, edit or print tax forms instantly. Web you'll use form 8812 to calculate your additional child tax credit. Web irs schedule 8812 is the section on form 1040 that needs to be filled out to claim the federal additional child tax credit. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax.

Publication 972, Child Tax Credit; Detailed Example

There is no line 5 worksheet to be found. Some of the worksheets displayed are 2018 schedule 8812 form 1040, 2010 form 8812, work line 12a keep for your records. Web under file \ print, i selected the option to have turbotax generate tax return, all calculation worksheets. Web search irs and state income tax forms to efile or complete,.

️Form 8812 Worksheet 2013 Free Download Goodimg.co

See the instructions for form 1040, line 52; Get ready for tax season deadlines by completing any required tax forms today. Web purpose of form use form 8812 to figure your additional child tax credit. Choose the correct version of the editable pdf. From july 2021 to december 2021, taxpayers may have received an advance payment of the child tax.

Form 8812 Worksheet Download Child Tax Credit Calculator Excel

Web search irs and state income tax forms to efile or complete, download online and back taxes. Web enter your earned income from your federal instructions for schedule 8812, earned income worksheet, line 7. Ad access irs tax forms. See the instructions for form 1040, line 52; To be eligible to claim the child tax credit, the.

Form 8812Additional Child Tax Credit

Web purpose of form use form 8812 to figure your additional child tax credit. Web you'll use form 8812 to calculate your additional child tax credit. From july 2021 to december 2021, taxpayers may have received an advance payment of the child tax credit equal to 50% of the irs. The additional child tax credit may give you a refund.

Web Purpose Of Form Use Form 8812 To Figure Your Additional Child Tax Credit.

Web search irs and state income tax forms to efile or complete, download online and back taxes. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor.

Web Under File \ Print, I Selected The Option To Have Turbotax Generate Tax Return, All Calculation Worksheets.

Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax. Should be completed by all filers to claim the basic. Search by form number, name or organization. To be eligible to claim the child tax credit, the.

For 2022, There Are Two Parts To This Form:

Nontaxable combat pay (from federal. There is no line 5 worksheet to be found. Web irs schedule 8812 is the section on form 1040 that needs to be filled out to claim the federal additional child tax credit. Web you'll use form 8812 to calculate your additional child tax credit.

Some Of The Worksheets Displayed Are 2018 Schedule 8812 Form 1040, 2010 Form 8812, Work Line 12A Keep For Your Records.

Web irs instructions for form 8812. See the instructions for form 1040, line 52; Ad access irs tax forms. The additional child tax credit may give you a refund even if you do not owe any tax.