Form 8814 And 4972

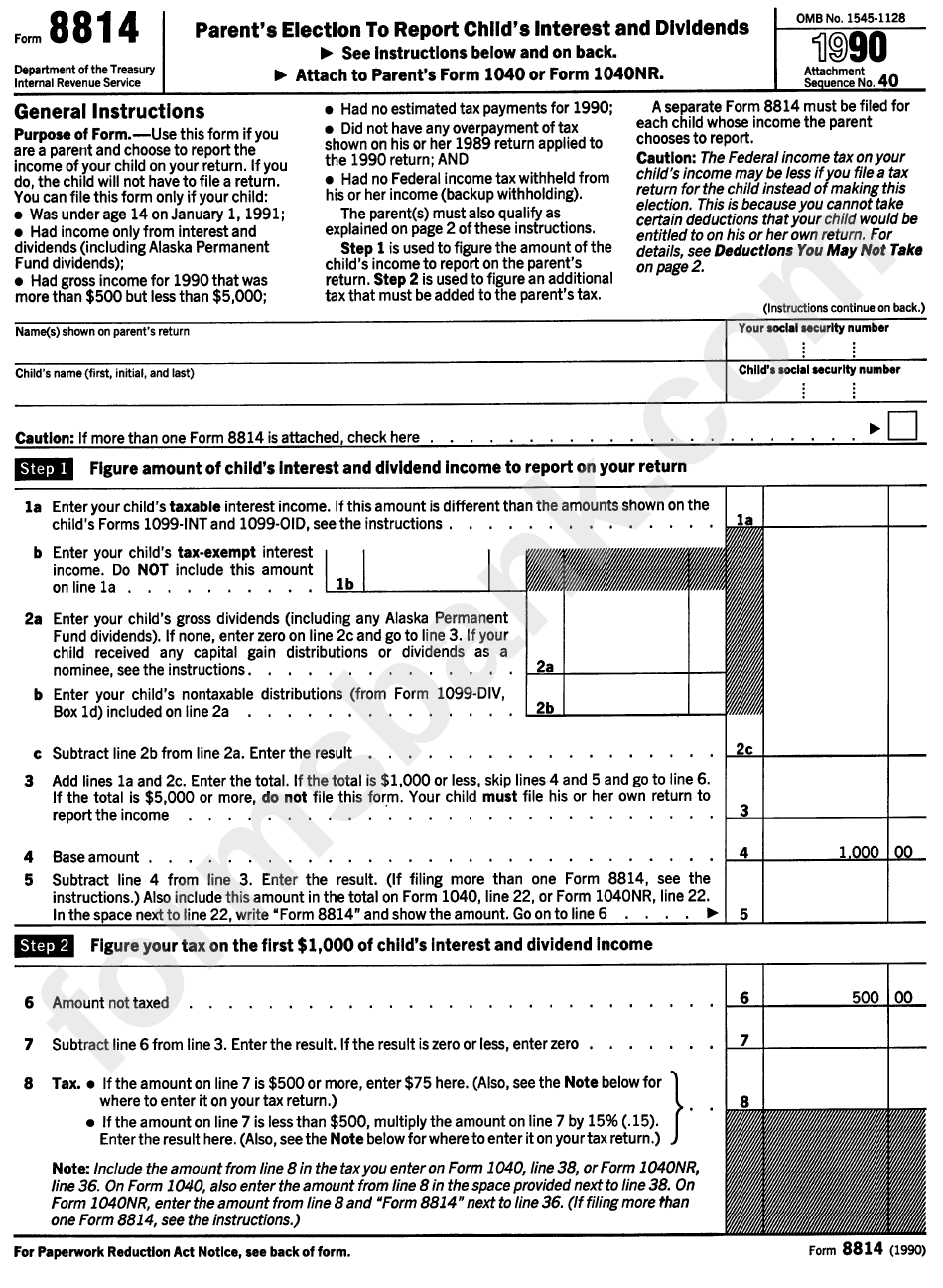

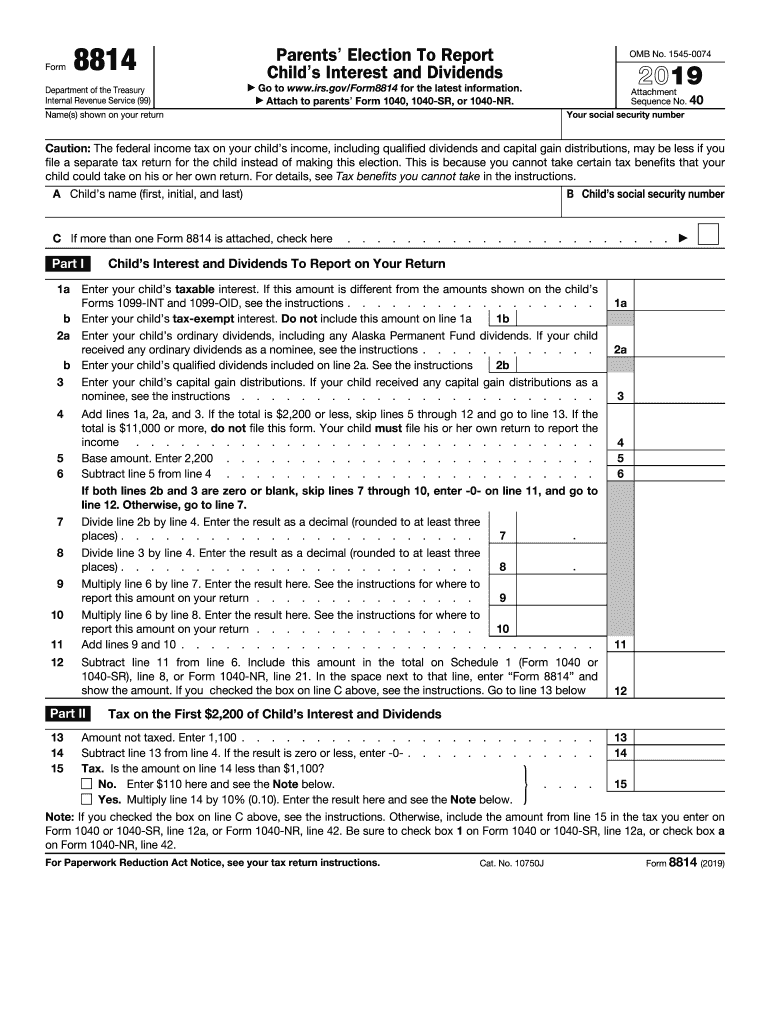

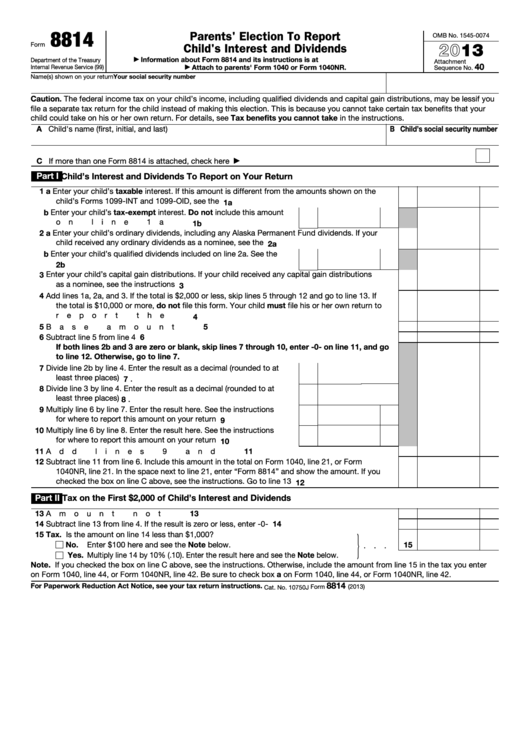

Form 8814 And 4972 - Web 8814 is parents election to report child's interest and dividendss 6251 is alternative minimum tax 4972 is tax on lump sum distributions ask your own tax. A separate form 8814 must be filed for. If there is an use form 4972, part ii, to apply a 20% tax rate to the capital gain portion. Edit your 2017 form 4972 online type text, add images, blackout confidential details, add comments, highlights and more. Web to make the election, complete and attach form (s) 8814 to your tax return and file your return by the due date (including extensions). A separate form 8814 must. Organizations that are not required to. Parents may elect to include their child's income from interest, dividends, and capital gains with. Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to file. Web to make the election, complete and attach form(s) 8814 to your tax return and file your return by the due date (including extensions).

Web we last updated the parents' election to report child's interest and dividends in january 2023, so this is the latest version of form 8814, fully updated for tax year 2022. A separate form 8814 must. Download or email irs 4972 & more fillable forms, register and subscribe now! If there is an use form 4972, part ii, to apply a 20% tax rate to the capital gain portion. Web to make the election, complete and attach form (s) 8814 to your tax return and file your return by the due date (including extensions). A separate form 8814 must. The following political organizations are not required to file form 8872: Web 8814 is parents election to report child's interest and dividendss 6251 is alternative minimum tax 4972 is tax on lump sum distributions ask your own tax. Form 8814 will be used if you elect to report your child's. A separate form 8814 must be filed for.

Web a separate form 8814 must be filed for each child. Organizations that are not required to. If there is an use form 4972, part ii, to apply a 20% tax rate to the capital gain portion. Download or email irs 4972 & more fillable forms, register and subscribe now! Web we last updated federal form 8814 in january 2023 from the federal internal revenue service. Form 8814 will be used if you elect to report your child's. Web to make the election, complete and attach form(s) 8814 to your tax return and file your return by the due date (including extensions). A separate form 8814 must. Web taxslayer support what is form 8814, parent's election to report child's interest/dividend earnings? Web 8814 is parents election to report child's interest and dividendss 6251 is alternative minimum tax 4972 is tax on lump sum distributions ask your own tax.

Form 8814 Parents' Election To Report Child'S Interest And Dividends

Web 8814 is parents election to report child's interest and dividendss 6251 is alternative minimum tax 4972 is tax on lump sum distributions ask your own tax. Web to make the election, complete and attach form (s) 8814 to your tax return and file your return by the due date (including extensions). Download or email irs 4972 & more fillable.

8814 form Fill out & sign online DocHub

Web general instructions purpose of form for children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's. Edit your 2017 form 4972 online type text, add images, blackout confidential details, add comments, highlights and more. Web to make the election, complete and attach form (s) 8814.

Irs form 8814 instructions

Form 8814 will be used if you elect to report your child's. Sign it in a few clicks draw your signature, type. A separate form 8814 must be filed for. Web to make the election, complete and attach form (s) 8814 to your tax return and file your return by the due date (including extensions). This form is for income.

Fillable Form 8814 Parents' Election To Report Child'S Interest And

The following choices are available. Form 8814 will be used if you elect to report your child's. This form is for income earned in tax year 2022, with tax returns due in april. Download or email irs 4972 & more fillable forms, register and subscribe now! Web a separate form 8814 must be filed for each child.

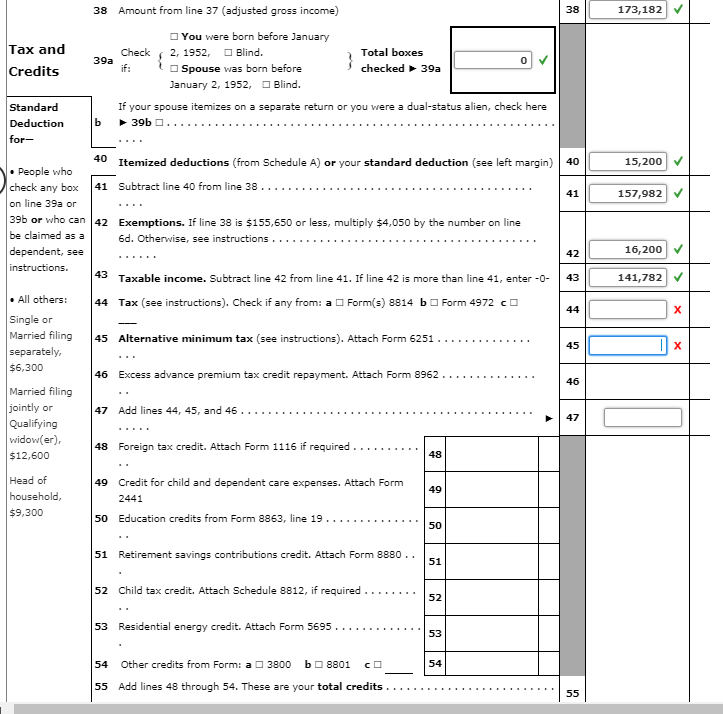

Solved 38 Amount from line 37 (adjusted gross 38

Organizations that are not required to. Complete, edit or print tax forms instantly. The following political organizations are not required to file form 8872: Complete, edit or print tax forms instantly. Web 8814 is parents election to report child's interest and dividendss 6251 is alternative minimum tax 4972 is tax on lump sum distributions ask your own tax.

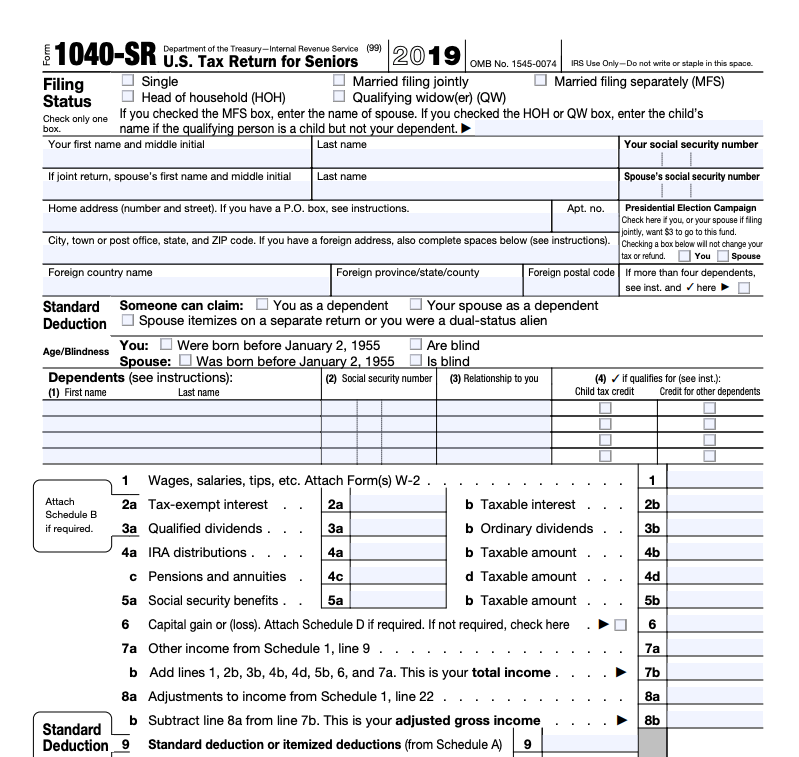

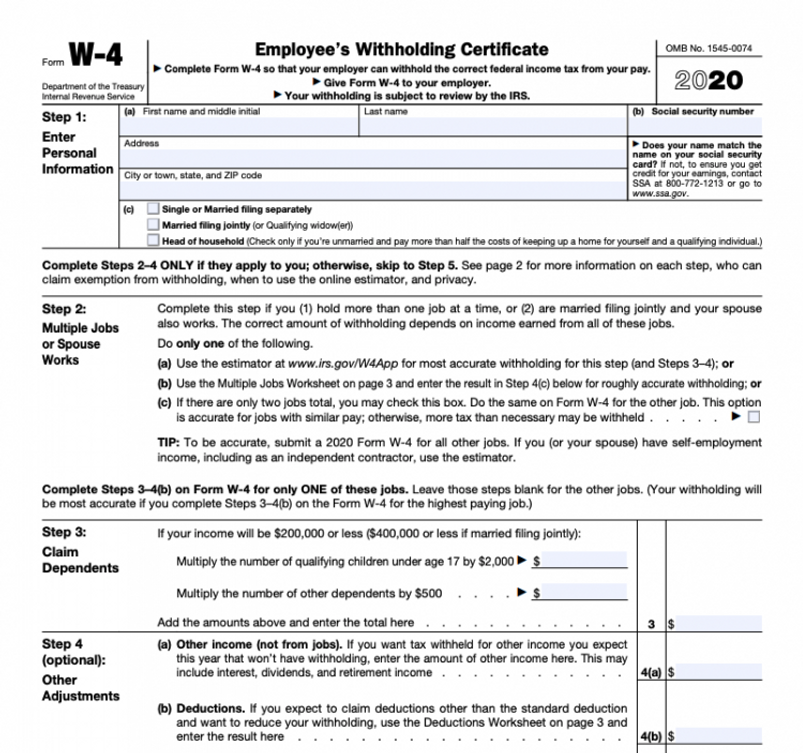

New Tax Forms for 2019 and 2020

Web we last updated federal form 8814 in january 2023 from the federal internal revenue service. The following political organizations are not required to file form 8872: Web to make the election, complete and attach form(s) 8814 to your tax return and file your return by the due date (including extensions). Complete, edit or print tax forms instantly. Complete, edit.

Irs form 8814 instructions

Edit your 2017 form 4972 online type text, add images, blackout confidential details, add comments, highlights and more. Web to make the election, complete and attach form (s) 8814 to your tax return and file your return by the due date (including extensions). Web a separate form 8814 must be filed for each child. Web we last updated federal form.

[Solved] I am trying to evaluate tax using tax rate schedules for 2019

Web taxslayer support what is form 8814, parent's election to report child's interest/dividend earnings? The following choices are available. A separate form 8814 must. Web we last updated the parents' election to report child's interest and dividends in january 2023, so this is the latest version of form 8814, fully updated for tax year 2022. Web we last updated federal.

New Tax Forms for 2019 and 2020

Web to make the election, complete and attach form(s) 8814 to your tax return and file your return by the due date (including extensions). Web taxslayer support what is form 8814, parent's election to report child's interest/dividend earnings? The following political organizations are not required to file form 8872: Parents may elect to include their child's income from interest, dividends,.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

Edit your 2017 form 4972 online type text, add images, blackout confidential details, add comments, highlights and more. A separate form 8814 must. Web we last updated federal form 8814 in january 2023 from the federal internal revenue service. Organizations that are not required to. Web taxslayer support what is form 8814, parent's election to report child's interest/dividend earnings?

A Separate Form 8814 Must Be Filed For.

The following choices are available. This form is for income earned in tax year 2022, with tax returns due in april. Edit your 2017 form 4972 online type text, add images, blackout confidential details, add comments, highlights and more. A separate form 8814 must.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Sign it in a few clicks draw your signature, type. The following political organizations are not required to file form 8872: Complete, edit or print tax forms instantly. Download or email irs 4972 & more fillable forms, register and subscribe now!

Form 8814 Will Be Used If You Elect To Report Your Child's.

Web we last updated federal form 8814 in january 2023 from the federal internal revenue service. Parents may elect to include their child's income from interest, dividends, and capital gains with. Web to make the election, complete and attach form (s) 8814 to your tax return and file your return by the due date (including extensions). A separate form 8814 must.

Web 8814 Is Parents Election To Report Child's Interest And Dividendss 6251 Is Alternative Minimum Tax 4972 Is Tax On Lump Sum Distributions Ask Your Own Tax.

Web to make the election, complete and attach form(s) 8814 to your tax return and file your return by the due date (including extensions). Web general instructions purpose of form for children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's. If there is an use form 4972, part ii, to apply a 20% tax rate to the capital gain portion. Web taxslayer support what is form 8814, parent's election to report child's interest/dividend earnings?