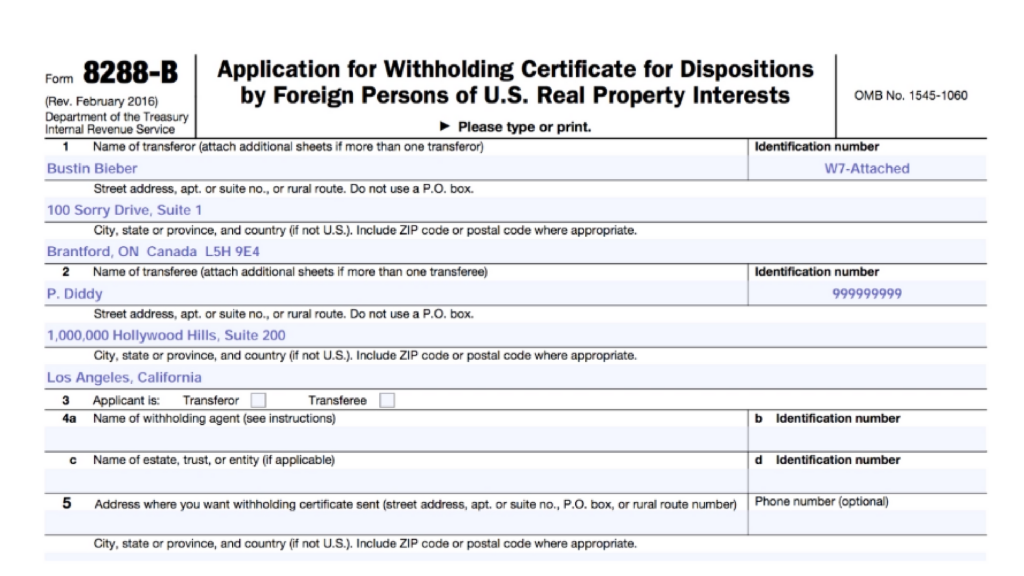

Form 8828-B

Form 8828-B - 64 name(s) social security number (as shown on page 1 of your tax return) Either the transferor (seller) or transferee (buyer) may apply for the withholding certificate. Foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. March 2010) department of the treasury internal revenue service (99) recapture of federal mortgage subsidy ' attach to form 1040. For example, an application without a Specific instructions complete all information for each line. Federal mortgage subsidy you have a federal mortgage subsidy if you received either of the following benefits. Web use this form to figure and report the recapture tax on the mortgage subsidy if you sold or otherwise disposed of your federally subsidized home. Federal mortgage subsidy you have a federal mortgage subsidy if you received either of the following benefits. Web use this form to figure and report the recapture tax on the mortgage subsidy if you sold or otherwise disposed of your federally subsidized home.

Specific instructions complete all information for each line. Real estate for $500,000, with a closing date of july 1. If you receive a withholding certificate from the irs that excuses withholding, you are not required to file form 8288. Foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. Box 409101, ogden, ut 84409. March 2010) department of the treasury internal revenue service (99) recapture of federal mortgage subsidy ' attach to form 1040. For example, an application without a The irs will normally act on an application by the 90th day after a complete application is received. Federal mortgage subsidy you have a federal mortgage subsidy if you received either of the following benefits. 64 name(s) social security number (as shown on page 1 of your tax return)

For example, an application without a Web use this form to figure and report the recapture tax on the mortgage subsidy if you sold or otherwise disposed of your federally subsidized home. Either the transferor (seller) or transferee (buyer) may apply for the withholding certificate. Federal mortgage subsidy you have a federal mortgage subsidy if you received either of the following benefits. Box 409101, ogden, ut 84409. Web use this form to figure and report the recapture tax on the mortgage subsidy if you sold or otherwise disposed of your federally subsidized home. 64 name(s) social security number (as shown on page 1 of your tax return) Real estate for $500,000, with a closing date of july 1. If you receive a withholding certificate from the irs that excuses withholding, you are not required to file form 8288. Federal mortgage subsidy you have a federal mortgage subsidy if you received either of the following benefits.

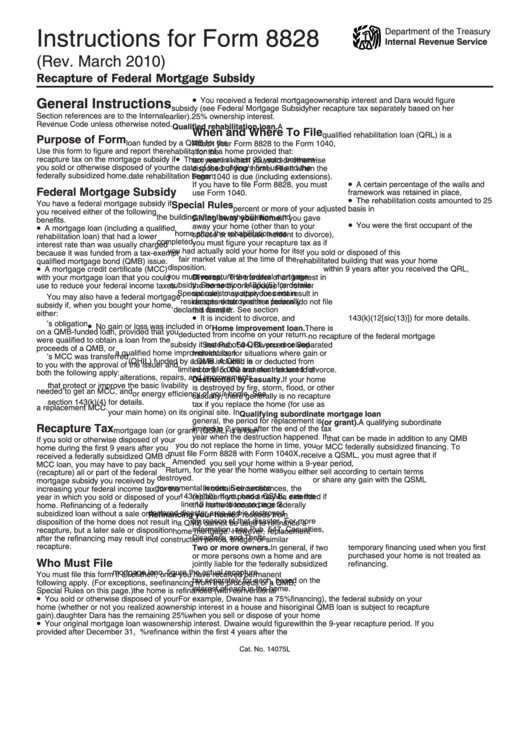

Form 8828 Recapture of Federal Mortgage Subsidy (2010) Free Download

Web use this form to figure and report the recapture tax on the mortgage subsidy if you sold or otherwise disposed of your federally subsidized home. A nonresident has a contract to sell u.s. An application that is not substantially complete when submitted will be rejected. Box 409101, ogden, ut 84409. March 2010) department of the treasury internal revenue service.

Form 8822 B 2019 Fillable and Editable PDF Template

The irs will normally act on an application by the 90th day after a complete application is received. March 2010) department of the treasury internal revenue service (99) recapture of federal mortgage subsidy ' attach to form 1040. An application that is not substantially complete when submitted will be rejected. Box 409101, ogden, ut 84409. For example, an application without.

Form 8828 Recapture of Federal Mortgage Subsidy Sign on the Piece of

Web use this form to figure and report the recapture tax on the mortgage subsidy if you sold or otherwise disposed of your federally subsidized home. Either the transferor (seller) or transferee (buyer) may apply for the withholding certificate. Web use this form to figure and report the recapture tax on the mortgage subsidy if you sold or otherwise disposed.

Model 8828 Grand Prix Limtied

Either the transferor (seller) or transferee (buyer) may apply for the withholding certificate. Real estate for $500,000, with a closing date of july 1. Specific instructions complete all information for each line. Web use this form to figure and report the recapture tax on the mortgage subsidy if you sold or otherwise disposed of your federally subsidized home. Box 409101,.

ios 9 register screen App interface, App, Ios app

Web use this form to figure and report the recapture tax on the mortgage subsidy if you sold or otherwise disposed of your federally subsidized home. The irs will normally act on an application by the 90th day after a complete application is received. A nonresident has a contract to sell u.s. 64 name(s) social security number (as shown on.

소음.진동배출 시설변경신고서 샘플, 양식 다운로드

For example, an application without a Either the transferor (seller) or transferee (buyer) may apply for the withholding certificate. Specific instructions complete all information for each line. Real estate for $500,000, with a closing date of july 1. Federal mortgage subsidy you have a federal mortgage subsidy if you received either of the following benefits.

Fill Free fillable Recapture of Federal Mortgage Subsidy Form 8828

If you receive a withholding certificate from the irs that excuses withholding, you are not required to file form 8288. A nonresident has a contract to sell u.s. Box 409101, ogden, ut 84409. Mortgage loan (including a qualified 64 name(s) social security number (as shown on page 1 of your tax return)

How to Reduce Withholding Taxes on the Sale of U.S. Property Madan CA

Web use this form to figure and report the recapture tax on the mortgage subsidy if you sold or otherwise disposed of your federally subsidized home. Either the transferor (seller) or transferee (buyer) may apply for the withholding certificate. A nonresident has a contract to sell u.s. For example, an application without a An application that is not substantially complete.

Instructions For Form 8828 Recapture Of Federal Mortgage Subsidy

Foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. Real estate for $500,000, with a closing date of july 1. For example, an application without a Box 409101, ogden, ut 84409. Either the transferor (seller) or transferee (buyer) may apply for the withholding certificate.

Bauer V107 for Farming Simulator 2015

Either the transferor (seller) or transferee (buyer) may apply for the withholding certificate. Web use this form to figure and report the recapture tax on the mortgage subsidy if you sold or otherwise disposed of your federally subsidized home. For example, an application without a Web use this form to figure and report the recapture tax on the mortgage subsidy.

Web Use This Form To Figure And Report The Recapture Tax On The Mortgage Subsidy If You Sold Or Otherwise Disposed Of Your Federally Subsidized Home.

Federal mortgage subsidy you have a federal mortgage subsidy if you received either of the following benefits. For example, an application without a Foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. Box 409101, ogden, ut 84409.

If You Receive A Withholding Certificate From The Irs That Excuses Withholding, You Are Not Required To File Form 8288.

64 name(s) social security number (as shown on page 1 of your tax return) Mortgage loan (including a qualified Real estate for $500,000, with a closing date of july 1. Specific instructions complete all information for each line.

Federal Mortgage Subsidy You Have A Federal Mortgage Subsidy If You Received Either Of The Following Benefits.

Either the transferor (seller) or transferee (buyer) may apply for the withholding certificate. A nonresident has a contract to sell u.s. An application that is not substantially complete when submitted will be rejected. March 2010) department of the treasury internal revenue service (99) recapture of federal mortgage subsidy ' attach to form 1040.

Web Use This Form To Figure And Report The Recapture Tax On The Mortgage Subsidy If You Sold Or Otherwise Disposed Of Your Federally Subsidized Home.

The irs will normally act on an application by the 90th day after a complete application is received.