Form 8857 Instructions

Form 8857 Instructions - Do not file it with the employee assigned to examine your return. What’s new however, you must file form 8857 no later than 2 years after form 8857 has been revised to reduce the number of mistakes the first irs attempt to collect the tax from you that occurs after Web form 8857 instructions: Form 8857 is used to request relief from tax liability when a spouse or former spouse should be. The preparer must give you a copy of form 8857 for your records. Important things you should know • do not file this form with your tax return. You filed a joint return. Web instructions for form 8857(rev. For instructions and the latest information. Someone who prepares form 8857 but does not charge you should not sign it.

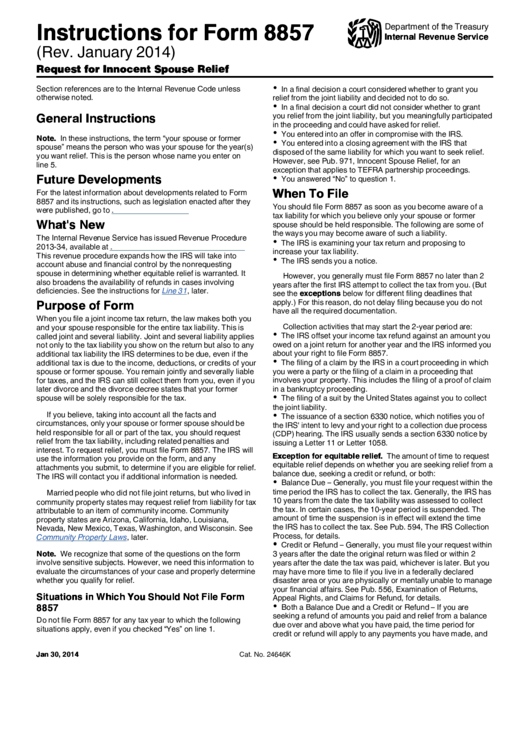

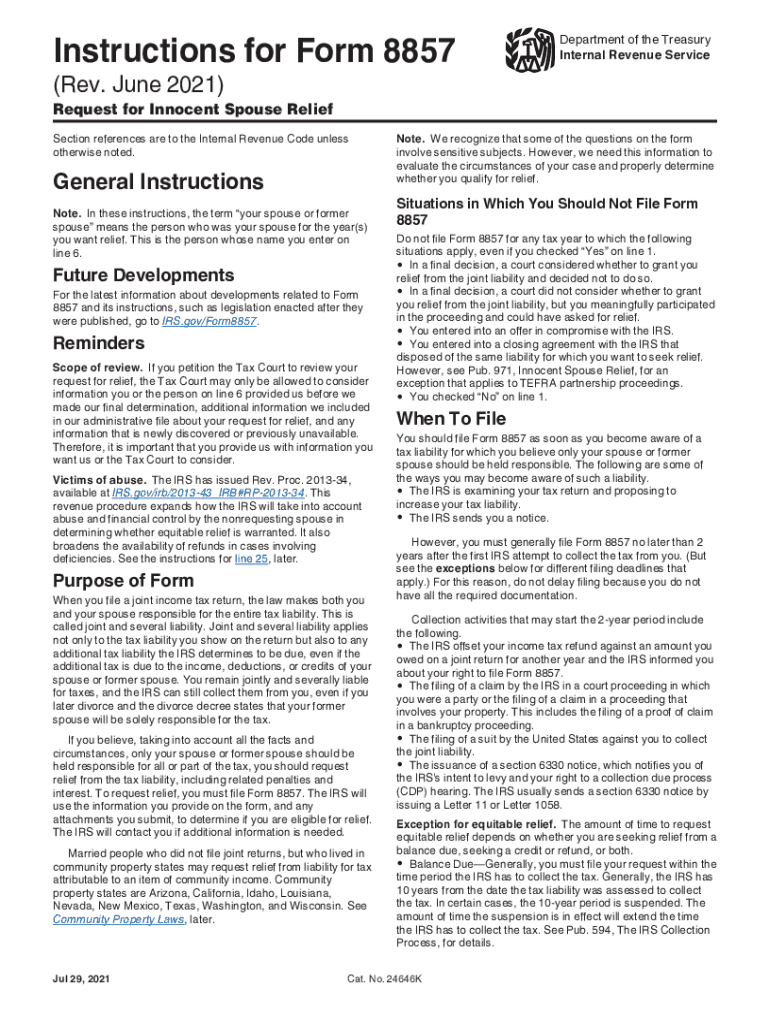

Web form 8857 instructions: The instructions for form 8857 have helpful directions. The irs will use the information you provide on irs form 8857, and any additional documentation you submit, to determine if you’re eligible for relief. June 2021) department of the treasury internal revenue service (99) request for innocent spouse relief. The instructions for form 8857 have helpful directions. Web information about form 8857, request for innocent spouse relief, including recent updates, related forms, and instructions on how to file. Web general instructions • the irs is examining your tax return and proposing to increase your tax liability. What’s new however, you must file form 8857 no later than 2 years after form 8857 has been revised to reduce the number of mistakes the first irs attempt to collect the tax from you that occurs after Web to request relief, file form 8857, request for innocent spouse relief. In these instructions, the term “your spouse or former spouse” means the person who was your spouse for the.

Someone who prepares form 8857 but does not charge you should not sign it. The instructions for form 8857 have helpful directions. • the irs sends you a notice. Generally, the irs has 10 years to collect an amount you owe. The preparer must give you a copy of form 8857 for your records. Web file form 8857 at one of the addresses or send it to the fax number shown in the instructions for form 8857. In these instructions, the term “your spouse or former spouse” means the person who was your spouse for the. You have two years to file from the time the irs first tries to collect from you to do so, but there are some exceptions. Form 8857 is used to request relief from tax liability when a spouse or former spouse should be. Web information about form 8857, request for innocent spouse relief, including recent updates, related forms, and instructions on how to file.

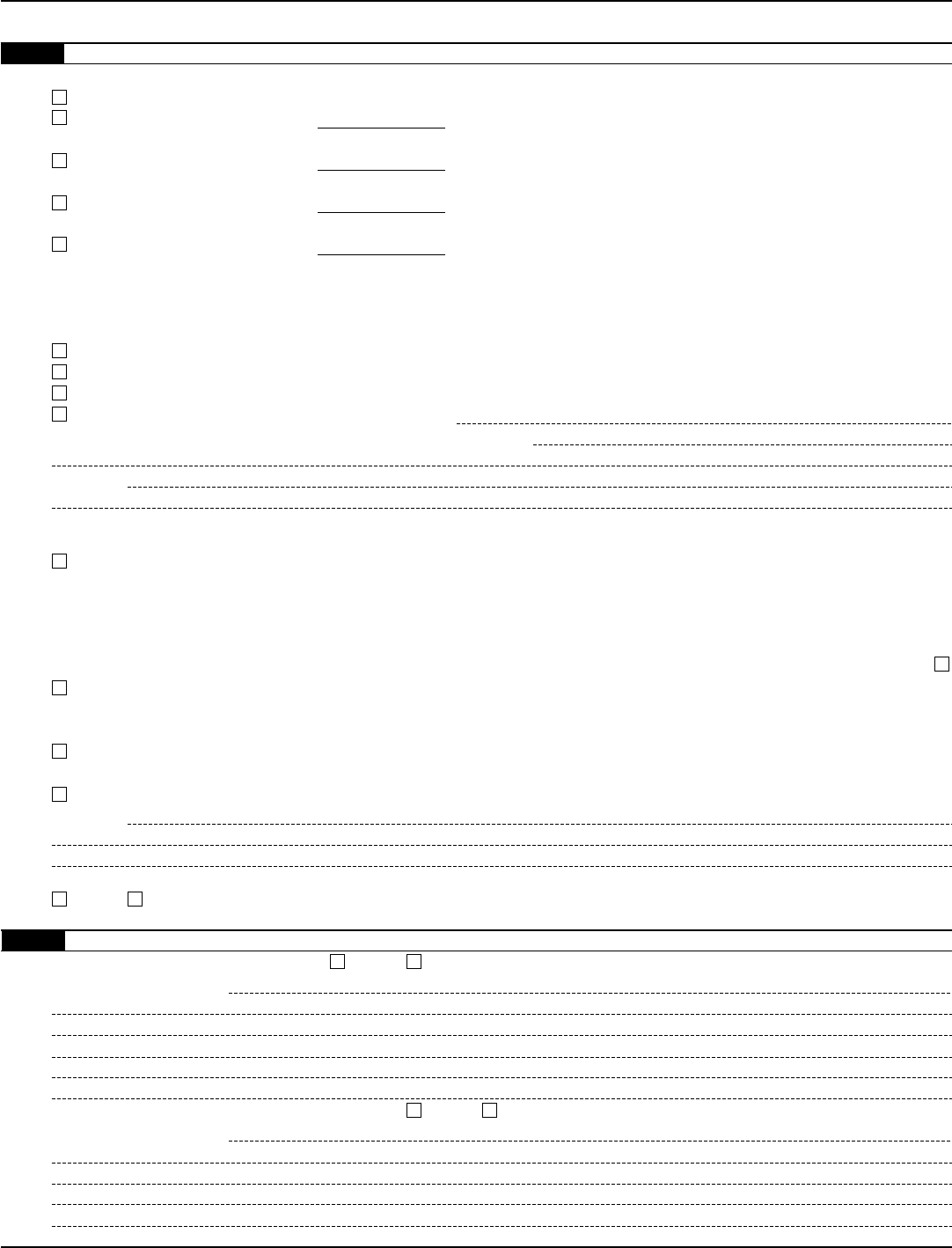

Form 8857 Edit, Fill, Sign Online Handypdf

Important things you should know • do not file this form with your tax return. You need to file form 8857 as soon as you find out that you are being held liable for taxes you believe should only be your spouse’s. Do not file it with the employee assigned to examine your return. You filed a joint return. Web.

Fillable Form 8857 Request For Innocent Spouse Relief printable pdf

Web information about form 8857, request for innocent spouse relief, including recent updates, related forms, and instructions on how to file. You filed a joint return. Web to request relief, file irs form 8857, request for innocent spouse relief. You have two years to file from the time the irs first tries to collect from you to do so, but.

Form 8857 Request for Innocent Spouse Relief (2014) Free Download

The irs will use the information you provide on form 8857, and any additional documentation you submit, to determine if you’re eligible for relief. For instructions and the latest information. Web instructions for form 8857(rev. In these instructions, the term “your spouse or former spouse” means the person who was your spouse for the. The instructions for form 8857 have.

IRS Form 8857 How to File

June 2021) department of the treasury internal revenue service (99) request for innocent spouse relief. You need to file form 8857 as soon as you find out that you are being held liable for taxes you believe should only be your spouse’s. You have two years to file from the time the irs first tries to collect from you to.

Be Free of Financial Responsibility After a Divorce with IRS Form 8857

Someone who prepares form 8857 but does not charge you should not sign it. You filed a joint return. The instructions for form 8857 have helpful directions. Web information about form 8857, request for innocent spouse relief, including recent updates, related forms, and instructions on how to file. What’s new however, you must file form 8857 no later than 2.

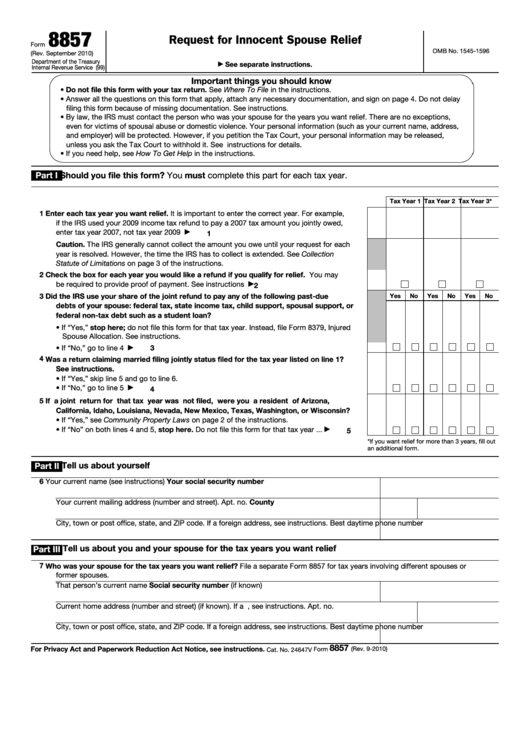

Instructions For Form 8857 (Rev. 2014) printable pdf download

Someone who prepares form 8857 but does not charge you should not sign it. In these instructions, the term “your spouse or former spouse” means the person who was your spouse for the. The preparer must give you a copy of form 8857 for your records. Important things you should know • do not file this form with your tax.

Form 8857 Instructions Fill Out and Sign Printable PDF Template signNow

Important things you should know • do not file this form with your tax return. The irs will use the information you provide on irs form 8857, and any additional documentation you submit, to determine if you’re eligible for relief. Web instructions for form 8857(rev. Web general instructions • the irs is examining your tax return and proposing to increase.

Form 8857 Edit, Fill, Sign Online Handypdf

Web file form 8857 at one of the addresses or send it to the fax number shown in the instructions for form 8857. Web information about form 8857, request for innocent spouse relief, including recent updates, related forms, and instructions on how to file. You filed a joint return. June 2021) request for innocent spouse relief department of the treasury.

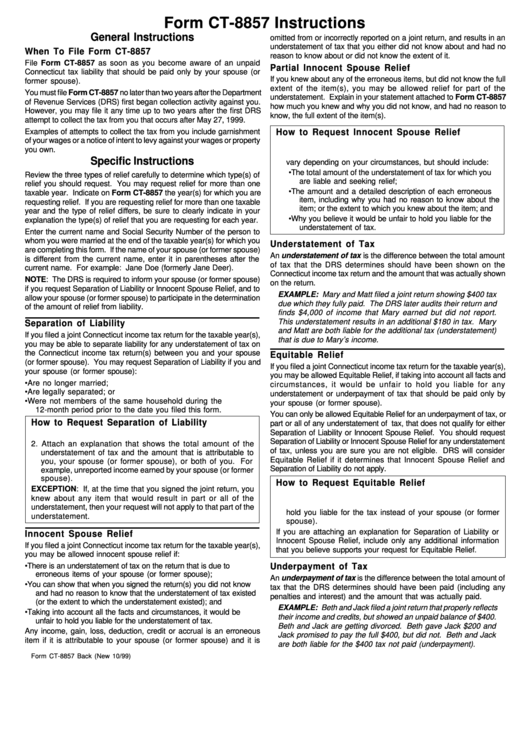

Form Ct8857 Instructions printable pdf download

You have two years to file from the time the irs first tries to collect from you to do so, but there are some exceptions. You filed a joint return. Generally, the irs has 10 years to collect an amount you owe. The preparer must give you a copy of form 8857 for your records. What’s new however, you must.

Form 8857 Edit, Fill, Sign Online Handypdf

Web information about form 8857, request for innocent spouse relief, including recent updates, related forms, and instructions on how to file. What’s new however, you must file form 8857 no later than 2 years after form 8857 has been revised to reduce the number of mistakes the first irs attempt to collect the tax from you that occurs after For.

Web Form 8857 Instructions:

Generally, the irs has 10 years to collect an amount you owe. Web to request relief, file form 8857, request for innocent spouse relief. Web file form 8857 at one of the addresses or send it to the fax number shown in the instructions for form 8857. You filed a joint return.

For Instructions And The Latest Information.

Web general instructions • the irs is examining your tax return and proposing to increase your tax liability. What’s new however, you must file form 8857 no later than 2 years after form 8857 has been revised to reduce the number of mistakes the first irs attempt to collect the tax from you that occurs after Web information about form 8857, request for innocent spouse relief, including recent updates, related forms, and instructions on how to file. You need to file form 8857 as soon as you find out that you are being held liable for taxes you believe should only be your spouse’s.

Web Instructions For Form 8857(Rev.

The irs will use the information you provide on irs form 8857, and any additional documentation you submit, to determine if you’re eligible for relief. The irs may grant innocent spouse relief if the requesting spouse meets the following criteria: The instructions for form 8857 have helpful directions. Web to request relief, file irs form 8857, request for innocent spouse relief.

June 2021) Department Of The Treasury Internal Revenue Service (99) Request For Innocent Spouse Relief.

The irs will use the information you provide on form 8857, and any additional documentation you submit, to determine if you’re eligible for relief. Someone who prepares form 8857 but does not charge you should not sign it. The preparer must give you a copy of form 8857 for your records. In these instructions, the term “your spouse or former spouse” means the person who was your spouse for the.