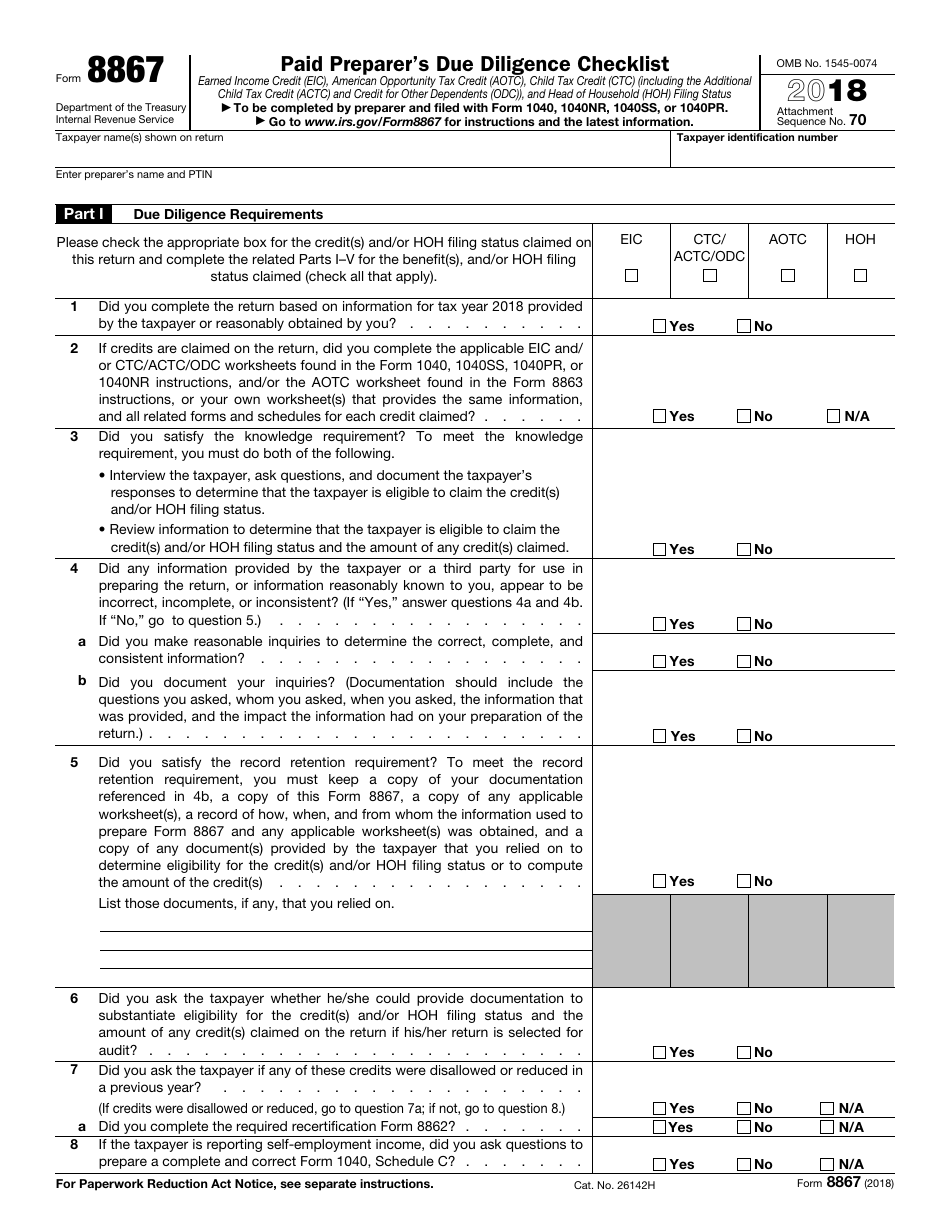

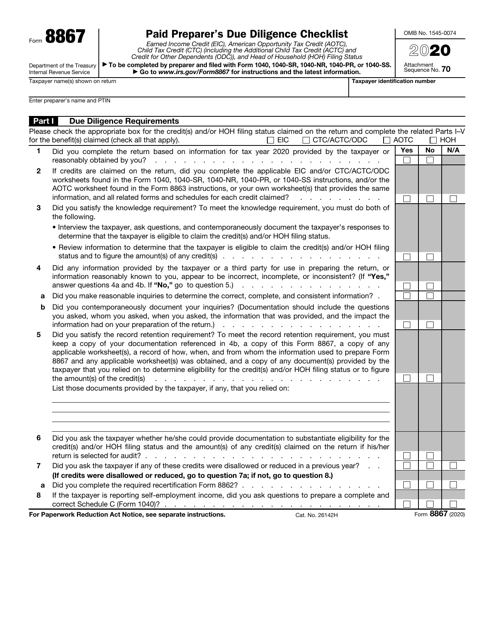

Form 8867 Due Diligence Checklist

Form 8867 Due Diligence Checklist - Web the internal revenue service (irs) created form 8867 paid preparer's due diligence checklist for paid tax preparers to certify, to the best of their knowledge, that the. Earned income credit (eic), american opportunity tax credit. Get ready for tax season deadlines by completing any required tax forms today. Use this section to provide information for and. Web the form 8867 2019 paid preparer’s due diligence checklist form is 2 pages long and contains: Web the purpose of the form is to ensure that the practitioner has considered all applicable eligibility criteria for certain tax credits for each return prepared, such as the. December 2021) department of the treasury internal revenue service. Complete, edit or print tax forms instantly. Below, you'll find information about entering form 8867, paid preparer's due diligence checklist: November 2022) paid preparer’s due diligence checklist for the earned income.

Once completed you can sign your fillable form or send for signing. Web keep a copy of the completed form 8867, paid preparer's due diligence checklist. Web this checklist is a comprehensive tool to use when preparing form 8867, paid preparer’s due diligence checklist, that is associated with claiming the earned income tax credit,. Department of the treasury internal revenue service. Web use fill to complete blank online irs pdf forms for free. Below, you'll find information about entering form 8867, paid preparer's due diligence checklist: Web solvedby intuit•updated 20 minutes ago. Complete, edit or print tax forms instantly. All forms are printable and downloadable. Web the purpose of the form is to ensure that the practitioner has considered all applicable eligibility criteria for certain tax credits for each return prepared, such as the.

Web keep a copy of the completed form 8867, paid preparer's due diligence checklist. Web when form 8867 is required, lacerte will generate the paid preparer's due diligence checklist as though all requirements have been completed. Web knowledge retention of records preparers who fail to meet the due diligence requirements can be assessed a penalty of $530 for each failure to meet all four due diligence. Web the purpose of the form is to ensure that the practitioner has considered all applicable eligibility criteria for certain tax credits for each return prepared, such as the. 204) if the taxpayer is. Ad access irs tax forms. Once completed you can sign your fillable form or send for signing. Get ready for tax season deadlines by completing any required tax forms today. Keep all five of the following records for 3 years from the latest of the dates specified in the form 8867 instructions under. Web complete this form 8867 truthfully and accurately and complete the actions described in this checklist for any applicable credit(s) claimed and hoh filing status, if claimed;.

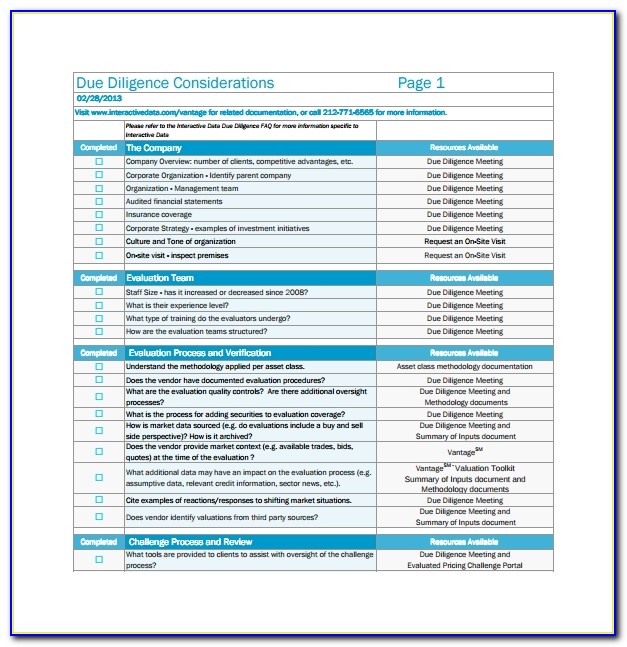

Due Diligence Checklist Form 8867 Template 1 Resume Examples

Web the purpose of the form is to ensure that the practitioner has considered all applicable eligibility criteria for certain tax credits for each return prepared, such as the. Web the form 8867 2019 paid preparer’s due diligence checklist form is 2 pages long and contains: Keep a copy of the worksheets or computations used to compute the amount. December.

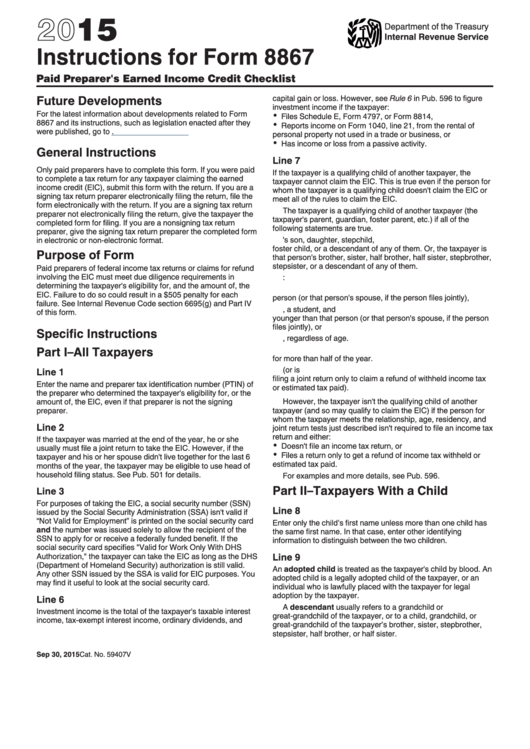

Instructions For Form 8867 Paid Preparer'S Earned Credit

Web the due diligence regulations require a paid tax return preparer to complete and submit form 8867, pdf paid preparer's due diligence checklist, with. Web keep a copy of the completed form 8867, paid preparer's due diligence checklist. 204) if the taxpayer is. All forms are printable and downloadable. Web when form 8867 is required, lacerte will generate the paid.

Due Diligence Checklist Template Uk

Paid tax return preparers are required to exercise due diligence when preparing any client’s return or claim for. Web the purpose of the form is to ensure that the practitioner has considered all applicable eligibility criteria for certain tax credits for each return prepared, such as the. Web use fill to complete blank online irs pdf forms for free. Web.

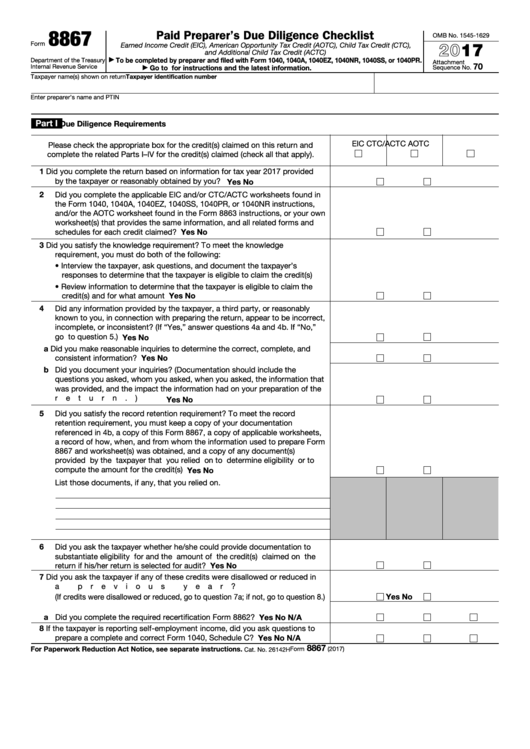

Fillable Form 8867 Paid Preparer'S Earned Credit Checklist

All forms are printable and downloadable. Web knowledge retention of records preparers who fail to meet the due diligence requirements can be assessed a penalty of $530 for each failure to meet all four due diligence. Below, you'll find information about entering form 8867, paid preparer's due diligence checklist: Department of the treasury internal revenue service. Web the internal revenue.

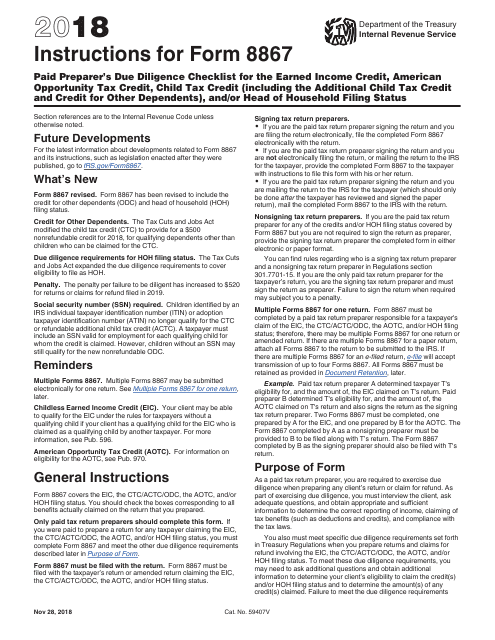

Download Instructions for IRS Form 8867 Paid Preparer's Due Diligence

Web when form 8867 is required, lacerte will generate the paid preparer's due diligence checklist as though all requirements have been completed. Paid tax return preparers are required to exercise due diligence when preparing any client’s return or claim for. Once completed you can sign your fillable form or send for signing. Ad access irs tax forms. Below, you'll find.

Solved Question 65 of 85. When is a tax preparer required to

Ad access irs tax forms. Below, you'll find information about entering form 8867, paid preparer's due diligence checklist: Web use fill to complete blank online irs pdf forms for free. Web when form 8867 is required, lacerte will generate the paid preparer's due diligence checklist as though all requirements have been completed. Web solvedby intuit•updated 20 minutes ago.

IRS Form 8867 Download Fillable PDF or Fill Online Paid Preparer's Due

Web solvedby intuit•updated 20 minutes ago. All forms are printable and downloadable. Paid preparer’s due diligence checklist. Web complete this form 8867 truthfully and accurately and complete the actions described in this checklist for any applicable credit(s) claimed and hoh filing status, if claimed;. Web knowledge retention of records preparers who fail to meet the due diligence requirements can be.

Due Diligence Checklist Template Word Template 1 Resume Examples

Below, you'll find information about entering form 8867, paid preparer's due diligence checklist: Web the due diligence regulations require a paid tax return preparer to complete and submit form 8867, pdf paid preparer's due diligence checklist, with. November 2022) paid preparer’s due diligence checklist for the earned income. Web use fill to complete blank online irs pdf forms for free..

IRS Form 8867 Download Fillable PDF or Fill Online Paid Preparer's Due

Web knowledge retention of records preparers who fail to meet the due diligence requirements can be assessed a penalty of $530 for each failure to meet all four due diligence. Earned income credit (eic), american opportunity tax credit. Get ready for tax season deadlines by completing any required tax forms today. All forms are printable and downloadable. Keep a copy.

Due Diligence Checklist Template Excel Template 1 Resume Examples

Web complete this form 8867 truthfully and accurately and complete the actions described in this checklist for any applicable credit(s) claimed and hoh filing status, if claimed;. Web when form 8867 is required, lacerte will generate the paid preparer's due diligence checklist as though all requirements have been completed. Keep all five of the following records for 3 years from.

Use This Section To Provide Information For And.

All forms are printable and downloadable. Keep all five of the following records for 3 years from the latest of the dates specified in the form 8867 instructions under. Web use this screen to enter information to complete form 8867, paid preparer’s due diligence checklist. Web the purpose of the form is to ensure that the practitioner has considered all applicable eligibility criteria for certain tax credits for each return prepared, such as the.

Paid Preparer’s Due Diligence Checklist.

Complete, edit or print tax forms instantly. Ad access irs tax forms. Web this checklist is a comprehensive tool to use when preparing form 8867, paid preparer’s due diligence checklist, that is associated with claiming the earned income tax credit,. Below, you'll find information about entering form 8867, paid preparer's due diligence checklist:

Keep A Copy Of The Worksheets Or Computations Used To Compute The Amount.

Paid tax return preparers are required to exercise due diligence when preparing any client’s return or claim for. Web when form 8867 is required, lacerte will generate the paid preparer's due diligence checklist as though all requirements have been completed. Web the due diligence regulations require a paid tax return preparer to complete and submit form 8867, pdf paid preparer's due diligence checklist, with. Web instructions for form 8867 department of the treasury internal revenue service (rev.

204) If The Taxpayer Is.

Web knowledge retention of records preparers who fail to meet the due diligence requirements can be assessed a penalty of $530 for each failure to meet all four due diligence. Web the form 8867 2019 paid preparer’s due diligence checklist form is 2 pages long and contains: Paid preparer’s due diligence checklist. Get ready for tax season deadlines by completing any required tax forms today.