Form 8868 Extension

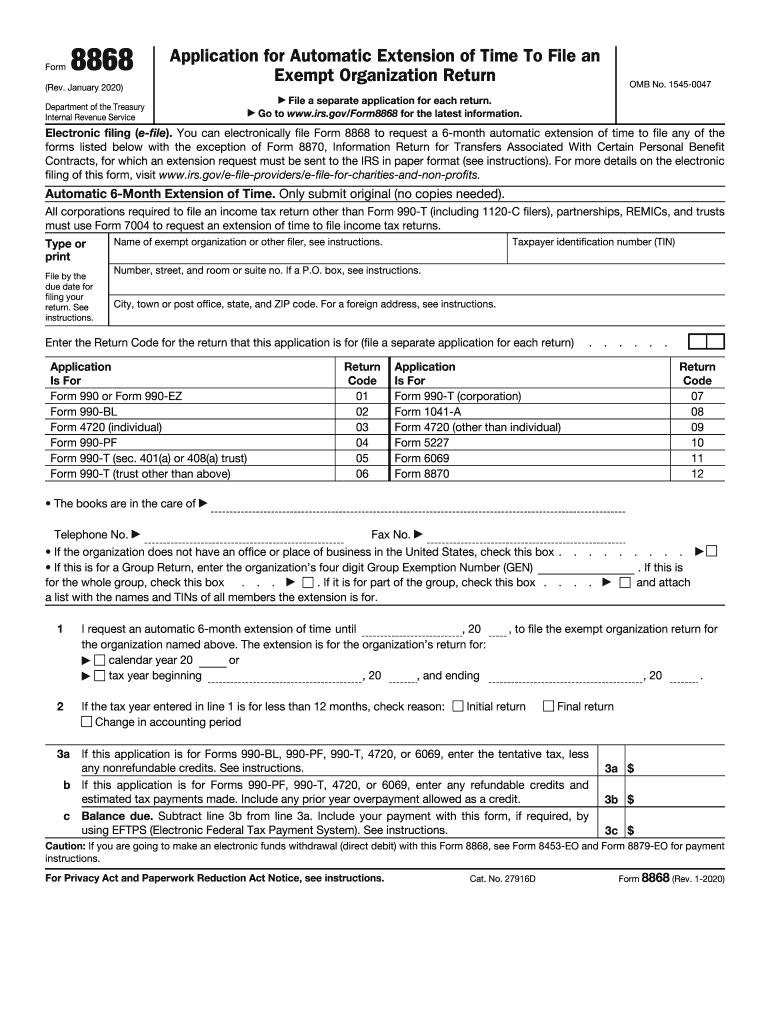

Form 8868 Extension - Form 8868 is a federal corporate income tax form. Ad file form 8868 online in minutes and extend your 990 deadline up to 6 months. Web may 15, 2023, is the deadline to file form 8868 if your exempt organization follows the calendar tax year. Use form 8868, application for extension of time to file an exempt organization return pdf, to. Create custom documents by adding smart fillable. Ad file form 8868 online in minutes and extend your 990 deadline up to 6 months. If your nonprofit organization has a. Complete, edit or print tax forms instantly. File form 8868 for free when you pay in advance for a 990 return with our package pricing. Web may 8, 2023.

Filing form 8868 extends your deadline up to october 15, 2023. Web may 15, 2023, is the deadline to file form 8868 if your exempt organization follows the calendar tax year. Citizen or resident) to file form 1040,. Download or email irs 8868 & more fillable forms, register and subscribe now! You can complete your filing in a few simple steps: Ad file form 8868 online in minutes and extend your 990 deadline up to 6 months. Web extension of time to file exempt organization returns. Ad file form 8868 online in minutes and extend your 990 deadline up to 6 months. Web pdf editing your way complete or edit your form 8868 anytime and from any device using our web, desktop, and mobile apps. Complete, edit or print tax forms instantly.

Web pdf editing your way complete or edit your form 8868 anytime and from any device using our web, desktop, and mobile apps. Complete, edit or print tax forms instantly. Download or email irs 8868 & more fillable forms, register and subscribe now! Ad file form 8868 online in minutes and extend your 990 deadline up to 6 months. File form 8868 for free when you pay in advance for a 990 return with our package pricing. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web use form 4868 to apply for 6 more months (4 if “out of the country” (defined later under. Complete, edit or print tax forms instantly. Filing form 8868 extends your deadline up to october 15, 2023. If your nonprofit organization has a.

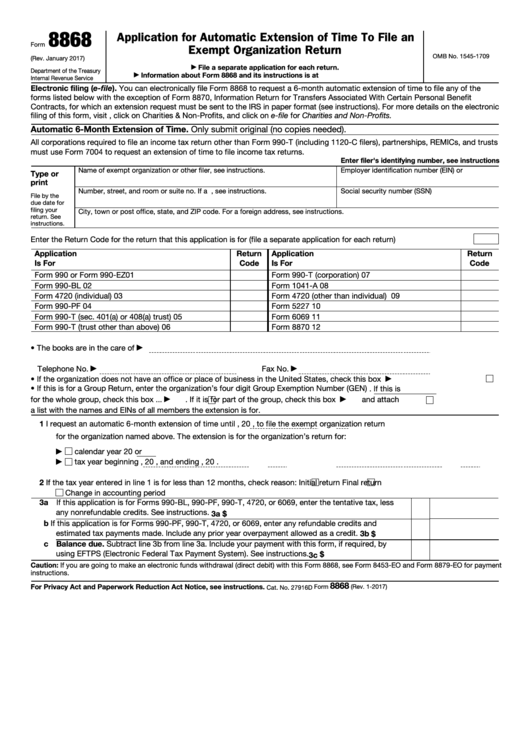

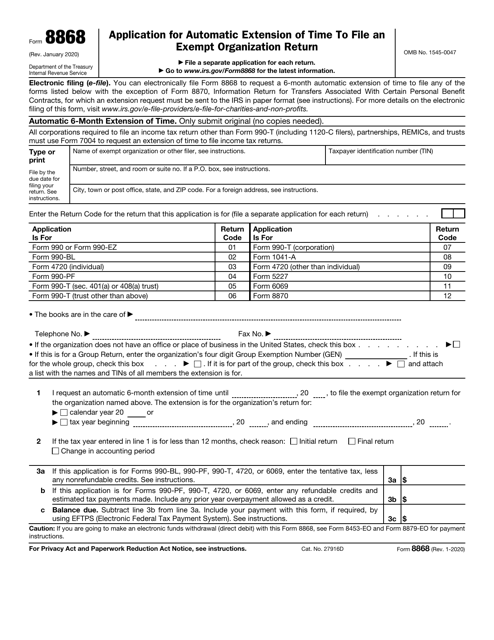

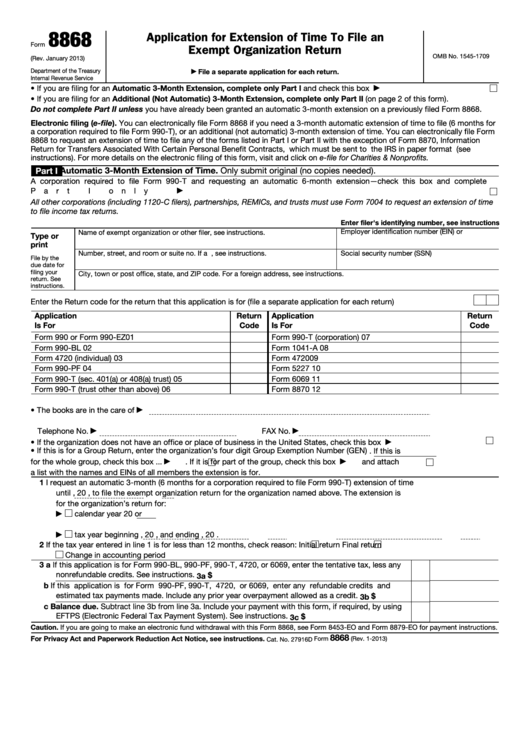

Irs form 8868

Web may 15, 2023, is the deadline to file form 8868 if your exempt organization follows the calendar tax year. File form 8868 for free when you pay in advance for a 990 return with our package pricing. Web extension of time to file exempt organization returns. Download or email irs 8868 & more fillable forms, register and subscribe now!.

How to File A LastMinute 990 Extension With Form 8868

Web extension of time to file exempt organization returns. Web may 15, 2023, is the deadline to file form 8868 if your exempt organization follows the calendar tax year. Web may 8, 2023. Download or email irs 8868 & more fillable forms, register and subscribe now! Taxpayers who are out of the country) and a u.s.

Form 8868 Application for Extension of Time to File an Exempt

Download or email irs 8868 & more fillable forms, register and subscribe now! Form 8868 is a federal corporate income tax form. Web there are several ways to submit form 4868. Use form 8868, application for extension of time to file an exempt organization return pdf, to. File form 8868 for free when you pay in advance for a 990.

Form 8868, NonProfit Organization Tax Extension Deadline Alert!

Download or email irs 8868 & more fillable forms, register and subscribe now! Ad file form 8868 online in minutes and extend your 990 deadline up to 6 months. Web pdf editing your way complete or edit your form 8868 anytime and from any device using our web, desktop, and mobile apps. Complete, edit or print tax forms instantly. Download.

If You Filed a Form 8868 Extension in May, it’s Time to File Your

Ad file form 8868 online in minutes and extend your 990 deadline up to 6 months. Web use form 4868 to apply for 6 more months (4 if “out of the country” (defined later under. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. You can complete your filing in.

Form 8868 Extension ExpressTaxExempt YouTube

Download or email irs 8868 & more fillable forms, register and subscribe now! You can complete your filing in a few simple steps: Use form 8868, application for extension of time to file an exempt organization return pdf, to. Filing form 8868 extends your deadline up to october 15, 2023. If your nonprofit organization has a.

Fillable Form 8868 Application For Automatic Extension Of Time To

Web pdf editing your way complete or edit your form 8868 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable. File form 8868 for free when you pay in advance for a 990 return with our package pricing. Web what is irs form 8868? Complete, edit or print tax forms.

IRS Form 8868 Download Fillable PDF or Fill Online Application for

Web may 15, 2023, is the deadline to file form 8868 if your exempt organization follows the calendar tax year. Create custom documents by adding smart fillable. Use form 8868, application for extension of time to file an exempt organization return pdf, to. Ad file form 8868 online in minutes and extend your 990 deadline up to 6 months. Taxpayers.

Fillable Form 8868 Application For Extension Of Time To File An

Web pdf editing your way complete or edit your form 8868 anytime and from any device using our web, desktop, and mobile apps. File form 8868 for free when you pay in advance for a 990 return with our package pricing. If your nonprofit organization has a. Web what is irs form 8868? Web use form 4868 to apply for.

Irs Form 8868 Fill Out and Sign Printable PDF Template signNow

Web may 8, 2023. Download or email irs 8868 & more fillable forms, register and subscribe now! Web what is irs form 8868? Ad file form 8868 online in minutes and extend your 990 deadline up to 6 months. Complete, edit or print tax forms instantly.

Web May 15, 2023, Is The Deadline To File Form 8868 If Your Exempt Organization Follows The Calendar Tax Year.

Complete, edit or print tax forms instantly. If your nonprofit organization has a. Web there are several ways to submit form 4868. Web extension of time to file exempt organization returns.

Ad File Form 8868 Online In Minutes And Extend Your 990 Deadline Up To 6 Months.

Download or email irs 8868 & more fillable forms, register and subscribe now! File form 8868 for free when you pay in advance for a 990 return with our package pricing. Download or email irs 8868 & more fillable forms, register and subscribe now! Web may 8, 2023.

Complete, Edit Or Print Tax Forms Instantly.

Web what is irs form 8868? Create custom documents by adding smart fillable. Taxpayers who are out of the country) and a u.s. You can complete your filing in a few simple steps:

Web Pdf Editing Your Way Complete Or Edit Your Form 8868 Anytime And From Any Device Using Our Web, Desktop, And Mobile Apps.

Form 8868 is a federal corporate income tax form. Web use form 4868 to apply for 6 more months (4 if “out of the country” (defined later under. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Ad file form 8868 online in minutes and extend your 990 deadline up to 6 months.