Form 8889 Instructions 2021

Form 8889 Instructions 2021 - Part i hsa contributions and deduction. Press f6 on your keyboard to bring up open forms. Table of contents health savings accounts how an hsa. Report distributions you took from the hsa (hopefully for eligible medical expenses). Web if the taxpayer contributed too much to the hsa, the excess contribution flows to form 5329 lines 47 and 48. For more information about form 8889, go to the form 8889 instructions. Web dec 30, 2021 for telehealth and other remote care services. Web information about form 8889, health savings accounts (hsas), including recent updates, related forms and instructions on how to file. Web they require you use this document to: General instructions purpose of form use form 8889 to:

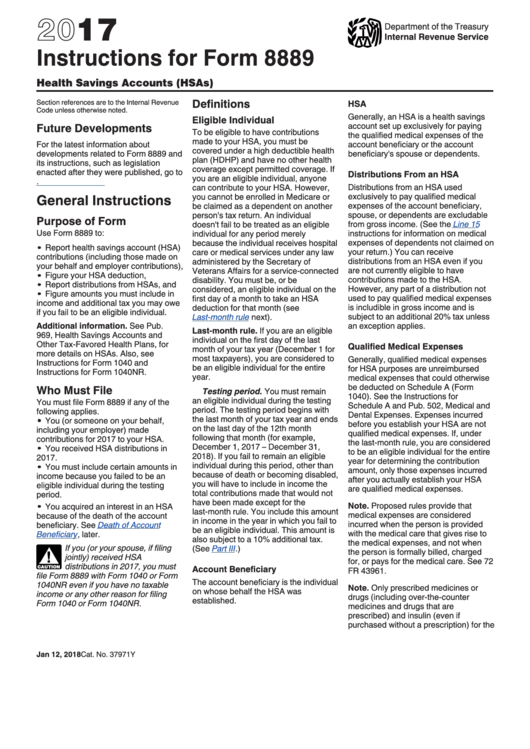

Covered under a hdhp and has no other insurance coverage, with the exception of telehealth and other remote care coverage; They have been updated to reflect the 2021 hsa and hdhp limits and thresholds (see our checkpoint article ) and the april 15, 2022, deadline for making hsa contributions for 2021. Web if the taxpayer contributed too much to the hsa, the excess contribution flows to form 5329 lines 47 and 48. Report distributions you took from the hsa (hopefully for eligible medical expenses). Press f6 on your keyboard to bring up open forms. Calculate taxes you owe on the distributions (if you used the. Table of contents health savings accounts how an hsa. Web irs releases 2021 form 8889 and instructions. Web form 8889 is used to report the contributions to and distributions from the hsa for the purpose of determining the hsa deduction and if any distributions are taxable. Web dec 30, 2021 for telehealth and other remote care services.

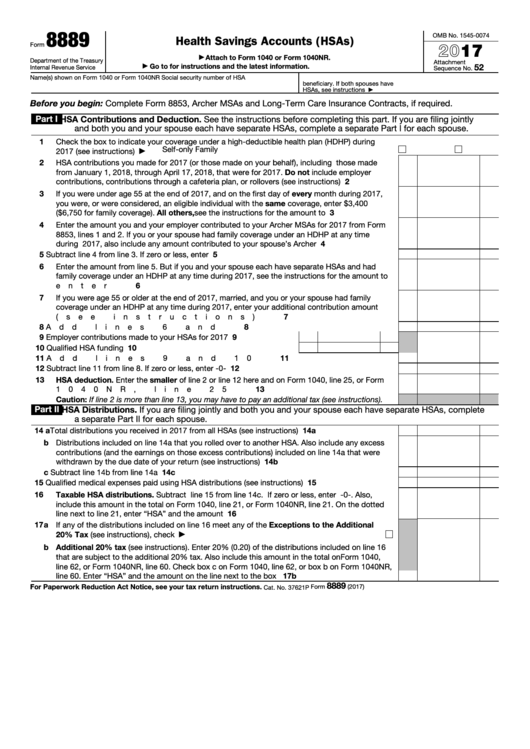

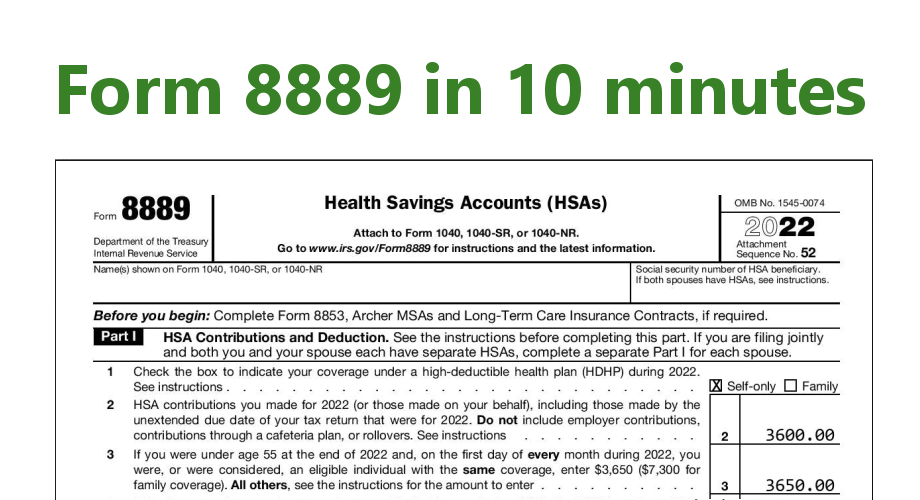

See the instructions before completing this part. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 09:09 am overview before you can deduct your contributions to a health savings account (hsa), you must prepare irs form 8889. Web the 2021 versions of form 8889 and its instructions are substantially similar to their 2020 counterparts. Calculate taxes you owe on the distributions (if you used the. General instructions purpose of form use form 8889 to: The irs recently released form 8889, health savings accounts (hsas), and the related instructions. Web 8889 before you begin: Report health savings account contributions (including those made on your behalf and employer contributions) determine your hsa deduction report distributions from your hsa Web calculate your tax deduction from making hsa contributions. Press f6 on your keyboard to bring up open forms.

1040 Form 2021 Printable Printable Form 2021

Web dec 30, 2021 for telehealth and other remote care services. Web calculate your tax deduction from making hsa contributions. The irs recently released form 8889, health savings accounts (hsas), and the related instructions. Part i hsa contributions and deduction. Press f6 on your keyboard to bring up open forms.

8889 Form 2021

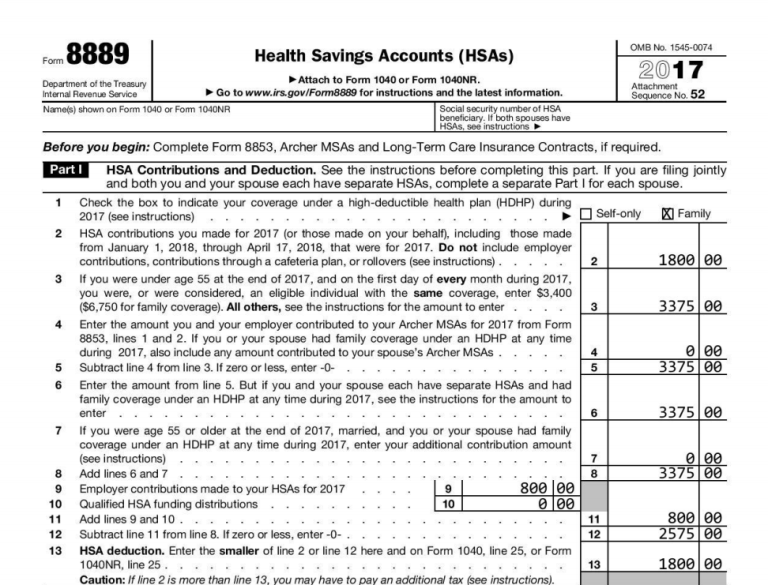

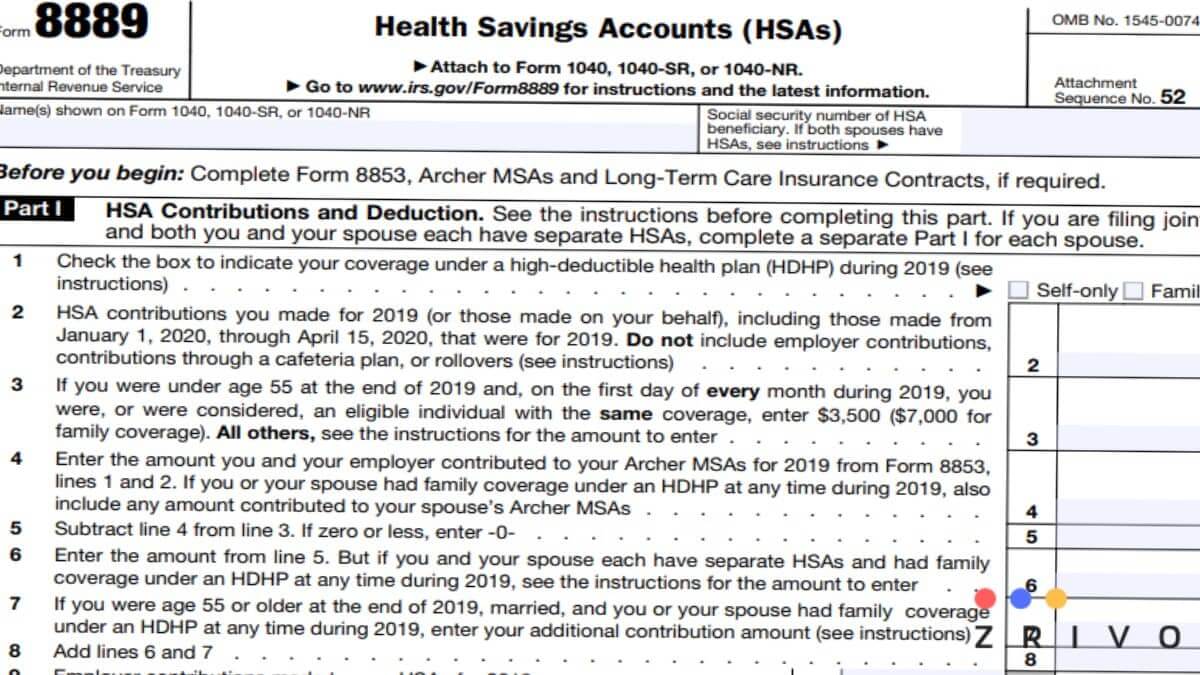

Part i hsa contributions and deduction. The irs recently released form 8889, health savings accounts (hsas), and the related instructions. If you are filing jointly and both you and your spouse each have separate hsas, complete a separate part i for each spouse. For more information about form 8889, go to the form 8889 instructions. Web they require you use.

Fillable Form 8889 Health Savings Accounts (Hsas) 2017 printable

Web irs releases 2021 form 8889 and instructions. For more information about form 8889, go to the form 8889 instructions. Report distributions you took from the hsa (hopefully for eligible medical expenses). Report health savings account contributions (including those made on your behalf and employer contributions) determine your hsa deduction report distributions from your hsa Web form 8889 is used.

Instructions For Form 8889 Health Savings Accounts (Hsas) 2017

Part i hsa contributions and deduction. If you are filing jointly and both you and your spouse each have separate hsas, complete a separate part i for each spouse. Type 8889 and select ok. Web dec 30, 2021 for telehealth and other remote care services. Web 8889 before you begin:

2017 HSA Form 8889 Instructions and Example HSA Edge

Web if the taxpayer contributed too much to the hsa, the excess contribution flows to form 5329 lines 47 and 48. If you are filing jointly and both you and your spouse each have separate hsas, complete a separate part i for each spouse. They have been updated to reflect the 2021 hsa and hdhp limits and thresholds (see our.

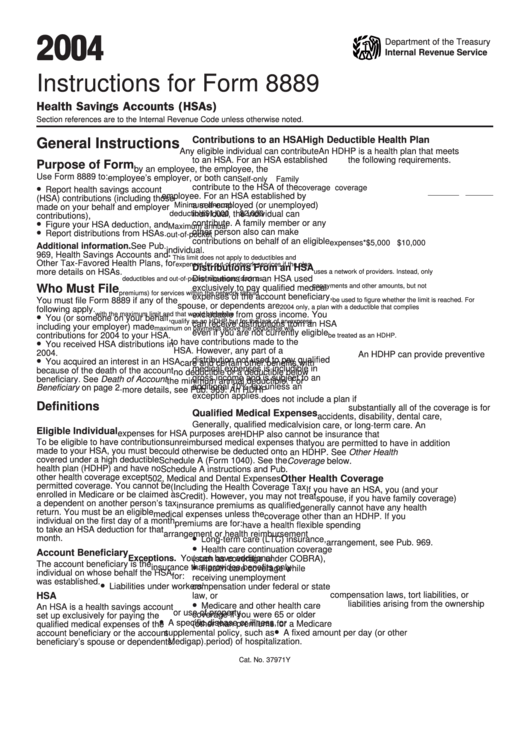

Instructions For Form 8889 Health Savings Accounts (Hsas) 2004

Web calculate your tax deduction from making hsa contributions. Form 8889 is used to report activity in a health savings account. Report health savings account contributions (including those made on your behalf and employer contributions) determine your hsa deduction report distributions from your hsa The irs recently released form 8889, health savings accounts (hsas), and the related instructions. If you.

EasyForm8889 simple instructions for HSA Tax Form 8889

Table of contents health savings accounts how an hsa. Web dec 30, 2021 for telehealth and other remote care services. Part i hsa contributions and deduction. They have been updated to reflect the 2021 hsa and hdhp limits and thresholds (see our checkpoint article ) and the april 15, 2022, deadline for making hsa contributions for 2021. Written by a.

8889 Form 2022 2023

Web calculate your tax deduction from making hsa contributions. They have been updated to reflect the 2021 hsa and hdhp limits and thresholds (see our checkpoint article ) and the april 15, 2022, deadline for making hsa contributions for 2021. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022.

2016 HSA Form 8889 instructions and example YouTube

Table of contents health savings accounts how an hsa. They have been updated to reflect the 2021 hsa and hdhp limits and thresholds (see our checkpoint article ) and the april 15, 2022, deadline for making hsa contributions for 2021. Web they require you use this document to: Form 8889 is used to report hsa contributions, figure hsa deductions and.

Form 8889 Is Used To Report Hsa Contributions, Figure Hsa Deductions And Report Hsa Distributions.

Web information about form 8889, health savings accounts (hsas), including recent updates, related forms and instructions on how to file. Form 8889 is used to report activity in a health savings account. If you are filing jointly and both you and your spouse each have separate hsas, complete a separate part i for each spouse. Type 8889 and select ok.

Web 8889 Before You Begin:

Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 09:09 am overview before you can deduct your contributions to a health savings account (hsa), you must prepare irs form 8889. Web calculate your tax deduction from making hsa contributions. Web what is the irs form 8889? Web if the taxpayer contributed too much to the hsa, the excess contribution flows to form 5329 lines 47 and 48.

Web Irs Releases 2021 Form 8889 And Instructions.

Part i hsa contributions and deduction. Web they require you use this document to: For more information about form 8889, go to the form 8889 instructions. Report health savings account contributions (including those made on your behalf and employer contributions) determine your hsa deduction report distributions from your hsa

Covered Under A Hdhp And Has No Other Insurance Coverage, With The Exception Of Telehealth And Other Remote Care Coverage;

Press f6 on your keyboard to bring up open forms. Calculate taxes you owe on the distributions (if you used the. Table of contents health savings accounts how an hsa. Web the 2021 versions of form 8889 and its instructions are substantially similar to their 2020 counterparts.