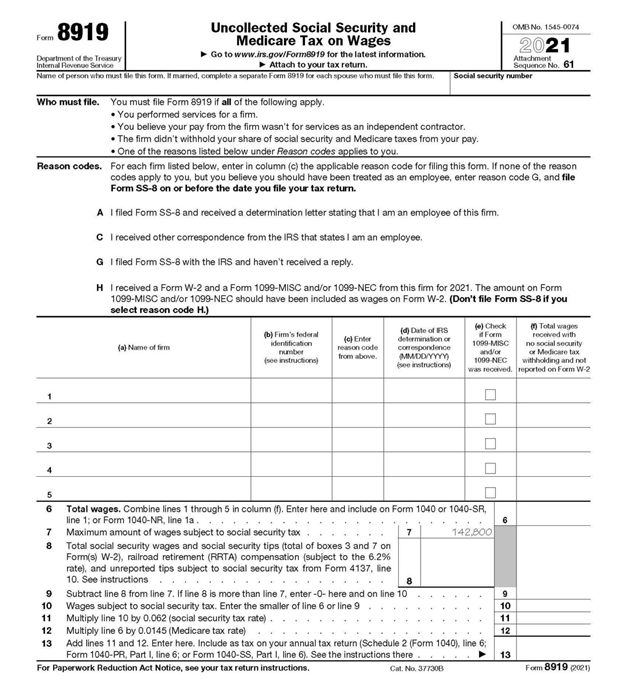

Form 8919 Line 6

Form 8919 Line 6 - You must file form 8919 if all of the following apply. Total social security and medicare taxes. 61 name of person who must file this form. Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their portion of the unpaid social security and medicare taxes owed on their compensation. Use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as an independent contractor by your employer. The maximum amount ($142,800) subject to social security tax is already entered for you. Perform services for a company as an independent contractor but the irs considers you an employee and social security and medicare taxes were not withheld from your pay; • you believe your pay from the firm wasn’t for services as an independent contractor. Add lines 11 and 12 and enter the answer on line 13. Web if you are required to complete form 8959, enter the line 6 (form 8919) total on line 3 of that form, as well.

Enter your total social security wages and tips, unreported tips, and railroad retirement compensation here. Total social security and medicare taxes. Web if you are required to complete form 8959, enter the line 6 (form 8919) total on line 3 of that form, as well. 61 name of person who must file this form. Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their portion of the unpaid social security and medicare taxes owed on their compensation. 2022 form 8919 2022 form 8919 2021 form 8919 2021 form 8919 2020 form 8919 2020 form 8919 • you performed services for a firm. Social security number who must file. Perform services for a company as an independent contractor but the irs considers you an employee and social security and medicare taxes were not withheld from your pay; Additional tax on iras, other qualified retirement plans, etc.

Web if you’re required to complete form 8959, enter line 6 (form 8919) total on line 3 of that form. The maximum amount ($142,800) subject to social security tax is already entered for you. Web form 8919 is used by certain employees to report uncollected social security and medicare taxes due on compensation. You may need to file form 8919 if you: Unreported social security and medicare tax from form 8919; Additional tax on iras, other qualified retirement plans, etc. Aattach to your tax return. Enter your total social security wages and tips, unreported tips, and railroad retirement compensation here. Perform services for a company as an independent contractor but the irs considers you an employee and social security and medicare taxes were not withheld from your pay; • you performed services for a firm.

Learn How to Fill the Form 8917 Tuition and Fees Deduction YouTube

This represents your total regular medicare taxes. Enter your total social security wages and tips, unreported tips, and railroad retirement compensation. • you performed services for a firm. Total social security and medicare taxes. Web form 8919 is used by certain employees to report uncollected social security and medicare taxes due on compensation.

8915 d form Fill out & sign online DocHub

Web 61 name of person who must file this form. Web unreported social security and medicare tax from form 4137; Unreported social security and medicare tax from form 8919; Multiply line 10 by 0.062, or 6.2%. • you performed services for a firm.

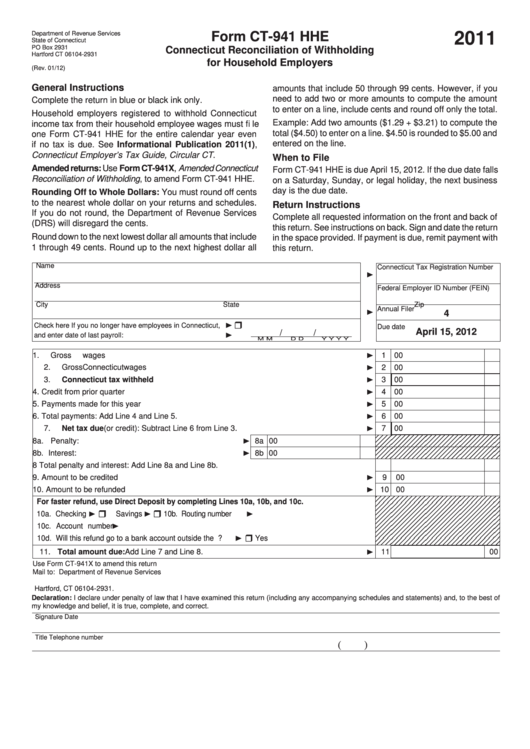

Form Ct941 Hhe Connecticut Reconciliation Of Withholding For

The maximum amount ($142,800) subject to social security tax is already entered for you. 2022 form 8919 2022 form 8919 2021 form 8919 2021 form 8919 2020 form 8919 2020 form 8919 61 name of person who must file this form. This represents your total social security taxes. Perform services for a company as an independent contractor but the irs.

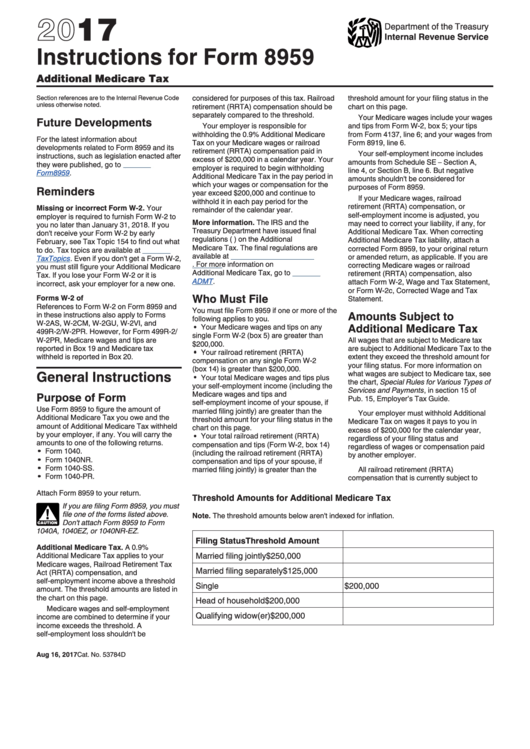

Instructions For Form 8959 Additional Medicare Tax 2017 printable

• you believe your pay from the firm wasn’t for services as an independent contractor. Enter your total social security wages and tips, unreported tips, and railroad retirement compensation here. The maximum amount ($142,800) subject to social security tax is already entered for you. You may need to file form 8919 if you: Additional tax on iras, other qualified retirement.

IRS expands crypto question on draft version of 1040 Tax Unfiltered

Web department of the treasury internal revenue service uncollected social security and medicare tax on wages ago to www.irs.gov/form8919 for the latest information. This represents your total social security taxes. 61 name of person who must file this form. You must file form 8919 if all of the following apply. Aattach to your tax return.

Fill Free fillable F8919 2018 Form 8919 PDF form

Perform services for a company as an independent contractor but the irs considers you an employee and social security and medicare taxes were not withheld from your pay; You may need to file form 8919 if you: Web if you’re required to complete form 8959, enter line 6 (form 8919) total on line 3 of that form. Use form 8919.

Form 8919 Fill out & sign online DocHub

This represents your total regular medicare taxes. Use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as an independent contractor by your employer. Add lines 11 and 12 and enter the answer on line 13. You may need to file.

2008 Form 1040 (Schedule Se) Edit, Fill, Sign Online Handypdf

The maximum amount ($142,800) subject to social security tax is already entered for you. Add lines 11 and 12 and enter the answer on line 13. Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their portion of the unpaid social security and.

When to Use IRS Form 8919 Uncollected Social Security and Medicare Tax

Web unreported social security and medicare tax from form 4137; The maximum amount ($142,800) subject to social security tax is already entered for you. Web if you’re required to complete form 8959, enter line 6 (form 8919) total on line 3 of that form. Web if you are required to complete form 8959, enter the line 6 (form 8919) total.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

Multiply line 6 by 0.0145, or 1.45%. The maximum amount ($142,800) subject to social security tax is already entered for you. Unreported social security and medicare tax from form 8919; You may need to file form 8919 if you: Web if you are required to complete form 8959, enter the line 6 (form 8919) total on line 3 of that.

Social Security Number Who Must File.

Multiply line 10 by 0.062, or 6.2%. Enter your total social security wages and tips, unreported tips, and railroad retirement compensation. Add lines 11 and 12 and enter the answer on line 13. Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their portion of the unpaid social security and medicare taxes owed on their compensation.

Enter Your Total Social Security Wages And Tips, Unreported Tips, And Railroad Retirement Compensation Here.

Multiply line 6 by 0.0145, or 1.45%. The maximum amount ($142,800) subject to social security tax is already entered for you. Your social security earnings will be recorded on your record once you submit by this form. 2022 form 8919 2022 form 8919 2021 form 8919 2021 form 8919 2020 form 8919 2020 form 8919

This Represents Your Total Social Security Taxes.

This represents your total regular medicare taxes. Web department of the treasury internal revenue service uncollected social security and medicare tax on wages ago to www.irs.gov/form8919 for the latest information. Web form 8919 is used by certain employees to report uncollected social security and medicare taxes due on compensation. The maximum amount ($142,800) subject to social security tax is already entered for you.

Use Form 8919 To Figure And Report Your Share Of The Uncollected Social Security And Medicare Taxes Due On Your Compensation If You Were An Employee But Were Treated As An Independent Contractor By Your Employer.

Web unreported social security and medicare tax from form 4137; Aattach to your tax return. • you performed services for a firm. If married, complete a separate form 8919 for each spouse who must file this form.