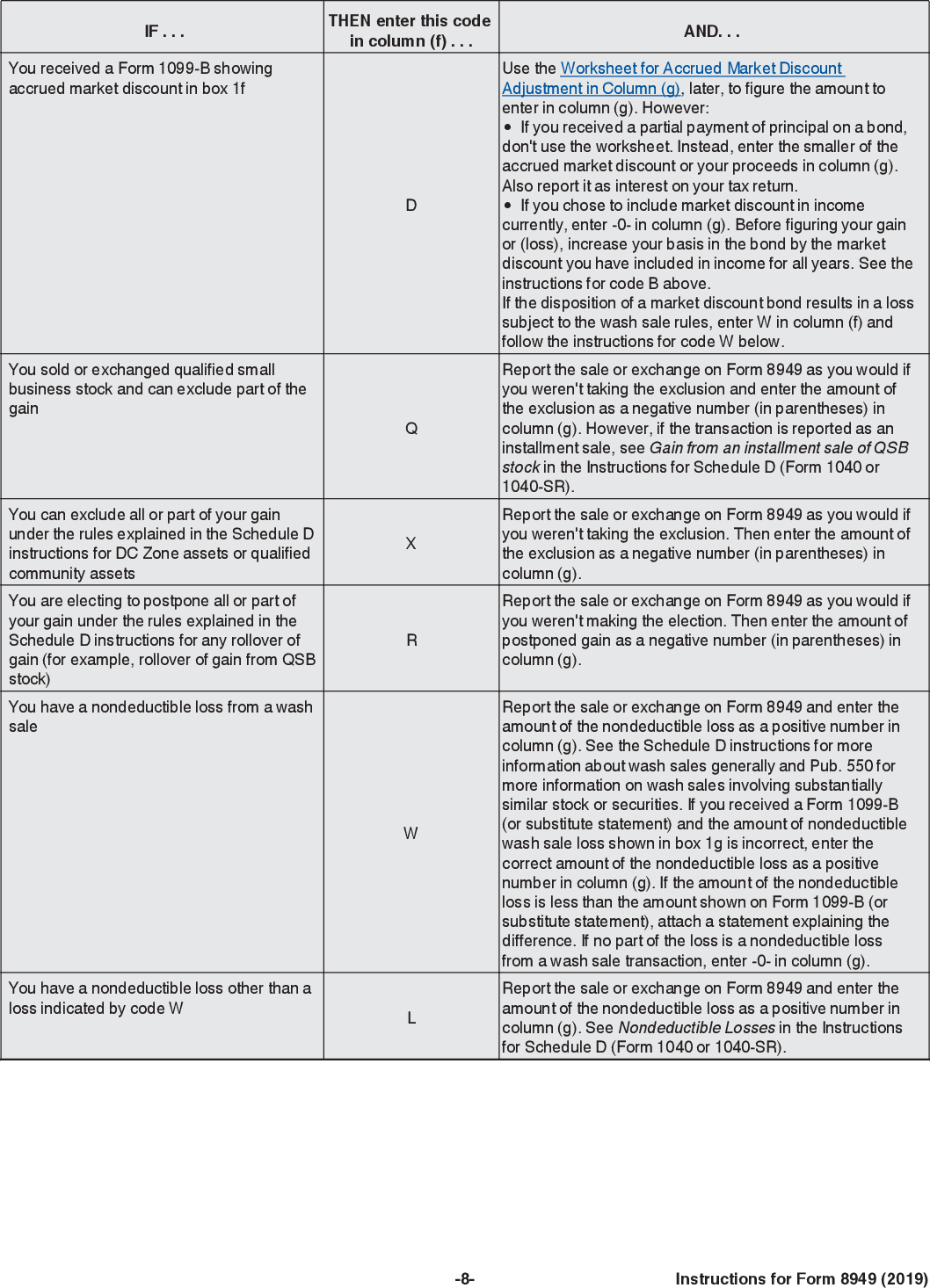

Form 8949 2020

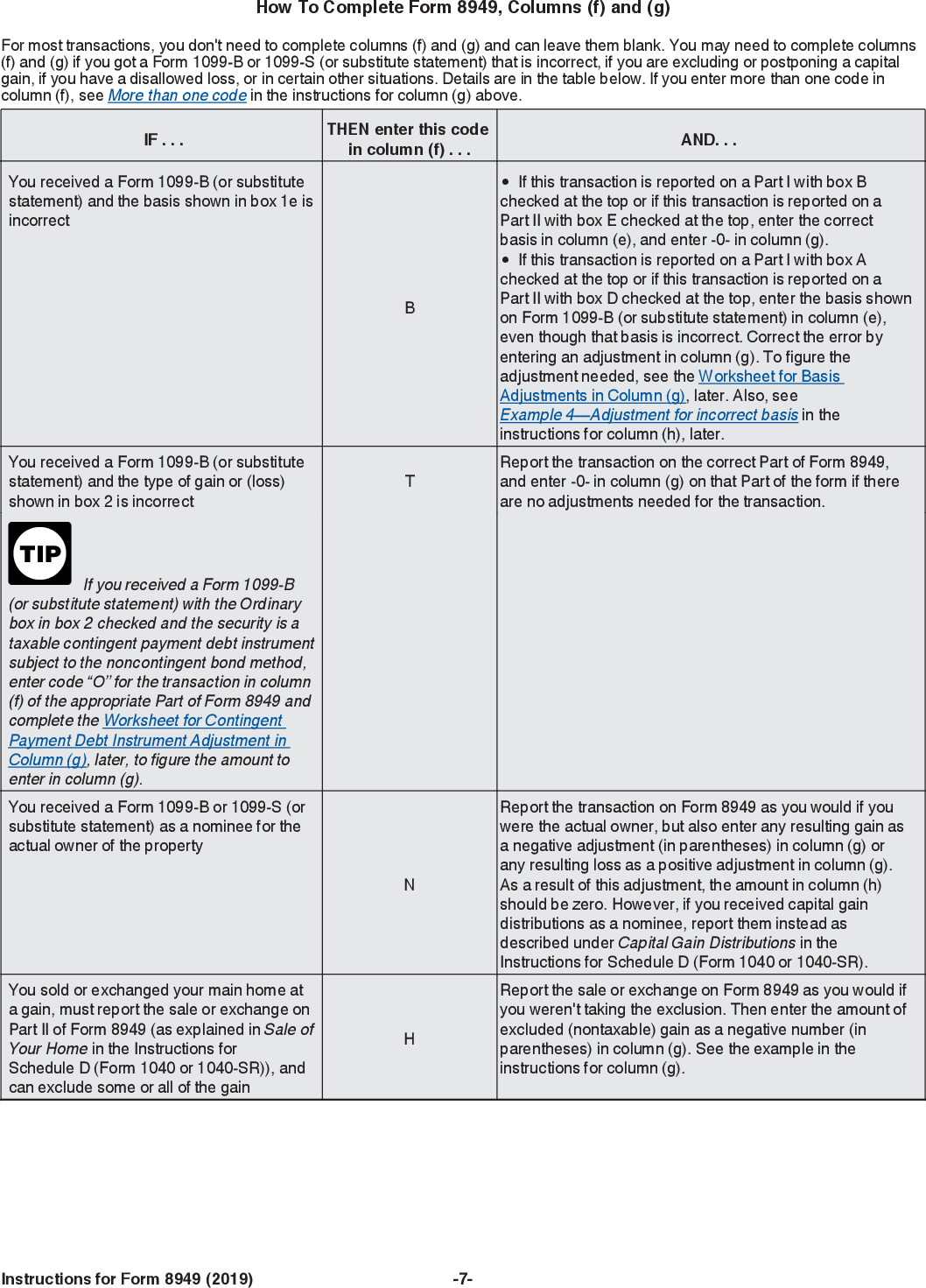

Form 8949 2020 - If you must report capital gains and losses from an investment in the past year, you'll need to file form 8949. Web form 8949 is used to list all capital gain and loss transactions. Web video instructions and help with filling out and completing form 8949 2020. Their initial decision to defer capital gain by investing it in a. Web print this form more about the federal form 8949 other ty 2022 we last updated the sales and other dispositions of capital assets in december 2022, so this is the latest. Web form 8949 (sales and other dispositions of capital assets) records the details of your capital asset (investment) sales or exchanges. You will report the totals of form. Ad access irs tax forms. Complete, edit or print tax forms instantly. •the sale or exchange of a capital asset not reported on another form or schedule.

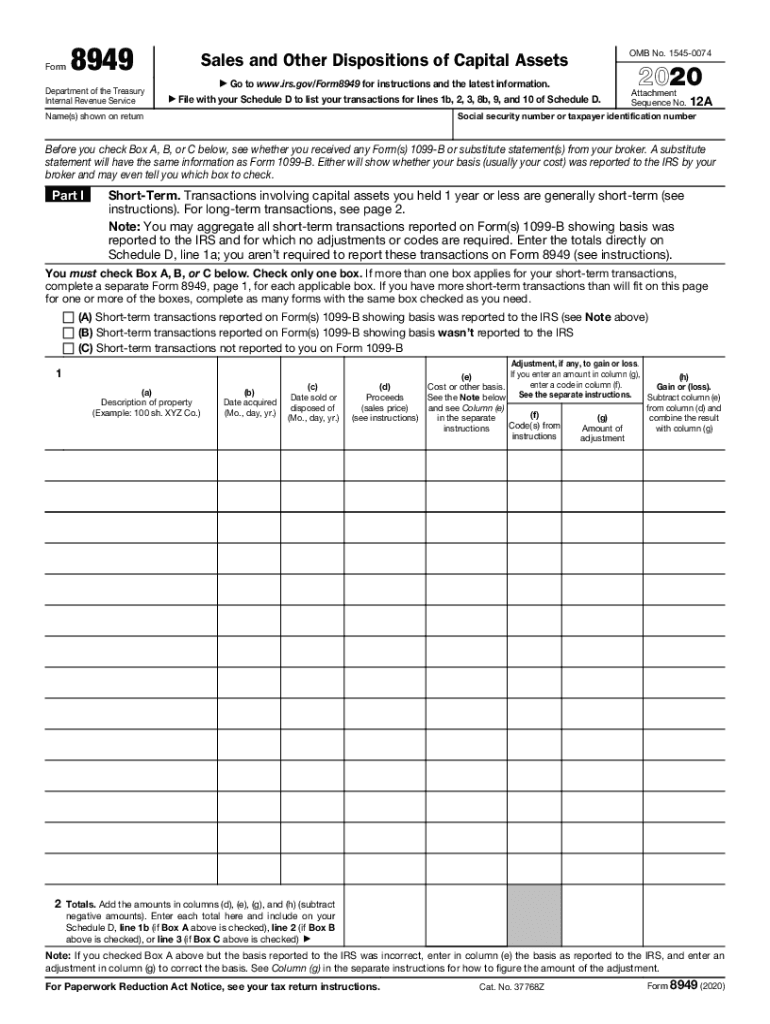

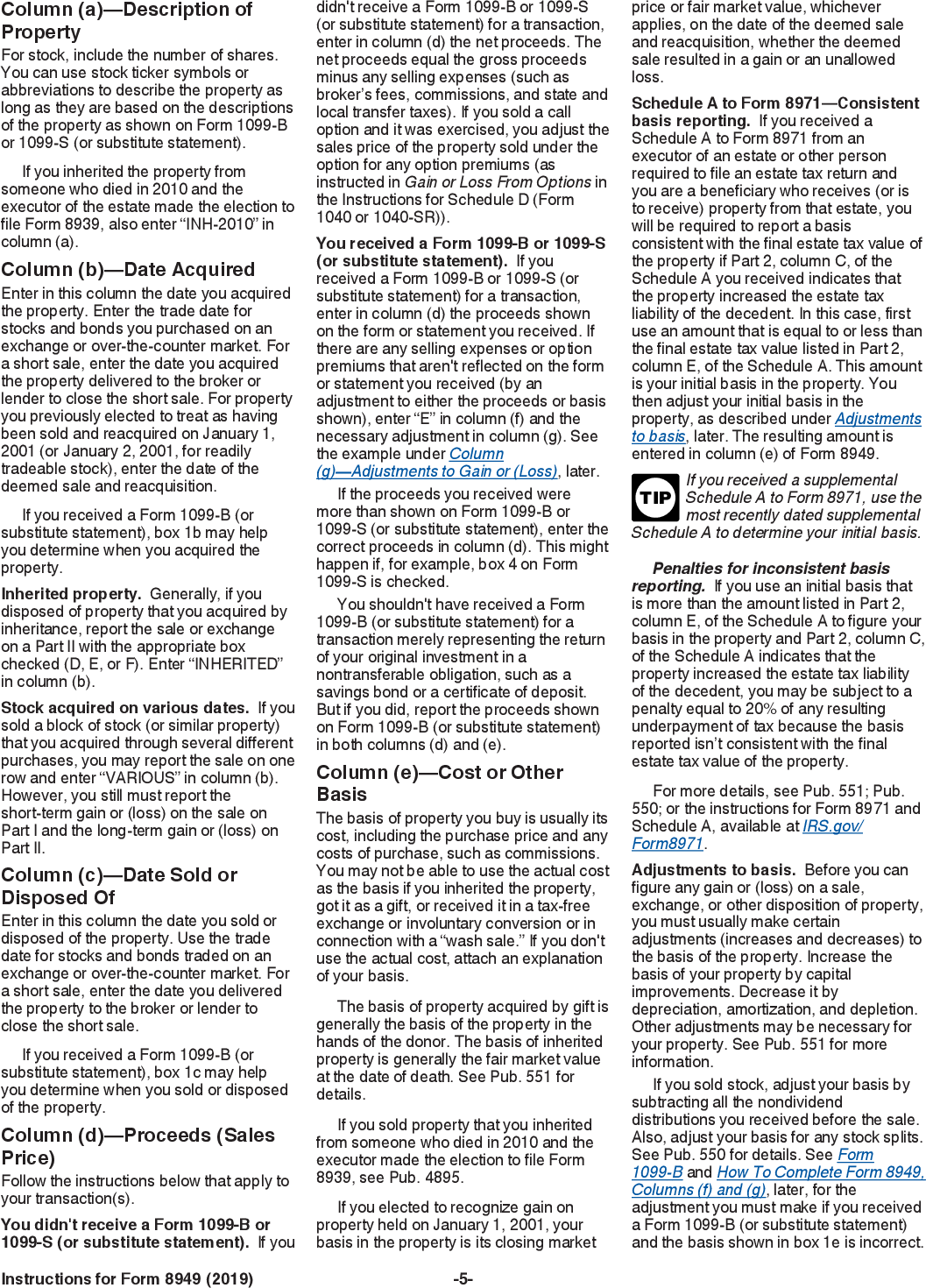

You report every sale of stock during the year, identifying the stock, the date you bought it, the date you sold it, and how much you. Web form 8949 is filled out first. Get ready for tax season deadlines by completing any required tax forms today. Web report the sale or exchange on form 8949 as you would if you were not taking the exclusion. Their initial decision to defer capital gain by investing it in a. This is an irs form used by individuals,. Then enter the amount of excluded (nontaxable) gain as a negative number. Web up to 10% cash back qof reporting on form 8949 and schedule d. Web if “yes,” attach form 8949 and see its instructions for additional requirements for reporting your gain or loss. You will report the totals of form.

Complete, edit or print tax forms instantly. Web print this form more about the federal form 8949 other ty 2022 we last updated the sales and other dispositions of capital assets in december 2022, so this is the latest. This is an irs form used by individuals,. Sales and other dispositions of capital assets. Web report the sale or exchange on form 8949 as you would if you were not taking the exclusion. Part i of the 8949 shows. Web video instructions and help with filling out and completing form 8949 2020. Get ready for tax season deadlines by completing any required tax forms today. General instructions file form 8949 with the schedule d for the return you are filing. Web if you exchange or sell capital assets, report them on your federal tax return using form 8949:

IRS Form 8949 instructions.

Web taxpayers can omit transactions from form 8949 if: Xyz co.) (mo., day, yr.) disposed of (mo., day, yr.) (d) proceeds (sales price) (see instructions) adjustment, if. Part i of the 8949 shows. If you must report capital gains and losses from an investment in the past year, you'll need to file form 8949. Web if “yes,” attach form 8949.

irs form 8949 instructions 2020 Fill Online, Printable, Fillable

Ad access irs tax forms. Their initial decision to defer capital gain by investing it in a. Web print this form more about the federal form 8949 other ty 2022 we last updated the sales and other dispositions of capital assets in december 2022, so this is the latest. Web if “yes,” attach form 8949 and see its instructions for.

Online Generation Of Schedule D And Form 8949 For 10 00 2021 Tax

Part i of the 8949 shows. Web form 8949 (sales and other dispositions of capital assets) records the details of your capital asset (investment) sales or exchanges. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web description of property date acquired date sold or (example:

Tax Form 8949 Instructions for Reporting Capital Gains and Losses

Web report the sale or exchange on form 8949 as you would if you were not taking the exclusion. Complete, edit or print tax forms instantly. Web form 8949 is filled out first. This is an irs form used by individuals,. Complete, edit or print tax forms instantly.

IRS Form 8949 instructions.

Web description of property date acquired date sold or (example: Web taxpayers can omit transactions from form 8949 if: Web form 8949 is used to list all capital gain and loss transactions. Xyz co.) (mo., day, yr.) disposed of (mo., day, yr.) (d) proceeds (sales price) (see instructions) adjustment, if. Then enter the amount of excluded (nontaxable) gain as a.

IRS 8949 Form 📝 Get Form 8949 With Instructions Printable Sample & Example

Web form 8949 is used to list all capital gain and loss transactions. Web form 8949 is filled out first. Web description of property date acquired date sold or (example: Web if you exchange or sell capital assets, report them on your federal tax return using form 8949: •the sale or exchange of a capital asset not reported on another.

IRS 8949 20202021 Fill out Tax Template Online US Legal Forms

Experience the best way to prepare your form 8949 online in a matter of minutes by following our step. Web report the sale or exchange on form 8949 as you would if you were not taking the exclusion. Web print this form more about the federal form 8949 other ty 2022 we last updated the sales and other dispositions of.

IRS Form 8949 instructions.

Their initial decision to defer capital gain by investing it in a. Web description of property date acquired date sold or (example: Ad access irs tax forms. Web up to 10% cash back qof reporting on form 8949 and schedule d. Web form 8949 (sales and other dispositions of capital assets) records the details of your capital asset (investment) sales.

IRS Form 8949 instructions.

Web form 8949 is filled out first. Web video instructions and help with filling out and completing form 8949 2020. Experience the best way to prepare your form 8949 online in a matter of minutes by following our step. Get ready for tax season deadlines by completing any required tax forms today. Web form 8949 (sales and other dispositions of.

Can you claim a family member as a dependent? (Guide to Claiming Your

If you must report capital gains and losses from an investment in the past year, you'll need to file form 8949. Experience the best way to prepare your form 8949 online in a matter of minutes by following our step. Web if you exchange or sell capital assets, report them on your federal tax return using form 8949: You report.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Complete, edit or print tax forms instantly. Sales and other dispositions of capital assets. Web if you exchange or sell capital assets, report them on your federal tax return using form 8949: All taxpayers use form 8949 to report:

If You Must Report Capital Gains And Losses From An Investment In The Past Year, You'll Need To File Form 8949.

Xyz co.) (mo., day, yr.) disposed of (mo., day, yr.) (d) proceeds (sales price) (see instructions) adjustment, if. Their initial decision to defer capital gain by investing it in a. Web description of property date acquired date sold or (example: Part i of the 8949 shows.

Web Form 8949 Is Filled Out First.

Web taxpayers can omit transactions from form 8949 if: Web if “yes,” attach form 8949 and see its instructions for additional requirements for reporting your gain or loss. Web print this form more about the federal form 8949 other ty 2022 we last updated the sales and other dispositions of capital assets in december 2022, so this is the latest. You report every sale of stock during the year, identifying the stock, the date you bought it, the date you sold it, and how much you.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web video instructions and help with filling out and completing form 8949 2020. This is an irs form used by individuals,. Web up to 10% cash back qof reporting on form 8949 and schedule d. •the sale or exchange of a capital asset not reported on another form or schedule.