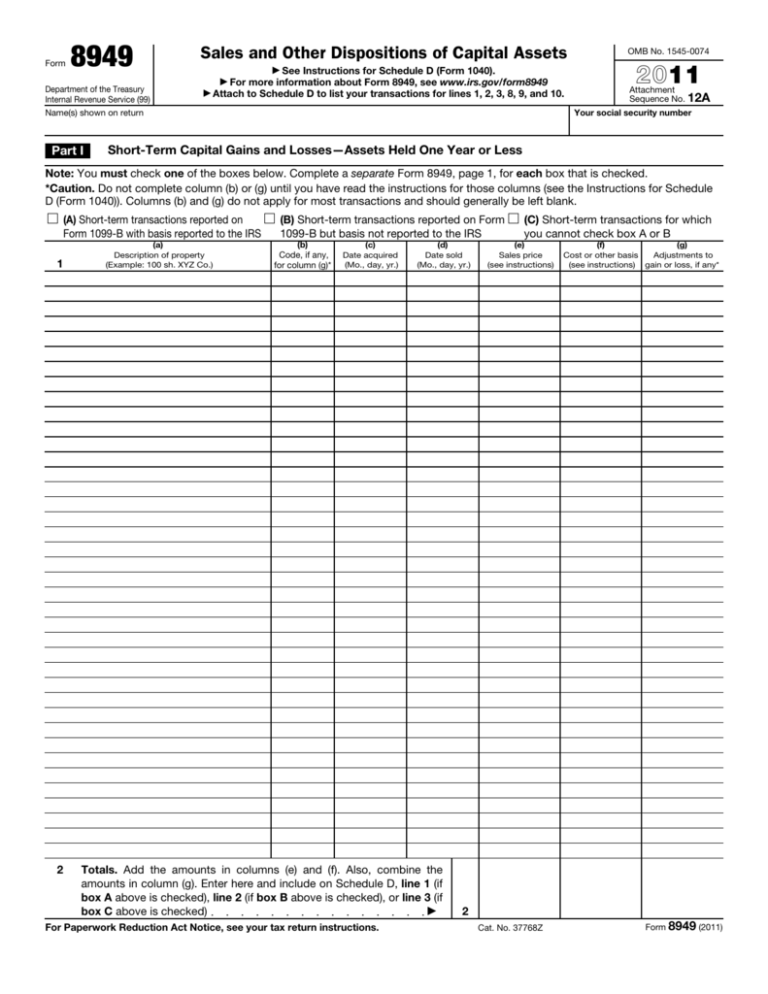

Form 8949 Code X

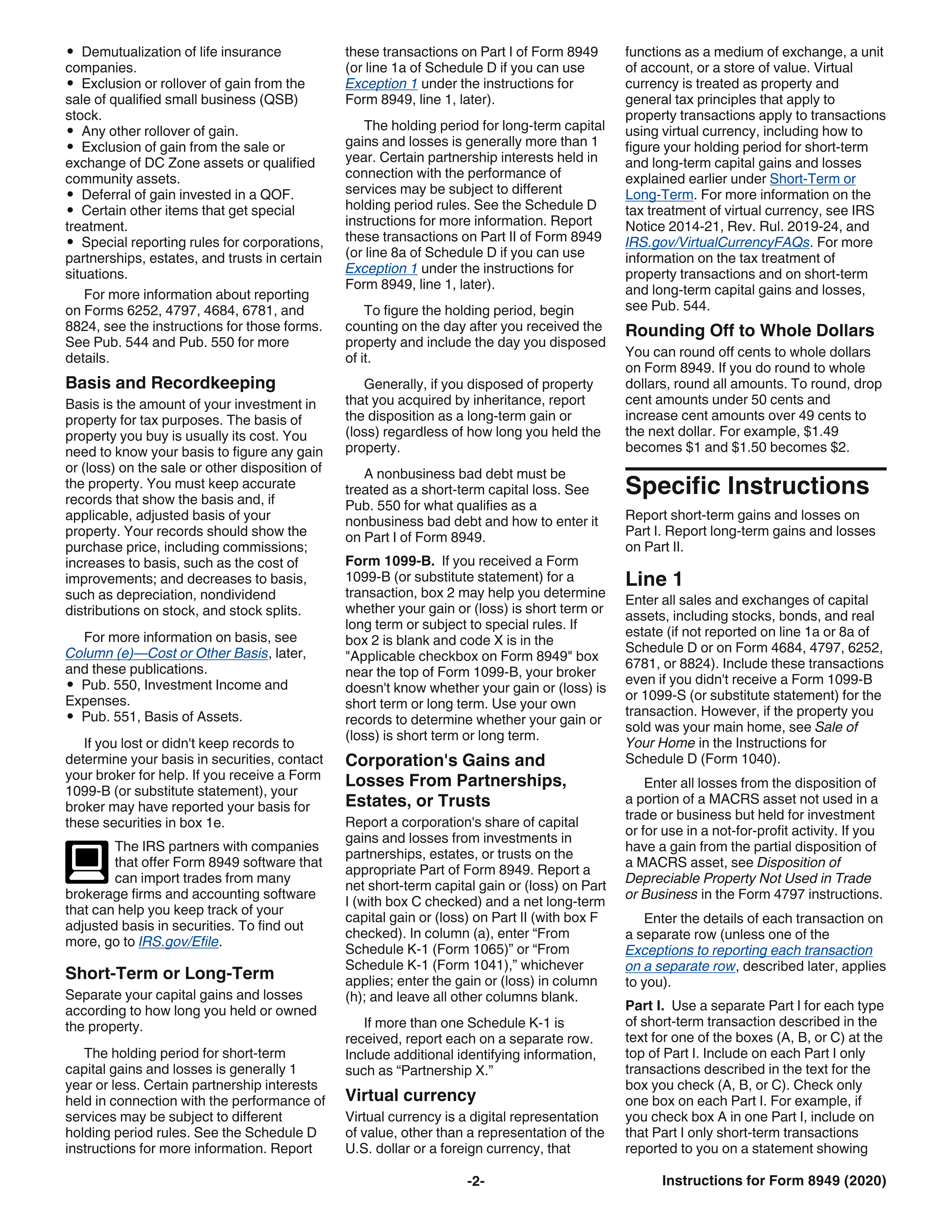

Form 8949 Code X - These adjustment codes will be included on form 8949, which will print along with schedule d. You can check this using the following steps: For a complete list of column (f) requirements, see the how to complete form 8949, columns (f) and (g) section of the form 8949 instructions. It is used to report capital gains and losses from sales and exchanges of capital assets to the internal revenue service (irs). Web 1= qualified small business stock (exclusion or rollover) if you have a code q generating and there aren't any entries for stock dispositions indicated as qualified small business stock, then you may have an amount entered in the screen. Web support form 8949 adjustment codes (1040) form 8949 adjustment codes are reported in column (f). Web where is form 8949? Web these adjustment codes are listed below along with information explaining the situation each code represents, as well as information regarding how to properly report the adjustment amount in your return. Web what is irs form 8949? Review the irs instructions for form 8949 for a complete list of.

Web these adjustment codes are listed below along with information explaining the situation each code represents, as well as information regarding how to properly report the adjustment amount in your return. Web support form 8949 adjustment codes (1040) form 8949 adjustment codes are reported in column (f). Web 1= qualified small business stock (exclusion or rollover) if you have a code q generating and there aren't any entries for stock dispositions indicated as qualified small business stock, then you may have an amount entered in the screen. Report the sale or exchange on form 8949 as you would if you were not. Web overview of form 8949: Form 8949 (sales and other dispositions of capital assets) records the details of your capital asset (investment) sales or exchanges. If the sale resulted in a gain but was not eligible for the exclusion, it will be reported on the appropriate form 8949 as a gain. Follow the instructions for the code you need to generate below. You can check this using the following steps: Report the transaction on form 8949 as you would if you were the actual owner, but enter any resulting gain as a negative adjustment (in parentheses) in column (g) or any resulting loss as a.

Form 8949 is filed along with schedule d. It is used to report capital gains and losses from sales and exchanges of capital assets to the internal revenue service (irs). Web support form 8949 adjustment codes (1040) form 8949 adjustment codes are reported in column (f). Report the transaction on form 8949 as you would if you were the actual owner, but enter any resulting gain as a negative adjustment (in parentheses) in column (g) or any resulting loss as a. The 8949 form can be quite daunting for newbie taxpayers. Form 8949 (sales and other dispositions of capital assets) records the details of your capital asset (investment) sales or exchanges. Solved•by turbotax•6685•updated april 12, 2023. Web form 8949, column (f) reports a code explaining any adjustments to gain or loss in column g. Follow the instructions for the code you need to generate below. File form 8949 with the schedule d for the return you are filing.

Form 8949 Pillsbury Tax Page

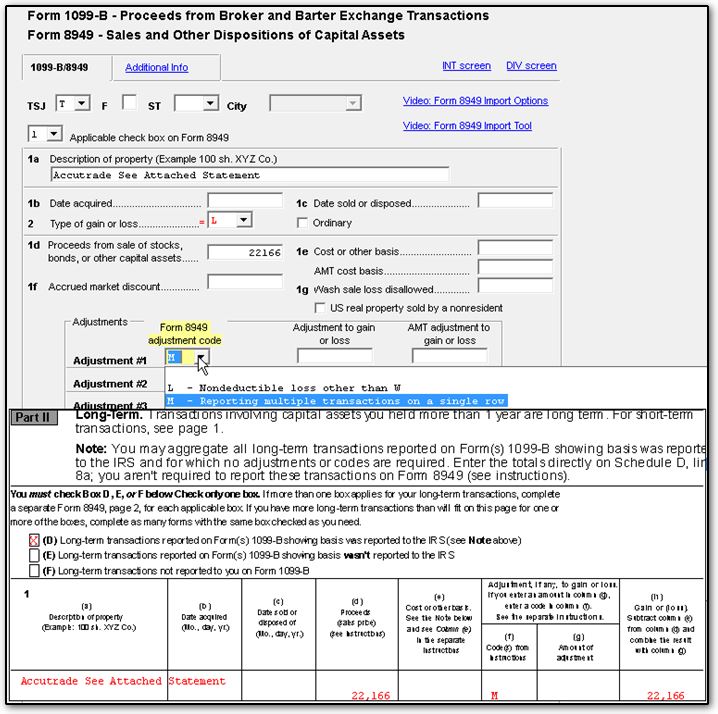

Web open the 8949 screen (on the income tab). At the top of the 8949 form, you’ll see some initial information, you need to fill that information. Report the transaction on form 8949 as you would if you were the actual owner, but enter any resulting gain as a negative adjustment (in parentheses) in column (g) or any resulting loss.

Tax Form 8949 Instructions for Reporting Capital Gains and Losses

If the sale resulted in a gain but was not eligible for the exclusion, it will be reported on the appropriate form 8949 as a gain. Web where is form 8949? Report the sale or exchange on form 8949 as you would if you were not. Select check box a, b, or c in part i for short term trades:.

Your Crypto Tax Questions Answered by a Tax Attorney & CPA

Report the transaction on form 8949 as you would if you were the actual owner, but enter any resulting gain as a negative adjustment (in parentheses) in column (g) or any resulting loss as a. Solved•by turbotax•6685•updated april 12, 2023. If the sale resulted in a gain but was not eligible for the exclusion, it will be reported on the.

8949 Import Transactions, PDI Indicator or PDF Attachment (1099B

Form 8949 is filed along with schedule d. You can check this using the following steps: Web open the 8949 screen (on the income tab). Report the sale or exchange on form 8949 as you would if you were not. Solved•by turbotax•6685•updated april 12, 2023.

IRS Form 8949 instructions.

If the sale resulted in a gain but was not eligible for the exclusion, it will be reported on the appropriate form 8949 as a gain. Web where is form 8949? For a complete list of column (f) requirements, see the how to complete form 8949, columns (f) and (g) section of the form 8949 instructions. Form 8949 is filed.

Online IRS Instructions 8949 2019 Fillable and Editable PDF Template

Sales and other dispositions of capital assets is a form used by individuals, partnerships, companies, trusts, and estates. If the sale resulted in a gain but was not eligible for the exclusion, it will be reported on the appropriate form 8949 as a gain. Web form 8949, column (f) reports a code explaining any adjustments to gain or loss in.

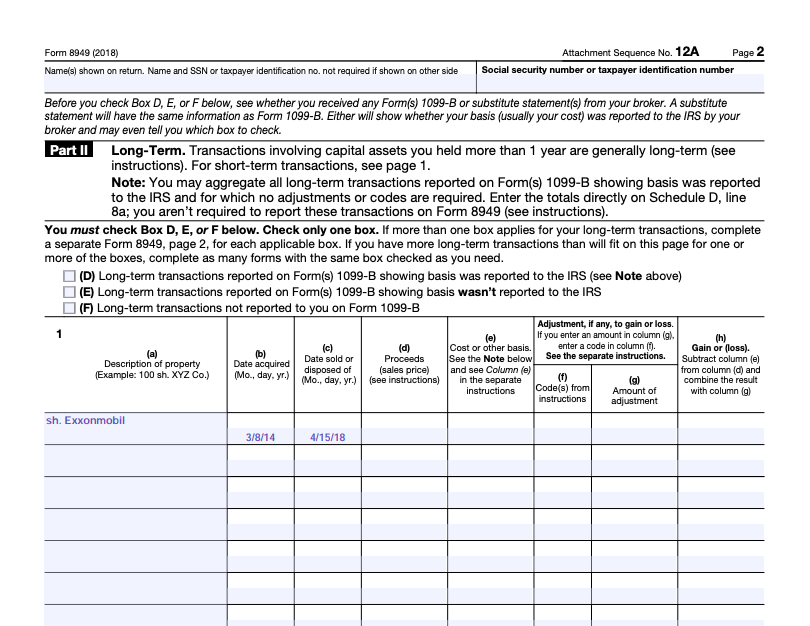

Can You Please Help Me Fill Out Form 8949? So I Kn...

File form 8949 with the schedule d for the return you are filing. Sales and other dispositions of capital assets is a form used by individuals, partnerships, companies, trusts, and estates. The 8949 form can be quite daunting for newbie taxpayers. It is used to report capital gains and losses from sales and exchanges of capital assets to the internal.

File IRS Form 8949 to Report Your Capital Gains or Losses

Form 8949 (sales and other dispositions of capital assets) records the details of your capital asset (investment) sales or exchanges. You can check this using the following steps: Then, check the appropriate box on 8949. Key takeaways the primary purpose of irs form 8949 is to report sales and exchanges of capital assets. Web 1= qualified small business stock (exclusion.

Online generation of Schedule D and Form 8949 for 10.00

Web use form 8949 to report sales and exchanges of capital assets. Review the irs instructions for form 8949 for a complete list of. Sales and other dispositions of capital assets is a form used by individuals, partnerships, companies, trusts, and estates. These adjustment codes will be included on form 8949, which will print along with schedule d. For a.

In the following Form 8949 example,the highlighted section below shows

Form 8949 (sales and other dispositions of capital assets) records the details of your capital asset (investment) sales or exchanges. Key takeaways the primary purpose of irs form 8949 is to report sales and exchanges of capital assets. File form 8949 with the schedule d for the return you are filing. Web what is irs form 8949? Web 1= qualified.

Solved•By Turbotax•6685•Updated April 12, 2023.

For a complete list of column (f) requirements, see the how to complete form 8949, columns (f) and (g) section of the form 8949 instructions. Form 8949 is filed along with schedule d. Select check box a, b, or c in part i for short term trades: Web open the 8949 screen (on the income tab).

Key Takeaways The Primary Purpose Of Irs Form 8949 Is To Report Sales And Exchanges Of Capital Assets.

Web 1= qualified small business stock (exclusion or rollover) if you have a code q generating and there aren't any entries for stock dispositions indicated as qualified small business stock, then you may have an amount entered in the screen. Report the sale or exchange on form 8949 as you would if you were not. Review the irs instructions for form 8949 for a complete list of. Web these adjustment codes are listed below along with information explaining the situation each code represents, as well as information regarding how to properly report the adjustment amount in your return.

You Can Check This Using The Following Steps:

Web what is irs form 8949? It is used to report capital gains and losses from sales and exchanges of capital assets to the internal revenue service (irs). The 8949 form can be quite daunting for newbie taxpayers. At the top of the 8949 form, you’ll see some initial information, you need to fill that information.

Web Support Form 8949 Adjustment Codes (1040) Form 8949 Adjustment Codes Are Reported In Column (F).

Web use form 8949 to report sales and exchanges of capital assets. Then, check the appropriate box on 8949. Web form 8949, column (f) reports a code explaining any adjustments to gain or loss in column g. Web overview of form 8949: