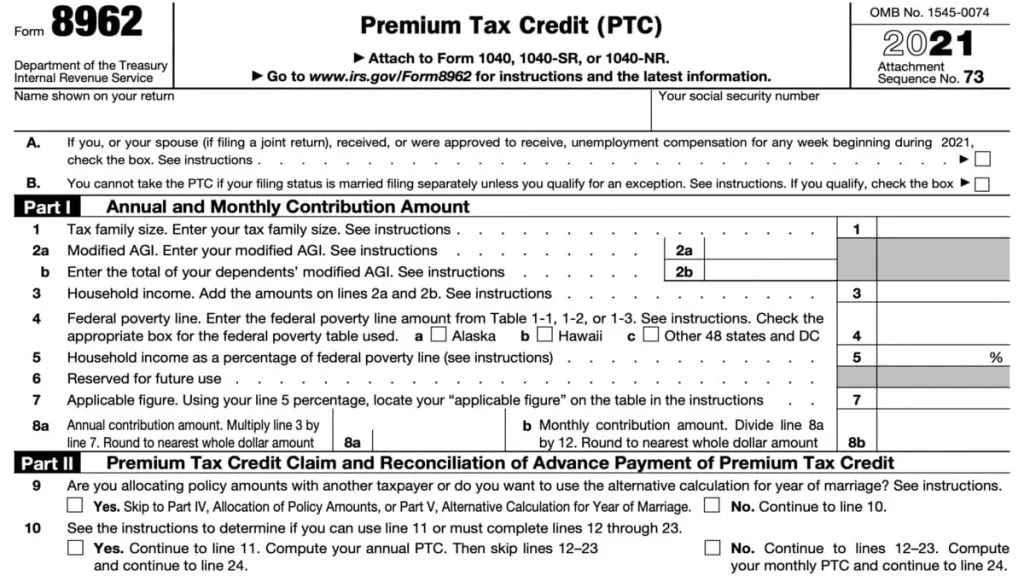

Form 8962 For 2022

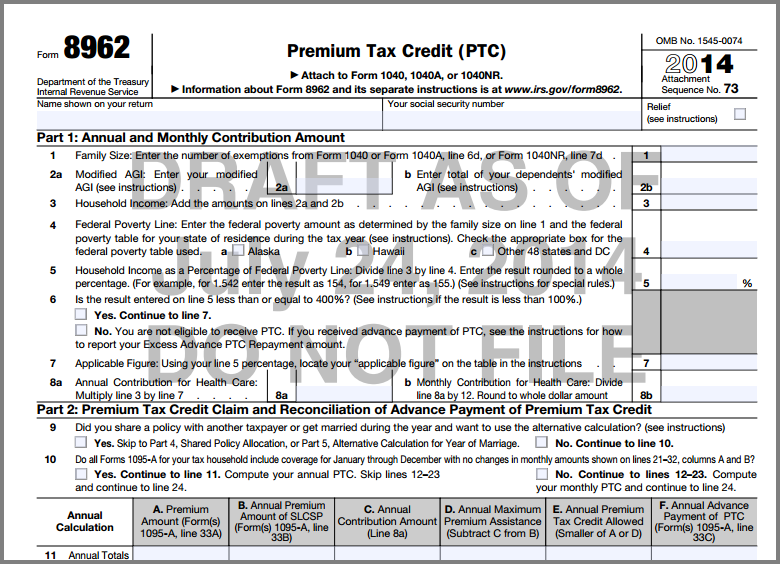

Form 8962 For 2022 - Try it for free now! Web form 8962 (2022) page. Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year. This form is only used by taxpayers who. If you’re claiming a net premium tax credit for 2022,. Taxpayers complete form 8862 and attach it to their tax return if: Create a blank & editable 8962 form,. Web to get this credit, you must meet certain requirements and file a tax return with form 8962, premium tax credit (ptc). Maximum household income limits have been eliminated. Ad download or email form 8962 & more fillable forms, register and subscribe now!

Create a blank & editable 8962 form,. You'll find out if you qualify for a premium tax credit based on your final 2022 income. The request for mail order forms may be used to order one copy or. Get ready for this year's tax season quickly and safely with pdffiller! Web if you downloaded the 2022 instructions for form 8962, premium tax credit, please be advised that there is an update to the 2nd bullet under exception 1—certain. Upload, modify or create forms. Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. You have to include form 8962 with your tax return if: Taxpayers complete form 8862 and attach it to their tax return if: Try it for free now!

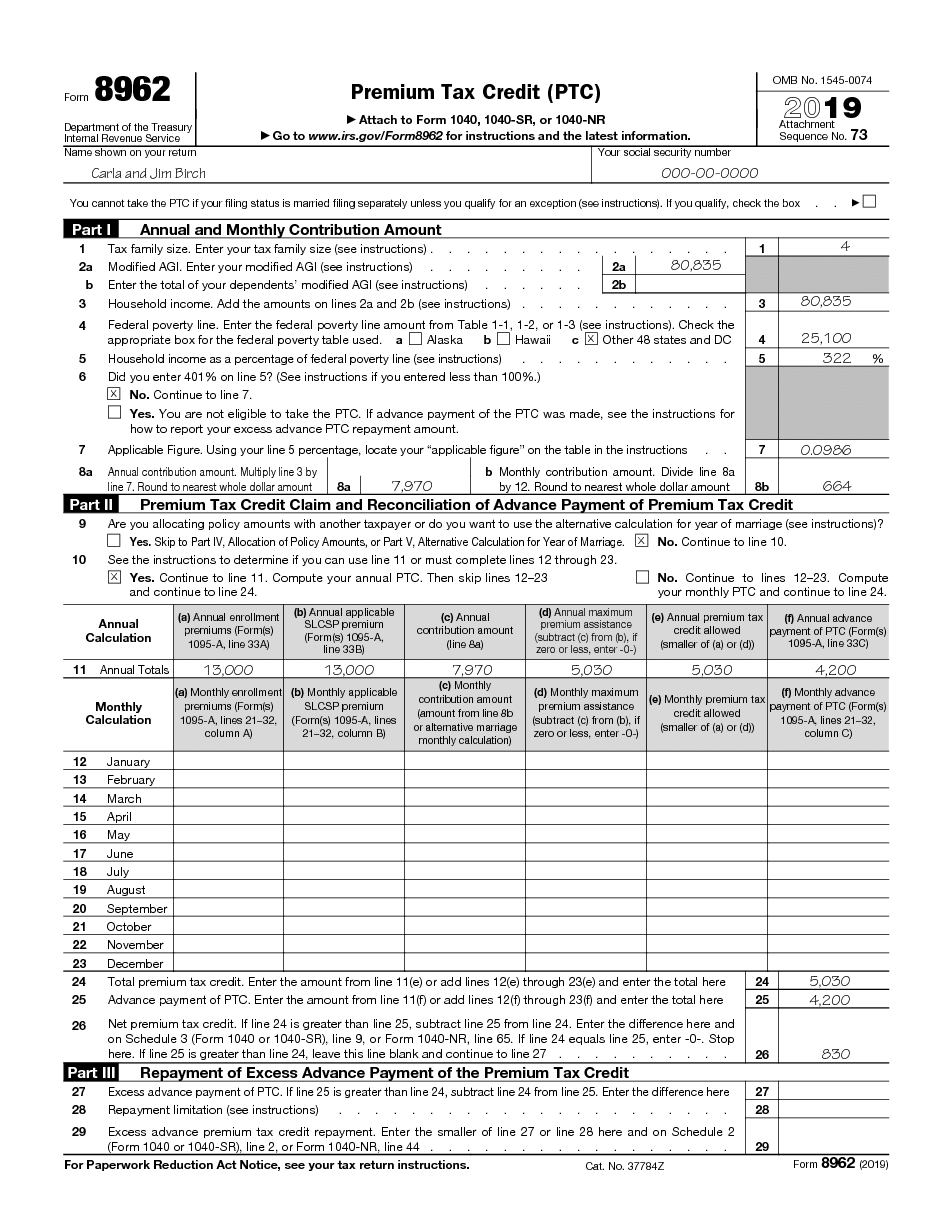

Web use this slcsp figure to fill out form 8962, premium tax credit (pdf, 110 kb). You can download or print current or past. You'll find out if you qualify for a premium tax credit based on your final 2022 income. Upload, modify or create forms. You have to include form 8962 with your tax return if: 2021 and 2022 ptc eligibility. Web to get this credit, you must meet certain requirements and file a tax return with form 8962, premium tax credit (ptc). This form is only used by taxpayers who. Create a blank & editable 8962 form,. Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year.

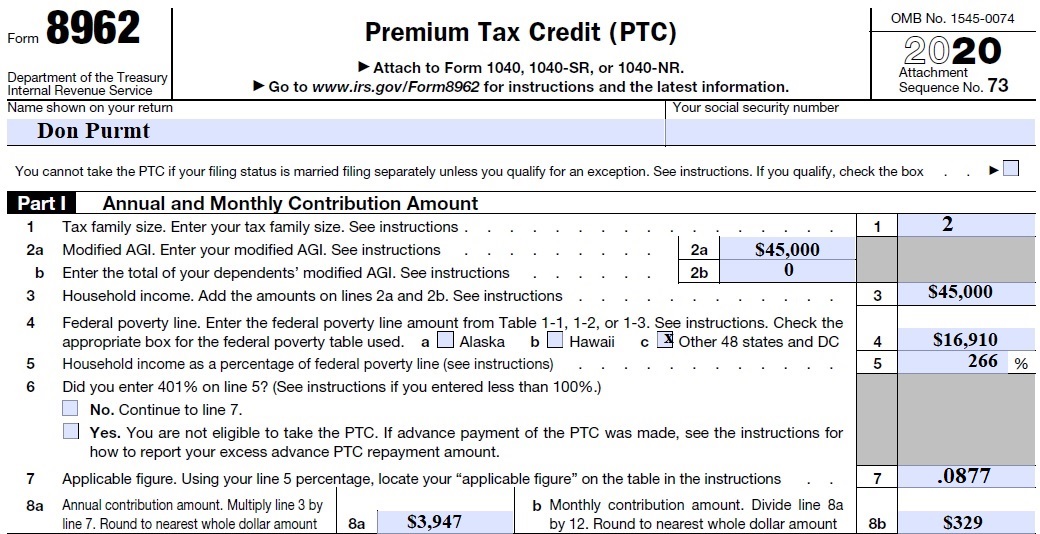

8962 Form 2022 2023 Premium Tax Credit IRS Forms TaxUni

Get ready for this year's tax season quickly and safely with pdffiller! This form is only used by taxpayers who. Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. Try it for free now! Web form 8962 is a form you must file with your federal.

Irs form 8962 Aca Irs form 8962 for ‘premium Tax Credits’ Successfully

Web use this slcsp figure to fill out form 8962, premium tax credit (pdf, 110 kb). Web if you downloaded the 2022 instructions for form 8962, premium tax credit, please be advised that there is an update to the 2nd bullet under exception 1—certain. You have to include form 8962 with your tax return if: Web form 8962 is a.

Health Insurance 1095A Subsidy Flow Through IRS Tax Return

Previously, household income of 400% or more of the federal poverty line made a taxpayer ineligible. Web about form 8862, information to claim certain credits after disallowance. You have to include form 8962 with your tax return if: Taxpayers complete form 8862 and attach it to their tax return if: Ad get ready for tax season deadlines by completing any.

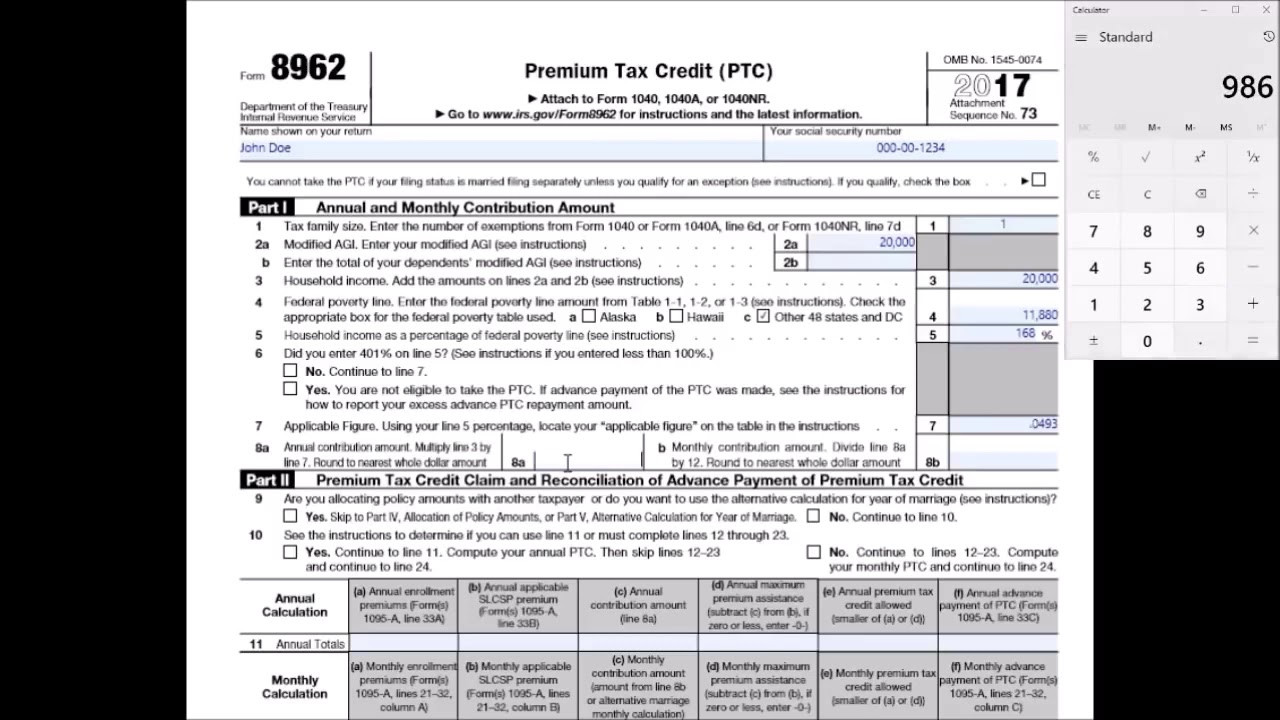

How To Fill Out Form 8962 Step By Step Premium Tax Credit Ptc Sample

Previously, household income of 400% or more of the federal poverty line made a taxpayer ineligible. Try it for free now! Web use this slcsp figure to fill out form 8962, premium tax credit (pdf, 110 kb). Create a blank & editable 8962 form,. Upload, modify or create forms.

Tax Form 8962 Printable Printable Forms Free Online

Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise. Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year. Create a.

IRS Form 8962 LinebyLine Instructions 2022 How to Fill out Form 8962

Upload, modify or create forms. Go to www.irs.gov/form8962 for instructions and the. Web we last updated the premium tax credit in december 2022, so this is the latest version of form 8962, fully updated for tax year 2022. Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal.

IRS 8962 Form Printable 2020 📝 Get Tax Form 8962 Printable Blank in PDF

Web use this slcsp figure to fill out form 8962, premium tax credit (pdf, 110 kb). This form is only used by taxpayers who. Web 2021 & 2022 eligibility. Web if you downloaded the 2022 instructions for form 8962, premium tax credit, please be advised that there is an update to the 2nd bullet under exception 1—certain. You have to.

8962 instructions Fill out & sign online DocHub

Web form 8962 (2022) page. Upload, modify or create forms. Web we last updated the premium tax credit in december 2022, so this is the latest version of form 8962, fully updated for tax year 2022. Get ready for this year's tax season quickly and safely with pdffiller! Web instructions for form 8962 premium tax credit (ptc) department of the.

Form 8962 Fill Out and Sign Printable PDF Template signNow

Taxpayers complete form 8862 and attach it to their tax return if: Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise. This form is only used by taxpayers who. Web form 8962 is used to figure the amount of premium tax credit and.

How To Fill Out Tax Form 8962 amulette

Try it for free now! Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. This form is only used by taxpayers who. Maximum household income limits have been eliminated. Web for 2022, you’ll have to report the excess aptc on your 2022 tax return or file.

Go To Www.irs.gov/Form8962 For Instructions And The.

2021 and 2022 ptc eligibility. Ad download or email form 8962 & more fillable forms, register and subscribe now! Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. If you’re claiming a net premium tax credit for 2022,.

You'll Find Out If You Qualify For A Premium Tax Credit Based On Your Final 2022 Income.

This form is only used by taxpayers who. Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year. For tax years 2021 and. You can download or print current or past.

Web About Form 8862, Information To Claim Certain Credits After Disallowance.

Web up to $40 cash back easily complete a printable irs 8962 form 2022 online. Web to get this credit, you must meet certain requirements and file a tax return with form 8962, premium tax credit (ptc). Web 2021 & 2022 eligibility. You’ll need it to complete form 8962, premium tax credit.

Maximum Household Income Limits Have Been Eliminated.

Create a blank & editable 8962 form,. Web we last updated the premium tax credit in december 2022, so this is the latest version of form 8962, fully updated for tax year 2022. Web this form includes details about the marketplace insurance you and household members had in 2022. Complete the following information for up to four policy amount allocations.