Form 8978 Instructions

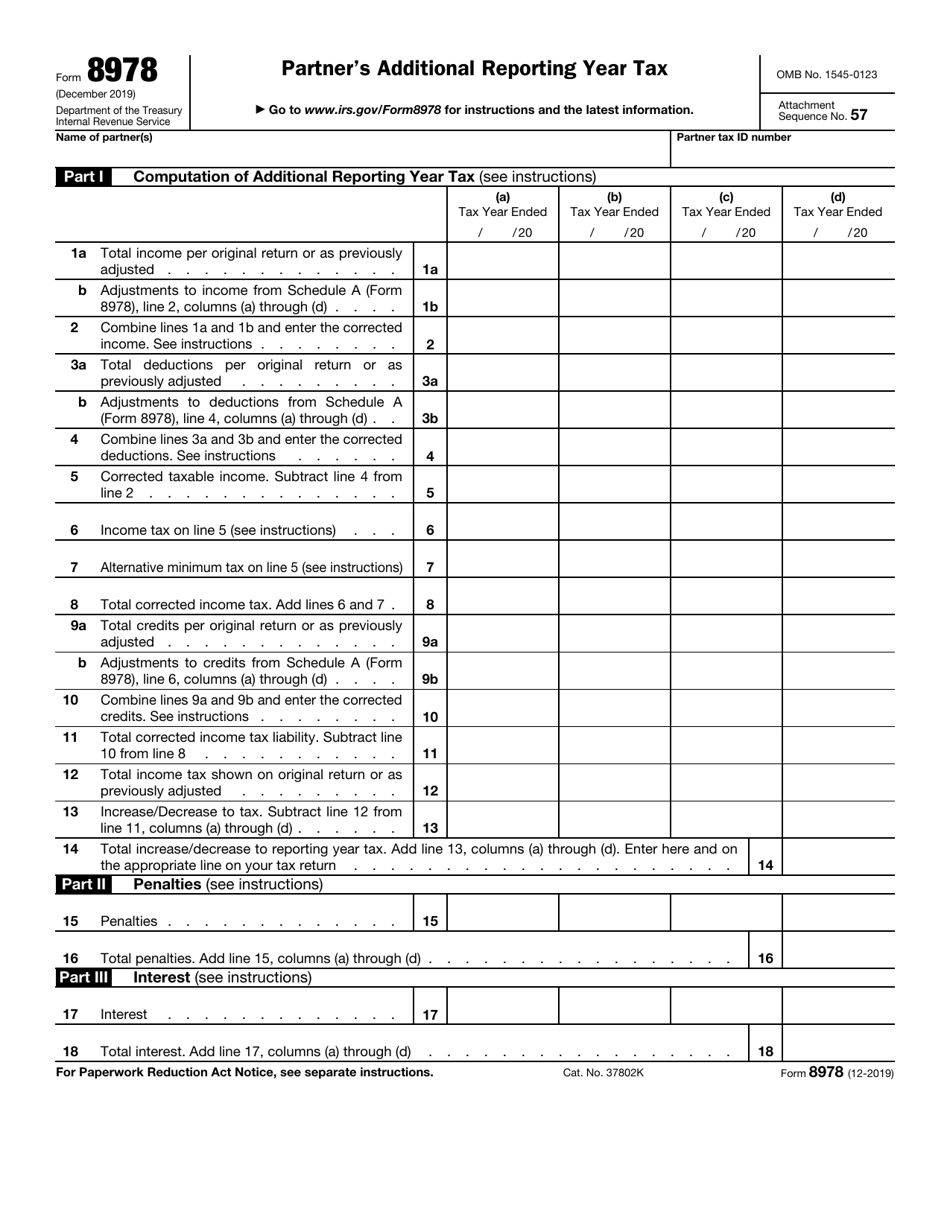

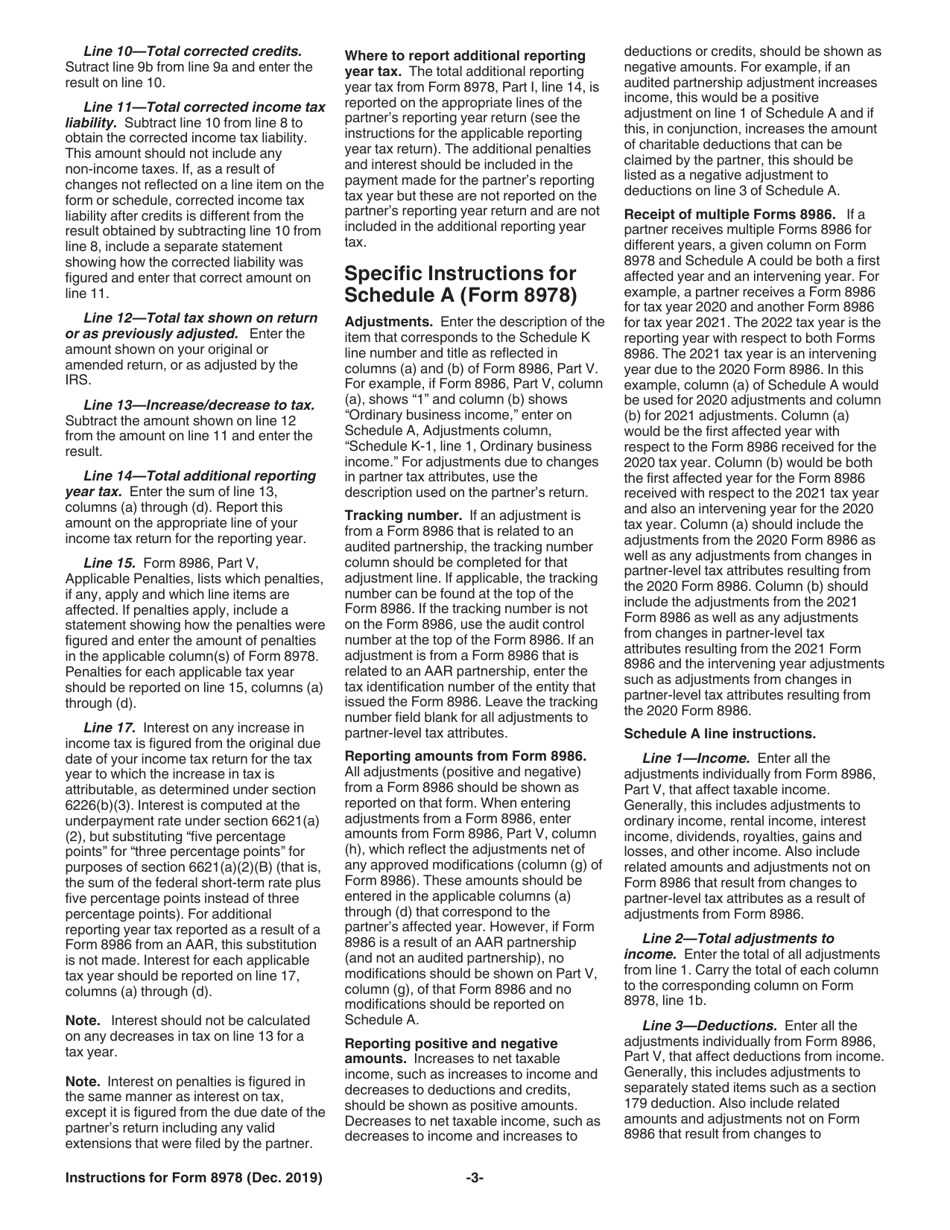

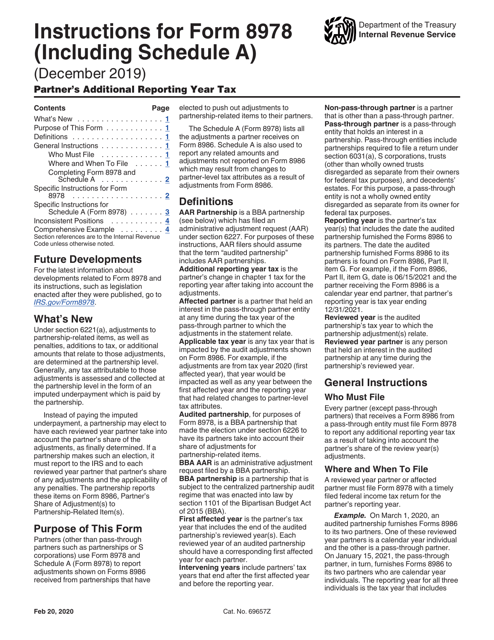

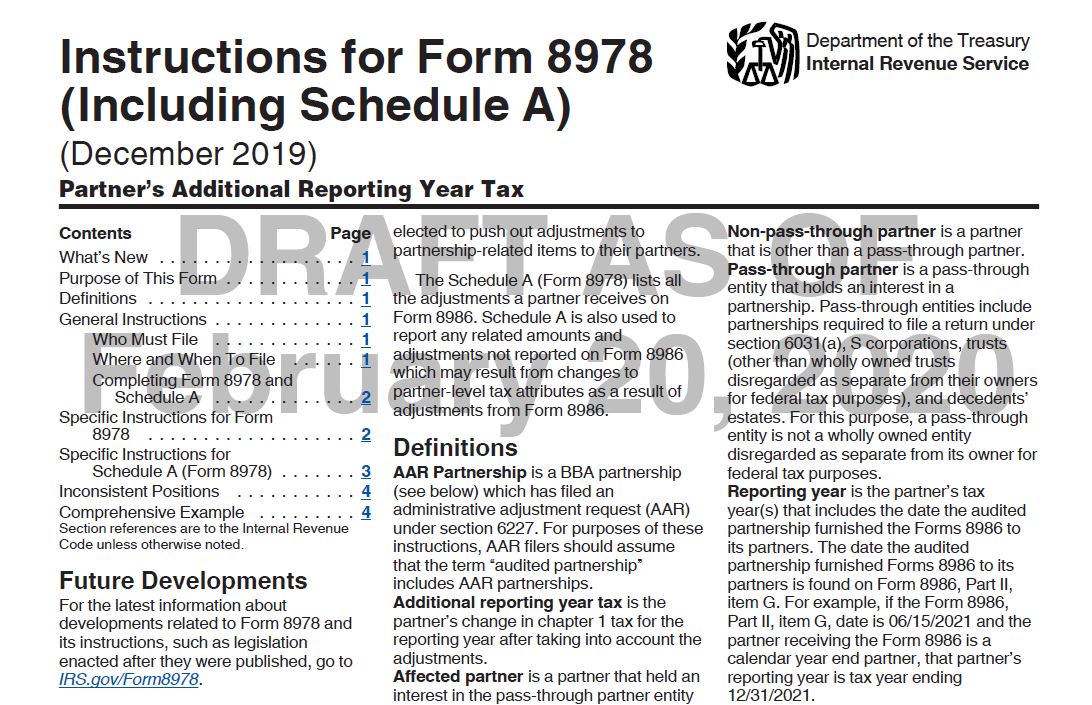

Form 8978 Instructions - The schedule a (form 8978) lists all the adjustments a partner receives on form 8986. Schedule a is also used to January 2023) partner’s additional reporting year tax department of the treasury internal revenue service go to www.irs.gov/form8978 for instructions and the latest information. Web instructions for form 6478, biofuel producer credit 0120 01/17/2020 inst 8978: Web the schedule a (form 8978) lists all the adjustments a partner receives on form 8986. 2019)) department of the treasury internal revenue service And (2) reporting an i.r.c. Web form 8978 draft instructions. Web instructions for form 8978 (including schedule a)(rev. §199a qualified business income deduction on.

Instructions for form 8978, partner's additional reporting year tax 0123 12/21/2022 Web instructions for form 8978 (including schedule a)(rev. December 2021) partner’s additional reporting year tax (for use with form 8978 (dec. Web any partner who receives irs form 8986 must file form 8978 to reflect the proper tax liabilities from the partnership election, and to pay any additional tax due. Schedule a is also used to The schedule a (form 8978) lists all the adjustments a partner receives on form 8986. §199a qualified business income deduction on. Web instructions for form 6478, biofuel producer credit 0120 01/17/2020 inst 8978: Web the schedule a (form 8978) lists all the adjustments a partner receives on form 8986. 2019) and schedule a (form 8978) (dec.

2019)) department of the treasury internal revenue service Instructions for form 8978, partner's additional reporting year tax 0123 12/21/2022 And (2) reporting an i.r.c. Web form 8978 draft instructions. 2019) and schedule a (form 8978) (dec. Web any partner who receives irs form 8986 must file form 8978 to reflect the proper tax liabilities from the partnership election, and to pay any additional tax due. Web instructions for form 6478, biofuel producer credit 0120 01/17/2020 inst 8978: Web revised instructions to form 8978, partner’s additional reporting year tax, released january 4 with changes made to reflect updates on (1) how positive and negative adjustments received by partners on forms 8986 should be reported on form 8978 and its schedule a; Schedule a is also used to Web instructions for form 8978 (including schedule a)(rev.

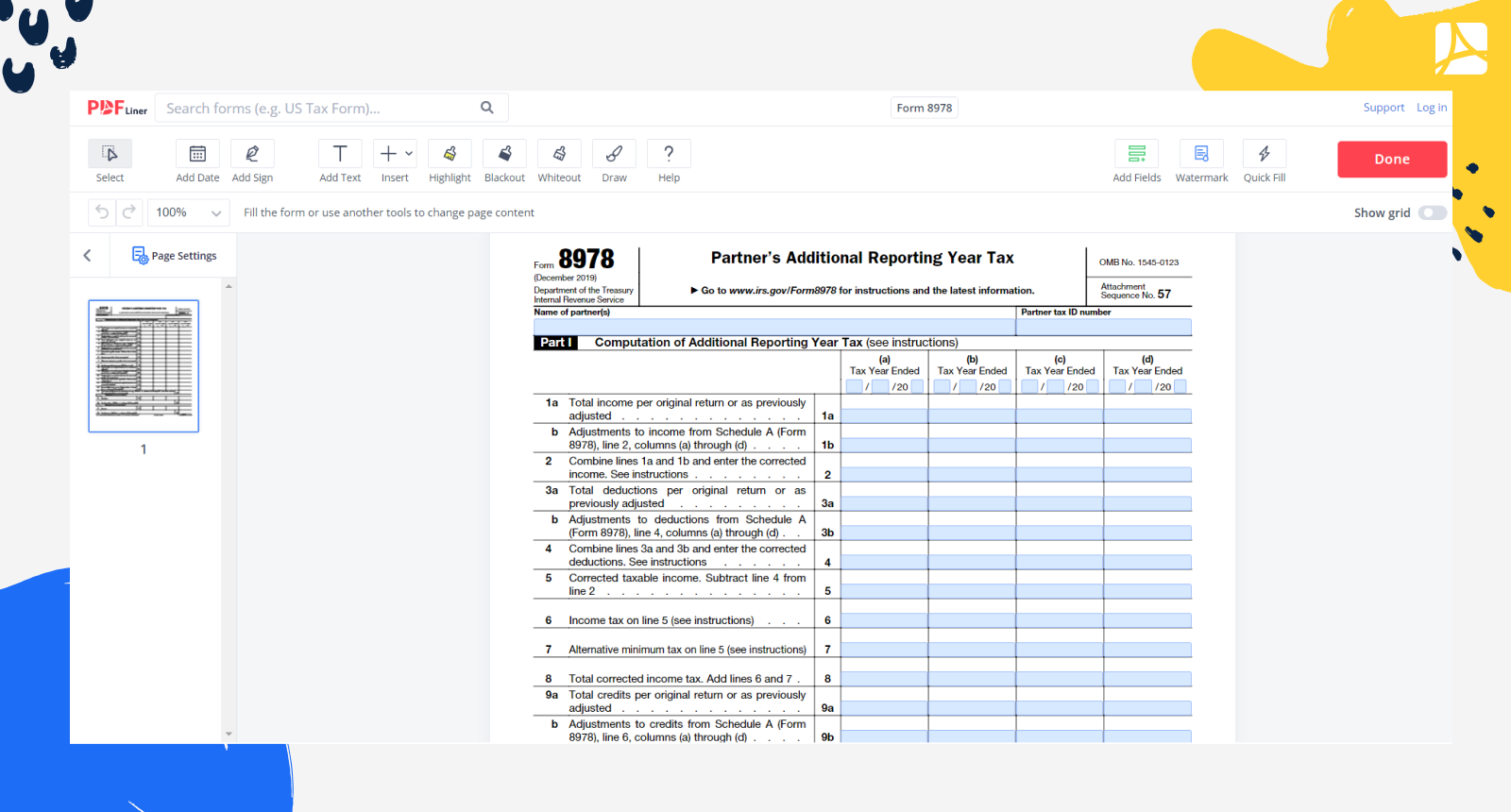

Form 8978 Printable Form 8978 blank, sign forms online — PDFliner

Name of partner(s) partner tax id numbersource of review year adjustments: Web form 8978 draft instructions. 2019) and schedule a (form 8978) (dec. And (2) reporting an i.r.c. Web instructions for form 8978 (including schedule a)(rev.

IRS Form 8978 Download Fillable PDF or Fill Online Partner's Additional

Web instructions for form 8978 (including schedule a)(rev. January 2023) partner’s additional reporting year tax department of the treasury internal revenue service go to www.irs.gov/form8978 for instructions and the latest information. Web revised instructions to form 8978, partner’s additional reporting year tax, released january 4 with changes made to reflect updates on (1) how positive and negative adjustments received by.

va form 268978 pdf Fill Online, Printable, Fillable Blank vaform

The schedule a (form 8978) lists all the adjustments a partner receives on form 8986. Web revised instructions to form 8978, partner’s additional reporting year tax, released january 4 with changes made to reflect updates on (1) how positive and negative adjustments received by partners on forms 8986 should be reported on form 8978 and its schedule a; Generally speaking,.

Download Instructions for IRS Form 8978 Partner's Additional Reporting

Web instructions for form 6478, biofuel producer credit 0120 01/17/2020 inst 8978: Web revised instructions to form 8978, partner’s additional reporting year tax, released january 4 with changes made to reflect updates on (1) how positive and negative adjustments received by partners on forms 8986 should be reported on form 8978 and its schedule a; 2019)) department of the treasury.

IRS Form 8978 Instructions Reporting Partner's Additional Taxes

2019) and schedule a (form 8978) (dec. §199a qualified business income deduction on. Web form 8978 draft instructions. Web instructions for form 8978 (including schedule a)(rev. December 2021) partner’s additional reporting year tax (for use with form 8978 (dec.

IRS Form 8978 Instructions Reporting Partner's Additional Taxes

2019) and schedule a (form 8978) (dec. Web the schedule a (form 8978) lists all the adjustments a partner receives on form 8986. Web instructions for form 8978 (including schedule a)(rev. Name of partner(s) partner tax id numbersource of review year adjustments: Generally speaking, partners use form 8978 and schedule a (form 8978) to report adjustments shown on forms 8986.

Download Instructions for IRS Form 8978 Partner's Additional Reporting

Instructions for form 8978, partner's additional reporting year tax 0123 12/21/2022 2019) and schedule a (form 8978) (dec. Web revised instructions to form 8978, partner’s additional reporting year tax, released january 4 with changes made to reflect updates on (1) how positive and negative adjustments received by partners on forms 8986 should be reported on form 8978 and its schedule.

Download Instructions for IRS Form 8978 Partner's Additional Reporting

2019) and schedule a (form 8978) (dec. §199a qualified business income deduction on. Web form 8978 draft instructions. Web instructions for form 8978 (including schedule a)(rev. Web any partner who receives irs form 8986 must file form 8978 to reflect the proper tax liabilities from the partnership election, and to pay any additional tax due.

IRS Release Draft Instructions to Form 8978

2019)) department of the treasury internal revenue service Instructions for form 8978, partner's additional reporting year tax 0123 12/21/2022 And (2) reporting an i.r.c. January 2023) partner’s additional reporting year tax department of the treasury internal revenue service go to www.irs.gov/form8978 for instructions and the latest information. Web the schedule a (form 8978) lists all the adjustments a partner receives.

Instructions for Form 8978 (Including Schedule A) (12/2021) Internal

January 2023) partner’s additional reporting year tax department of the treasury internal revenue service go to www.irs.gov/form8978 for instructions and the latest information. 2019) and schedule a (form 8978) (dec. December 2021) partner’s additional reporting year tax (for use with form 8978 (dec. Web any partner who receives irs form 8986 must file form 8978 to reflect the proper tax.

Name Of Partner(S) Partner Tax Id Numbersource Of Review Year Adjustments:

Web any partner who receives irs form 8986 must file form 8978 to reflect the proper tax liabilities from the partnership election, and to pay any additional tax due. January 2023) partner’s additional reporting year tax department of the treasury internal revenue service go to www.irs.gov/form8978 for instructions and the latest information. Web the schedule a (form 8978) lists all the adjustments a partner receives on form 8986. Web form 8978 draft instructions.

Web Revised Instructions To Form 8978, Partner’s Additional Reporting Year Tax, Released January 4 With Changes Made To Reflect Updates On (1) How Positive And Negative Adjustments Received By Partners On Forms 8986 Should Be Reported On Form 8978 And Its Schedule A;

The schedule a (form 8978) lists all the adjustments a partner receives on form 8986. Generally speaking, partners use form 8978 and schedule a (form 8978) to report adjustments shown on forms 8986 received from partnerships that have elected to push. §199a qualified business income deduction on. Web instructions for form 6478, biofuel producer credit 0120 01/17/2020 inst 8978:

Schedule A Is Also Used To

Instructions for form 8978, partner's additional reporting year tax 0123 12/21/2022 2019) and schedule a (form 8978) (dec. Web instructions for form 8978 (including schedule a)(rev. And (2) reporting an i.r.c.

2019)) Department Of The Treasury Internal Revenue Service

December 2021) partner’s additional reporting year tax (for use with form 8978 (dec.