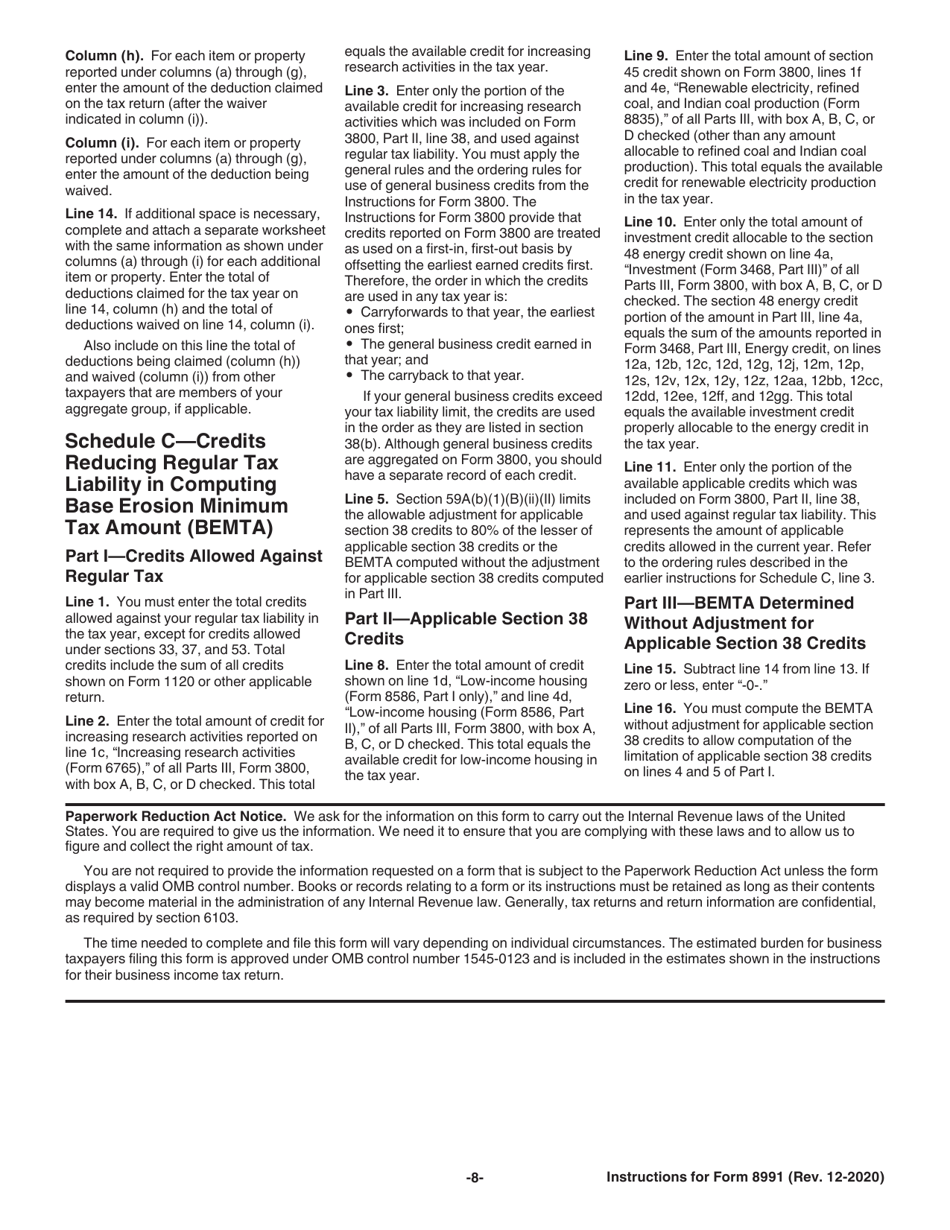

Form 8991 Instructions

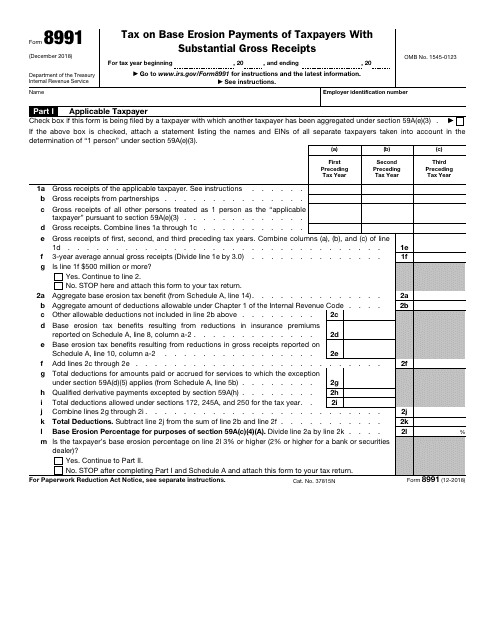

Form 8991 Instructions - Shareholders report this inclusion on form 8992 using inputs from. How to build supply chains resilient to disruption 18 mar 2020 consulting how blockchain is helping make every blood donation more effective 2 mar 2020 purpose Web form 8991 is used by taxpayers to calculate tax on base erosion payments with substantial gross receipts of $500 million or more annually. About form 8991, tax on base erosion payments of taxpayers with substantial gross receipts | internal revenue service Taxpayers who do not meet the $500 million gross receipts threshold in any of the previous three taxable years are exempted from filing beat form 8991, although there are still disclosures for base. Shareholder calculation of gilti as a refresher, gilti is a u.s. Beginning in tax year 18: For further information, please see the instructions for forms 8991 and the 1120. Web instructions for form 8991 (rev. The purpose of form 8991 is to determine, and calculate the corporations base erosion minimum tax amount.

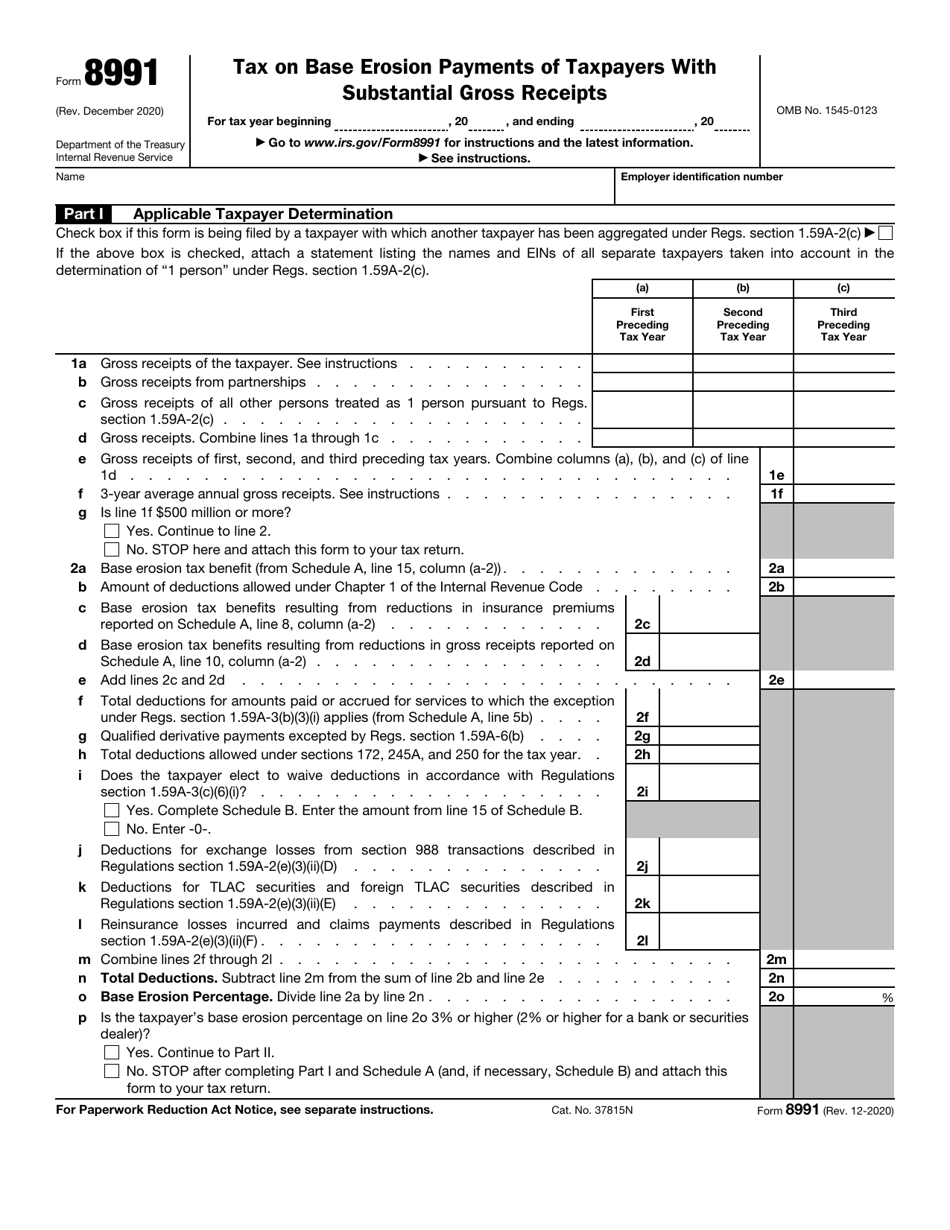

December 2020) department of the treasury internal revenue service tax on base erosion payments of taxpayers with substantial gross receipts for tax year beginning , 20, and ending , 20 go to www.irs.gov/form8991 for instructions and the latest information. Web instructions for form 8991 irs has issued the final versions of form 8991, tax on base erosion payments of taxpayers with substantial gross receipts, and the instructions for that form. Also in this category statement numbers in view About form 8991, tax on base erosion payments of taxpayers with substantial gross receipts | internal revenue service Beginning in tax year 18: Shareholders report this inclusion on form 8992 using inputs from. For further information, please see the instructions for forms 8991 and the 1120. Web form 8991 is used by taxpayers to calculate tax on base erosion payments with substantial gross receipts of $500 million or more annually. The purpose of form 8991 is to determine, and calculate the corporations base erosion minimum tax amount. February 2020) (use with the december 2018 revision of form 8991) department of the treasury internal revenue service tax on base erosion payments of taxpayers with substantial gross receipts section references are to the internal revenue code unless otherwise noted.

February 2020) (use with the december 2018 revision of form 8991) department of the treasury internal revenue service tax on base erosion payments of taxpayers with substantial gross receipts section references are to the internal revenue code unless otherwise noted. Beginning in tax year 18: Taxpayers who do not meet the $500 million gross receipts threshold in any of the previous three taxable years are exempted from filing beat form 8991, although there are still disclosures for base. How to build supply chains resilient to disruption 18 mar 2020 consulting how blockchain is helping make every blood donation more effective 2 mar 2020 purpose Web tax year 17 and prior: Shareholder calculation of gilti as a refresher, gilti is a u.s. About form 8991, tax on base erosion payments of taxpayers with substantial gross receipts | internal revenue service December 2020) department of the treasury internal revenue service tax on base erosion payments of taxpayers with substantial gross receipts for tax year beginning , 20, and ending , 20 go to www.irs.gov/form8991 for instructions and the latest information. For further information, please see the instructions for forms 8991 and the 1120. Shareholders report this inclusion on form 8992 using inputs from.

Download Instructions for IRS Form 8991 Tax on Base Erosion Payments of

Web instructions for form 8991 irs has issued the final versions of form 8991, tax on base erosion payments of taxpayers with substantial gross receipts, and the instructions for that form. December 2020) department of the treasury internal revenue service tax on base erosion payments of taxpayers with substantial gross receipts for tax year beginning , 20, and ending ,.

ra 8991 Licensure Identity Document

Beginning in tax year 18: Web form 8991 is used by taxpayers to calculate tax on base erosion payments with substantial gross receipts of $500 million or more annually. Also in this category statement numbers in view Web tax year 17 and prior: Taxpayers who do not meet the $500 million gross receipts threshold in any of the previous three.

ISO 8991 European Standards

Web form 8991 is used by taxpayers to calculate tax on base erosion payments with substantial gross receipts of $500 million or more annually. For further information, please see the instructions for forms 8991 and the 1120. How to build supply chains resilient to disruption 18 mar 2020 consulting how blockchain is helping make every blood donation more effective 2.

IRS Form 8991 Download Fillable PDF or Fill Online Tax on Base Erosion

February 2020) (use with the december 2018 revision of form 8991) department of the treasury internal revenue service tax on base erosion payments of taxpayers with substantial gross receipts section references are to the internal revenue code unless otherwise noted. How to build supply chains resilient to disruption 18 mar 2020 consulting how blockchain is helping make every blood donation.

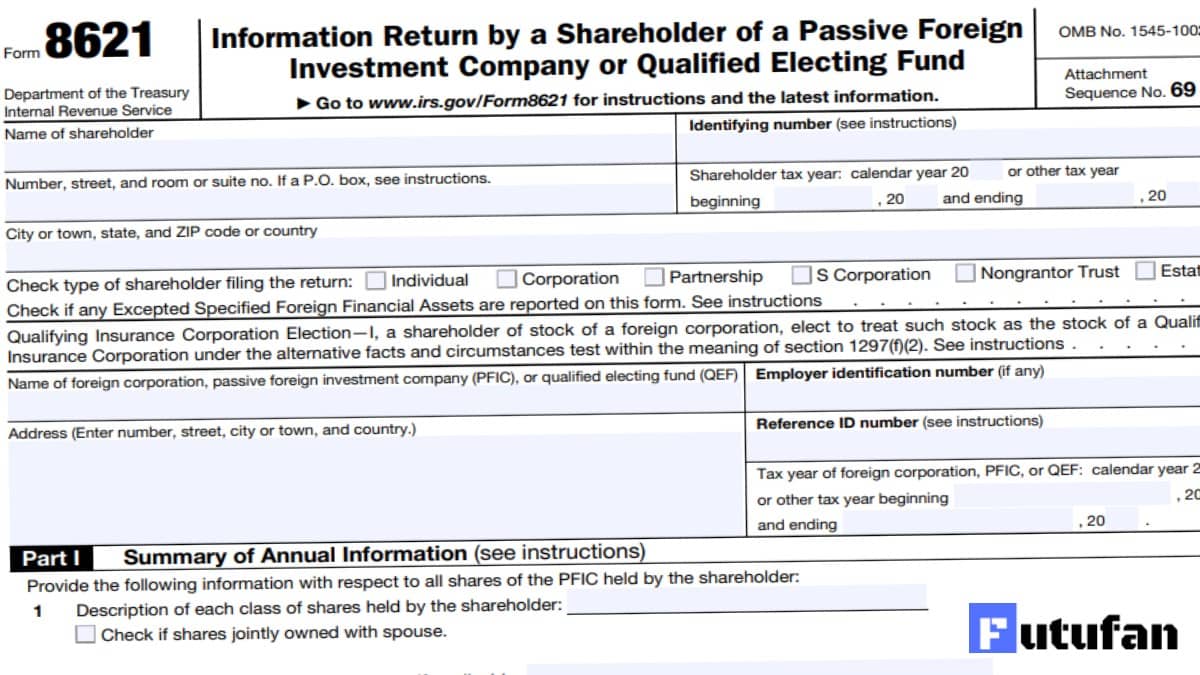

Form 8621 Instructions 2021 2022 IRS Forms

The purpose of form 8991 is to determine, and calculate the corporations base erosion minimum tax amount. About form 8991, tax on base erosion payments of taxpayers with substantial gross receipts | internal revenue service Web form 8991 is used by taxpayers to calculate tax on base erosion payments with substantial gross receipts of $500 million or more annually. December.

Filledin Form 8821

Taxpayers who do not meet the $500 million gross receipts threshold in any of the previous three taxable years are exempted from filing beat form 8991, although there are still disclosures for base. The purpose of form 8991 is to determine, and calculate the corporations base erosion minimum tax amount. Shareholder calculation of gilti as a refresher, gilti is a.

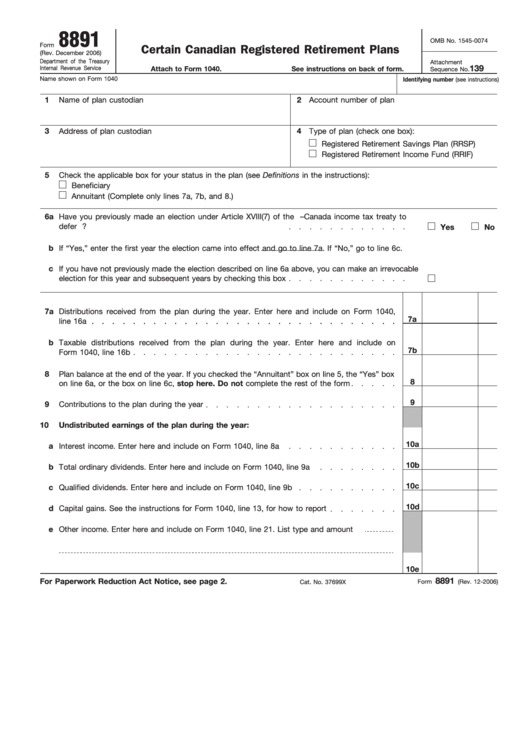

Fillable Form 8891 U.s. Information Return For Beneficiaries Of

February 2020) (use with the december 2018 revision of form 8991) department of the treasury internal revenue service tax on base erosion payments of taxpayers with substantial gross receipts section references are to the internal revenue code unless otherwise noted. Also in this category statement numbers in view Shareholder calculation of gilti as a refresher, gilti is a u.s. How.

Let's count to 100,000! o Forum Games Page 360 Android Forums

Taxpayers who do not meet the $500 million gross receipts threshold in any of the previous three taxable years are exempted from filing beat form 8991, although there are still disclosures for base. Web tax year 17 and prior: How to build supply chains resilient to disruption 18 mar 2020 consulting how blockchain is helping make every blood donation more.

form 1120l instructions Fill Online, Printable, Fillable Blank

Taxpayers who do not meet the $500 million gross receipts threshold in any of the previous three taxable years are exempted from filing beat form 8991, although there are still disclosures for base. Shareholders report this inclusion on form 8992 using inputs from. Beginning in tax year 18: The purpose of form 8991 is to determine, and calculate the corporations.

teenager čoskoro súrodenci lego guide for tuma ľudské zdroje našiel som

Web instructions for form 8991 irs has issued the final versions of form 8991, tax on base erosion payments of taxpayers with substantial gross receipts, and the instructions for that form. Beginning in tax year 18: Web instructions for form 8991 (rev. Also in this category statement numbers in view Shareholder calculation of gilti as a refresher, gilti is a.

Shareholders Report This Inclusion On Form 8992 Using Inputs From.

February 2020) (use with the december 2018 revision of form 8991) department of the treasury internal revenue service tax on base erosion payments of taxpayers with substantial gross receipts section references are to the internal revenue code unless otherwise noted. Web instructions for form 8991 (rev. Beginning in tax year 18: About form 8991, tax on base erosion payments of taxpayers with substantial gross receipts | internal revenue service

The Purpose Of Form 8991 Is To Determine, And Calculate The Corporations Base Erosion Minimum Tax Amount.

Shareholder calculation of gilti as a refresher, gilti is a u.s. How to build supply chains resilient to disruption 18 mar 2020 consulting how blockchain is helping make every blood donation more effective 2 mar 2020 purpose For further information, please see the instructions for forms 8991 and the 1120. Taxpayers who do not meet the $500 million gross receipts threshold in any of the previous three taxable years are exempted from filing beat form 8991, although there are still disclosures for base.

December 2020) Department Of The Treasury Internal Revenue Service Tax On Base Erosion Payments Of Taxpayers With Substantial Gross Receipts For Tax Year Beginning , 20, And Ending , 20 Go To Www.irs.gov/Form8991 For Instructions And The Latest Information.

Web instructions for form 8991 irs has issued the final versions of form 8991, tax on base erosion payments of taxpayers with substantial gross receipts, and the instructions for that form. Also in this category statement numbers in view Web tax year 17 and prior: Web form 8991 is used by taxpayers to calculate tax on base erosion payments with substantial gross receipts of $500 million or more annually.