Form 8993 Instructions 2021

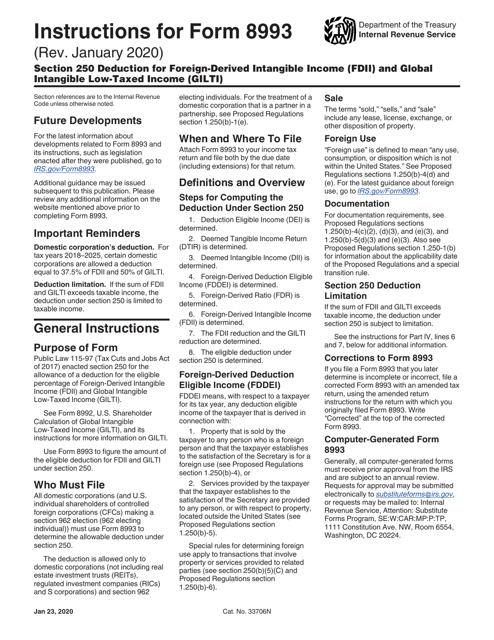

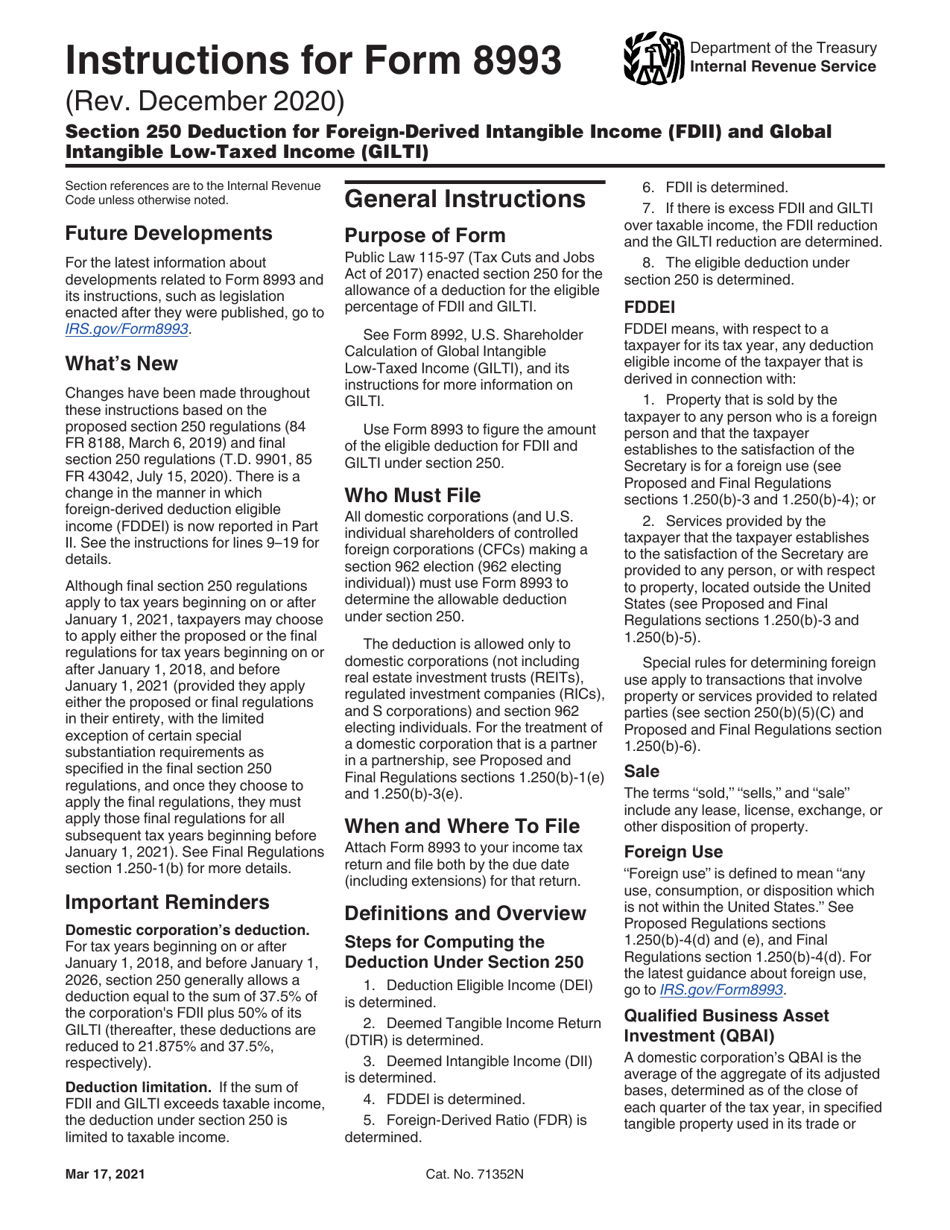

Form 8993 Instructions 2021 - For paperwork reduction act notice, see separate instructions. All domestic corporations (and u.s. Department of the treasury internal revenue service (rev. January 2020) department of the treasury internal revenue service. Department of the treasury internal revenue service (rev. Web as provided by the irs: December 2020) department of the treasury internal revenue service. Section 1, information to determine deduction eligible income (dei) and qualified business asset. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. Web instructions for form 8993.

Web instructions for form 8993 department of the treasury internal revenue service (rev. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. January 2020) department of the treasury internal revenue service. Web instructions for form 8993 (rev. Who must file irs form 8993? Department of the treasury internal revenue service (rev. Individual shareholders of controlled foreign corporations (cfcs) making a section 962. Web as provided by the irs: Web instructions for form 8993. All domestic corporations (and u.s.

Web october 26, 2021 draft as of form 8993 (rev. Individual shareholders of controlled foreign corporations (cfcs) making a section 962. December 2020) department of the treasury internal revenue service. For paperwork reduction act notice, see separate instructions. Department of the treasury internal revenue service (rev. Section 1, information to determine deduction eligible income (dei) and qualified business asset. Web instructions for form 8993 department of the treasury internal revenue service (rev. Web instructions for form 8993 (rev. Department of the treasury internal revenue service (rev. Web instructions for form 8993.

Download Instructions for IRS Form 8993 Section 250 Deduction for

Individual shareholders of controlled foreign corporations (cfcs) making a section 962. Web instructions for form 8993 (rev. Web october 26, 2021 draft as of form 8993 (rev. All domestic corporations (and u.s. Who must file irs form 8993?

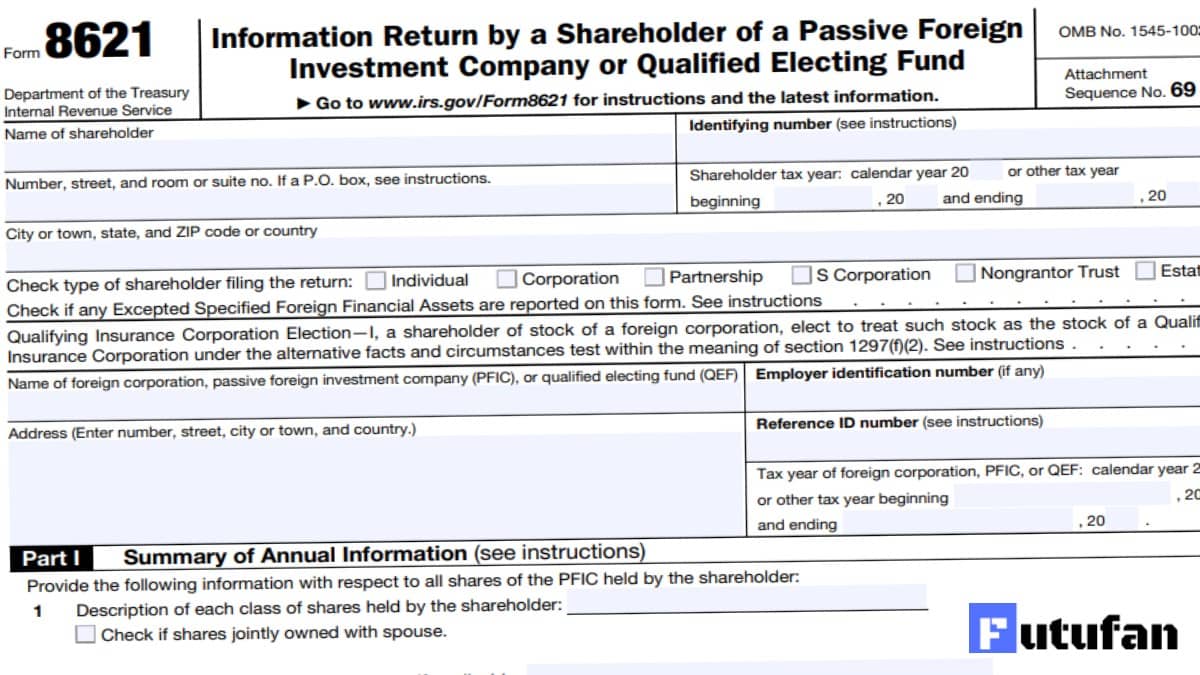

Form 8621 Instructions 2021 2022 IRS Forms

For paperwork reduction act notice, see separate instructions. Department of the treasury internal revenue service (rev. Web october 26, 2021 draft as of form 8993 (rev. Who must file irs form 8993? January 2020) department of the treasury internal revenue service.

CA FTB 592V 20212022 US Legal Forms

Department of the treasury internal revenue service (rev. Web instructions for form 8993. Web october 26, 2021 draft as of form 8993 (rev. Web as provided by the irs: Department of the treasury internal revenue service (rev.

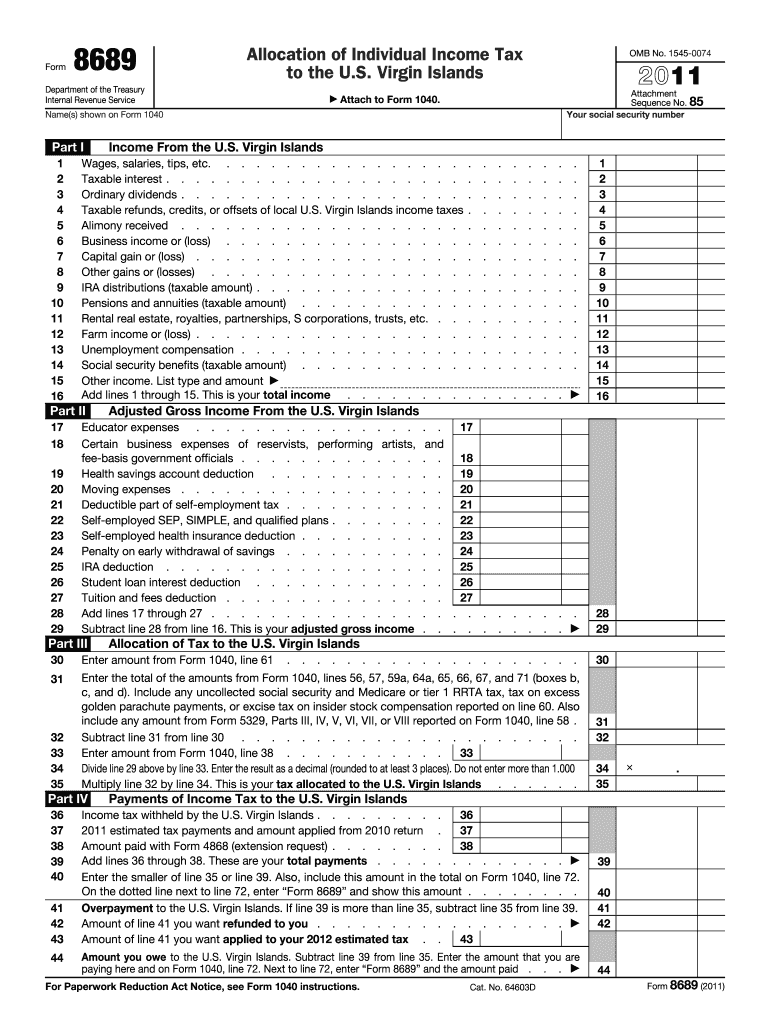

2011 form 8689 Fill out & sign online DocHub

Individual shareholders of controlled foreign corporations (cfcs) making a section 962. For paperwork reduction act notice, see separate instructions. Web instructions for form 8993 department of the treasury internal revenue service (rev. Department of the treasury internal revenue service (rev. January 2020) department of the treasury internal revenue service.

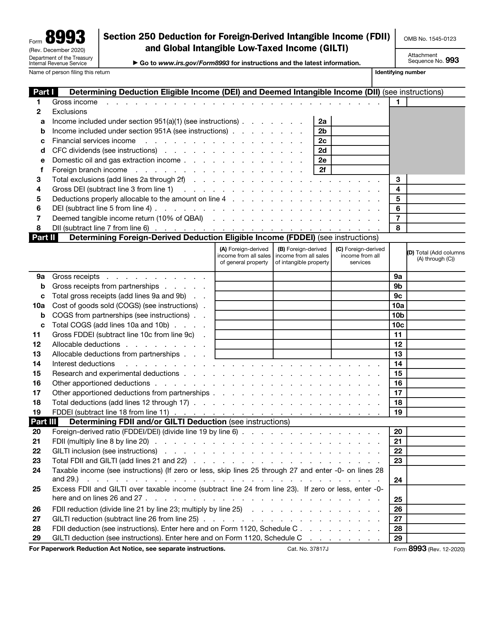

IRS Form 8993 Download Fillable PDF or Fill Online Section 250

Individual shareholders of controlled foreign corporations (cfcs) making a section 962. Web instructions for form 8993 (rev. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. Web instructions for form 8993 department of the treasury internal revenue service (rev. January 2020) department of the treasury.

Form 8995 Basics & Beyond

Web as provided by the irs: Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. Section 1, information to determine deduction eligible income (dei) and qualified business asset. Web october 26, 2021 draft as of form 8993 (rev. January 2020) department of the treasury internal.

Learn How to Fill the Form 8863 Education Credits YouTube

All domestic corporations (and u.s. December 2020) department of the treasury internal revenue service. Individual shareholders of controlled foreign corporations (cfcs) making a section 962. Section 1, information to determine deduction eligible income (dei) and qualified business asset. Who must file irs form 8993?

Unemployment Benefits Fill Out and Sign Printable PDF Template signNow

Department of the treasury internal revenue service (rev. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. Web as provided by the irs: Web october 26, 2021 draft as of form 8993 (rev. December 2020) department of the treasury internal revenue service.

8889 Form 2021 IRS Forms Zrivo

Department of the treasury internal revenue service (rev. All domestic corporations (and u.s. Who must file irs form 8993? Web instructions for form 8993 (rev. Web as provided by the irs:

Download Instructions for IRS Form 8993 Section 250 Deduction for

Web october 26, 2021 draft as of form 8993 (rev. Individual shareholders of controlled foreign corporations (cfcs) making a section 962. Web instructions for form 8993. January 2020) department of the treasury internal revenue service. All domestic corporations (and u.s.

January 2020) Department Of The Treasury Internal Revenue Service.

Web instructions for form 8993. Individual shareholders of controlled foreign corporations (cfcs) making a section 962. Web instructions for form 8993 (rev. Department of the treasury internal revenue service (rev.

Web October 26, 2021 Draft As Of Form 8993 (Rev.

For paperwork reduction act notice, see separate instructions. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. Web instructions for form 8993 department of the treasury internal revenue service (rev. December 2020) department of the treasury internal revenue service.

All Domestic Corporations (And U.s.

Section 1, information to determine deduction eligible income (dei) and qualified business asset. Department of the treasury internal revenue service (rev. Web as provided by the irs: Who must file irs form 8993?