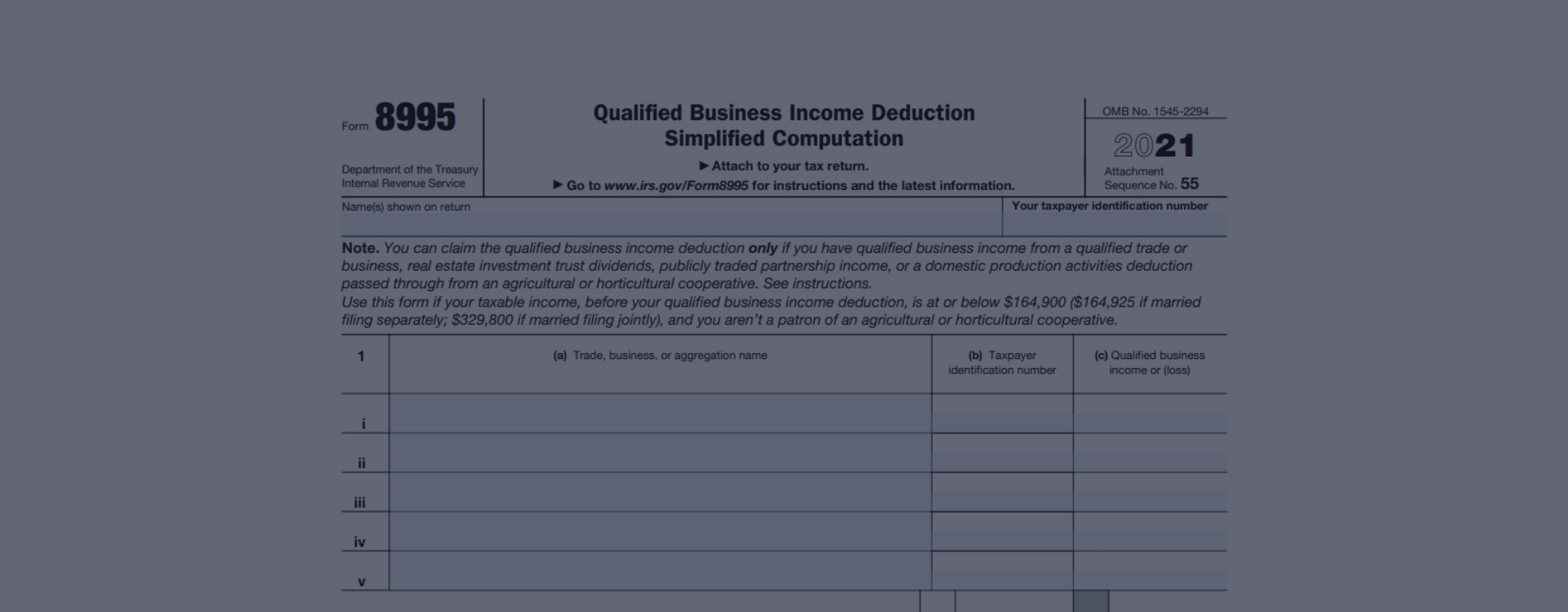

Form 8995 2022

Form 8995 2022 - Other federal individual income tax forms: We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Steps to complete the federal form 8995 accurately before proceeding with the essential details, let me remind you that a printable form 8995 is available on the irs website for convenience. A new row has been included for the 2022 suspended and allowed losses. Web information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on how to file. Web a worksheet is added to provide a reasonable method to track and compute your previously disallowed losses or deductions to be included in your qualified business income deduction calculation for the year allowed. Web irs form 8995 for 2022 must be filed by individuals, partnerships, s corporations, and trusts or estates that have qualified business income (qbi) from a qualified trade or business. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web updated for tax year 2022 • february 2, 2023 04:34 pm overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995. Web the 2022 irs form 8995 calculates the allowable qbi deduction for eligible taxpayers with qualified trade or business income, which can significantly reduce their taxable income.

We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Web irs form 8995 for 2022 must be filed by individuals, partnerships, s corporations, and trusts or estates that have qualified business income (qbi) from a qualified trade or business. Web tax form 8995 for 2022 is especially relevant, as it helps taxpayers take maximum advantage of the new tax laws. Web updated for tax year 2022 • february 2, 2023 04:34 pm overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995. This statement is used to calculate the qbi deduction, which can provide significant tax savings for eligible taxpayers. Steps to complete the federal form 8995 accurately before proceeding with the essential details, let me remind you that a printable form 8995 is available on the irs website for convenience. Click to expand the qualified business. A new row has been included for the 2022 suspended and allowed losses. Include the following schedules (their specific instructions are shown later), as appropriate: Web this form is for income earned in tax year 2022, with tax returns due in april 2023.

Go to www.irs.gov/form8995 for instructions and the latest information. Web a worksheet is added to provide a reasonable method to track and compute your previously disallowed losses or deductions to be included in your qualified business income deduction calculation for the year allowed. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web irs form 8995 for 2022 must be filed by individuals, partnerships, s corporations, and trusts or estates that have qualified business income (qbi) from a qualified trade or business. Web tax form 8995 for 2022 is especially relevant, as it helps taxpayers take maximum advantage of the new tax laws. Steps to complete the federal form 8995 accurately before proceeding with the essential details, let me remind you that a printable form 8995 is available on the irs website for convenience. Use form 8995 to figure your qualified business income deduction. Web the 2022 irs form 8995 calculates the allowable qbi deduction for eligible taxpayers with qualified trade or business income, which can significantly reduce their taxable income.

IRS Form 8995 Instructions Your Simplified QBI Deduction

Web irs form 8995 for 2022 must be filed by individuals, partnerships, s corporations, and trusts or estates that have qualified business income (qbi) from a qualified trade or business. Other federal individual income tax forms: Use form 8995 to figure your qualified business income deduction. A new row has been included for the 2022 suspended and allowed losses. Steps.

8995 Form 📝 Get IRS Form 8995 With Instructions Printable PDF Sample

Other federal individual income tax forms: Go to www.irs.gov/form8995a for instructions and the latest information. Go to www.irs.gov/form8995 for instructions and the latest information. Web tax form 8995 for 2022 is especially relevant, as it helps taxpayers take maximum advantage of the new tax laws. Web irs form 8995 for 2022 must be filed by individuals, partnerships, s corporations, and.

IRS Form 8995A Your Guide to the QBI Deduction

Web a worksheet is added to provide a reasonable method to track and compute your previously disallowed losses or deductions to be included in your qualified business income deduction calculation for the year allowed. Web information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on how to file. Click to expand the.

Using Form 8995 To Determine Your Qualified Business Deduction

Web a worksheet is added to provide a reasonable method to track and compute your previously disallowed losses or deductions to be included in your qualified business income deduction calculation for the year allowed. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web information about form 8995,.

Form 8995 Fill Out and Sign Printable PDF Template signNow

We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Web a worksheet is added to provide a reasonable method to track and compute your previously disallowed losses or deductions to be included in your qualified business income deduction calculation for the year allowed. Other.

8995 Fill out & sign online DocHub

This statement is used to calculate the qbi deduction, which can provide significant tax savings for eligible taxpayers. Web updated for tax year 2022 • february 2, 2023 04:34 pm overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995. Web tax form 8995 for 2022 is especially relevant, as.

Qualified Business Deduction Worksheet Example Math Worksheets

Web updated for tax year 2022 • february 2, 2023 04:34 pm overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995. Web irs form 8995 for 2022 must be filed by individuals, partnerships, s corporations, and trusts or estates that have qualified business income (qbi) from a qualified trade.

Staying on Top of Changes to the 20 QBI Deduction (199A) One Year

Go to www.irs.gov/form8995a for instructions and the latest information. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Include the following schedules (their specific instructions are shown later), as appropriate: Web updated for tax year 2022 • february 2, 2023 04:34 pm overview if your work qualifies you.

Form 8995 (Qualified Business Deduction Simplified Computation)

Use form 8995 to figure your qualified business income deduction. Other federal individual income tax forms: Web this form is for income earned in tax year 2022, with tax returns due in april 2023. A new row has been included for the 2022 suspended and allowed losses. We will update this page with a new version of the form for.

8995 Form 📝 IRS Form 8995 for Instructions Printable Sample With PDF

Web tax form 8995 for 2022 is especially relevant, as it helps taxpayers take maximum advantage of the new tax laws. Web a worksheet is added to provide a reasonable method to track and compute your previously disallowed losses or deductions to be included in your qualified business income deduction calculation for the year allowed. Web information about form 8995,.

Web The 2022 Irs Form 8995 Calculates The Allowable Qbi Deduction For Eligible Taxpayers With Qualified Trade Or Business Income, Which Can Significantly Reduce Their Taxable Income.

Web irs form 8995 for 2022 must be filed by individuals, partnerships, s corporations, and trusts or estates that have qualified business income (qbi) from a qualified trade or business. A new row has been included for the 2022 suspended and allowed losses. Web a worksheet is added to provide a reasonable method to track and compute your previously disallowed losses or deductions to be included in your qualified business income deduction calculation for the year allowed. Go to www.irs.gov/form8995a for instructions and the latest information.

Click To Expand The Qualified Business.

Web updated for tax year 2022 • february 2, 2023 04:34 pm overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995. Steps to complete the federal form 8995 accurately before proceeding with the essential details, let me remind you that a printable form 8995 is available on the irs website for convenience. Include the following schedules (their specific instructions are shown later), as appropriate: Other federal individual income tax forms:

Go To Www.irs.gov/Form8995 For Instructions And The Latest Information.

This statement is used to calculate the qbi deduction, which can provide significant tax savings for eligible taxpayers. Use form 8995 to figure your qualified business income deduction. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web this form is for income earned in tax year 2022, with tax returns due in april 2023.

Web Information About Form 8995, Qualified Business Income Deduction Simplified Computation, Including Recent Updates, Related Forms And Instructions On How To File.

We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Web tax form 8995 for 2022 is especially relevant, as it helps taxpayers take maximum advantage of the new tax laws.