Form 8997 Instructions

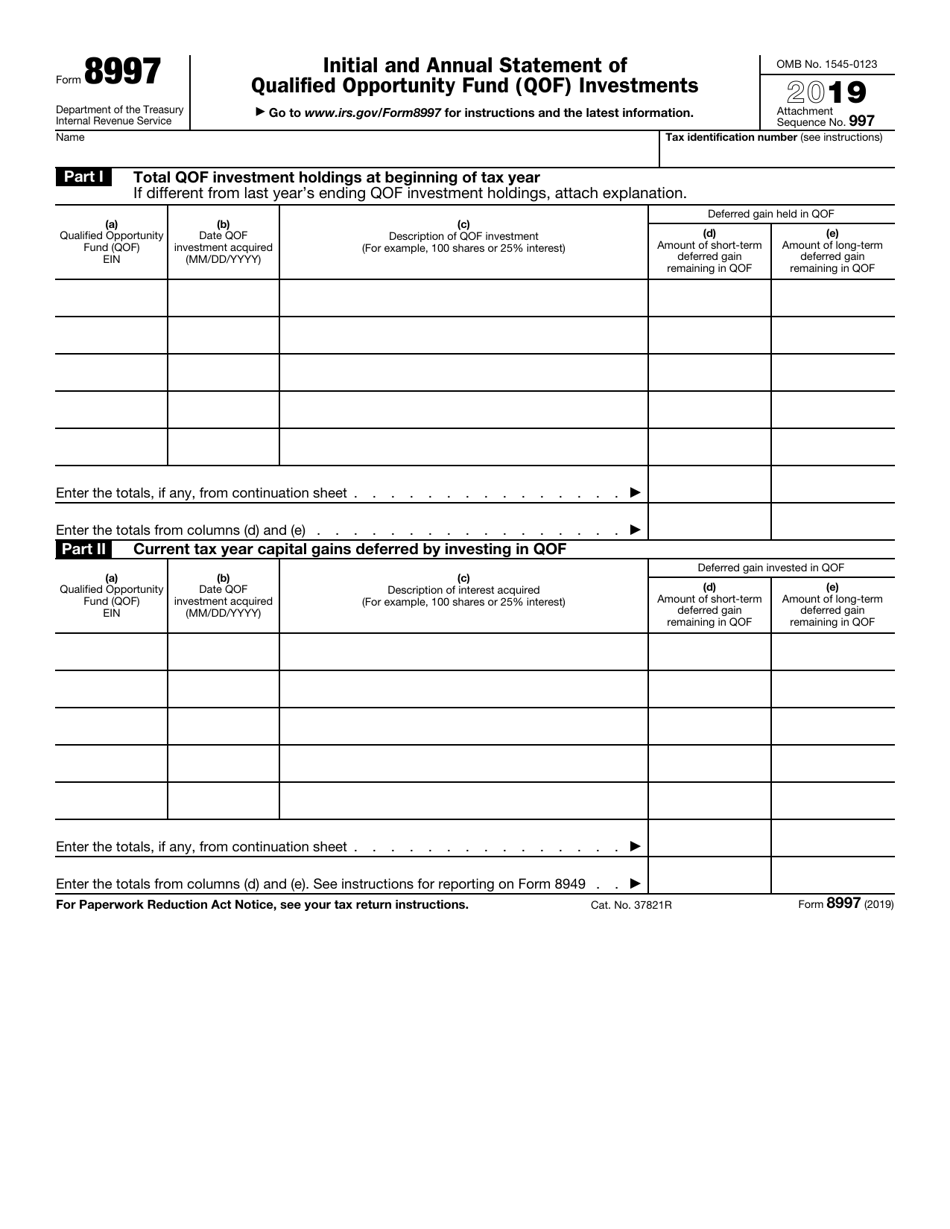

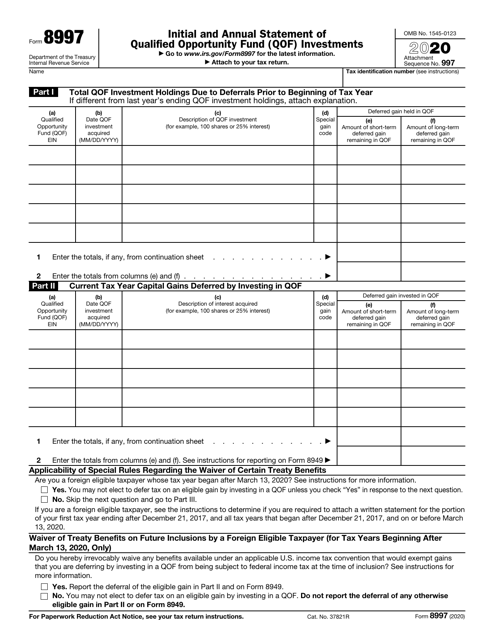

Form 8997 Instructions - Web taxpayers use form 8997 to inform the irs of the qof/qoz investments and deferred capital gains held at the beginning and end of the current tax year, any capital gains. Web the workflow to enter an election to defer tax on eligible gain by investing in a qof in the program mirrors the form 8949 instructions. The qof’s employer identification number (ein) the date the taxpayer acquired. See instructions for reporting on form 8949. Applicability of special rules regarding the waiver of certain treaty benefits are you a. Web up to 10% cash back each part of form 8997 requires five pieces of information: An estate is a domestic estate if it isn't a foreign estate. Under the opportunity zones (oz) incentive, taxpayers can defer taxes by. Web how to fill out irs form 8997 (for oz investors), with ashley tison. Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end of the current tax year, as well as any capital.

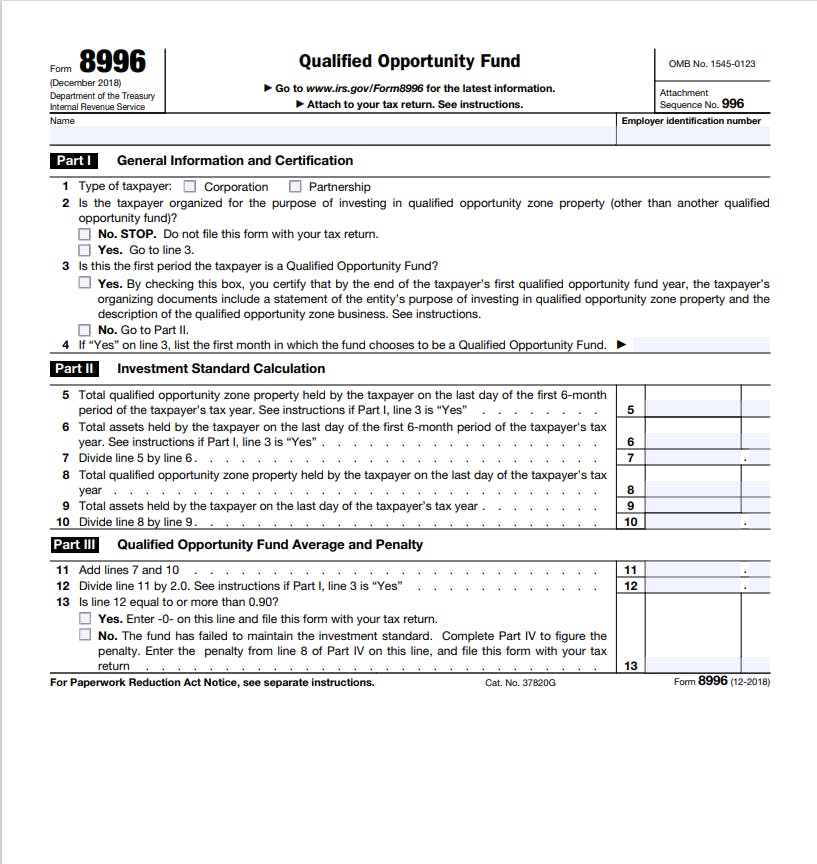

Web taxpayers use form 8997 to inform the irs of the qof/qoz investments and deferred capital gains held at the beginning and end of the current tax year, any capital gains. See instructions for reporting on form 8949. Web current revision form 8996 pdf instructions for form 8996 pdf ( hmtl) recent developments clarification of instructions for form 8996 informing qualified. Under the opportunity zones (oz) incentive, taxpayers can defer taxes by. Web the purpose of the form 8997 is to provide a centralized form for an investor in qualified opportunity funds to report their investments in and the capital gains. Web how to fill out irs form 8997 (for oz investors), with ashley tison. The qof’s employer identification number (ein) the date the taxpayer acquired. Fill in fund (s) acquisition date, ein (employer identification number), percentage acquired, and the amount being deferred (usually. Web see the form 8997 instructions. Web up to 10% cash back each part of form 8997 requires five pieces of information:

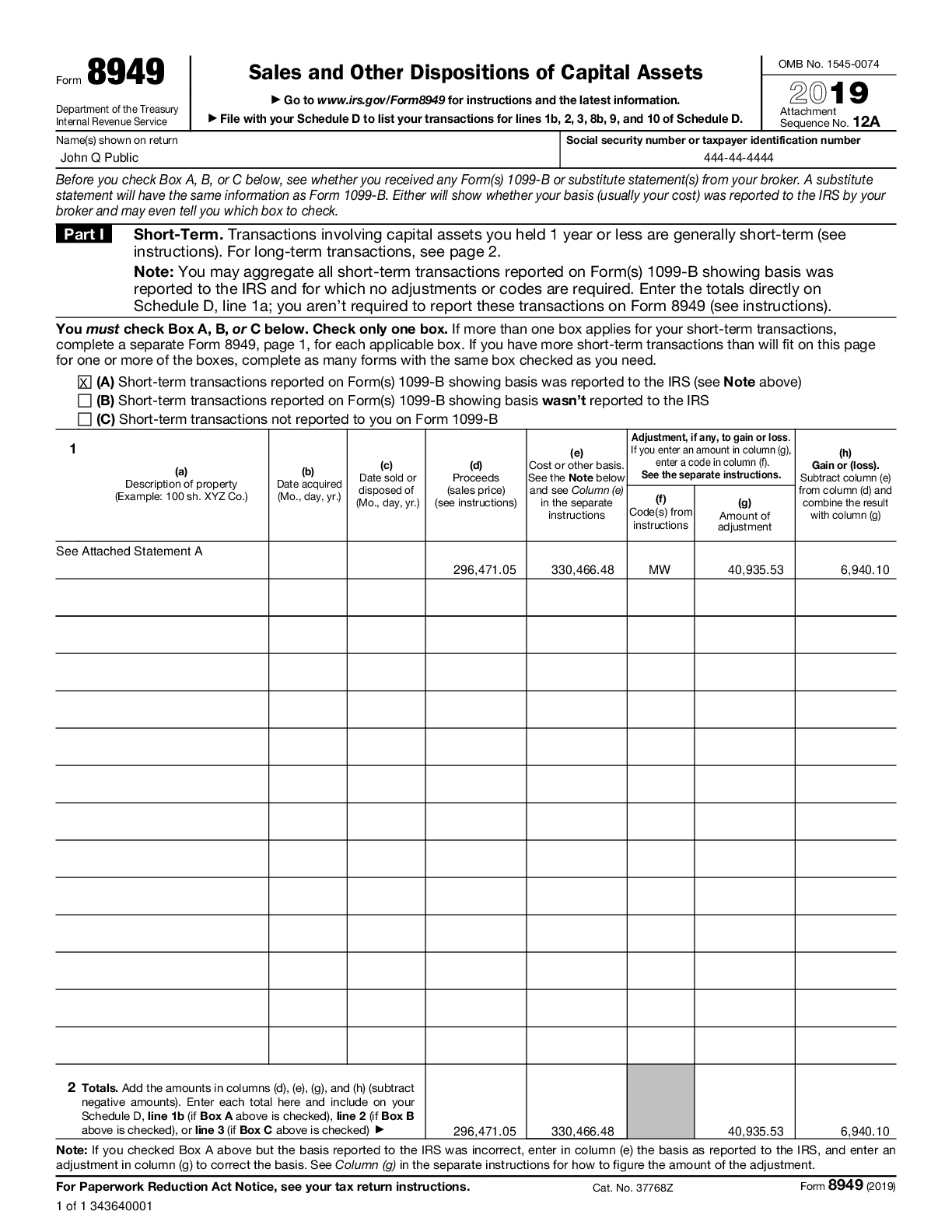

Web form 8997, initial and annual statement of qualified opportunity fund investments is a new form. Web for an investor who has deferred capital gains into a qualified opportunity fund, this is how to complete irs forms 8949 and 8997 to ensure that you receive the. Web current revision form 8996 pdf instructions for form 8996 pdf ( hmtl) recent developments clarification of instructions for form 8996 informing qualified. Web enter the totals from columns (e) and (f). Web see the form 8997 instructions. The qof’s employer identification number (ein) the date the taxpayer acquired. See instructions for reporting on form 8949. You will need to enter it as two. An estate is a domestic estate if it isn't a foreign estate. Web if you are a foreign eligible taxpayer, see the instructions to determine if you are required to attach a written statement for the portion of your first tax year ending after december 21,.

How To Fill Out IRS Form 8997 (For OZ Investors), With Ashley Tison

Web up to 10% cash back each part of form 8997 requires five pieces of information: Web form 8997, initial and annual statement of qualified opportunity fund investments is a new form. Web description of the fund. Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end of the.

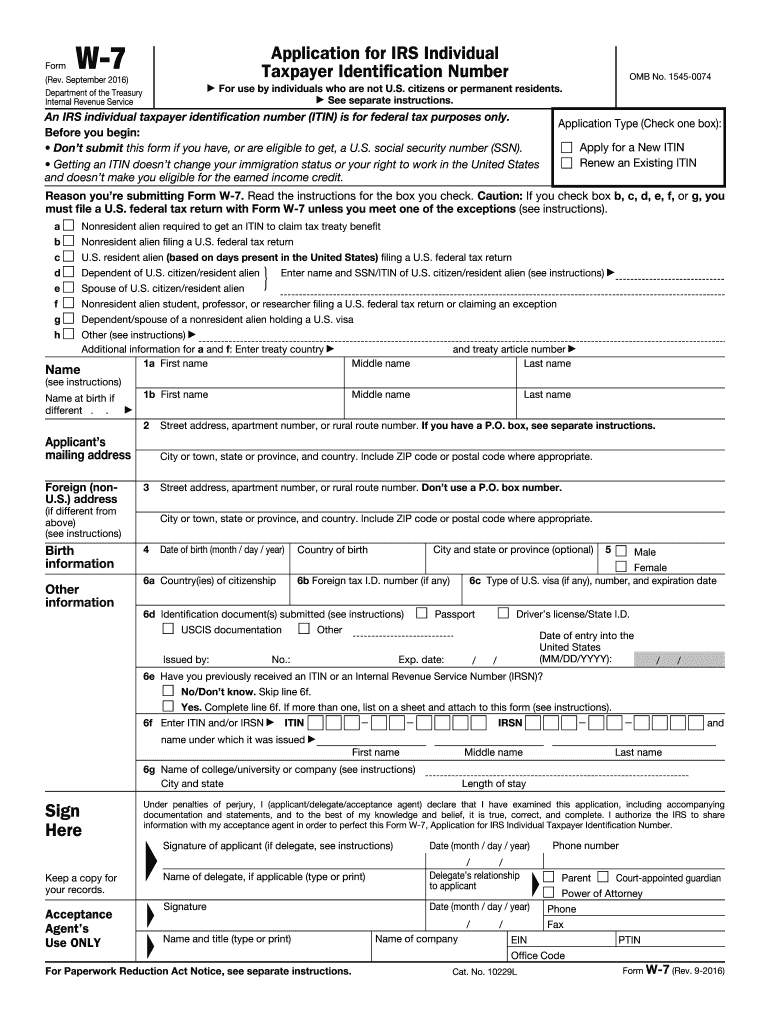

Apply For Tax ID Number TIN Number

Web the draft 2019 form 8997 requires taxpayers to report for each qof investment: Web up to 10% cash back each part of form 8997 requires five pieces of information: Web the purpose of the form 8997 is to provide a centralized form for an investor in qualified opportunity funds to report their investments in and the capital gains. Applicability.

Explanation of IRS "Exception 2"

Web see the form 8997 instructions. Web how to fill out irs form 8997 (for oz investors), with ashley tison. An estate is a domestic estate if it isn't a foreign estate. Web the purpose of the form 8997 is to provide a centralized form for an investor in qualified opportunity funds to report their investments in and the capital.

IRS Form 8997 Download Fillable PDF or Fill Online Initial and Annual

Web if you are a foreign eligible taxpayer, see the instructions to determine if you are required to attach a written statement for the portion of your first tax year ending after december 21,. Web description of the fund. Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end.

Reimbursement Request form Template Lovely Travel Expense Reimbursement

Under the opportunity zones (oz) incentive, taxpayers can defer taxes by. Web enter the totals from columns (e) and (f). Web if you are a foreign eligible taxpayer, see the instructions to determine if you are required to attach a written statement for the portion of your first tax year ending after december 21,. Web the workflow to enter an.

IRS Form 8997 Download Fillable PDF or Fill Online Initial and Annual

Web taxpayers use form 8997 to inform the irs of the qof/qoz investments and deferred capital gains held at the beginning and end of the current tax year, any capital gains. You will need to enter it as two. Under the opportunity zones (oz) incentive, taxpayers can defer taxes by. An estate is a domestic estate if it isn't a.

IRS Form 8997 The Sherbert Group

The qof’s employer identification number (ein) the date the taxpayer acquired. Fill in fund (s) acquisition date, ein (employer identification number), percentage acquired, and the amount being deferred (usually. A foreign estate is one the income of which is from sources outside the united states that. Web how to fill out irs form 8997 (for oz investors), with ashley tison..

Adrisse Vet Brokerage Account Growth 1099 Div Relevant Experience For

Web if you are a foreign eligible taxpayer, see the instructions to determine if you are required to attach a written statement for the portion of your first tax year ending after december 21,. Web the purpose of the form 8997 is to provide a centralized form for an investor in qualified opportunity funds to report their investments in and.

1.5" x 0.5" White Matte Laser Label Sheets for Inkjet & Laser Printers

You will need to enter it as two. Under the opportunity zones (oz) incentive, taxpayers can defer taxes by. Applicability of special rules regarding the waiver of certain treaty benefits are you a. Web how to fill out irs form 8997 (for oz investors), with ashley tison. Web current revision form 8996 pdf instructions for form 8996 pdf ( hmtl).

To

Web how to fill out irs form 8997 (for oz investors), with ashley tison. Fill in fund (s) acquisition date, ein (employer identification number), percentage acquired, and the amount being deferred (usually. Qof investments held at the beginning of the current tax year, including the amount of short. You can file your tax return without that, however. A foreign estate.

Web See The Form 8997 Instructions.

Web for an investor who has deferred capital gains into a qualified opportunity fund, this is how to complete irs forms 8949 and 8997 to ensure that you receive the. Under the opportunity zones (oz) incentive, taxpayers can defer taxes by. Fill in fund (s) acquisition date, ein (employer identification number), percentage acquired, and the amount being deferred (usually. Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end of the current tax year, as well as any capital.

Web Form 8997 Department Of The Treasury Internal Revenue Service Initial And Annual Statement Of Qualified Opportunity Fund (Qof) Investments Go To.

See instructions for reporting on form 8949. A foreign estate is one the income of which is from sources outside the united states that. Web the workflow to enter an election to defer tax on eligible gain by investing in a qof in the program mirrors the form 8949 instructions. Web the purpose of the form 8997 is to provide a centralized form for an investor in qualified opportunity funds to report their investments in and the capital gains.

The Qof’s Employer Identification Number (Ein) The Date The Taxpayer Acquired.

Web up to 10% cash back each part of form 8997 requires five pieces of information: Web enter the totals from columns (e) and (f). Web the draft 2019 form 8997 requires taxpayers to report for each qof investment: Applicability of special rules regarding the waiver of certain treaty benefits are you a.

Web These Letters Notify The Taxpayers That They May Not Have Properly Followed The Instructions For Form 8997, Initial And Annual Statement Of Qualified Opportunity.

Qof investments held at the beginning of the current tax year, including the amount of short. You can file your tax return without that, however. Web taxpayers use form 8997 to inform the irs of the qof/qoz investments and deferred capital gains held at the beginning and end of the current tax year, any capital gains. Web current revision form 8996 pdf instructions for form 8996 pdf ( hmtl) recent developments clarification of instructions for form 8996 informing qualified.