Form 941 Electronic Filing

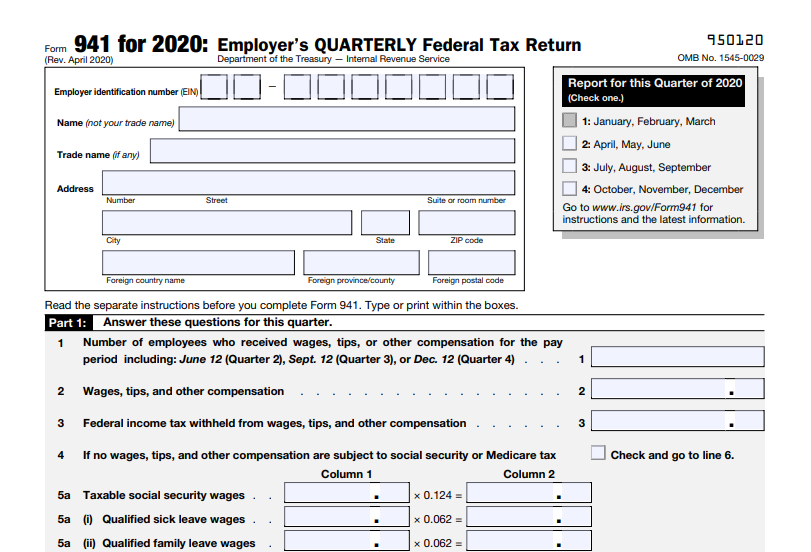

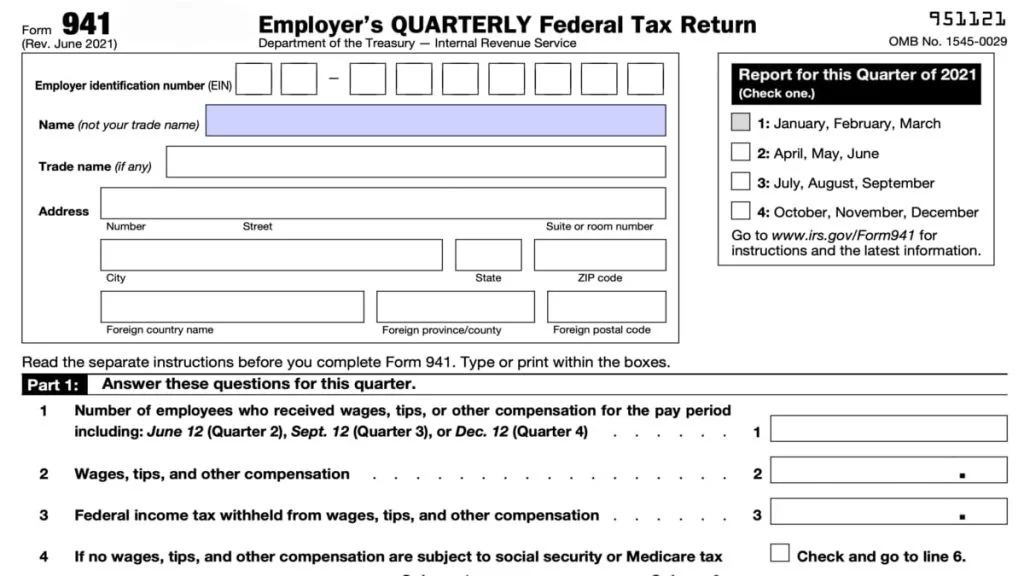

Form 941 Electronic Filing - Electronic payment options for businesses and individuals. 1 choose tax year & quarter 2 enter social security & medicare taxes 3 enter deposit schedule & tax liability 4 choose irs payment methods 5 review your form 941 6 transmit your form 941 to the irs are you ready to file your form 941? Answer these questions for this quarter. October, november, december go to www.irs.gov/form941 for instructions and the latest information. It is secure and accurate. Web select the company you would like to use to file your employment tax forms electronically. However, don't use efw to make federal tax deposits. Special filing address for exempt organizations; Read the separate instructions before you complete form 941. Web irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income taxes and payroll taxes that they withheld from their employees’ wages — as well.

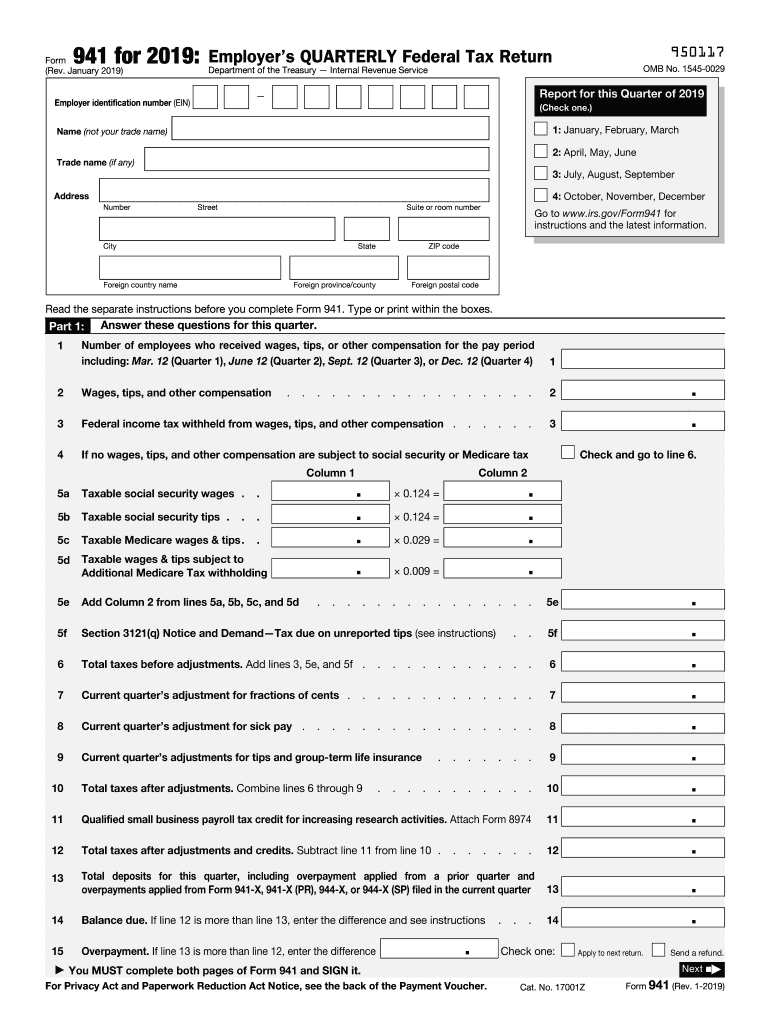

For more information on paying your taxes using efw, go to irs.gov/efw. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. 940, 941, 943, 944 and 945. However, don't use efw to make federal tax deposits. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Special filing address for exempt organizations; Web free from the u.s. It is secure and accurate. October, november, december go to www.irs.gov/form941 for instructions and the latest information. Web irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income taxes and payroll taxes that they withheld from their employees’ wages — as well.

It is secure and accurate. 1 choose tax year & quarter 2 enter social security & medicare taxes 3 enter deposit schedule & tax liability 4 choose irs payment methods 5 review your form 941 6 transmit your form 941 to the irs are you ready to file your form 941? And indian tribal governmental entities; Read the separate instructions before you complete form 941. Web free from the u.s. Type or print within the boxes. You receive acknowledgement within 24 hours. However, don't use efw to make federal tax deposits. Convenient electronic funds withdrawal (efw), and credit card. For more information on paying your taxes using efw, go to irs.gov/efw.

Form 941 Instructions & Info on Tax Form 941 (including Mailing Info)

Web internal revenue service. Type or print within the boxes. 1 choose tax year & quarter 2 enter social security & medicare taxes 3 enter deposit schedule & tax liability 4 choose irs payment methods 5 review your form 941 6 transmit your form 941 to the irs are you ready to file your form 941? Web select the company.

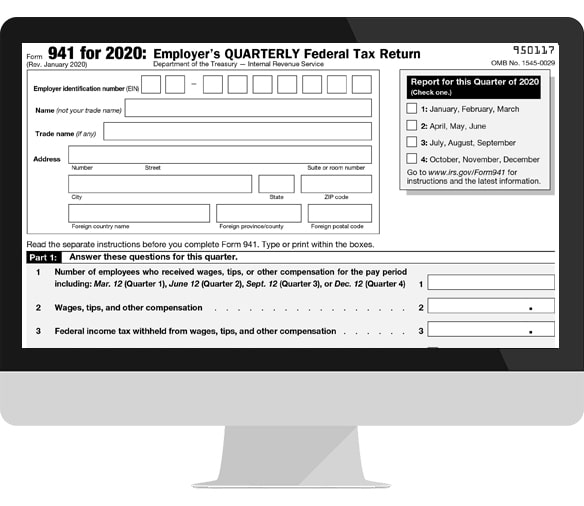

File Form 941 Online for 2019 Express941

Answer these questions for this quarter. Electronic payment options for businesses and individuals. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. October, november, december go to www.irs.gov/form941 for instructions and the latest information. Web free from the u.s.

Form 941 Fill Out and Sign Printable PDF Template signNow

Convenient electronic funds withdrawal (efw), and credit card. Type or print within the boxes. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Electronic payment options for businesses and individuals. Web quickly and easily file irs 2023 form 941 online to the irs with covid changes.

IRS Form 941 Online Filing for 2023 EFile 941 for 4.95/form

For more information on paying your taxes using efw, go to irs.gov/efw. 940, 941, 943, 944 and 945. Web internal revenue service. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. And indian tribal governmental entities;

14 Form Electronic Filing The Story Of 14 Form Electronic Filing Has

Electronic payment options for businesses and individuals. However, don't use efw to make federal tax deposits. Web irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income taxes and payroll taxes that they withheld from their employees’ wages — as well. Web free from the u.s. Web internal revenue service.

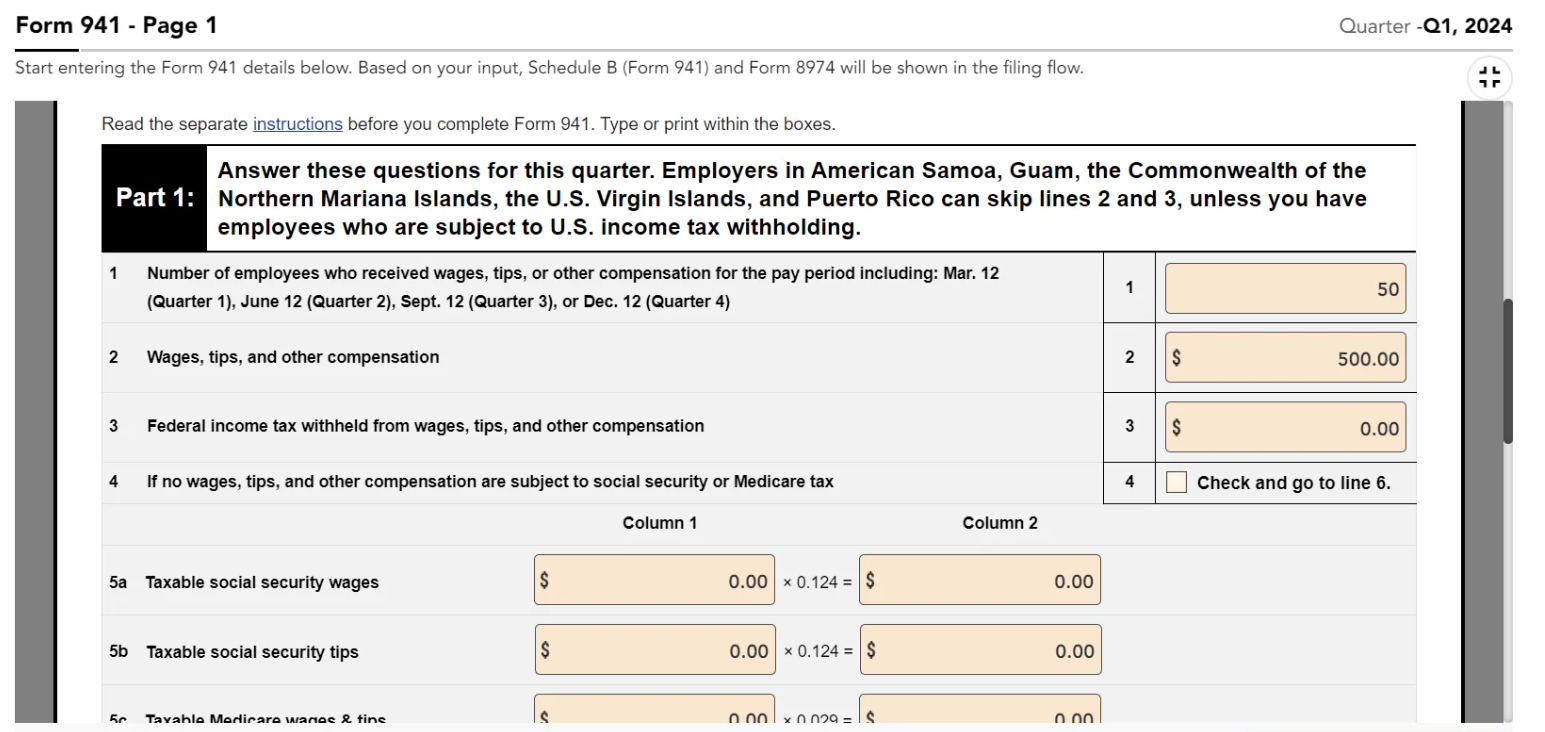

How to Complete Form 941 in 5 Simple Steps

Web quickly and easily file irs 2023 form 941 online to the irs with covid changes. Answer these questions for this quarter. Web internal revenue service. Type or print within the boxes. You receive acknowledgement within 24 hours.

941 Form 2023

However, don't use efw to make federal tax deposits. Web quickly and easily file irs 2023 form 941 online to the irs with covid changes. Special filing address for exempt organizations; Web free from the u.s. Web select the company you would like to use to file your employment tax forms electronically.

7 Tips for Filing IRS Form 941 Every Quarter Workful

October, november, december go to www.irs.gov/form941 for instructions and the latest information. 1 choose tax year & quarter 2 enter social security & medicare taxes 3 enter deposit schedule & tax liability 4 choose irs payment methods 5 review your form 941 6 transmit your form 941 to the irs are you ready to file your form 941? For more.

Form 941 Employer's Quarterly Federal Tax Return Definition

Convenient electronic funds withdrawal (efw), and credit card. Answer these questions for this quarter. Type or print within the boxes. And indian tribal governmental entities; Web select the company you would like to use to file your employment tax forms electronically.

Web Internal Revenue Service.

October, november, december go to www.irs.gov/form941 for instructions and the latest information. Convenient electronic funds withdrawal (efw), and credit card. Answer these questions for this quarter. Web irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income taxes and payroll taxes that they withheld from their employees’ wages — as well.

Includes Schedule B And Form 8974.

And indian tribal governmental entities; Web quickly and easily file irs 2023 form 941 online to the irs with covid changes. However, don't use efw to make federal tax deposits. Electronic payment options for businesses and individuals.

Type Or Print Within The Boxes.

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Read the separate instructions before you complete form 941. Special filing address for exempt organizations; It is secure and accurate.

Web Select The Company You Would Like To Use To File Your Employment Tax Forms Electronically.

You receive acknowledgement within 24 hours. 940, 941, 943, 944 and 945. For more information on paying your taxes using efw, go to irs.gov/efw. 1 choose tax year & quarter 2 enter social security & medicare taxes 3 enter deposit schedule & tax liability 4 choose irs payment methods 5 review your form 941 6 transmit your form 941 to the irs are you ready to file your form 941?

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)