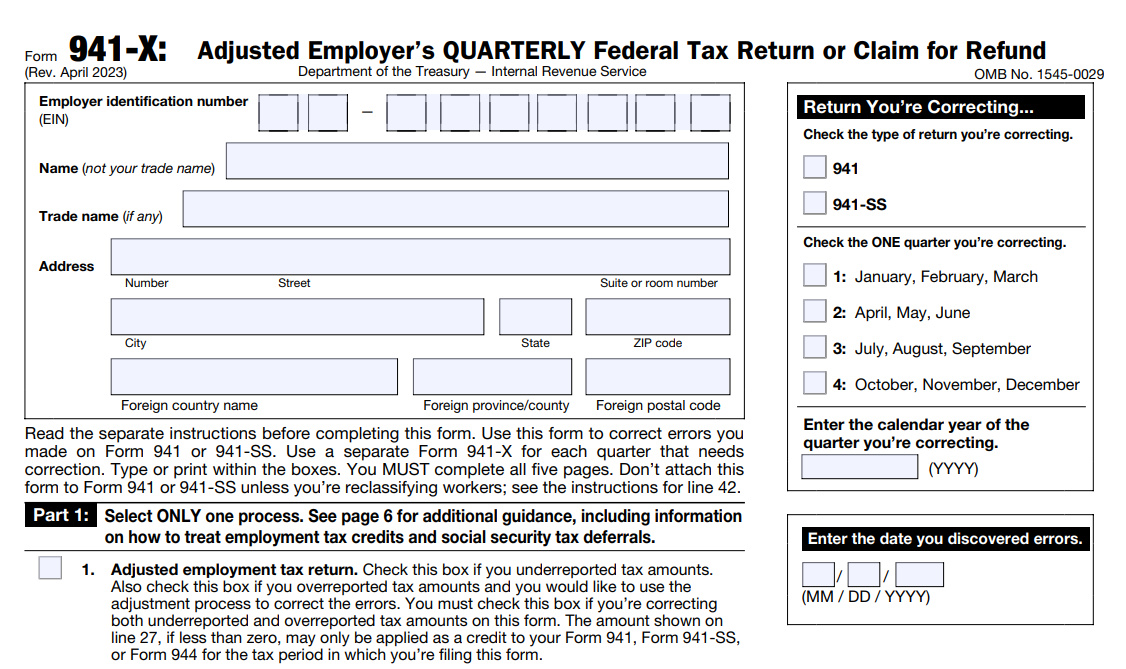

Form 941 Ss

Form 941 Ss - This is the final week the social security administration is sending out payments for july. Web want to file form 944 annually instead of forms 941 quarterly, check here. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Web form 941 for 2023: We need it to figure and collect the right amount of tax. Virgin islands, or if you have. Check here, and if you are a seasonal employer and you do not have to file a return for. You must fill out this form and. If changes in law require additional changes to form. Web use this form to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you).

If you haven’t received your ein by the due date of form 941, write “applied for” and the date you applied in this entry. Report income taxes, social security tax, or medicare tax withheld from employee's. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Exception for exempt organizations, federal, state and local government. Web use this form to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Web want to file form 944 annually instead of forms 941 quarterly, check here. You must complete all five pages. This is the final week the social security administration is sending out payments for july. Type or print within the boxes. If changes in law require additional changes to form.

Web about form 941, employer's quarterly federal tax return. If you haven’t received your ein by the due date of form 941, write “applied for” and the date you applied in this entry. July 22, 2023 5:00 a.m. You must complete all five pages. Type or print within the boxes. If changes in law require additional changes to form. (your employment tax liability generally will be $1,000 or less if you expect to pay $5,000 or. Check here, and if you are a seasonal employer and you do not have to file a return for. Report income taxes, social security tax, or medicare tax withheld from employee's. Employers use form 941 to:

File 941 Online How to File 2023 Form 941 electronically

If you haven’t received your ein by the due date of form 941, write “applied for” and the date you applied in this entry. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Web form 941 for 2023: If changes in law require additional changes to form. Type or print within the boxes.

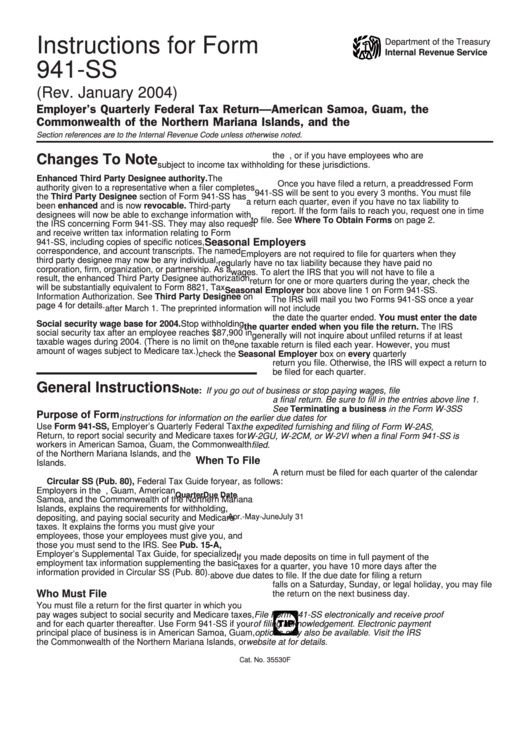

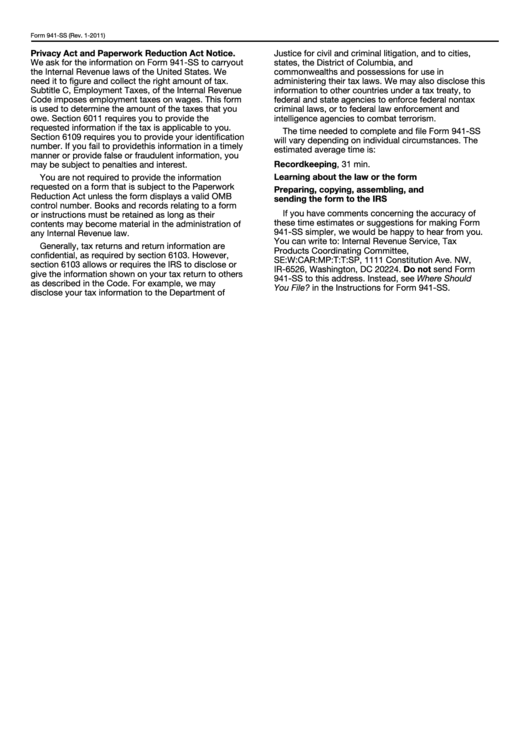

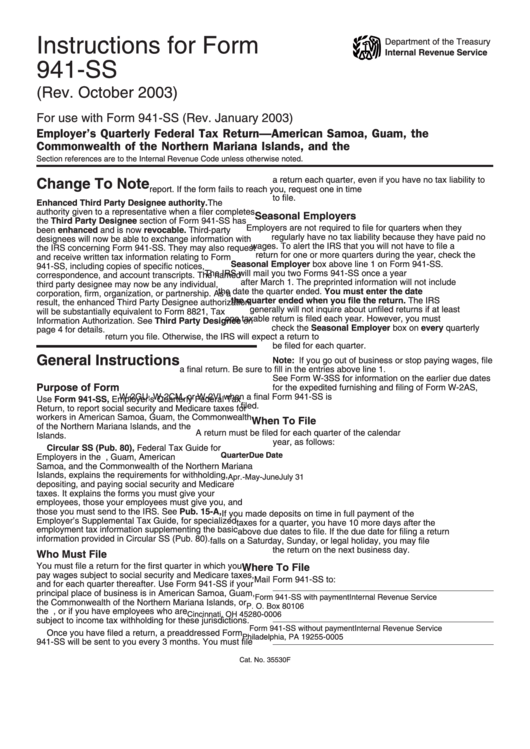

Instructions For Form 941Ss Employer'S Quarterly Federal Tax

We need it to figure and collect the right amount of tax. Web form 941 for 2023: July 22, 2023 5:00 a.m. This is the final week the social security administration is sending out payments for july. Check here, and if you are a seasonal employer and you do not have to file a return for.

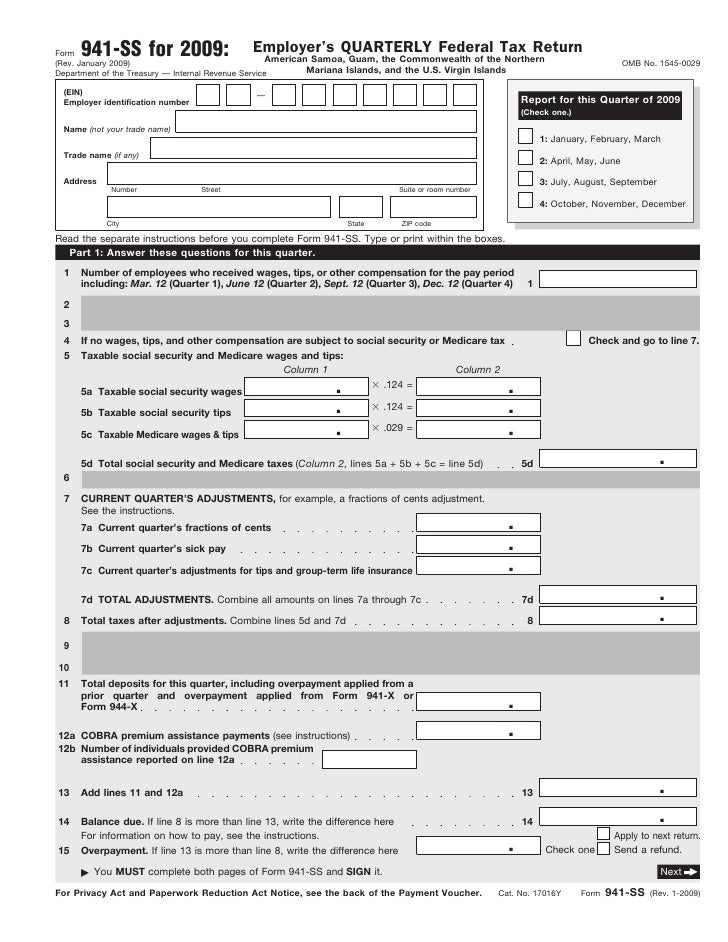

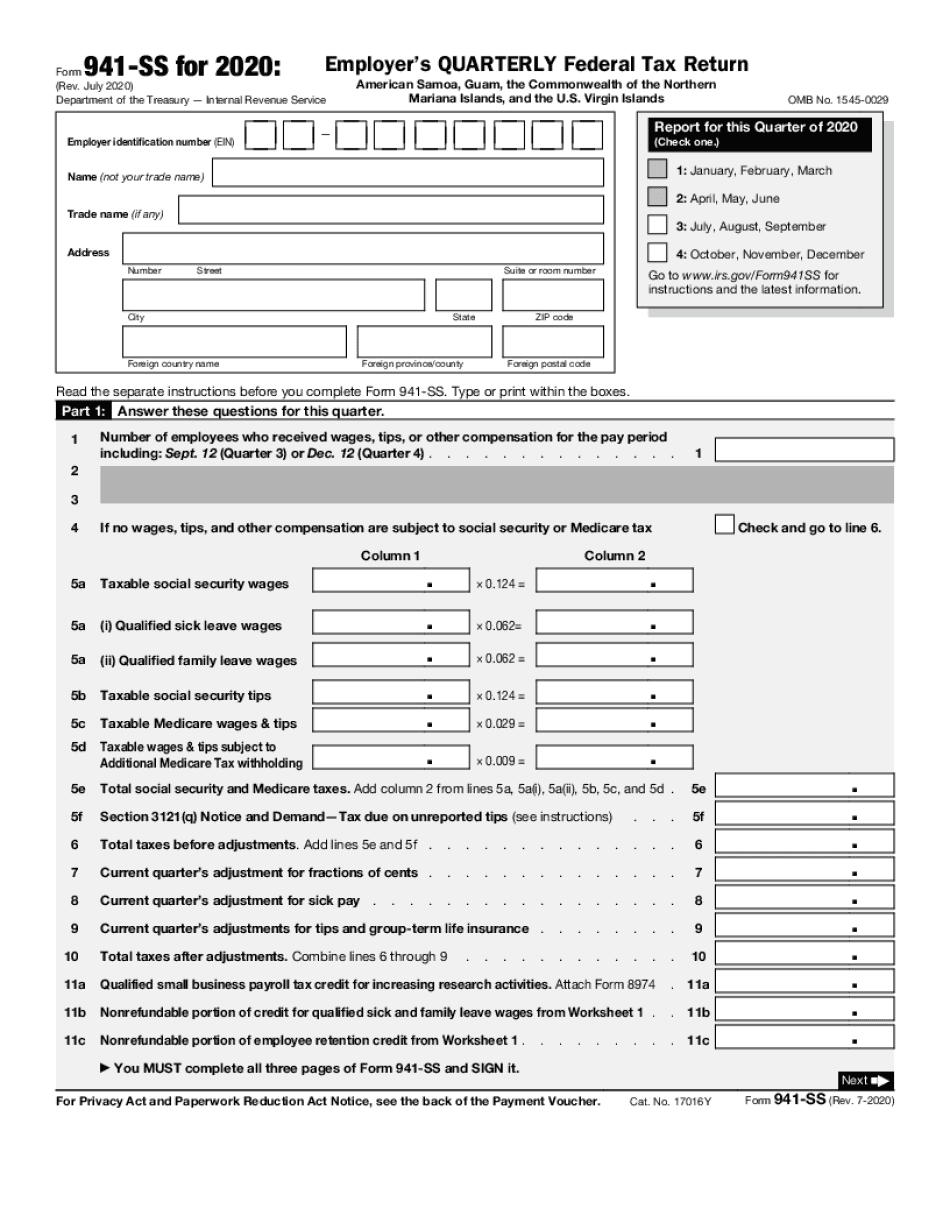

Form 941SS Employer's Quarterly Federal Tax Return (2015) Free Download

Web about form 941, employer's quarterly federal tax return. If changes in law require additional changes to form. Type or print within the boxes. We need it to figure and collect the right amount of tax. (your employment tax liability generally will be $1,000 or less if you expect to pay $5,000 or.

941SS 2022 2023 941 Forms Zrivo

Web use this form to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Type or print within the boxes. Employers use form 941 to: (your employment tax liability generally will be $1,000 or less if you expect to pay $5,000 or. Virgin.

Form 941SS Employer's Quarterly Federal Tax Return American Samoa…

If you haven’t received your ein by the due date of form 941, write “applied for” and the date you applied in this entry. Web about form 941, employer's quarterly federal tax return. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Report income taxes, social security tax, or medicare tax withheld from.

941 ss 2020 Fill Online, Printable, Fillable Blank

If you haven’t received your ein by the due date of form 941, write “applied for” and the date you applied in this entry. You must fill out this form and. Report income taxes, social security tax, or medicare tax withheld from employee's. This is the final week the social security administration is sending out payments for july. Web use.

Instructions For Form 941Ss Employer'S Quarterly Federal Tax

(your employment tax liability generally will be $1,000 or less if you expect to pay $5,000 or. Exception for exempt organizations, federal, state and local government. This is the final week the social security administration is sending out payments for july. You must complete all five pages. July 22, 2023 5:00 a.m.

Instructions For Form 941Ss Employer'S Quarterly Federal Tax

Report income taxes, social security tax, or medicare tax withheld from employee's. Web about form 941, employer's quarterly federal tax return. You must fill out this form and. You must complete all five pages. If you haven’t received your ein by the due date of form 941, write “applied for” and the date you applied in this entry.

Form 941SS Employer's Quarterly Federal Tax Return (2015) Free Download

Check here, and if you are a seasonal employer and you do not have to file a return for. Web about form 941, employer's quarterly federal tax return. If changes in law require additional changes to form. This is the final week the social security administration is sending out payments for july. Web want to file form 944 annually instead.

Form 941SS Employer's Quarterly Federal Tax Return (2015) Free Download

If you haven’t received your ein by the due date of form 941, write “applied for” and the date you applied in this entry. Type or print within the boxes. Virgin islands, or if you have. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Employers use form 941 to:

Exception For Exempt Organizations, Federal, State And Local Government.

Virgin islands, or if you have. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Report income taxes, social security tax, or medicare tax withheld from employee's. You must complete all five pages.

This Is The Final Week The Social Security Administration Is Sending Out Payments For July.

Web about form 941, employer's quarterly federal tax return. Employers use form 941 to: Web want to file form 944 annually instead of forms 941 quarterly, check here. Check here, and if you are a seasonal employer and you do not have to file a return for.

If Changes In Law Require Additional Changes To Form.

Web use this form to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). We need it to figure and collect the right amount of tax. You must fill out this form and. If you haven’t received your ein by the due date of form 941, write “applied for” and the date you applied in this entry.

July 22, 2023 5:00 A.m.

(your employment tax liability generally will be $1,000 or less if you expect to pay $5,000 or. Type or print within the boxes. Web form 941 for 2023: