Form 941 X Fillable

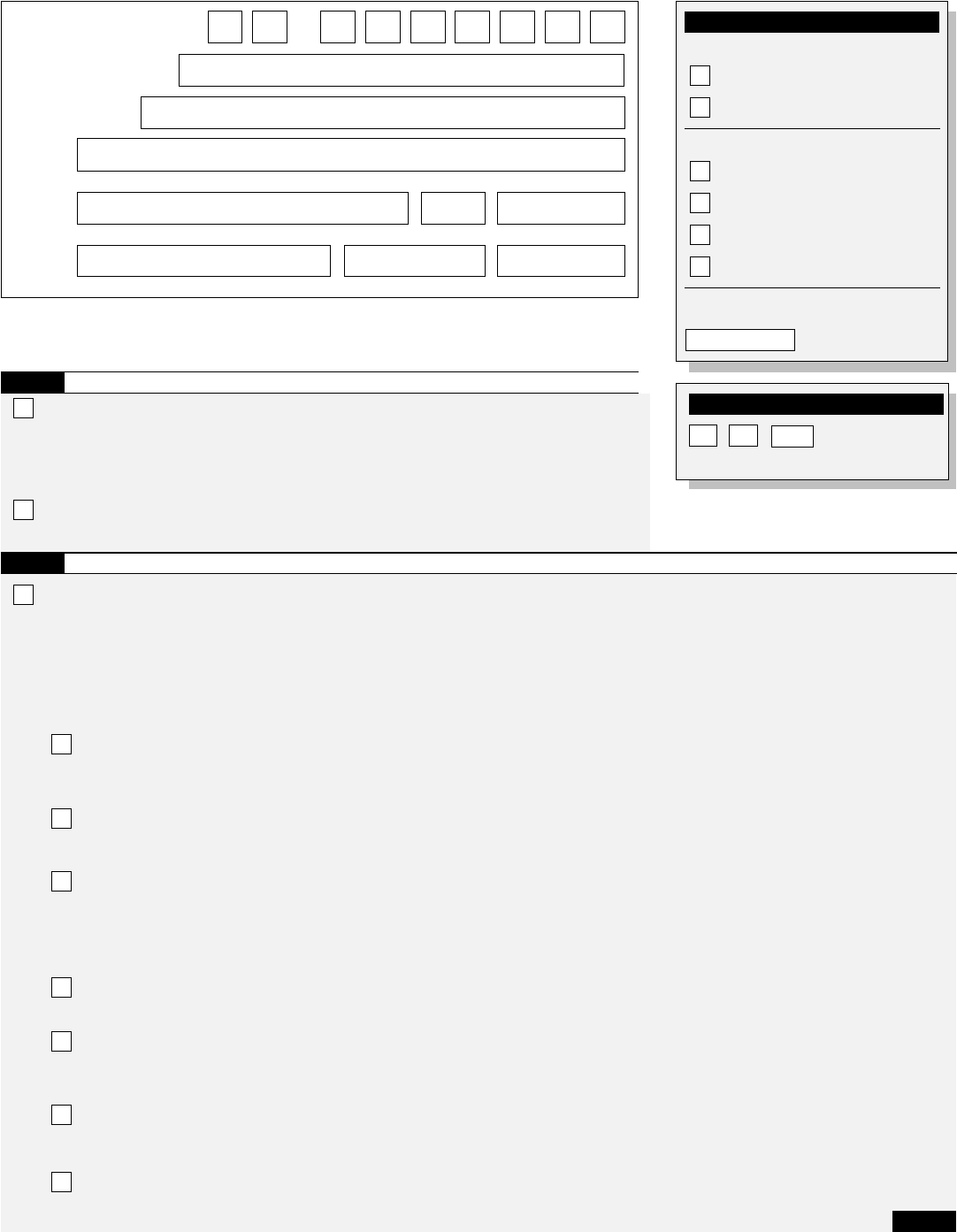

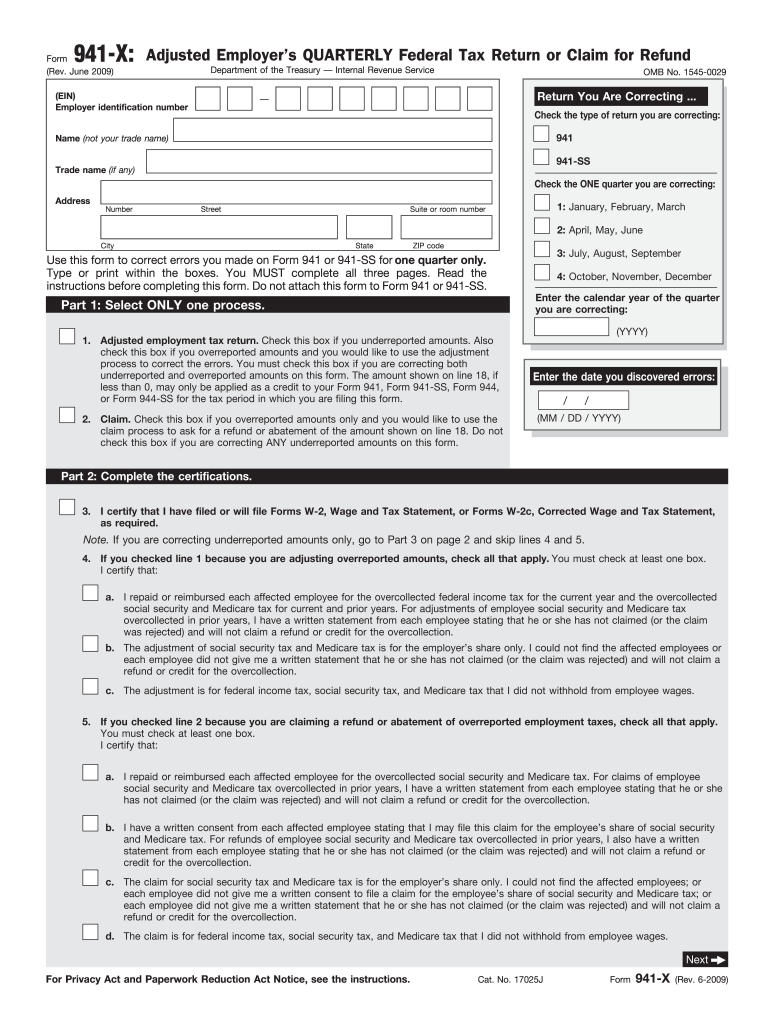

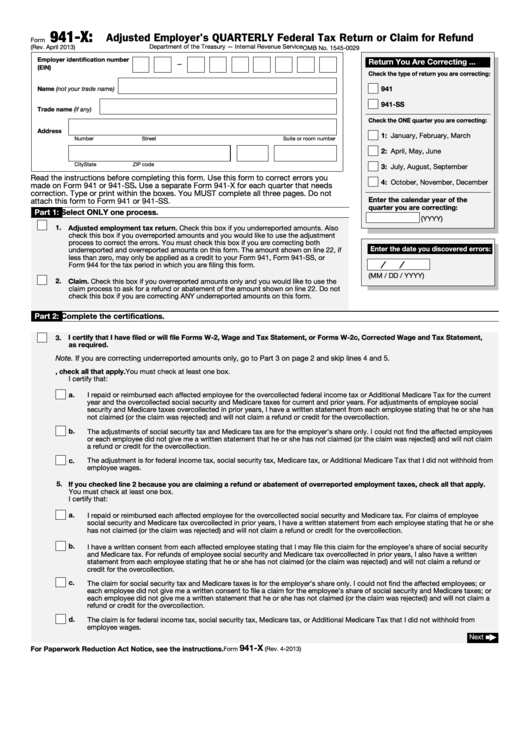

Form 941 X Fillable - January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Even easier than paper filing. Ad access irs tax forms. Ad access irs tax forms. Try it for free now! April, may, june enter the calendar year of the quarter you are correcting: For tax years beginning before january 1, 2023, a qualified small business may elect to. We need it to figure and collect the right amount of tax. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Upload, modify or create forms.

Upload, modify or create forms. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Complete, edit or print tax forms instantly. Try it for free now! Even easier than paper filing. Report income taxes, social security tax, or medicare tax withheld from employee's. Try it for free now! Ad access irs tax forms. April, may, june enter the calendar year of the quarter you are correcting:

Complete, edit or print tax forms instantly. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Try it for free now! Web fillable form 941 2021 is relatively simple to fill out. Report income taxes, social security tax, or medicare tax withheld from employee's. Try it for free now! You must complete all five pages. Upload, modify or create forms. April, may, june enter the calendar year of the quarter you are correcting: Fill, download & print instantly.

941x Worksheet 1

Complete, edit or print tax forms instantly. Upload, modify or create forms. Upload, modify or create forms. Employers use form 941 to: Try it for free now!

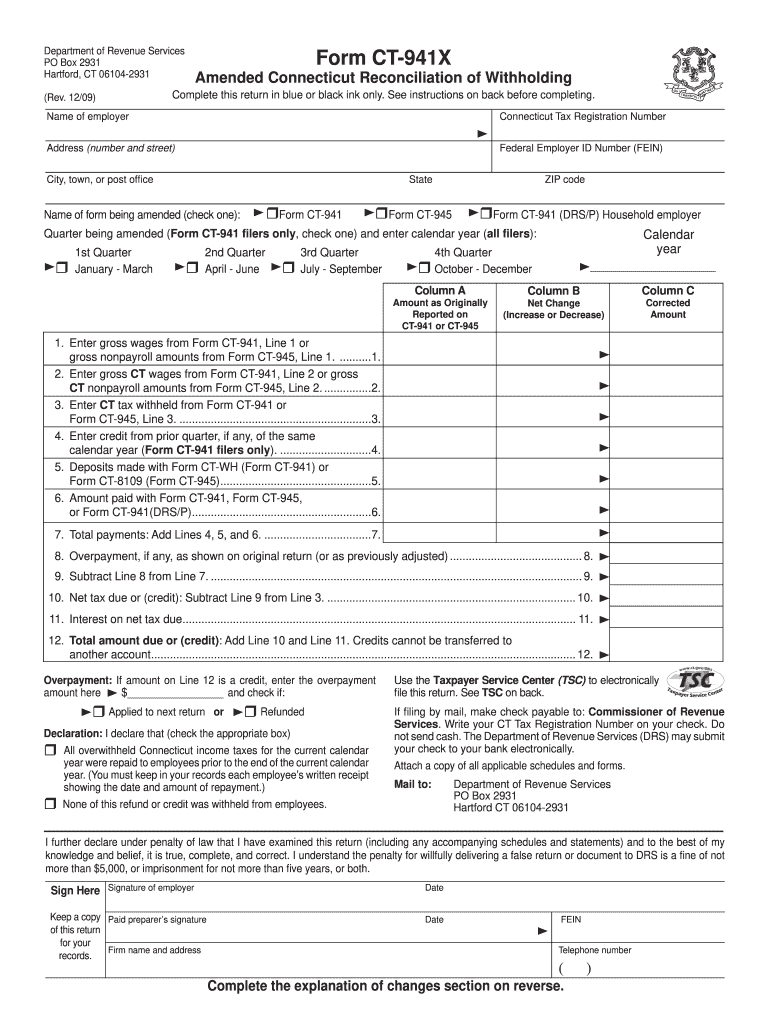

Form 941X Edit, Fill, Sign Online Handypdf

Upload, modify or create forms. When reporting a negative amount in columns. Report income taxes, social security tax, or medicare tax withheld from employee's. Web about form 941, employer's quarterly federal tax return. Ad access irs tax forms.

Form 941 X mailing address Fill online, Printable, Fillable Blank

Report income taxes, social security tax, or medicare tax withheld from employee's. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Ad access irs tax forms. Type or print within the boxes. Even easier than paper filing.

What You Need to Know About Just Released IRS Form 941X Blog

Upload, modify or create forms. Ad access irs tax forms. Web about form 941, employer's quarterly federal tax return. Just remember to enter your business name and address, the total amount of wages paid to employees during the quarter, the. When reporting a negative amount in columns.

2009 Form IRS 941X Fill Online, Printable, Fillable, Blank pdfFiller

Just remember to enter your business name and address, the total amount of wages paid to employees during the quarter, the. Complete, edit or print tax forms instantly. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Ad access irs tax forms. Even easier than paper filing.

Fillable Form 941X Adjusted Employer'S Quarterly Federal Tax Return

Type or print within the boxes. Ad access irs tax forms. April, may, june read the separate instructions before completing this form. When reporting a negative amount in columns. Even easier than paper filing.

2019 Form IRS 941 Fill Online, Printable, Fillable, Blank pdfFiller

You must complete all five pages. Web fillable form 941 2021 is relatively simple to fill out. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. Ad access irs tax forms. Try it for free now!

IRS Form 941X Complete & Print 941X for 2021

Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Report income taxes, social security tax, or medicare tax withheld from employee's. April, may, june read the separate instructions before completing this form. Upload, modify or create forms. Web about form 941, employer's quarterly federal tax return.

941x Worksheet 1 Excel

April, may, june enter the calendar year of the quarter you are correcting: We need it to figure and collect the right amount of tax. Complete, edit or print tax forms instantly. Try it for free now! July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no.

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

Try it for free now! You must complete all five pages. Employers use form 941 to: Just remember to enter your business name and address, the total amount of wages paid to employees during the quarter, the. We need it to figure and collect the right amount of tax.

Type Or Print Within The Boxes.

Upload, modify or create forms. For tax years beginning before january 1, 2023, a qualified small business may elect to. Fill, download & print instantly. Even easier than paper filing.

Just Remember To Enter Your Business Name And Address, The Total Amount Of Wages Paid To Employees During The Quarter, The.

Ad access irs tax forms. Try it for free now! Report income taxes, social security tax, or medicare tax withheld from employee's. Upload, modify or create forms.

Complete, Edit Or Print Tax Forms Instantly.

We need it to figure and collect the right amount of tax. Try it for free now! Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Web about form 941, employer's quarterly federal tax return.

Ad Access Irs Tax Forms.

April, may, june read the separate instructions before completing this form. Employers use form 941 to: Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. When reporting a negative amount in columns.