Form 941X For Erc

Form 941X For Erc - Check the claim box 4. Section 2301 (b) (1) of the cares act limits the. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Web the irs has observed a significant increase in false employee retention credit (erc) claims. The sum of line 30 and line 31 multiplied by the credit. Fill out your contact details 2. Web for each quarter that you have qualified wages for the erc, you will need to file amended 941x payroll tax returns to get your refund checks from the irs. Find the right form 2. Businesses can receive up to $26k per eligible employee. Use worksheet 1 for 941 3.

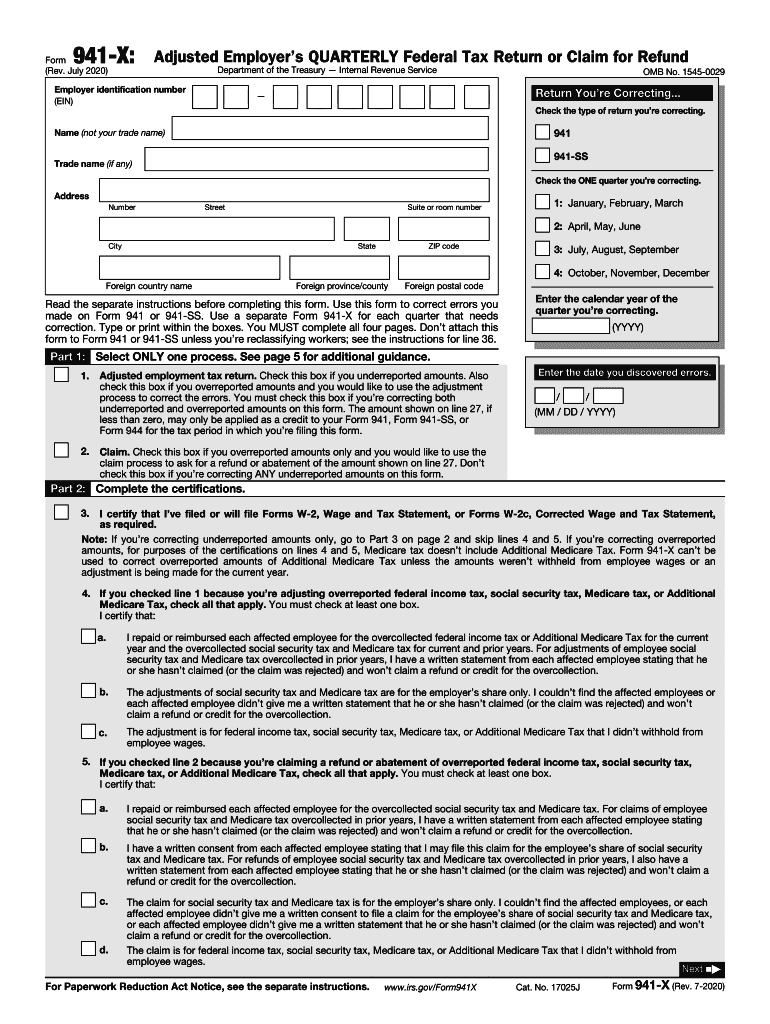

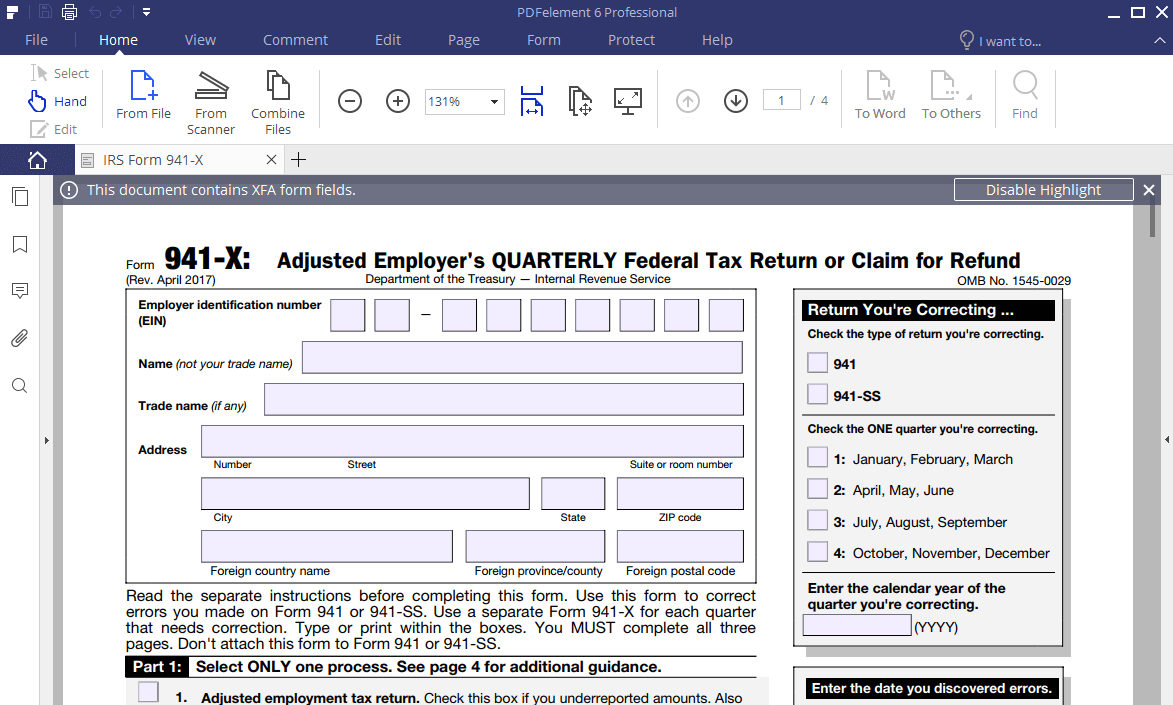

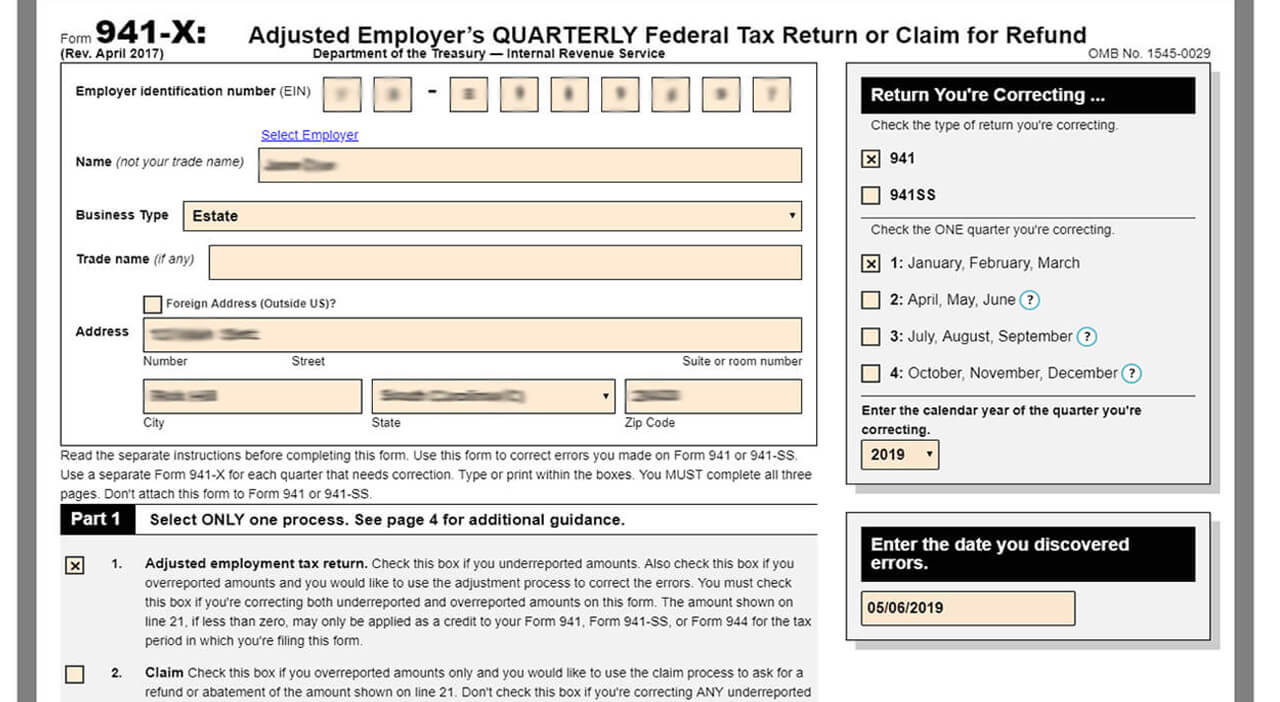

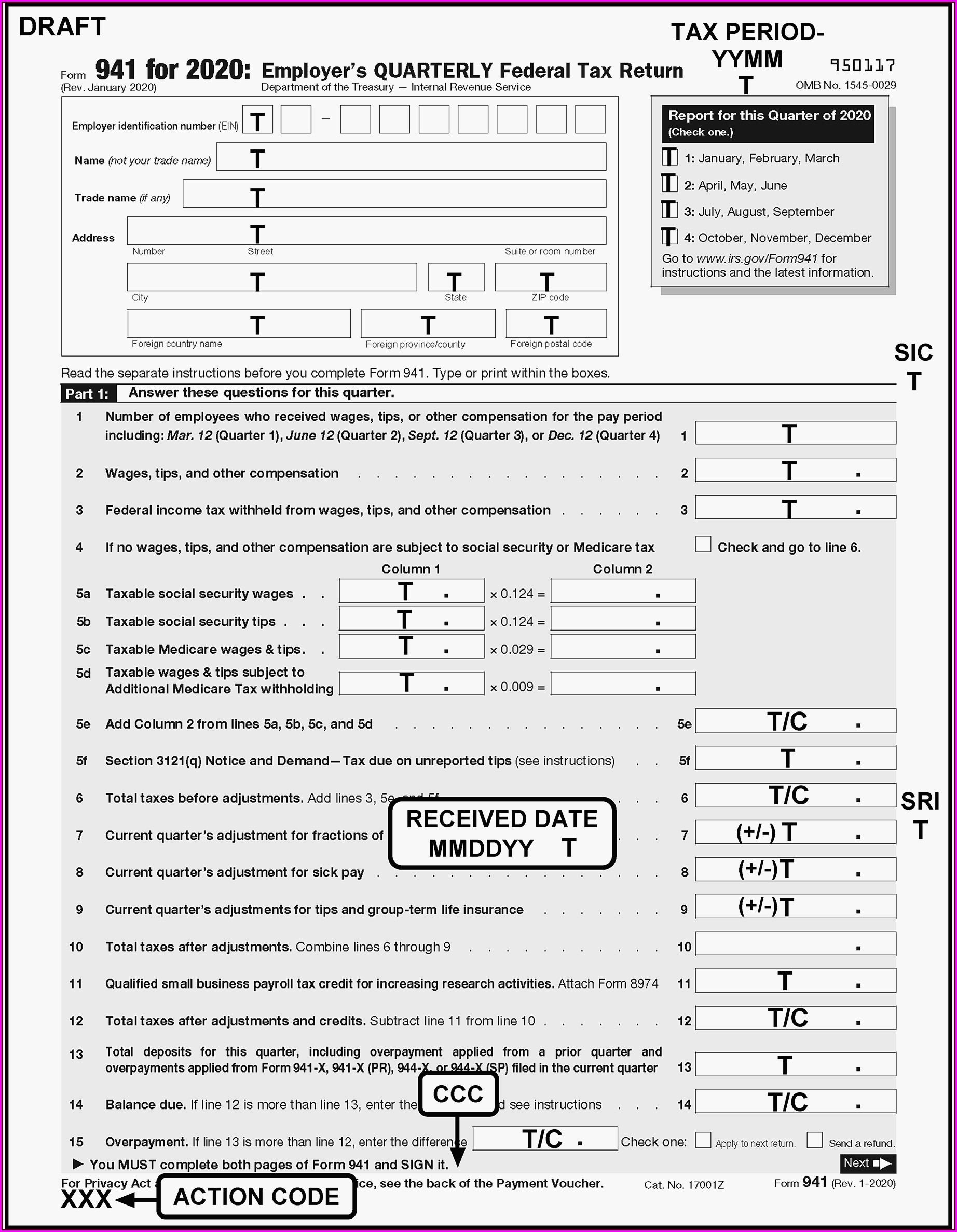

Web 9 steps to apply for the ertc with irs form 941 1. Section 2301 (b) (1) of the cares act limits the. Find the right form 2. Web form 941x instructions to claim the ertc 1. Fill in the required details on the header,. The sum of line 30 and line 31 multiplied by the credit. Corrections to amounts reported on form. Web for each quarter that you have qualified wages for the erc, you will need to file amended 941x payroll tax returns to get your refund checks from the irs. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,. An employer is required to file an irs 941x in the event of an error on a.

April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,. Update of 941 x form 2020 employee retention credit. Web the irs has observed a significant increase in false employee retention credit (erc) claims. Businesses can receive up to $26k per eligible employee. Find the right form 2. Web for each quarter that you have qualified wages for the erc, you will need to file amended 941x payroll tax returns to get your refund checks from the irs. Fill out your contact details 2. Web for 2020, the erc can be claimed by eligible employers who paid qualified wages after march 12, 2020, and before january 1, 2021, and who experienced a full or. An employer is required to file an irs 941x in the event of an error on a.

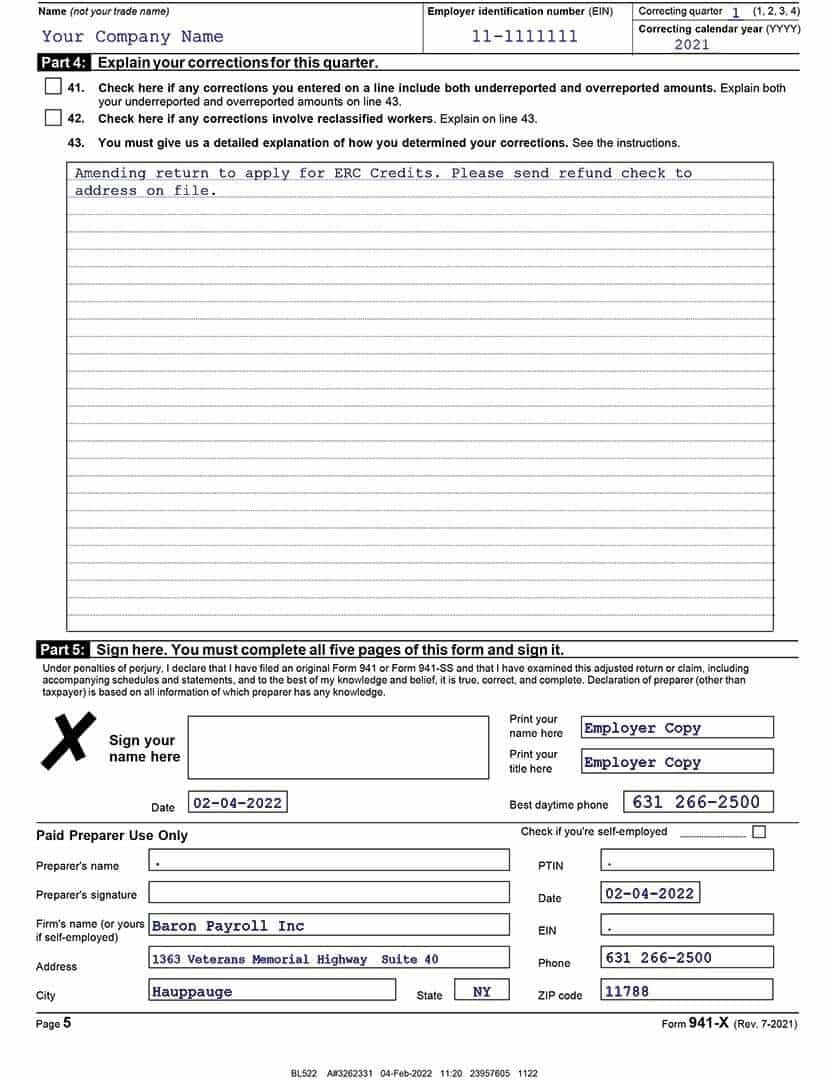

StepbyStep How to Guide to Filing Your 941X ERTC Baron Payroll

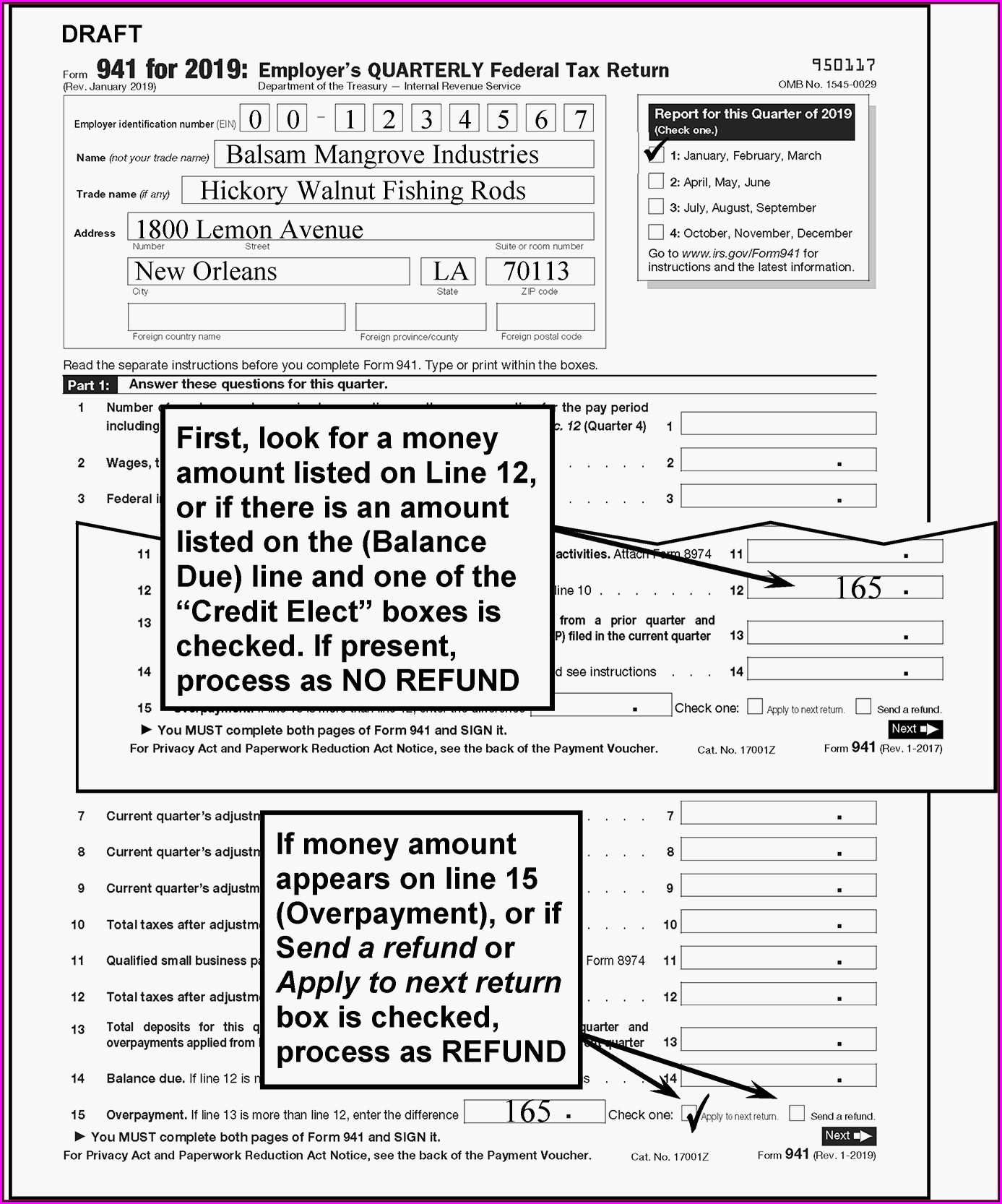

Note the type of return and filing period 3. Web the erc, as originally enacted, is a fully refundable tax credit for employers equal to 50 percent of qualified wages. An employer is required to file an irs 941x in the event of an error on a. Update of 941 x form 2020 employee retention credit. Washington — with the.

StepbyStep How to Guide to Filing Your 941X ERTC Baron Payroll

Fill in the required details on the header,. Web for each quarter that you have qualified wages for the erc, you will need to file amended 941x payroll tax returns to get your refund checks from the irs. Unsolicited calls or advertisements mentioning an easy application process. statements that the promoter or company can. Businesses can receive up to $26k.

941 X Form Fill Out and Sign Printable PDF Template signNow

Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,. If you are located in. Check the claim box 4. Unsolicited calls or advertisements mentioning an easy application process. statements that the promoter or company can. Web the irs has observed a significant increase in false employee retention credit (erc) claims.

IRS Form 941X Learn How to Fill it Easily

The erc, sometimes also called the employee retention tax. Use worksheet 1 for 941 3. The sum of line 30 and line 31 multiplied by the credit. Businesses can receive up to $26k per eligible employee. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,.

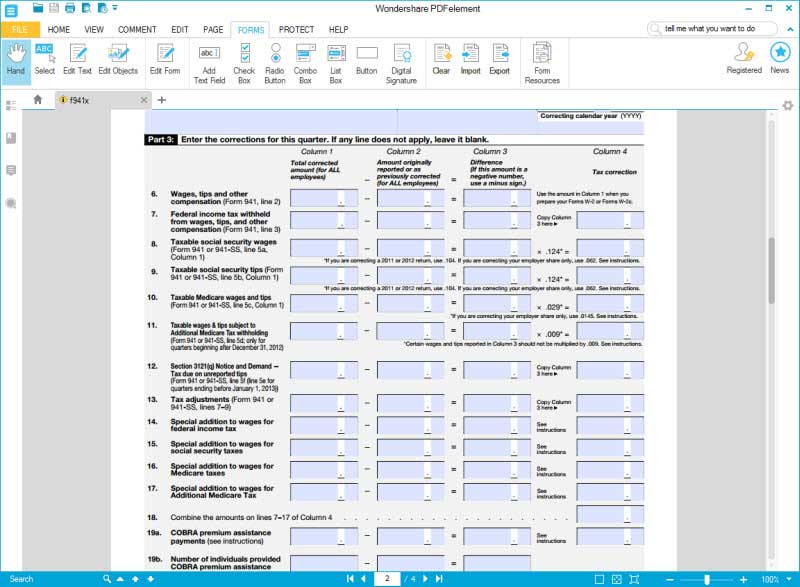

How to Complete & Download Form 941X (Amended Form 941)?

Businesses can receive up to $26k per eligible employee. Web 941 x instructions for amended return to claim erc. Web for 2020, the erc can be claimed by eligible employers who paid qualified wages after march 12, 2020, and before january 1, 2021, and who experienced a full or. An employer is required to file an irs 941x in the.

StepbyStep How to Guide to Filing Your 941X ERTC Baron Payroll

Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,. Washington — with the internal revenue service making substantial progress in the ongoing effort related to the employee. Web for 2020, the erc can be claimed by eligible employers who paid qualified wages after march 12, 2020, and before january 1, 2021, and who experienced a full or. The.

Irs.gov Form 941x Form Resume Examples yKVBjnRVMB

Web for each quarter that you have qualified wages for the erc, you will need to file amended 941x payroll tax returns to get your refund checks from the irs. Use worksheet 1 for 941 3. Web for more information about the employee retention credit, including the dates for which the credit may be claimed, go to irs.gov/erc. The sum.

Irs.gov Forms 941 X Form Resume Examples 1ZV8dXoV3X

Web 9 steps to apply for the ertc with irs form 941 1. Web form 941x instructions to claim the ertc 1. Use worksheet 1 for 941 3. An employer is required to file an irs 941x in the event of an error on a. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the.

erc form download romanholidayvannuys

Businesses can receive up to $26k per eligible employee. Web 9 steps to apply for the ertc with irs form 941 1. Check the claim box 4. Fill in the required details on the header,. Web for 2020, the erc can be claimed by eligible employers who paid qualified wages after march 12, 2020, and before january 1, 2021, and.

Worksheet 2 941x

If you are located in. Web consequently, most employers will need to instead file an amended return or claim for refund for the quarters ended in june, september and december of 2020 using. Web warning signs of an erc scam include: Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,. April 2023) adjusted employer’s quarterly federal tax return.

Fill Out Your Contact Details 2.

The erc, sometimes also called the employee retention tax. Unsolicited calls or advertisements mentioning an easy application process. statements that the promoter or company can. Update of 941 x form 2020 employee retention credit. Web warning signs of an erc scam include:

Section 2301 (B) (1) Of The Cares Act Limits The.

Businesses can receive up to $26k per eligible employee. Corrections to amounts reported on form. Web for 2020, the erc can be claimed by eligible employers who paid qualified wages after march 12, 2020, and before january 1, 2021, and who experienced a full or. Note the type of return and filing period 3.

Web The Erc, As Originally Enacted, Is A Fully Refundable Tax Credit For Employers Equal To 50 Percent Of Qualified Wages.

Businesses can receive up to $26k per eligible employee. Washington — with the internal revenue service making substantial progress in the ongoing effort related to the employee. Web for each quarter that you have qualified wages for the erc, you will need to file amended 941x payroll tax returns to get your refund checks from the irs. Use worksheet 1 for 941 3.

April 2023) Adjusted Employer’s Quarterly Federal Tax Return Or Claim For Refund Department Of The Treasury — Internal Revenue Service Omb No.

If you are located in. Find the right form 2. Fill in the required details on the header,. Web the irs has observed a significant increase in false employee retention credit (erc) claims.