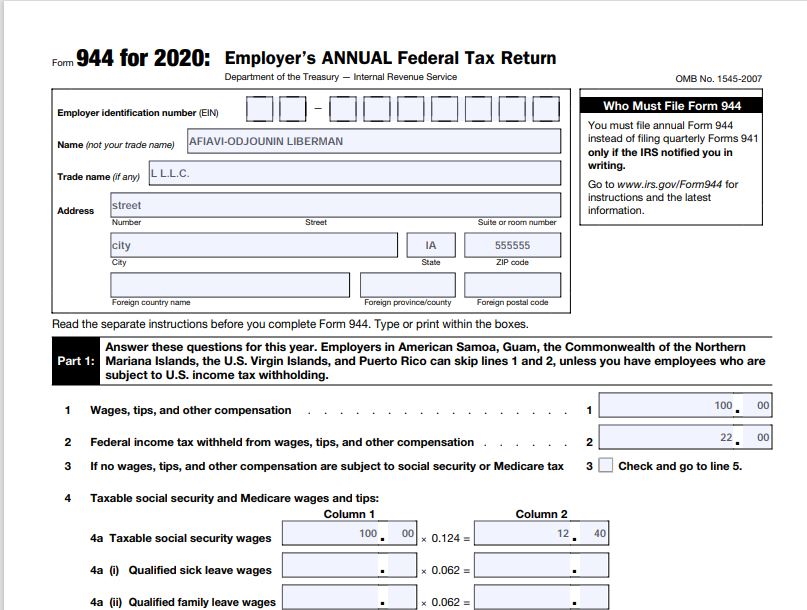

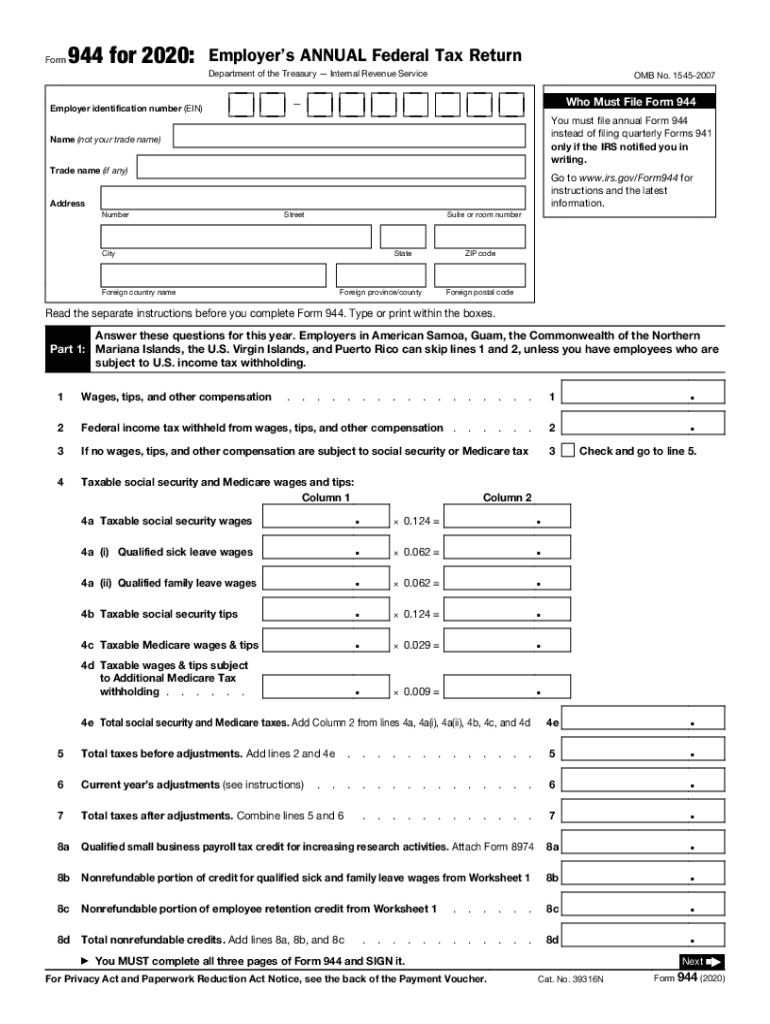

Form 944 For 2020

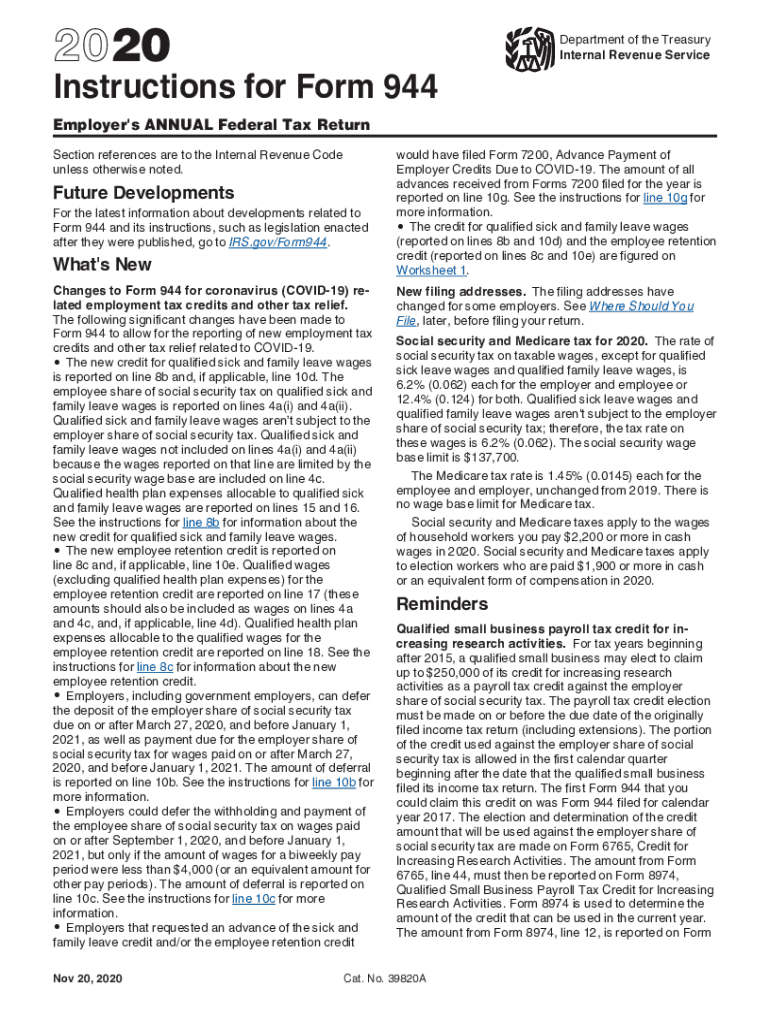

Form 944 For 2020 - Related your employee retention credit calculator for 2020 and 2021: Web form 944, employer’s annual federal tax return, is a form that eligible small businesses file annually to report federal income tax and fica tax (social security and medicare taxes) on employee wages. Use this form to correct errors on a form 944 that you previously filed. Form 944 allows small employers ($1,000 or less of annual liability for social security, medicare, and withheld income taxes) to pay yearly, not quarterly. •the new credit for qualified sick and family leave wages is reported on line 8b and, if applicable, line 10d. Web form 944 for 2020: Peopleimage / getty images irs form 944 is the. The deadline for filing the form is feb. Irs form 944 explained by jean murray updated on july 23, 2020 in this article view all what is form 944? Web finalized versions of the 2020 form 944 and its instructions are available.

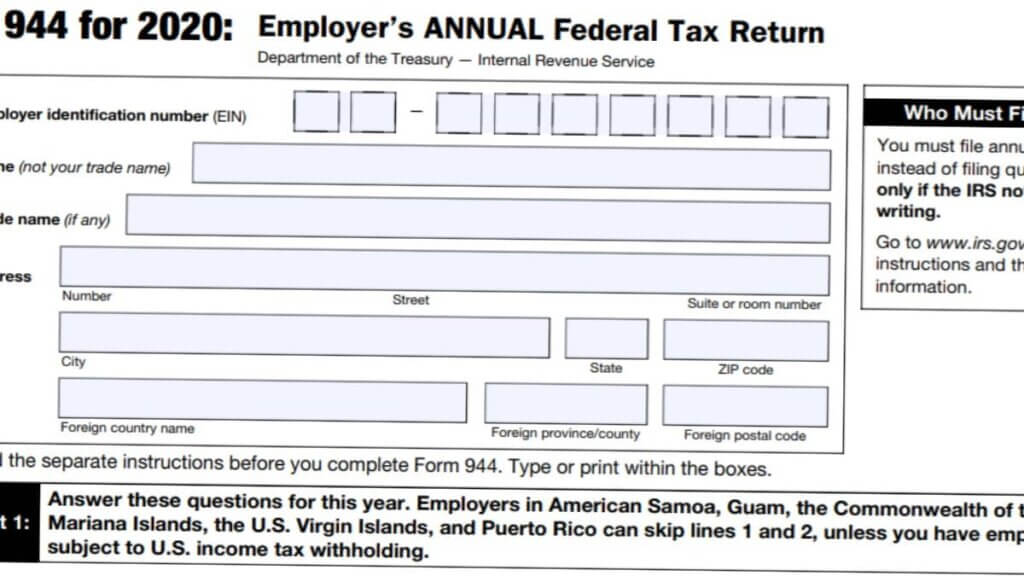

Use this form to correct errors on a form 944 that you previously filed. Web form 944, employer’s annual federal tax return, is a form that eligible small businesses file annually to report federal income tax and fica tax (social security and medicare taxes) on employee wages. Employer’s annual federal tax return department of the treasury — internal revenue service omb no. Enter your owner’s name first and last name whether you are a sole proprietor, llc, or llc taxed as s corp. The deadline for filing the form is feb. Form 944 allows small employers ($1,000 or less of annual liability for social security, medicare, and withheld income taxes) to pay yearly, not quarterly. Small business owners also use irs form 944 to calculate and report their employer social security and medicare tax liability. 23 by the internal revenue service. Irs form 944 explained by jean murray updated on july 23, 2020 in this article view all what is form 944? Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file.

Enter your business ein number. Employer’s annual federal tax return department of the treasury — internal revenue service omb no. Use this form to correct errors on a form 944 that you previously filed. 23 by the internal revenue service. How to determine your erc amount finances and taxes. Small business owners also use irs form 944 to calculate and report their employer social security and medicare tax liability. Web finalized versions of the 2020 form 944 and its instructions are available. Irs form 944 explained by jean murray updated on july 23, 2020 in this article view all what is form 944? Web who must file form 944? •the new credit for qualified sick and family leave wages is reported on line 8b and, if applicable, line 10d.

Form 944 Employer's Annual Federal Tax Return (2015) Free Download

23 by the internal revenue service. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. Employer’s annual federal tax return department of the treasury — internal revenue service omb no. The deadline for filing the form is feb. Use this form to correct errors on a form 944.

Form 944 2020 Fill Out and Sign Printable PDF Template signNow

Peopleimage / getty images irs form 944 is the. Enter your owner’s name first and last name whether you are a sole proprietor, llc, or llc taxed as s corp. Form 944 allows small employers ($1,000 or less of annual liability for social security, medicare, and withheld income taxes) to pay yearly, not quarterly. Small business owners also use irs.

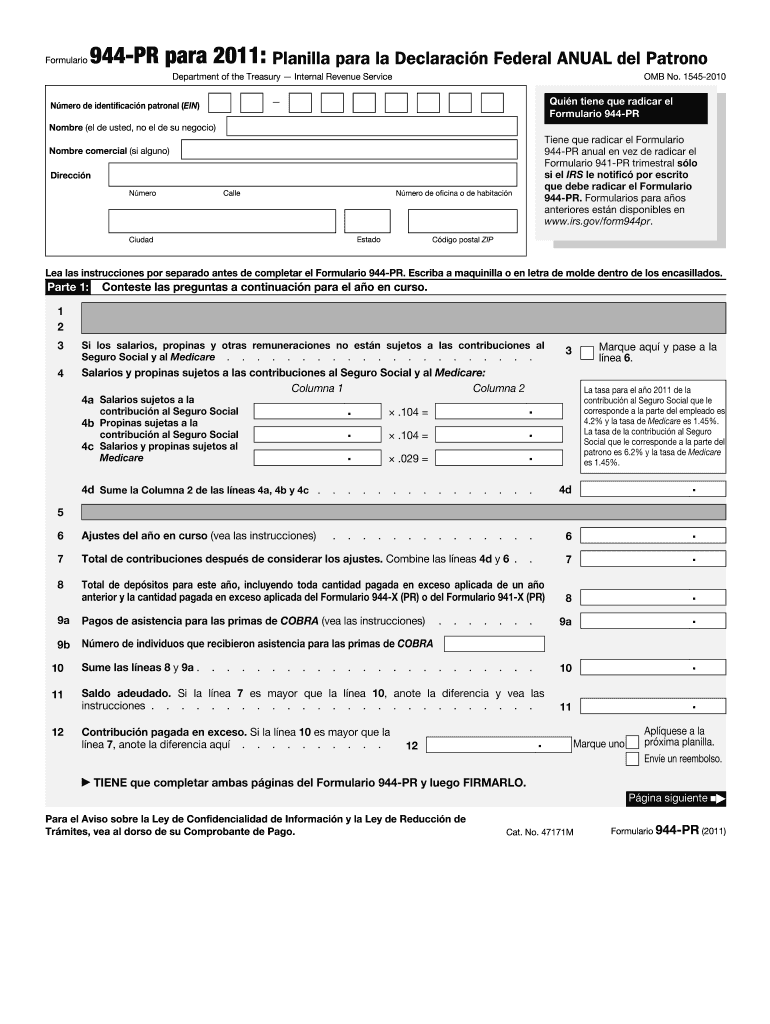

944 Pr Fill Out and Sign Printable PDF Template signNow

•the new credit for qualified sick and family leave wages is reported on line 8b and, if applicable, line 10d. Peopleimage / getty images irs form 944 is the. Have it in on your computer and start to fill it out. Employer’s annual federal tax return department of the treasury — internal revenue service omb no. Small business owners also.

2020 Form IRS 944 Fill Online, Printable, Fillable, Blank pdfFiller

Web building your business business taxes what is irs form 944? The deadline for filing the form is feb. How to determine your erc amount finances and taxes. Enter your owner’s name first and last name whether you are a sole proprietor, llc, or llc taxed as s corp. •the new credit for qualified sick and family leave wages is.

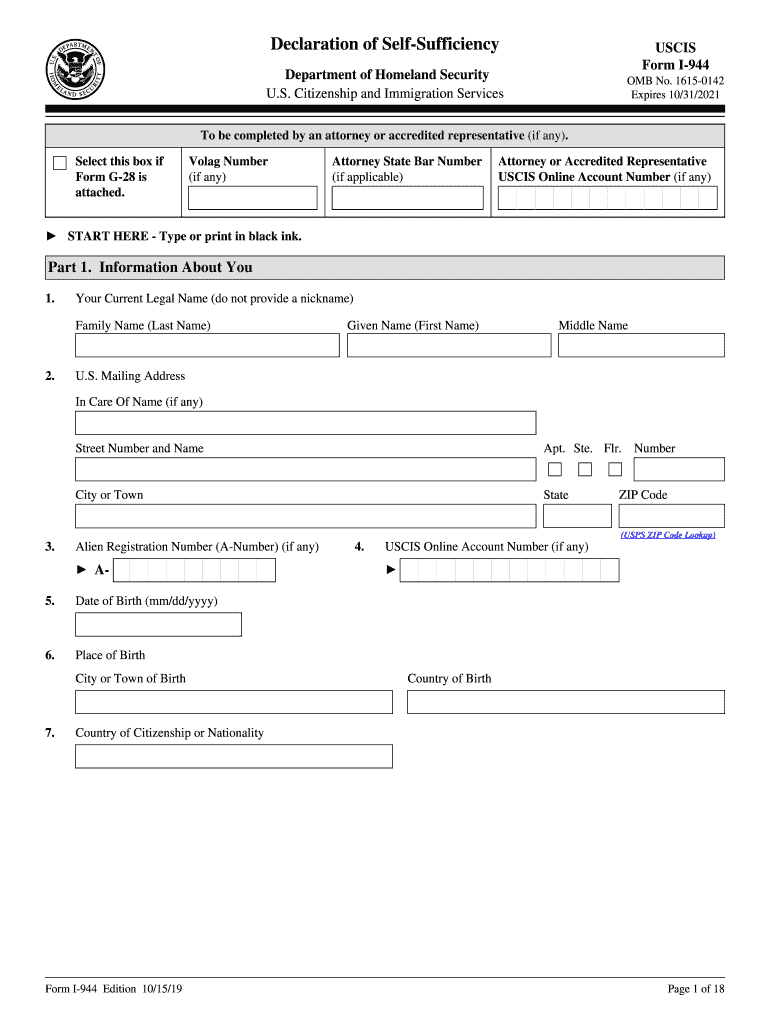

I 944 Pdf 20202021 Fill and Sign Printable Template Online US

The deadline for filing the form is feb. Enter your owner’s name first and last name whether you are a sole proprietor, llc, or llc taxed as s corp. Web finalized versions of the 2020 form 944 and its instructions are available. Employer’s annual federal tax return department of the treasury — internal revenue service omb no. 23 by the.

How To Fill Out Form I944 StepByStep Instructions [2021]

Small business owners also use irs form 944 to calculate and report their employer social security and medicare tax liability. Irs form 944 explained by jean murray updated on july 23, 2020 in this article view all what is form 944? How to determine your erc amount finances and taxes. Web finalized versions of the 2020 form 944 and its.

How to Complete Form 944 for 2020 Employer’s Annual Federal Tax

Irs form 944 explained by jean murray updated on july 23, 2020 in this article view all what is form 944? Enter your owner’s name first and last name whether you are a sole proprietor, llc, or llc taxed as s corp. Web who must file form 944? Web form 944 is an irs tax form that reports the taxes.

IRS 944 2019 Fill and Sign Printable Template Online US Legal Forms

The deadline for filing the form is feb. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. How to determine your erc amount finances and taxes. Have it in on your computer and start to fill it out. Use this form to correct errors on a form 944.

944 Form 2021 2022 IRS Forms Zrivo

Have it in on your computer and start to fill it out. Web form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve withheld from your employees’ paychecks. Form 944 allows small employers ($1,000 or less of annual liability for social security, medicare, and withheld.

IRS Form 944 Instructions and Who Needs to File It

Enter your business ein number. Web form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve withheld from your employees’ paychecks. •the new credit for qualified sick and family leave wages is reported on line 8b and, if applicable, line 10d. Web form 944, employer’s.

Peopleimage / Getty Images Irs Form 944 Is The.

Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. 23 by the internal revenue service. Web form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve withheld from your employees’ paychecks. Web finalized versions of the 2020 form 944 and its instructions are available.

Enter Your Owner’s Name First And Last Name Whether You Are A Sole Proprietor, Llc, Or Llc Taxed As S Corp.

How to determine your erc amount finances and taxes. The finalized versions of the 2020 form 944, employer’s annual federal tax return, and its instructions were released nov. Web building your business business taxes what is irs form 944? The deadline for filing the form is feb.

Enter Your Business Ein Number.

Use this form to correct errors on a form 944 that you previously filed. Small business owners also use irs form 944 to calculate and report their employer social security and medicare tax liability. Web form 944 for 2020: Related your employee retention credit calculator for 2020 and 2021:

Have It In On Your Computer And Start To Fill It Out.

Web who must file form 944? Irs form 944 explained by jean murray updated on july 23, 2020 in this article view all what is form 944? Employer’s annual federal tax return department of the treasury — internal revenue service omb no. •the new credit for qualified sick and family leave wages is reported on line 8b and, if applicable, line 10d.

![How To Fill Out Form I944 StepByStep Instructions [2021]](https://self-lawyer.com/wp-content/uploads/2020/05/I-944-2-1024x572.png)