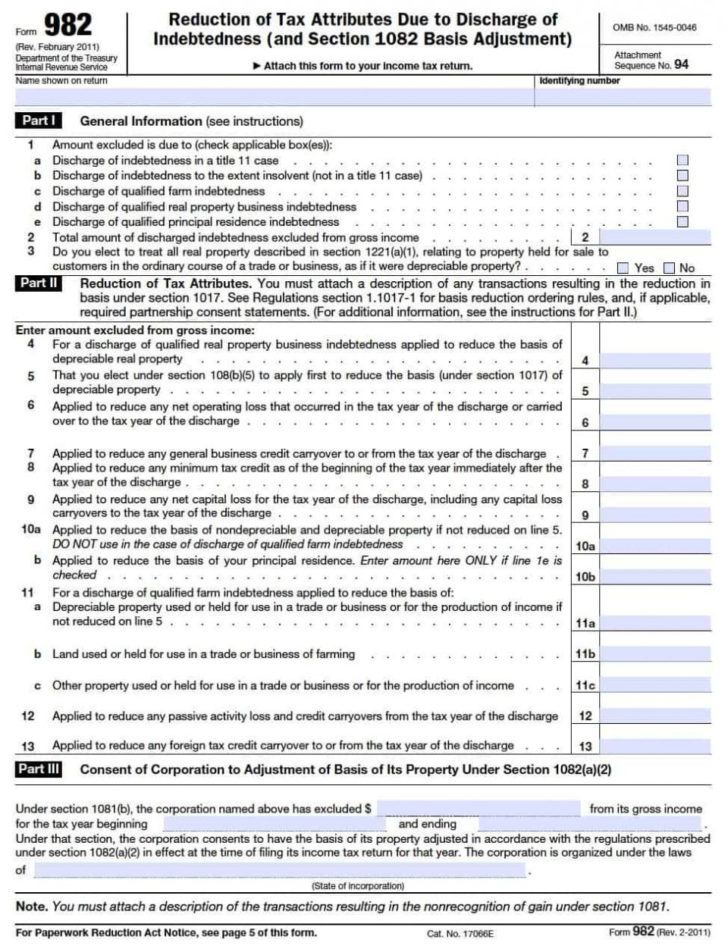

Form 982 Cancellation Of Debt

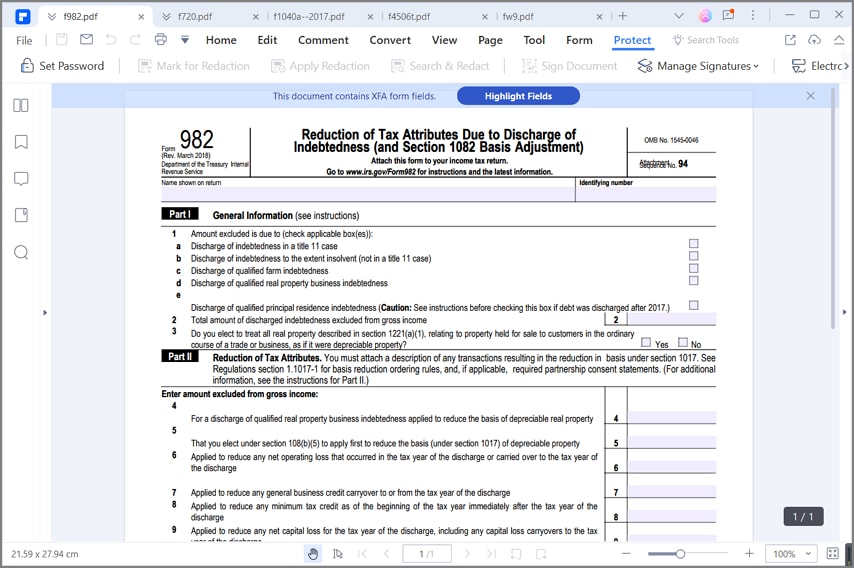

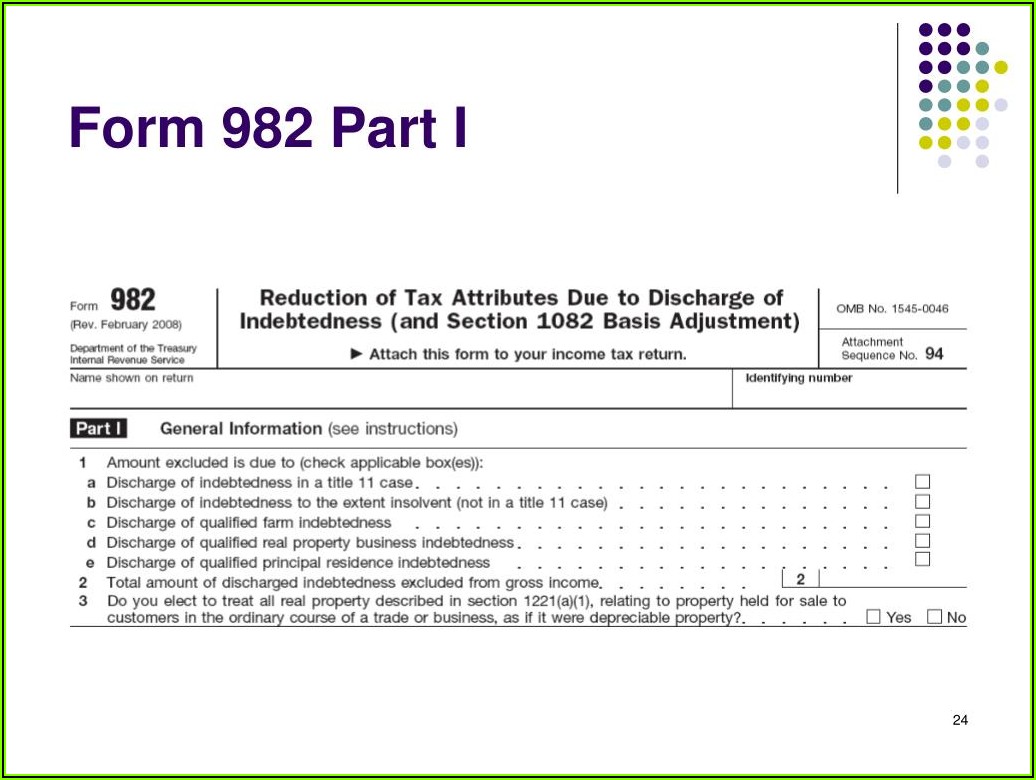

Form 982 Cancellation Of Debt - Web in order to report the exclusion, the taxpayer must file form 982 with their tax return. Web once form 982 is complete you will want to review form 1040 other income line. Web file form 982 with your tax return. Web the amount of debt forgiven must be reported on a irs form 982 (pdf) and this form must be attached to your tax return. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. If one of these exceptions applies, the taxpayer must file. Web what is form 982? Complete, edit or print tax forms instantly. Web charlie checks the box on line 1d of form 982 and enters $20,000 on line 2.

Web charlie checks the box on line 1d of form 982 and enters $20,000 on line 2. If you had debt cancelled and are no longer obligated to repay the. Ad access irs tax forms. Charlie must also use line 4 of form 982 to reduce the basis in depreciable real property by the. However, if it was a discharge of. Web any taxpayer that excludes discharged debt from gross income must report the exclusion and related adjustments to tax attributes on form 982, reduction of tax attributes due. What is a discharge of indebtedness to the extent insolvent? Web once form 982 is complete you will want to review form 1040 other income line. To enter form 982 in taxslayer pro, from the main menu of the tax return (form 1040). If one of these exceptions applies, the taxpayer must file.

Web typically, the taxpayer must report the amount of debt cancellation as income unless one of several exceptions applies. Web in order to report the exclusion, the taxpayer must file form 982 with their tax return. Web charlie checks the box on line 1d of form 982 and enters $20,000 on line 2. Complete, edit or print tax forms instantly. This is because you received a benefit. Web the amount of debt forgiven must be reported on a irs form 982 (pdf) and this form must be attached to your tax return. If you had debt cancelled and are no longer obligated to repay the. Web information about form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment), including recent updates, related. Web once form 982 is complete you will want to review form 1040 other income line. Web file form 982 with your tax return.

How to Use IRS Form 982 and 1099C Cancellation of Debt

However, if it was a discharge of. Get ready for tax season deadlines by completing any required tax forms today. Web information about form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment), including recent updates, related. According to irs publication 4681 : A number of exceptions and exemptions can eliminate your obligations.

Cancellation Of Debt Form 982 Instructions Form Resume Examples

According to irs publication 4681 : Charlie must also use line 4 of form 982 to reduce the basis in depreciable real property by the. What is a discharge of indebtedness to the extent insolvent? A number of exceptions and exemptions can eliminate your obligations. This is because you received a benefit.

Form 982 Credit Card Debt Cancellation

Web typically, the taxpayer must report the amount of debt cancellation as income unless one of several exceptions applies. Web in order to report the exclusion, the taxpayer must file form 982 with their tax return. Web information about form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment), including recent updates, related. Web.

Cancellation Of Debt Form Form Resume Examples ygKzkXJ63P

This is because you received a benefit. Complete, edit or print tax forms instantly. Web once form 982 is complete you will want to review form 1040 other income line. A number of exceptions and exemptions can eliminate your obligations. Web file form 982 with your tax return.

Irs Of Debt Form Form Resume Examples ojYqD0M9zl

Ad access irs tax forms. Exclusions (form 982) if you had debt cancelled and are no longer obligated to repay the debt, you generally must include the. Web to show that all or part of your canceled debt is excluded from income because it is qualified farm debt, check the box on line 1c of form 982 and attach it.

Cancellation Of Debt Form 982 Instructions Form Resume Examples

Complete, edit or print tax forms instantly. If you had debt cancelled and are no longer obligated to repay the. According to irs publication 4681 : Web if you had debt cancelled and are no longer obligated to repay the debt, you generally must include the amount of cancelled debt in your income. What is a discharge of indebtedness to.

Irs Of Debt Form Form Resume Examples ojYqD0M9zl

This is because you received a benefit. A number of exceptions and exemptions can eliminate your obligations. If one of these exceptions applies, the taxpayer must file. Web any taxpayer that excludes discharged debt from gross income must report the exclusion and related adjustments to tax attributes on form 982, reduction of tax attributes due. Web in order to report.

How To Deal With The IRS Regarding Cancellation Of Debt

To report the amount qualifying for. Web information about form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment), including recent updates, related. Ad access irs tax forms. Charlie must also use line 4 of form 982 to reduce the basis in depreciable real property by the. Exclusions (form 982) if you had debt.

Form 982 Insolvency Worksheet —

What is a discharge of indebtedness to the extent insolvent? Web file form 982 with your tax return. Complete, edit or print tax forms instantly. Exclusions (form 982) if you had debt cancelled and are no longer obligated to repay the debt, you generally must include the. According to irs publication 4681 :

Cancellation Of Debt Form 1099 C Form Resume Examples N8VZpKM9we

To report the amount qualifying for. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained later). Web information about form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment), including recent updates, related. Exclusions (form.

If One Of These Exceptions Applies, The Taxpayer Must File.

This is the amount of your canceled debt that's taxable. According to irs publication 4681 : However, if it was a discharge of. Web typically, the taxpayer must report the amount of debt cancellation as income unless one of several exceptions applies.

Web Charlie Checks The Box On Line 1D Of Form 982 And Enters $20,000 On Line 2.

Web file form 982 with your tax return. Charlie must also use line 4 of form 982 to reduce the basis in depreciable real property by the. Web once form 982 is complete you will want to review form 1040 other income line. Web the amount of debt forgiven must be reported on a irs form 982 (pdf) and this form must be attached to your tax return.

Ad Access Irs Tax Forms.

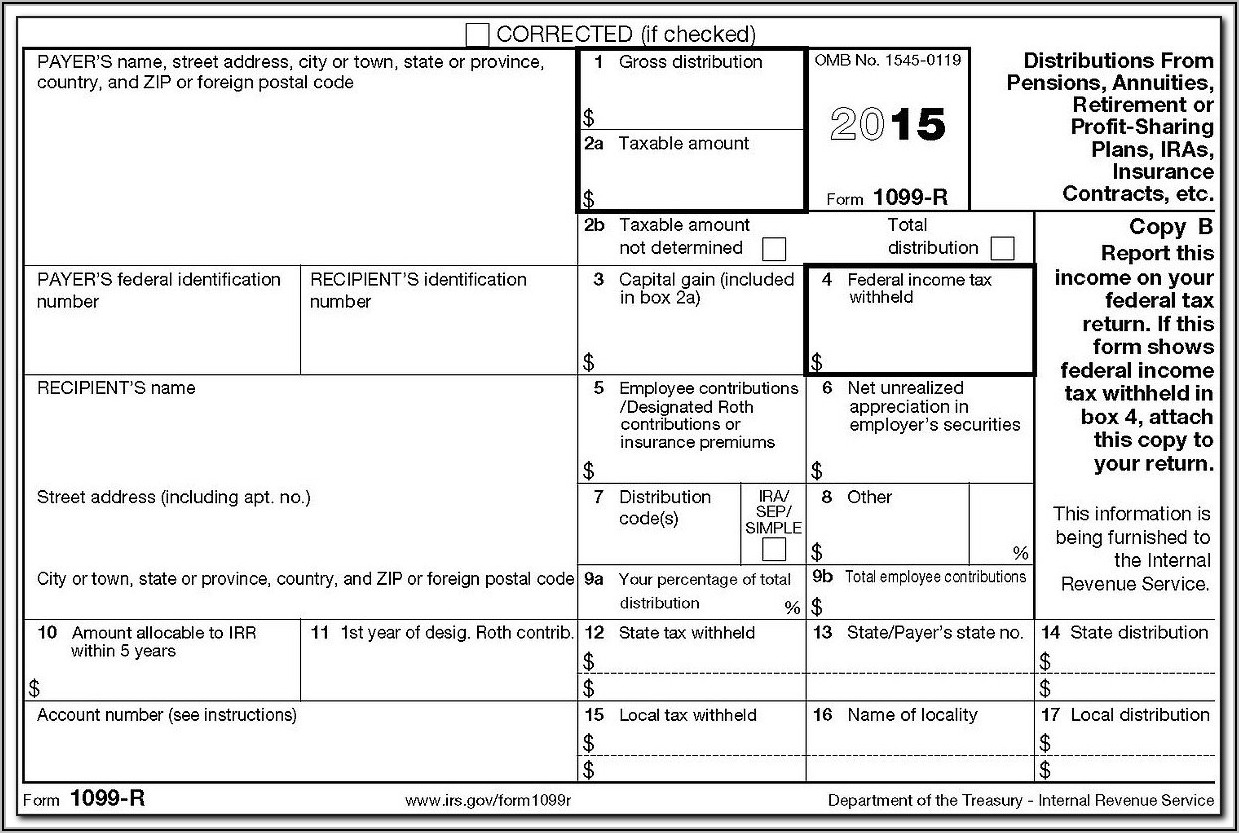

Ad access irs tax forms. Complete, edit or print tax forms instantly. Web you must report any taxable amount of a canceled debt as ordinary income on irs form 1040 or irs form 1040nr tax returns. To report the amount qualifying for.

If You Had Debt Cancelled And Are No Longer Obligated To Repay The.

Web to show that all or part of your canceled debt is excluded from income because it is qualified farm debt, check the box on line 1c of form 982 and attach it to. Web if you had debt cancelled and are no longer obligated to repay the debt, you generally must include the amount of cancelled debt in your income. Web in order to report the exclusion, the taxpayer must file form 982 with their tax return. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained later).