Form 990 N Due Date

Form 990 N Due Date - When is form 990 due? Web due date for filing returns requried by irc 6033. Ending date of tax year. To use the table, you must know when your organization’s tax year ends. If your organization filed an 8868 extension on february 15, 2023, then your form 990 extended deadline is august 15, 2023. Web upcoming form 990 deadline: Web 990 series forms are due on july 17, 2023! If the due date falls on a saturday, sunday, or legal holiday, file on the next business day. For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. A business day is any day that isn't a saturday, sunday, or legal holiday.

If your organization filed an 8868 extension on february 15, 2023, then your form 990 extended deadline is august 15, 2023. Web 990 series forms are due on july 17, 2023! A business day is any day that isn't a saturday, sunday, or legal holiday. Web upcoming form 990 deadline: Web due date for filing returns requried by irc 6033. For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. To use the table, you must know when your organization’s tax year ends. There are two kinds of tax years: When is form 990 due? If the due date falls on a saturday, sunday, or legal holiday, file on the next business day.

Web due date for filing returns requried by irc 6033. There are two kinds of tax years: For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. Ending date of tax year. If your organization filed an 8868 extension on february 15, 2023, then your form 990 extended deadline is august 15, 2023. If the due date falls on a saturday, sunday, or legal holiday, file on the next business day. When is form 990 due? To use the table, you must know when your organization’s tax year ends. Web 990 series forms are due on july 17, 2023! A business day is any day that isn't a saturday, sunday, or legal holiday.

IRS Form 990N Download Printable PDF or Fill Online Electronic Notice

If your organization filed an 8868 extension on february 15, 2023, then your form 990 extended deadline is august 15, 2023. A business day is any day that isn't a saturday, sunday, or legal holiday. Ending date of tax year. Web due date for filing returns requried by irc 6033. There are two kinds of tax years:

Meet the May 17, 2021 EPostcard Form 990N Deadline In 3 Simple Steps

If the due date falls on a saturday, sunday, or legal holiday, file on the next business day. Ending date of tax year. Web upcoming form 990 deadline: For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. If your organization filed an 8868.

what is the extended due date for form 990 Fill Online, Printable

If the due date falls on a saturday, sunday, or legal holiday, file on the next business day. For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. There are two kinds of tax years: When is form 990 due? Web upcoming form 990.

A concrete proposal for a Twin Cities Drupal User Group nonprofit

There are two kinds of tax years: Is extension form 8868 due? If your organization filed an 8868 extension on february 15, 2023, then your form 990 extended deadline is august 15, 2023. When is form 990 due? For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due.

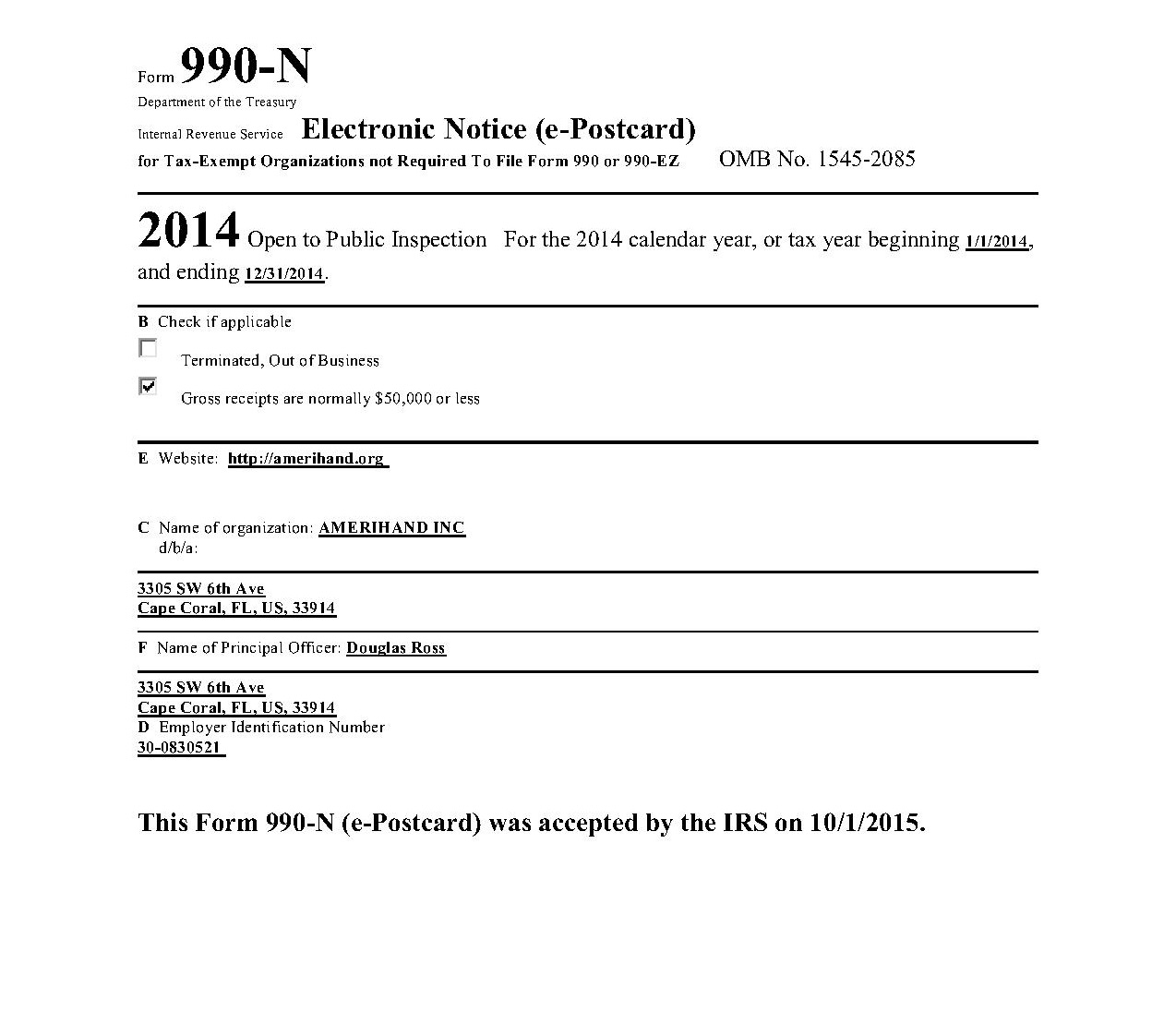

AAMERIHAND IRS FORM 990N

There are two kinds of tax years: If the due date falls on a saturday, sunday, or legal holiday, file on the next business day. When is form 990 due? Web due date for filing returns requried by irc 6033. For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990.

IRS Form 990 Download Fillable PDF or Fill Online Return of

A business day is any day that isn't a saturday, sunday, or legal holiday. Ending date of tax year. For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. If the due date falls on a saturday, sunday, or legal holiday, file on the.

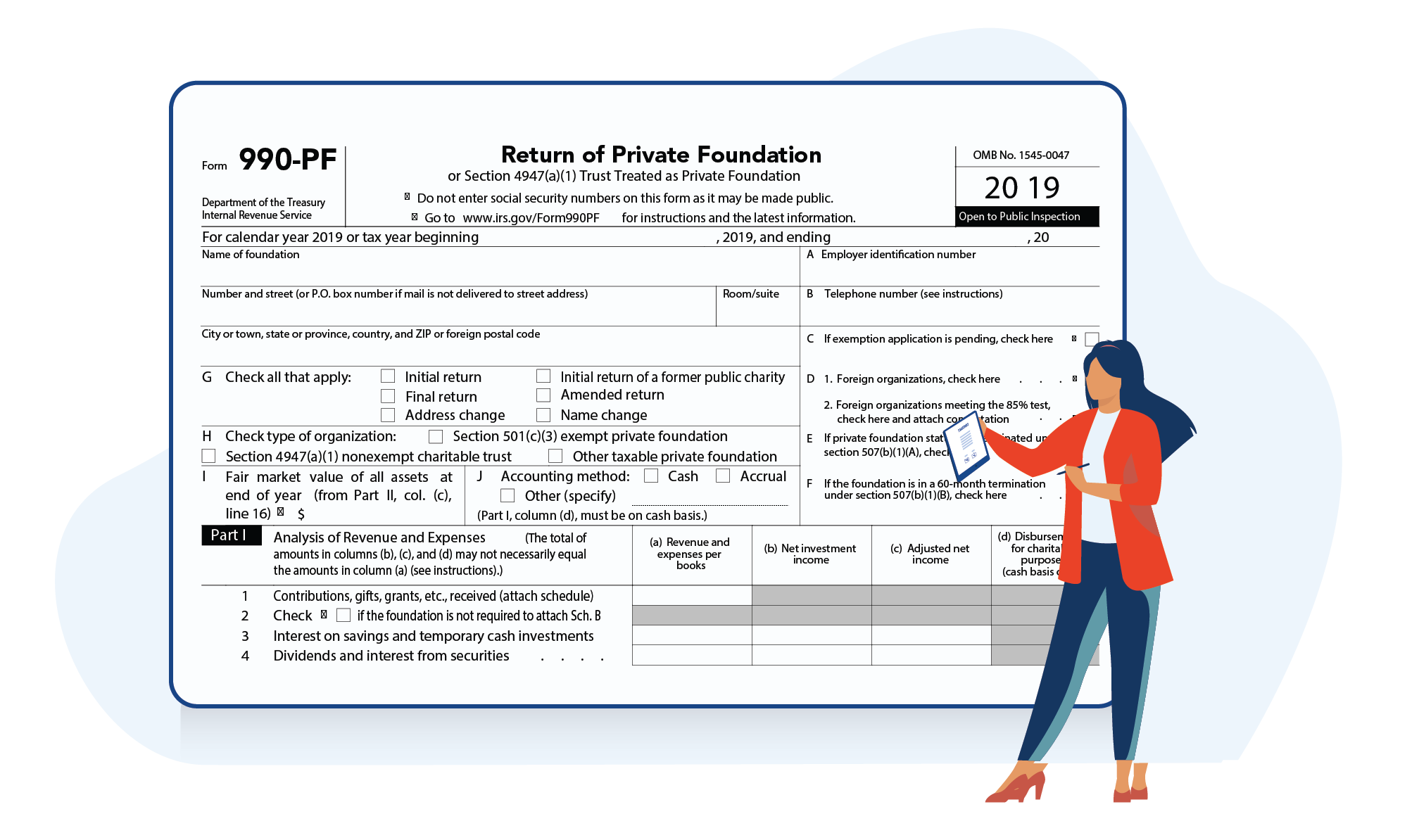

What is Form 990PF?

If your organization filed an 8868 extension on february 15, 2023, then your form 990 extended deadline is august 15, 2023. If the due date falls on a saturday, sunday, or legal holiday, file on the next business day. Web 990 series forms are due on july 17, 2023! Web upcoming form 990 deadline: For organizations with an accounting tax.

How To Never Mistake IRS Form 990 and Form 990N Again

Web due date for filing returns requried by irc 6033. Web 990 series forms are due on july 17, 2023! When is form 990 due? If the due date falls on a saturday, sunday, or legal holiday, file on the next business day. Ending date of tax year.

Today is Your Form 990 Deadline! It's Your Last Chance to Extend Your

There are two kinds of tax years: Web 990 series forms are due on july 17, 2023! Web upcoming form 990 deadline: If the due date falls on a saturday, sunday, or legal holiday, file on the next business day. Is extension form 8868 due?

2016 Form 990 Due This Monday for Land Trusts Filing on Calendar Year

If the due date falls on a saturday, sunday, or legal holiday, file on the next business day. To use the table, you must know when your organization’s tax year ends. For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. There are two.

Web 990 Series Forms Are Due On July 17, 2023!

When is form 990 due? If the due date falls on a saturday, sunday, or legal holiday, file on the next business day. To use the table, you must know when your organization’s tax year ends. A business day is any day that isn't a saturday, sunday, or legal holiday.

Web Upcoming Form 990 Deadline:

There are two kinds of tax years: Web due date for filing returns requried by irc 6033. If your organization filed an 8868 extension on february 15, 2023, then your form 990 extended deadline is august 15, 2023. Ending date of tax year.

Is Extension Form 8868 Due?

For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023.