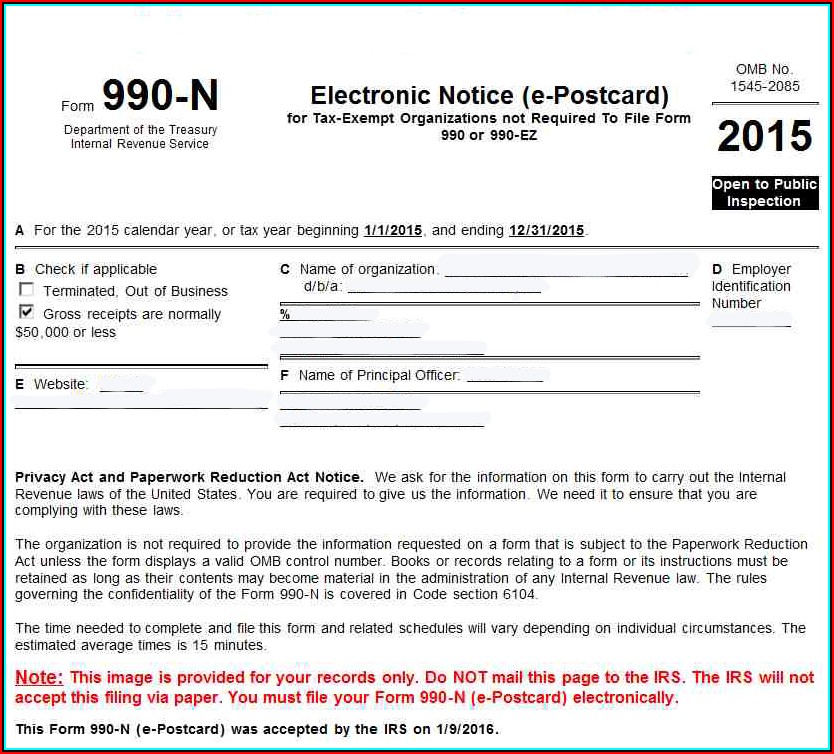

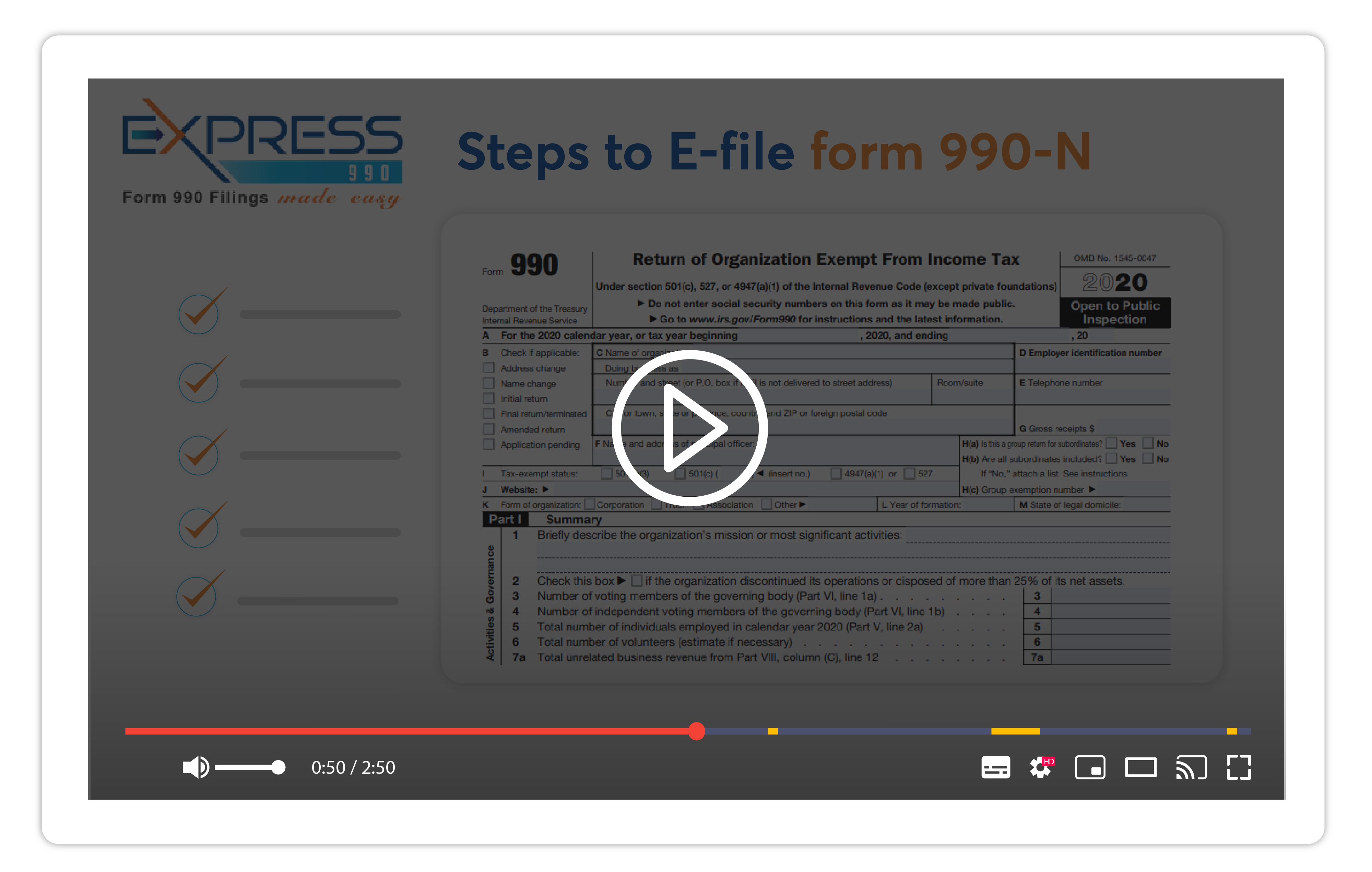

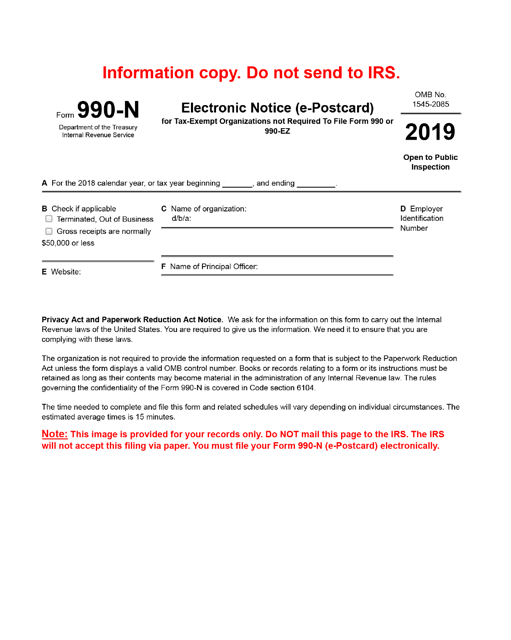

Form 990 N Electronic Filing System

Form 990 N Electronic Filing System - Complete, edit or print tax forms instantly. Supports filing for 2022, 2021, & 2020 tax year. Search ein, choose tax year, review & transmit to the irs. Ad access irs tax forms. You’ll have the chance to save your. Request for taxpayer identification number (tin) and certification. Login to access the application go to the. Click “submit filing” button, then “ok” (when you are ready to submit). Request for transcript of tax return. From the drop down, select either exempt organization.

You’ll have the chance to save your. Web step 1 open the electronic filing page: Get ready for tax season deadlines by completing any required tax forms today. Request for taxpayer identification number (tin) and certification. From the drop down, select either exempt organization. Web nonprofit filers can now electronically sign their form 8453 signature form in the system when they perform the authentication process. Web form 990 online and electronic filing : Complete, edit or print tax forms instantly. Click “submit filing” button, then “ok” (when you are ready to submit). Request for transcript of tax return.

Complete, edit or print tax forms instantly. Web nonprofit filers can now electronically sign their form 8453 signature form in the system when they perform the authentication process. Ad access irs tax forms. Supports filing for 2022, 2021, & 2020 tax year. From the drop down, select either exempt organization. The website can be found at. Click “submit filing” button, then “ok” (when you are ready to submit). Web the irs announced that effective aug. Get ready for tax season deadlines by completing any required tax forms today. Search ein, choose tax year, review & transmit to the irs.

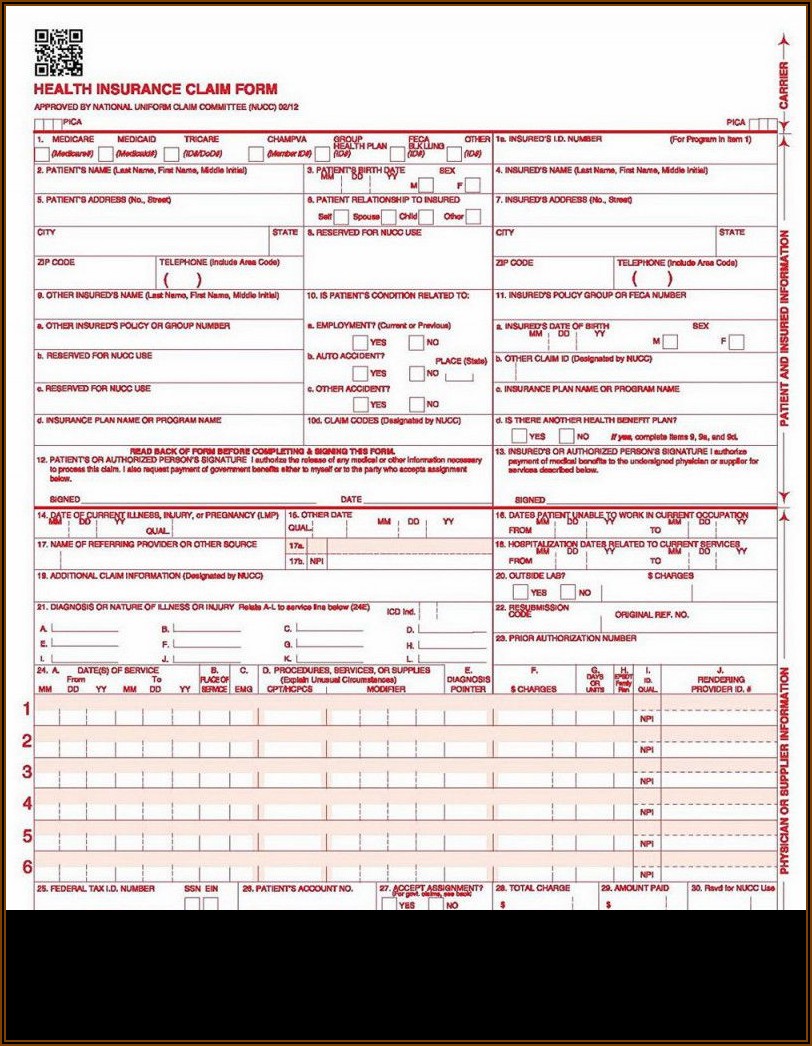

Electronic W 9 Form Form Resume Examples goVLmEb2va

Ad access irs tax forms. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Click “submit filing” button, then “ok” (when you are ready to submit). Supports filing for 2022, 2021, & 2020 tax year. Complete, edit or print tax forms instantly.

20182022 Form IRS Publication 5248 Fill Online, Printable, Fillable

Login to access the application go to the. Supports filing for 2022, 2021, & 2020 tax year. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. From the drop down, select either exempt organization. Request for taxpayer identification number (tin) and certification.

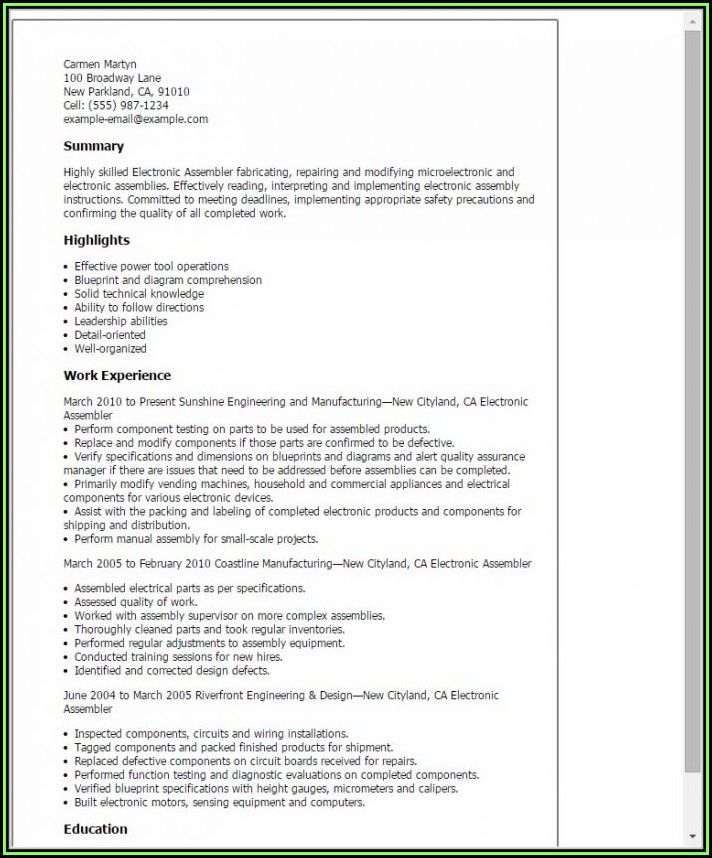

Irs Form 990 N Electronic Filing System User Guide Form Resume

Web step 1 open the electronic filing page: Request for taxpayer identification number (tin) and certification. Ad access irs tax forms. Login to access the application go to the. From the drop down, select either exempt organization.

Efile Form 990N 2020 IRS Form 990N Online Filing

Web form 990 online and electronic filing : From the drop down, select either exempt organization. Ad access irs tax forms. Login to access the application go to the. Request for taxpayer identification number (tin) and certification.

Irs Form 990 N Electronic Filing System User Guide Form Resume

Request for taxpayer identification number (tin) and certification. Get ready for tax season deadlines by completing any required tax forms today. Web the irs announced that effective aug. Ad access irs tax forms. Click “submit filing” button, then “ok” (when you are ready to submit).

Irs Form 990 N Electronic Filing System User Guide Form Resume

The website can be found at. Click “submit filing” button, then “ok” (when you are ready to submit). From the drop down, select either exempt organization. Search ein, choose tax year, review & transmit to the irs. Web the irs announced that effective aug.

Form 990 Electronic Filing Requirements Atlanta Audit Firm

Web step 1 open the electronic filing page: You’ll have the chance to save your. From the drop down, select either exempt organization. Request for taxpayer identification number (tin) and certification. Get ready for tax season deadlines by completing any required tax forms today.

Tax exempt organizations to file form 990N (ePostcard) by express990

Request for taxpayer identification number (tin) and certification. You’ll have the chance to save your. Web form 990 online and electronic filing : Get ready for tax season deadlines by completing any required tax forms today. Web step 1 open the electronic filing page:

Irs Form 990 N Electronic Filing System User Guide Form Resume

Click “submit filing” button, then “ok” (when you are ready to submit). You’ll have the chance to save your. Ad access irs tax forms. Request for taxpayer identification number (tin) and certification. Login to access the application go to the.

IRS Form 990N Download Printable PDF or Fill Online Electronic Notice

Click “submit filing” button, then “ok” (when you are ready to submit). Web step 1 open the electronic filing page: You’ll have the chance to save your. The website can be found at. Get ready for tax season deadlines by completing any required tax forms today.

Click “Submit Filing” Button, Then “Ok” (When You Are Ready To Submit).

Complete, edit or print tax forms instantly. Request for transcript of tax return. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. You’ll have the chance to save your.

Supports Filing For 2022, 2021, & 2020 Tax Year.

Web nonprofit filers can now electronically sign their form 8453 signature form in the system when they perform the authentication process. Get ready for tax season deadlines by completing any required tax forms today. Web step 1 open the electronic filing page: Ad access irs tax forms.

The Website Can Be Found At.

Request for taxpayer identification number (tin) and certification. Web the irs announced that effective aug. Web form 990 online and electronic filing : Login to access the application go to the.

Search Ein, Choose Tax Year, Review & Transmit To The Irs.

From the drop down, select either exempt organization.