Form Ct-W4P 2022

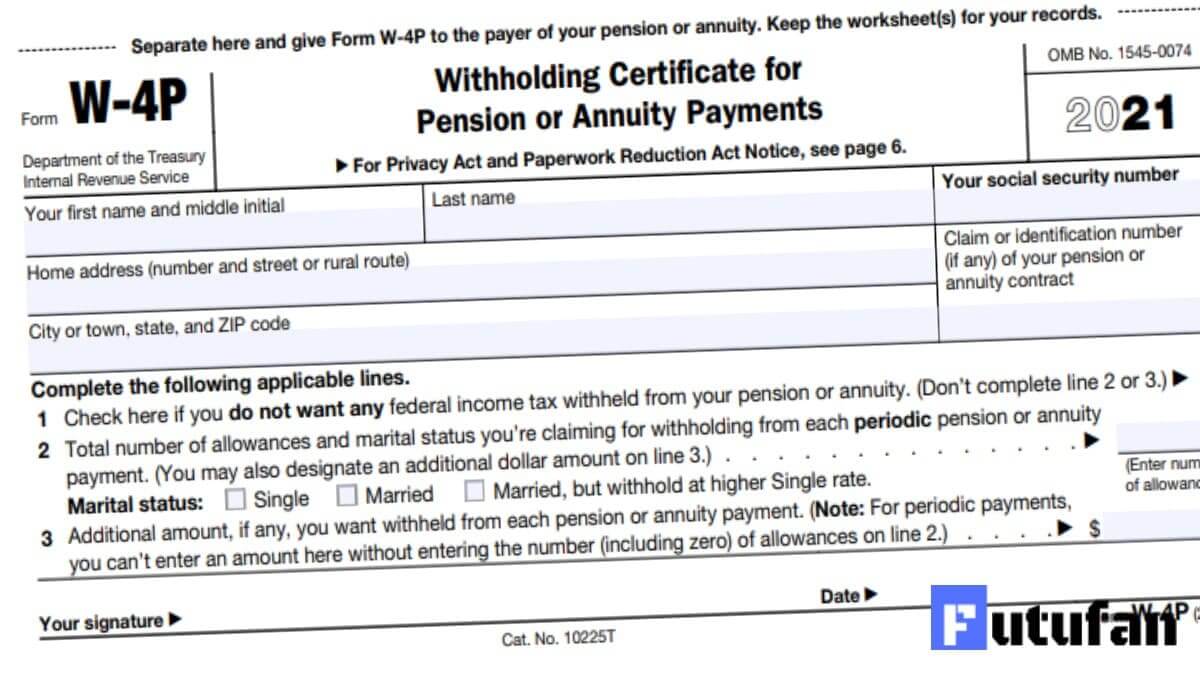

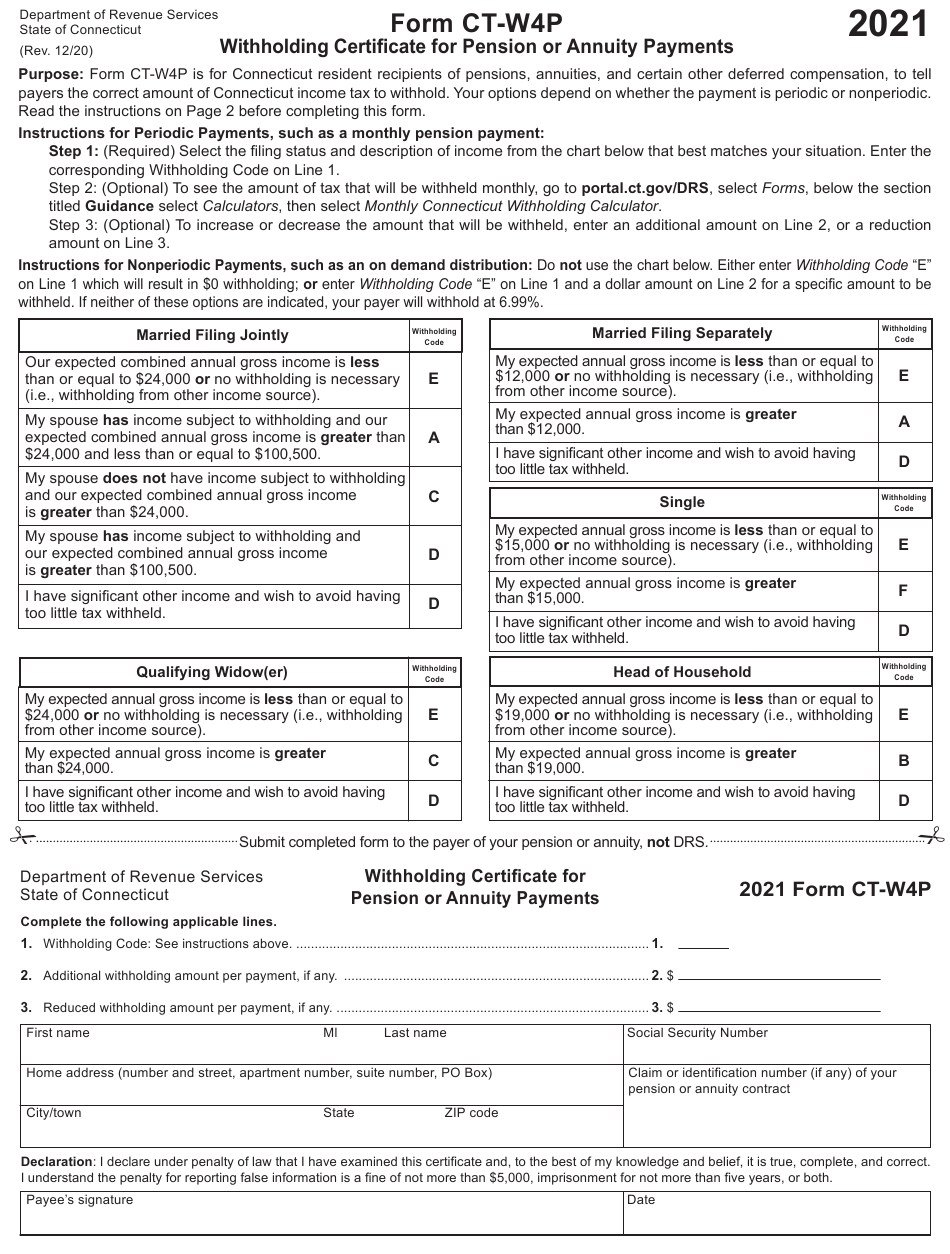

Form Ct-W4P 2022 - Web withholding on form w‐4 or form w‐4p. Legislation passed in 2017 requires payers that maintain an office or transact business in ct and make payments of taxable pensions or annuity. This calculator is intended to be used as a tool to calculate your monthly connecticut income tax. If you (and/or your spouse) have one or more jobs, then enter the total taxable annual pay from all jobs, plus any income entered. Web department of revenue services 2022 state of connecticut (rev. Futureplan erisa team january 04 2022. Save or instantly send your ready documents. See form w‐4v, voluntary withholding request,. This form is for income earned in tax year 2022, with. Web pension or annuity withholding calculator purpose:

Web department of revenue services 2022 state of connecticut (rev. Futureplan erisa team january 04 2022. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut. Web pension or annuity withholding calculator purpose: See form w‐4v, voluntary withholding request,. Web withholding on form w‐4 or form w‐4p. Legislation passed in 2017 requires payers that maintain an office or transact business in ct and make payments of taxable pensions or annuity. Save or instantly send your ready documents. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut. This form is for income earned in tax year 2022, with.

This calculator is intended to be used as a tool to calculate your monthly connecticut income tax. Web withholding on form w‐4 or form w‐4p. Legislation passed in 2017 requires payers that maintain an office or transact business in ct and make payments of taxable pensions or annuity. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut. Save or instantly send your ready documents. Web pension or annuity withholding calculator purpose: Web department of revenue services 2022 state of connecticut (rev. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut. Easily fill out pdf blank, edit, and sign them.

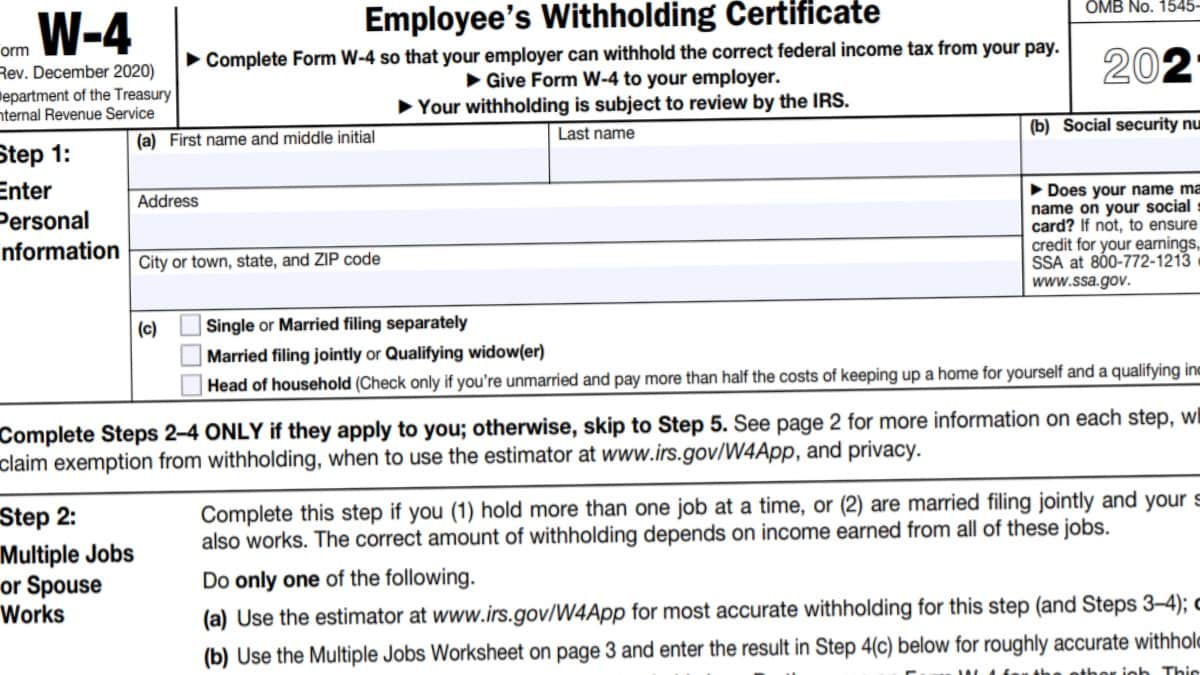

W4 Form 2022 W4 Forms TaxUni

Futureplan erisa team january 04 2022. This calculator is intended to be used as a tool to calculate your monthly connecticut income tax. Web withholding on form w‐4 or form w‐4p. Web reserved for future use. Web department of revenue services 2022 state of connecticut (rev.

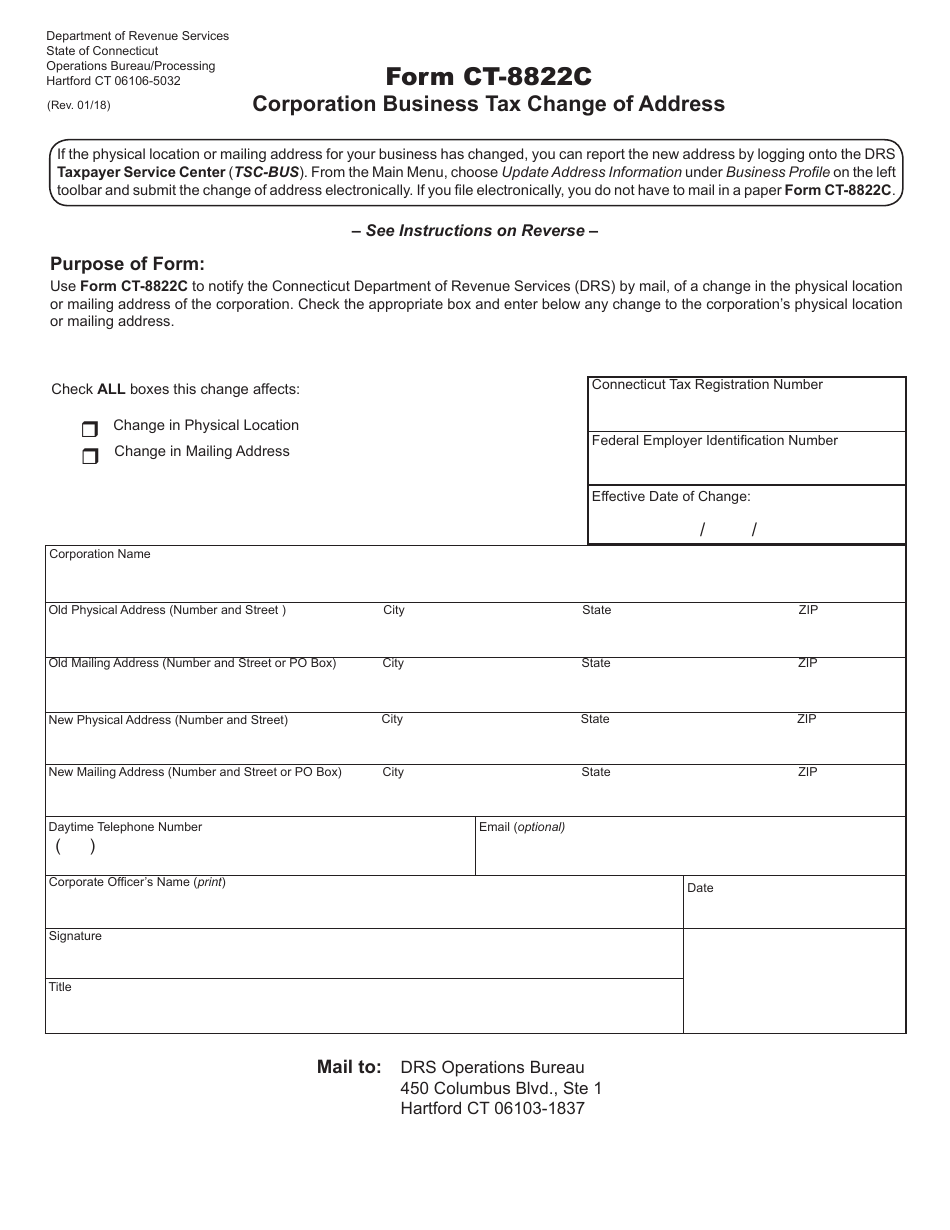

Form CT8822C Download Printable PDF or Fill Online Corporation

Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut. Web pension or annuity withholding calculator purpose: Web department of revenue services 2022 state of connecticut (rev. This form is for income earned in tax year 2022, with. Futureplan erisa team january 04 2022.

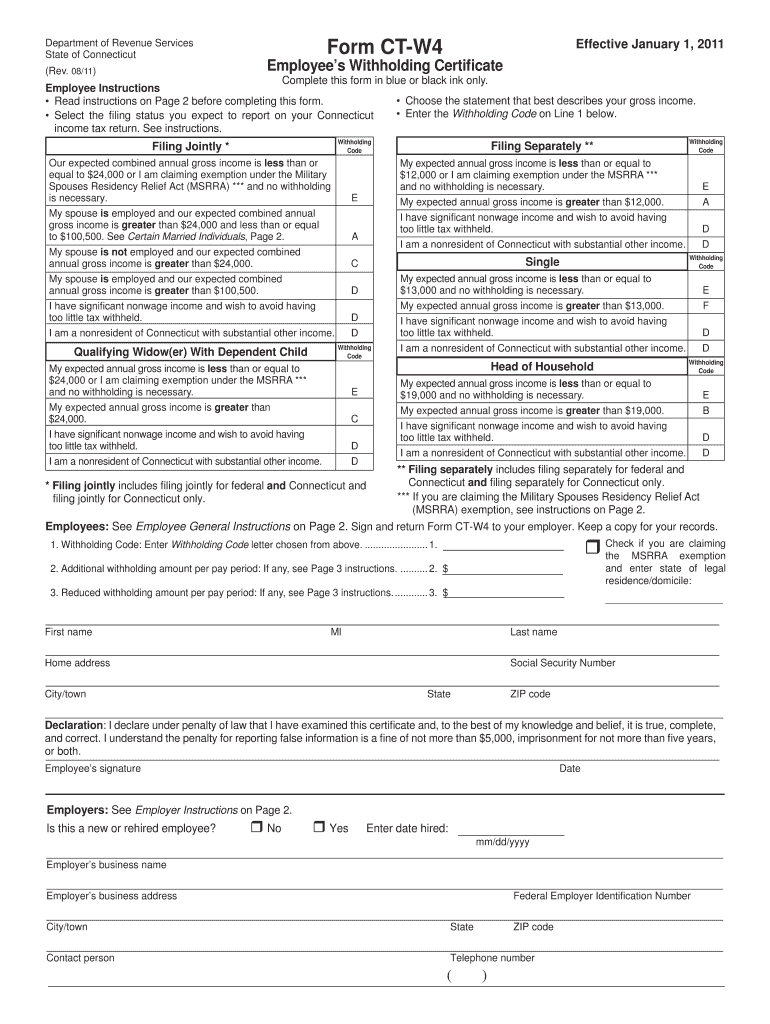

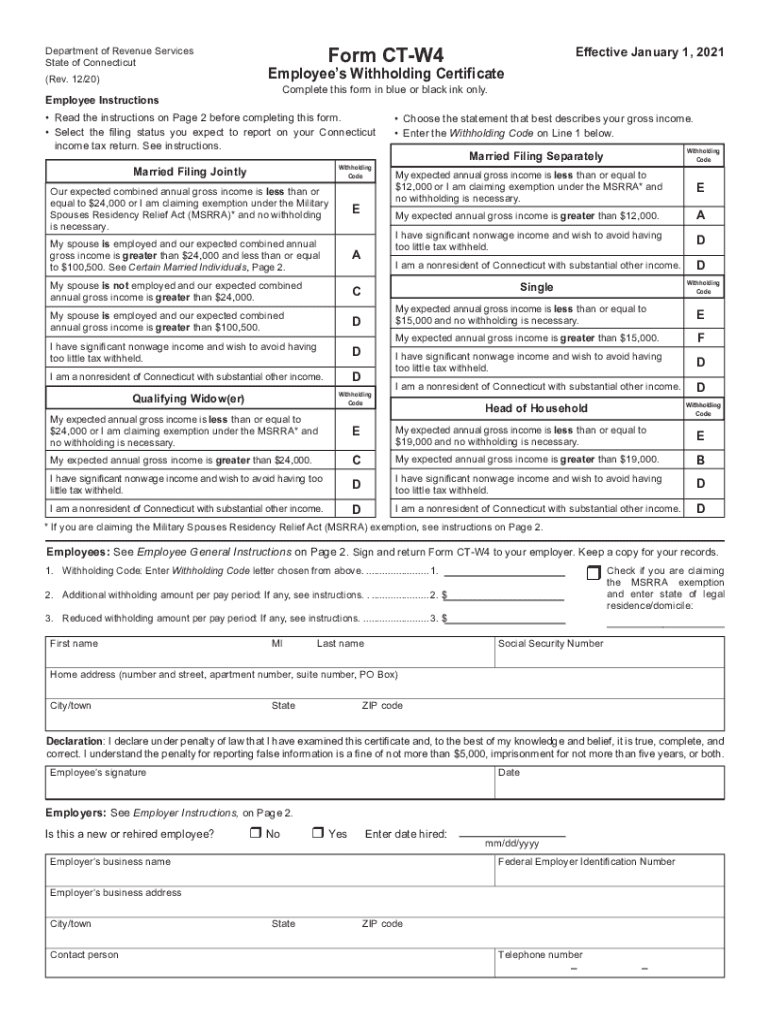

Ct W4 Fillable Form Fill and Sign Printable Template Online US

Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut. Web withholding on form w‐4 or form w‐4p. See form w‐4v, voluntary withholding request,. Web pension or annuity withholding calculator purpose: Save or instantly send your ready documents.

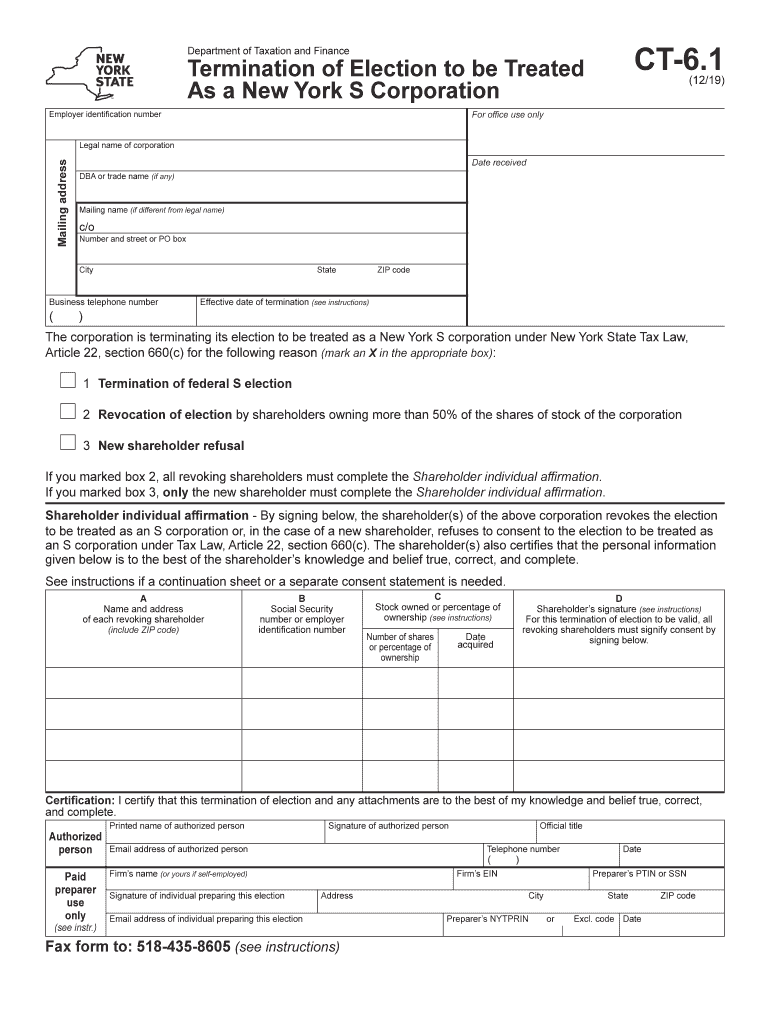

20192022 Form NY CT6.1 Fill Online, Printable, Fillable, Blank

Futureplan erisa team january 04 2022. Web reserved for future use. Web withholding on form w‐4 or form w‐4p. Save or instantly send your ready documents. See form w‐4v, voluntary withholding request,.

W4P Form 2022 2023

Web pension or annuity withholding calculator purpose: Web department of revenue services 2022 state of connecticut (rev. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut. If you (and/or your spouse) have one or more jobs, then enter the total taxable annual pay from all jobs,.

Connecticut State Withholding Form 2022

Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut. Easily fill out pdf blank, edit, and sign them. Form ct‑w4p is for connecticut.

W4 Form 2022 Instructions W4 Forms TaxUni

This form is for income earned in tax year 2022, with. See form w‐4v, voluntary withholding request,. Social security and railroad retirement payments may be includible in income. If you (and/or your spouse) have one or more jobs, then enter the total taxable annual pay from all jobs, plus any income entered. Web department of revenue services 2022 state of.

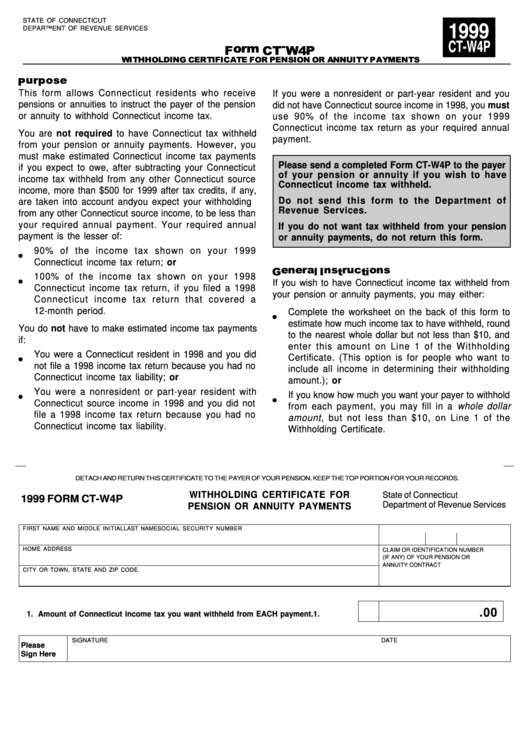

Fillable Form CtW4p Withholding Certificate For Pension Or Annuity

Easily fill out pdf blank, edit, and sign them. Legislation passed in 2017 requires payers that maintain an office or transact business in ct and make payments of taxable pensions or annuity. See form w‐4v, voluntary withholding request,. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of.

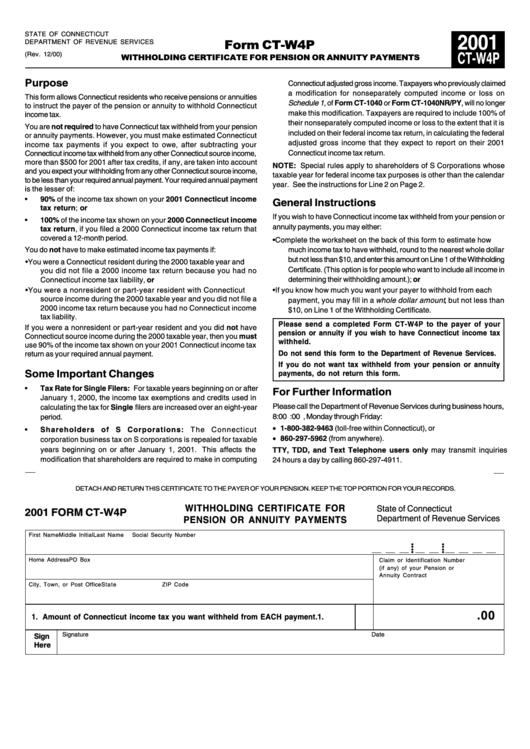

Form CtW4p2001 Withholding Certificate For Pension Or Annuity

Web department of revenue services 2022 state of connecticut (rev. Web pension or annuity withholding calculator purpose: Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut. See form w‐4v, voluntary withholding request,. This form is for income earned in tax year 2022, with.

Ct W4 Fill Out and Sign Printable PDF Template signNow

Web department of revenue services 2022 state of connecticut (rev. Web withholding on form w‐4 or form w‐4p. This form is for income earned in tax year 2022, with. Legislation passed in 2017 requires payers that maintain an office or transact business in ct and make payments of taxable pensions or annuity. Easily fill out pdf blank, edit, and sign.

If You (And/Or Your Spouse) Have One Or More Jobs, Then Enter The Total Taxable Annual Pay From All Jobs, Plus Any Income Entered.

Social security and railroad retirement payments may be includible in income. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut. This form is for income earned in tax year 2022, with. Legislation passed in 2017 requires payers that maintain an office or transact business in ct and make payments of taxable pensions or annuity.

Web Pension Or Annuity Withholding Calculator Purpose:

This calculator is intended to be used as a tool to calculate your monthly connecticut income tax. Futureplan erisa team january 04 2022. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut. Web department of revenue services 2022 state of connecticut (rev.

Save Or Instantly Send Your Ready Documents.

Easily fill out pdf blank, edit, and sign them. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut. Web withholding on form w‐4 or form w‐4p. See form w‐4v, voluntary withholding request,.