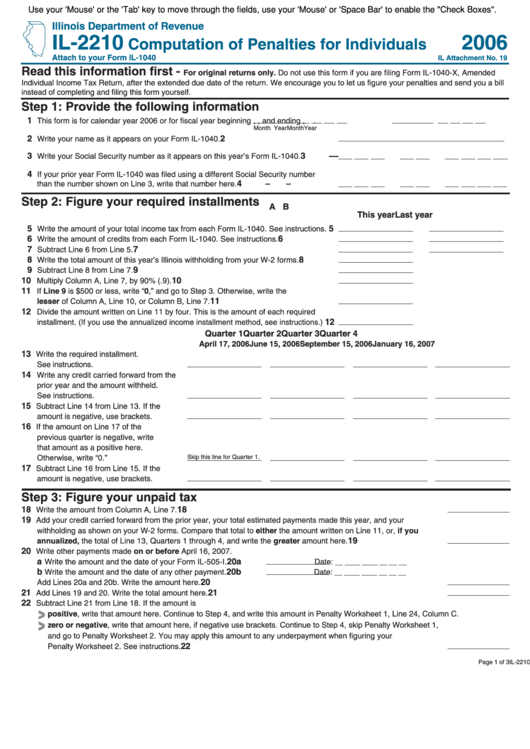

Form Il 2210

Form Il 2210 - Web what is the purpose of this form? Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Miscellaneous and then uncheck the. This form is for income earned in tax year 2022, with tax returns due in april. Complete, edit or print tax forms instantly. The purpose of this form is to fi gure any penalties you may owe if you did not make timely estimated payments, pay the tax you owe by the. Web general instructions future developments for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were. Save or instantly send your ready documents. This includes any corrected return fi led before the extended due date of the.

Complete, edit or print tax forms instantly. Department of the treasury internal revenue service. Web general instructions future developments for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were. The purpose of this form is to fi gure any penalties you may owe if you did not make timely estimated payments, pay the tax you owe by the. Underpayment of estimated tax by individuals, estates, and trusts. Web irs form 2210 (underpayment of estimated tax by individuals, estates, and trusts) calculates the underpayment penalty if you didn't withhold or pay enough taxes. You could just go into someones illinois return and click tools; This includes any corrected return fi led before the extended due date of the. Web what is the purpose of this form? The irs will generally figure your penalty for you and you should not file form 2210.

This includes any corrected return fi led before the extended due date of the. Easily fill out pdf blank, edit, and sign them. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Save or instantly send your ready documents. Web general instructions future developments for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were. Web irs form 2210 (underpayment of estimated tax by individuals, estates, and trusts) calculates the underpayment penalty if you didn't withhold or pay enough taxes. Underpayment of estimated tax by individuals, estates, and trusts. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web what is the purpose of this form? Department of the treasury internal revenue service.

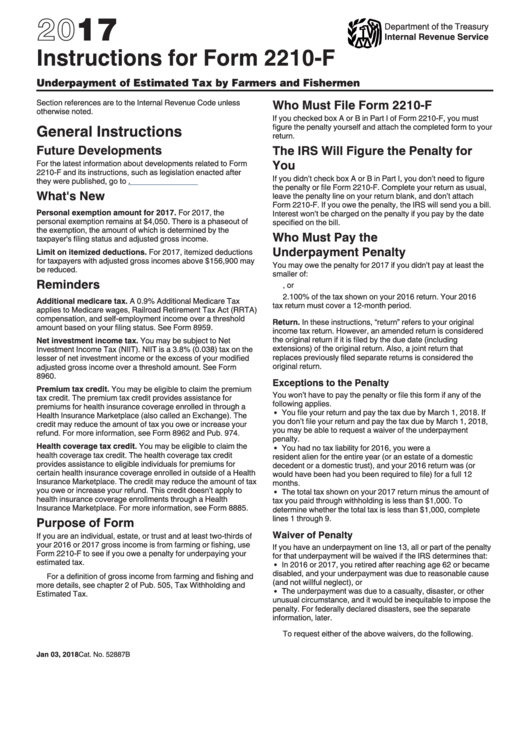

Instructions For Form 2210F Underpayment Of Estimated Tax By Farmers

The purpose of this form is to fi gure any penalties you may owe if you did not make timely estimated payments, pay the tax you owe by the. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Underpayment of estimated tax by individuals,.

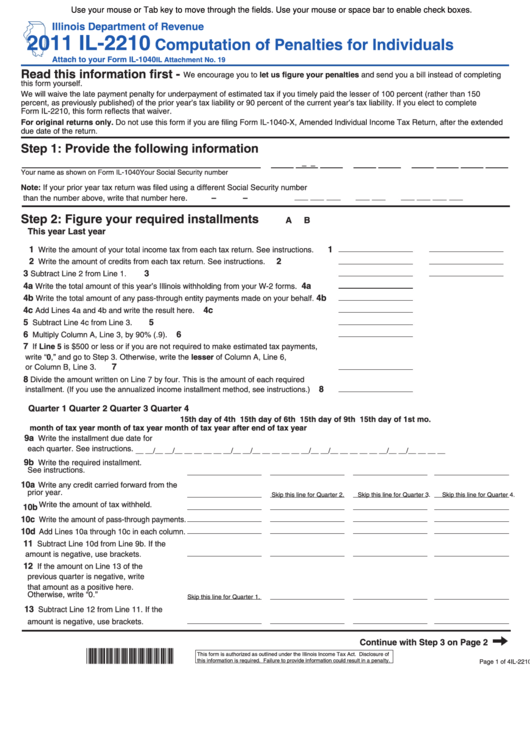

Fillable Form Il2210 Computation Of Penalties For Individuals 2011

Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Payment voucher for amended individual income tax. Complete, edit or print tax forms instantly. This form is for income earned in tax year 2022, with tax returns due in april. The irs will generally figure.

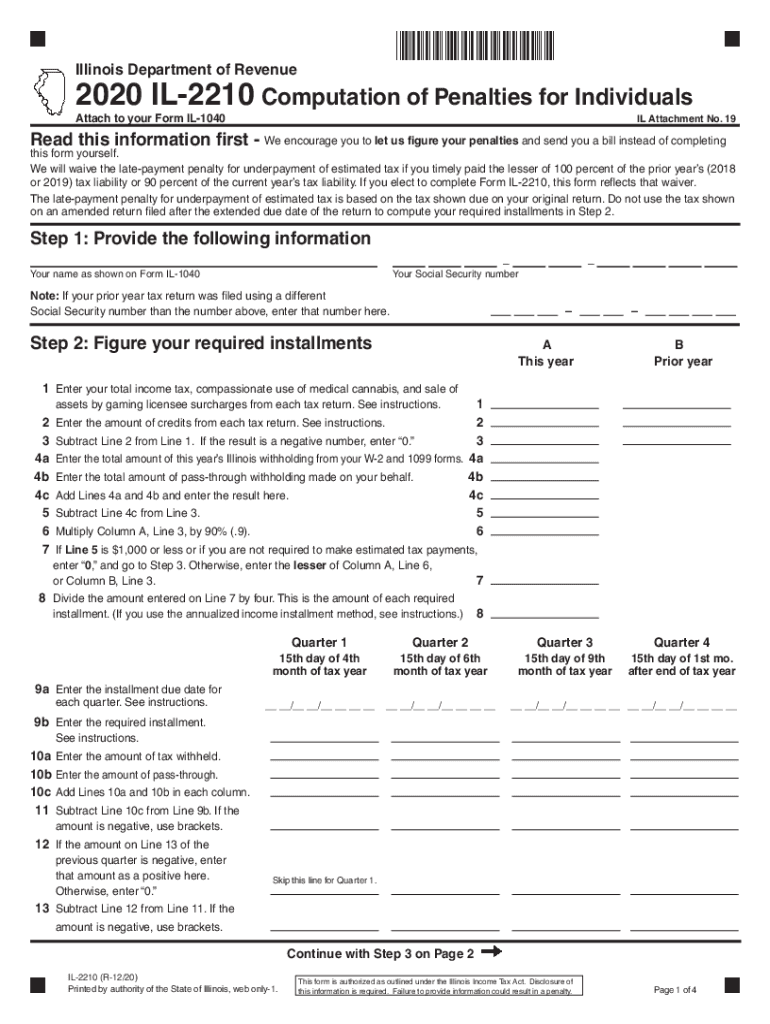

Printable Illinois Form IL 2210 Computation Of Penalties For

The purpose of this form is to fi gure any penalties you may owe if you did not make timely estimated payments, pay the tax you owe by the. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web general instructions future developments for the latest information about developments related to form 2210 and its.

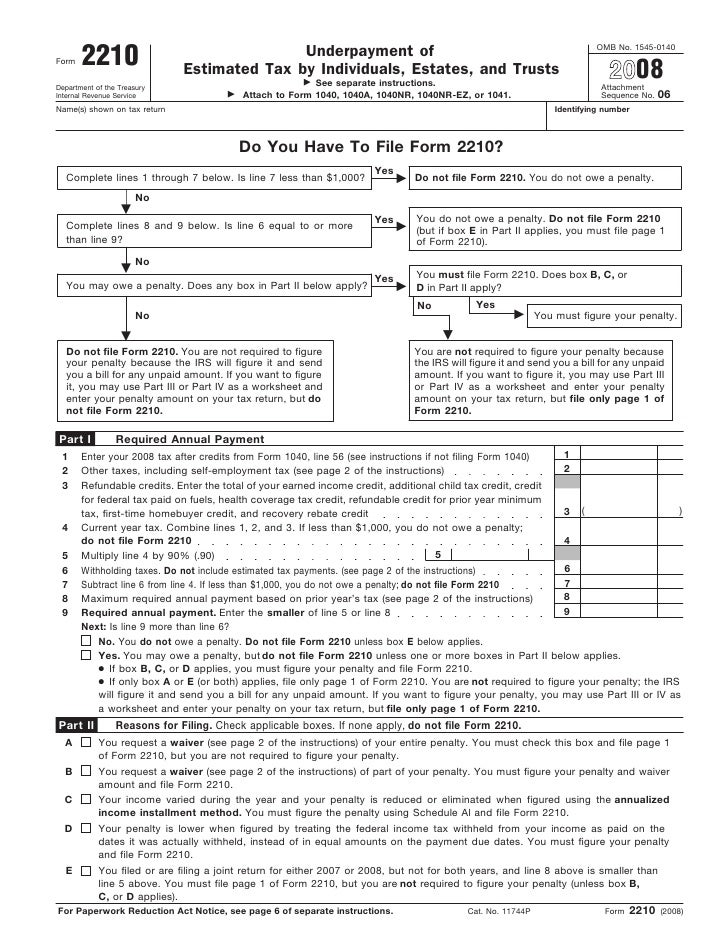

Ssurvivor Irs Form 2210 Instructions

Web general instructions future developments for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were. This form allows you to figure penalties you may owe if you did not make timely estimated payments, pay the tax you. Save or instantly send your ready documents. Easily fill out pdf blank, edit,.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Web irs form 2210 (underpayment of estimated tax by individuals, estates, and trusts) calculates the underpayment penalty if you didn't withhold or pay enough taxes. The irs will generally figure your penalty for you and you should not file form 2210. Payment voucher for amended individual income tax. You could just go into someones illinois return and click tools; Web.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Web irs form 2210 (underpayment of estimated tax by individuals, estates, and trusts) calculates the underpayment penalty if you didn't withhold or pay enough taxes. Save or instantly send your ready documents. Payment voucher for amended individual income tax. You could just go into someones illinois return and click tools; The purpose of this form is to fi gure any.

Form 2210Underpayment of Estimated Tax

Web general information what is the purpose of this form? Web irs form 2210 (underpayment of estimated tax by individuals, estates, and trusts) calculates the underpayment penalty if you didn't withhold or pay enough taxes. Department of the treasury internal revenue service. Web general instructions future developments for the latest information about developments related to form 2210 and its instructions,.

Fillable Form Il2210 Computation Of Penalties For Individuals 2006

The irs will generally figure your penalty for you and you should not file form 2210. The purpose of this form is to fi gure any penalties you may owe if you did not make timely estimated payments, pay the tax you owe by the. Web general information what is the purpose of this form? This form allows you to.

Instructions for Federal Tax Form 2210 Sapling

Web what is the purpose of this form? Miscellaneous and then uncheck the. Web general instructions future developments for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver.

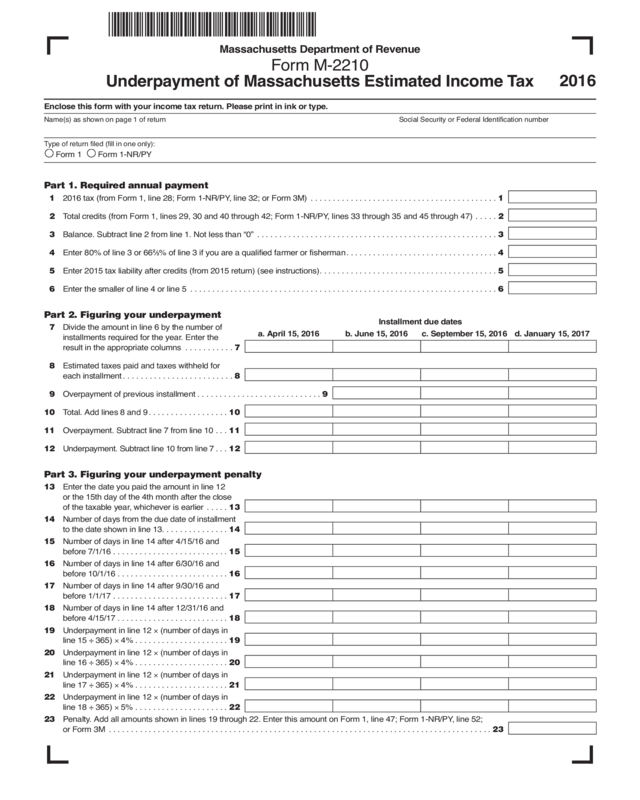

Form M2210 Edit, Fill, Sign Online Handypdf

Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. The irs will generally figure your penalty for you and you should not file form 2210. Web general instructions future developments for the latest information about developments related to form 2210 and its instructions, such.

Web General Instructions Future Developments For The Latest Information About Developments Related To Form 2210 And Its Instructions, Such As Legislation Enacted After They Were.

The purpose of this form is to fi gure any penalties you may owe if you did not make timely estimated payments, pay the tax you owe by the. This includes any corrected return fi led before the extended due date of the. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Save or instantly send your ready documents.

This Form Allows You To Figure Penalties You May Owe If You Did Not Make Timely Estimated Payments, Pay The Tax You.

Easily fill out pdf blank, edit, and sign them. Web general instructions future developments for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were. Payment voucher for amended individual income tax. The irs will generally figure your penalty for you and you should not file form 2210.

Department Of The Treasury Internal Revenue Service.

Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. This form is for income earned in tax year 2022, with tax returns due in april. Web what is the purpose of this form? Complete, edit or print tax forms instantly.

Complete, Edit Or Print Tax Forms Instantly.

Miscellaneous and then uncheck the. Web general information what is the purpose of this form? Underpayment of estimated tax by individuals, estates, and trusts. You could just go into someones illinois return and click tools;