Form It-204 Instructions

Form It-204 Instructions - Prepare tax documents themselves, without the assistance of a tax professional; Every llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; Enter identifying information on the federal idauth screen in the electronic filing folder, if applicable. You as a partner are liable for tax on your share of the partnership income, whether or not distributed. Verify the file this return electronically box is checked on the federal elf screen in the electronic filing folder. Used to report income, deductions, gains, losses and credits from the operation of a partnership. Returns for calendar year 2022 are due march 15, 2023.

Used to report income, deductions, gains, losses and credits from the operation of a partnership. Prepare tax documents themselves, without the assistance of a tax professional; Enter identifying information on the federal idauth screen in the electronic filing folder, if applicable. You as a partner are liable for tax on your share of the partnership income, whether or not distributed. Every llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; Verify the file this return electronically box is checked on the federal elf screen in the electronic filing folder. Returns for calendar year 2022 are due march 15, 2023.

Returns for calendar year 2022 are due march 15, 2023. You as a partner are liable for tax on your share of the partnership income, whether or not distributed. Enter identifying information on the federal idauth screen in the electronic filing folder, if applicable. Used to report income, deductions, gains, losses and credits from the operation of a partnership. Prepare tax documents themselves, without the assistance of a tax professional; Every llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; Verify the file this return electronically box is checked on the federal elf screen in the electronic filing folder.

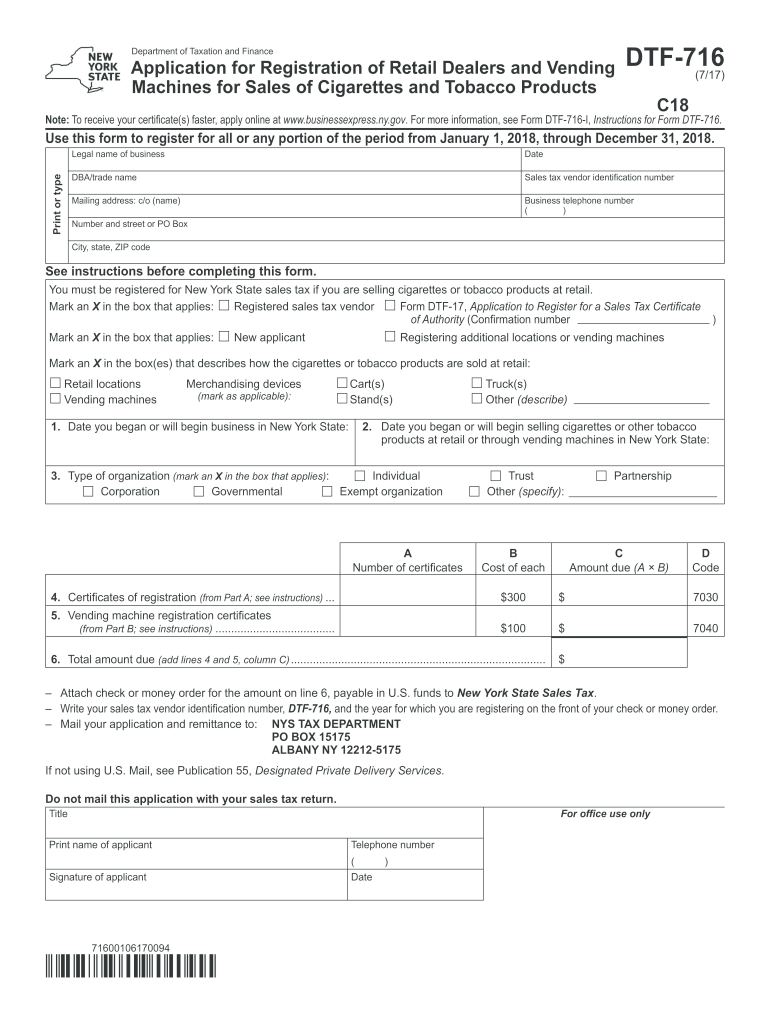

Dtf 716 20202022 Fill and Sign Printable Template Online US Legal

Returns for calendar year 2022 are due march 15, 2023. You as a partner are liable for tax on your share of the partnership income, whether or not distributed. Prepare tax documents themselves, without the assistance of a tax professional; Enter identifying information on the federal idauth screen in the electronic filing folder, if applicable. Verify the file this return.

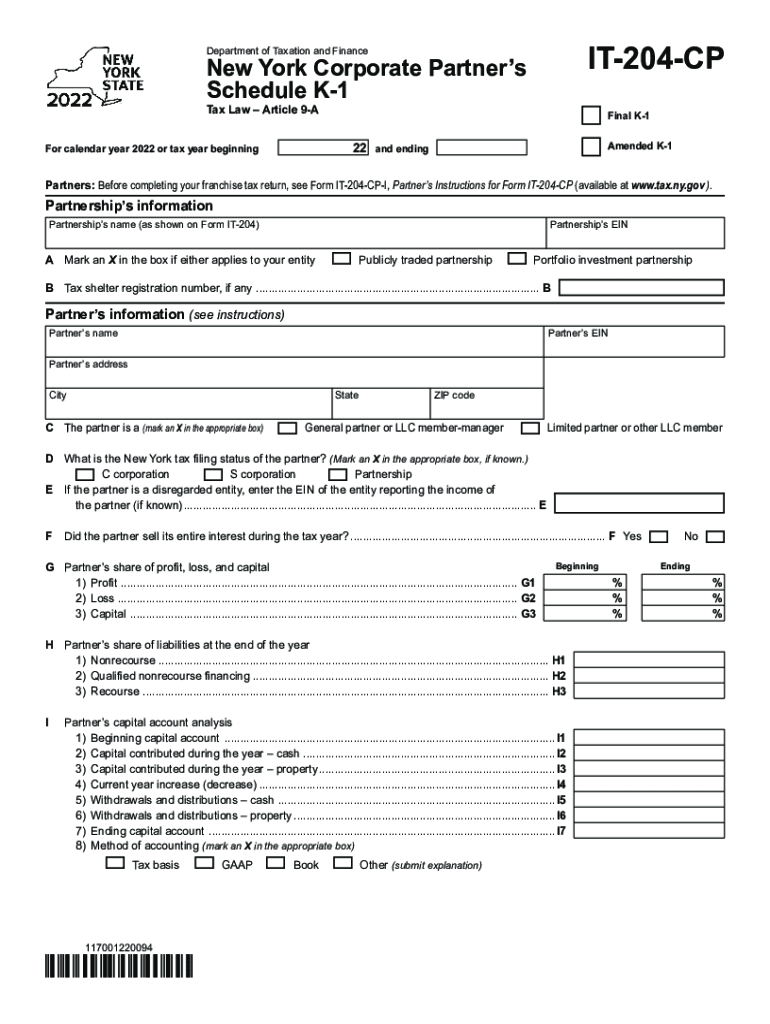

Download Instructions for Form IT204CP New York Corporate Partner's

Prepare tax documents themselves, without the assistance of a tax professional; Every llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; Returns for calendar year 2022 are due march 15, 2023. Used to report income, deductions, gains, losses and credits from the operation of a partnership..

Ny Taxation Cp Fill Out and Sign Printable PDF Template signNow

Returns for calendar year 2022 are due march 15, 2023. Enter identifying information on the federal idauth screen in the electronic filing folder, if applicable. Prepare tax documents themselves, without the assistance of a tax professional; Used to report income, deductions, gains, losses and credits from the operation of a partnership. You as a partner are liable for tax on.

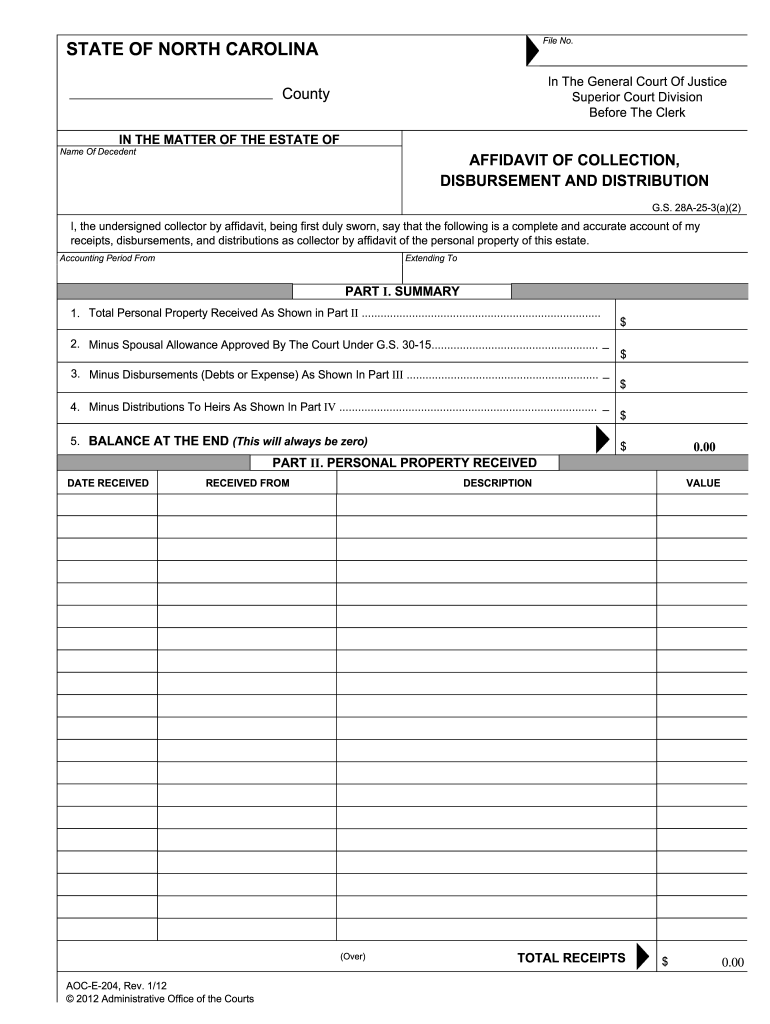

Nc Form Aoc E 204 Instructions Fill Out and Sign Printable PDF

Every llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; Enter identifying information on the federal idauth screen in the electronic filing folder, if applicable. Used to report income, deductions, gains, losses and credits from the operation of a partnership. Prepare tax documents themselves, without the.

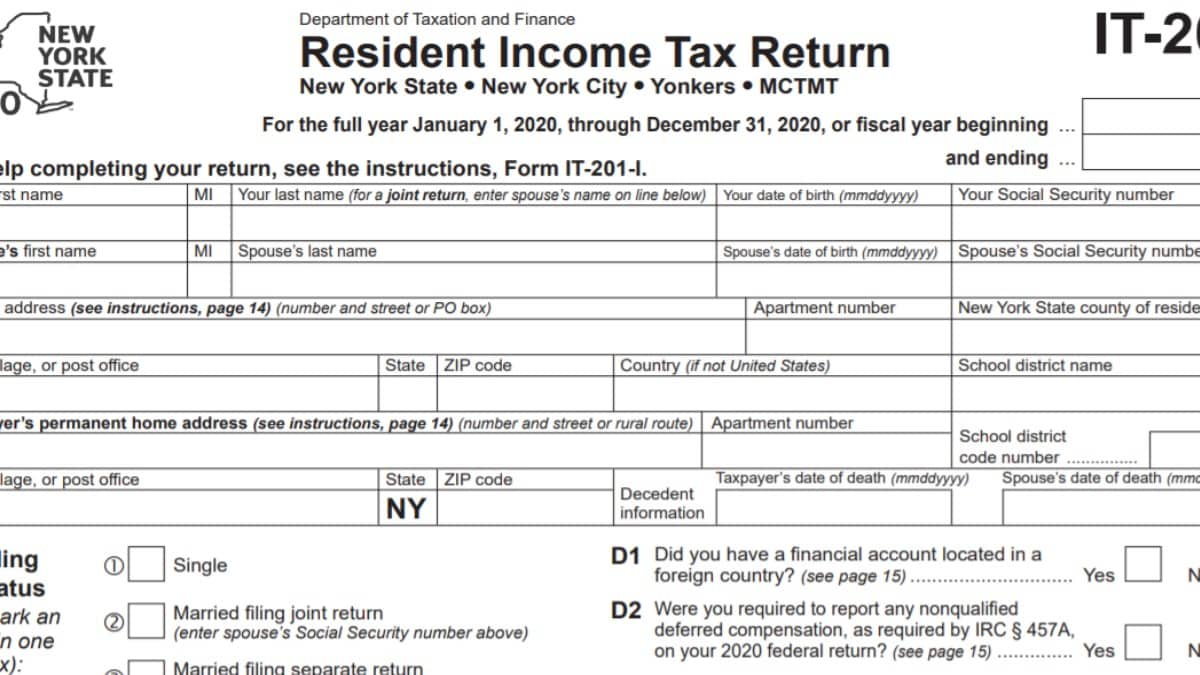

IT201 Instructions 2022 2023 State Taxes TaxUni

Every llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; Prepare tax documents themselves, without the assistance of a tax professional; Enter identifying information on the federal idauth screen in the electronic filing folder, if applicable. You as a partner are liable for tax on your.

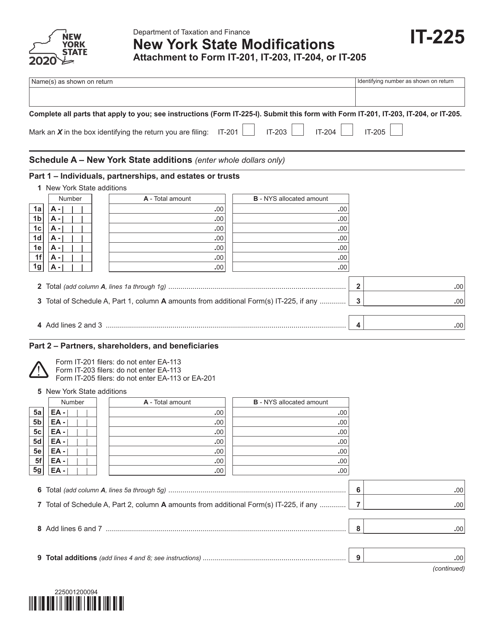

Form IT225 Download Fillable PDF or Fill Online New York State

Verify the file this return electronically box is checked on the federal elf screen in the electronic filing folder. Every llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; Returns for calendar year 2022 are due march 15, 2023. Prepare tax documents themselves, without the assistance.

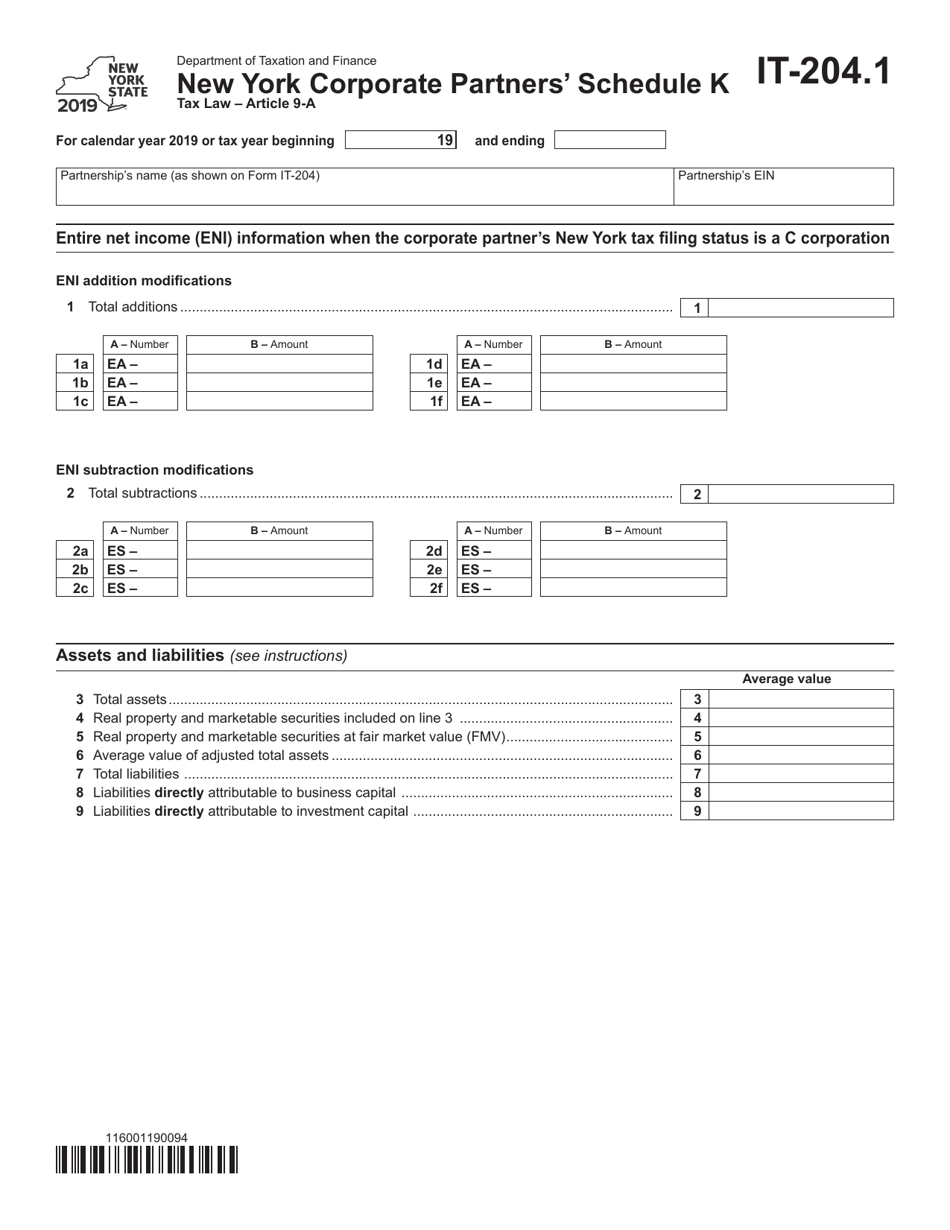

Form IT204.1 Schedule K Download Fillable PDF or Fill Online New York

Prepare tax documents themselves, without the assistance of a tax professional; Verify the file this return electronically box is checked on the federal elf screen in the electronic filing folder. You as a partner are liable for tax on your share of the partnership income, whether or not distributed. Every llc that is a disregarded entity for federal income tax.

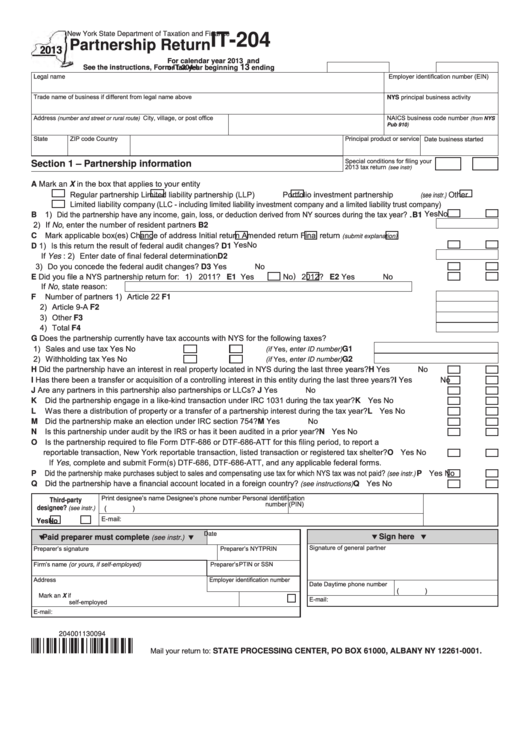

Fillable Form It204 Partnership Return 2013 printable pdf download

Enter identifying information on the federal idauth screen in the electronic filing folder, if applicable. Prepare tax documents themselves, without the assistance of a tax professional; Every llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; Returns for calendar year 2022 are due march 15, 2023..

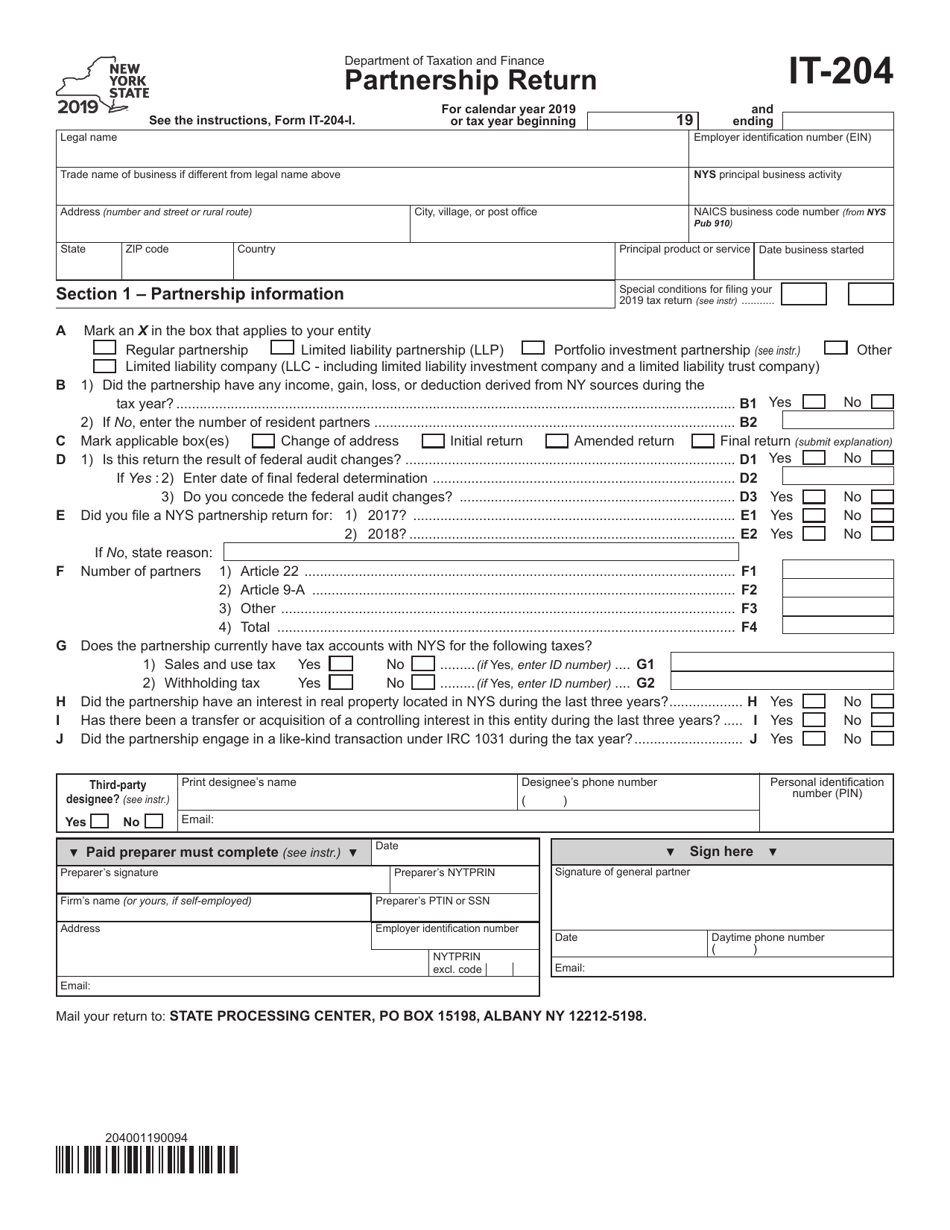

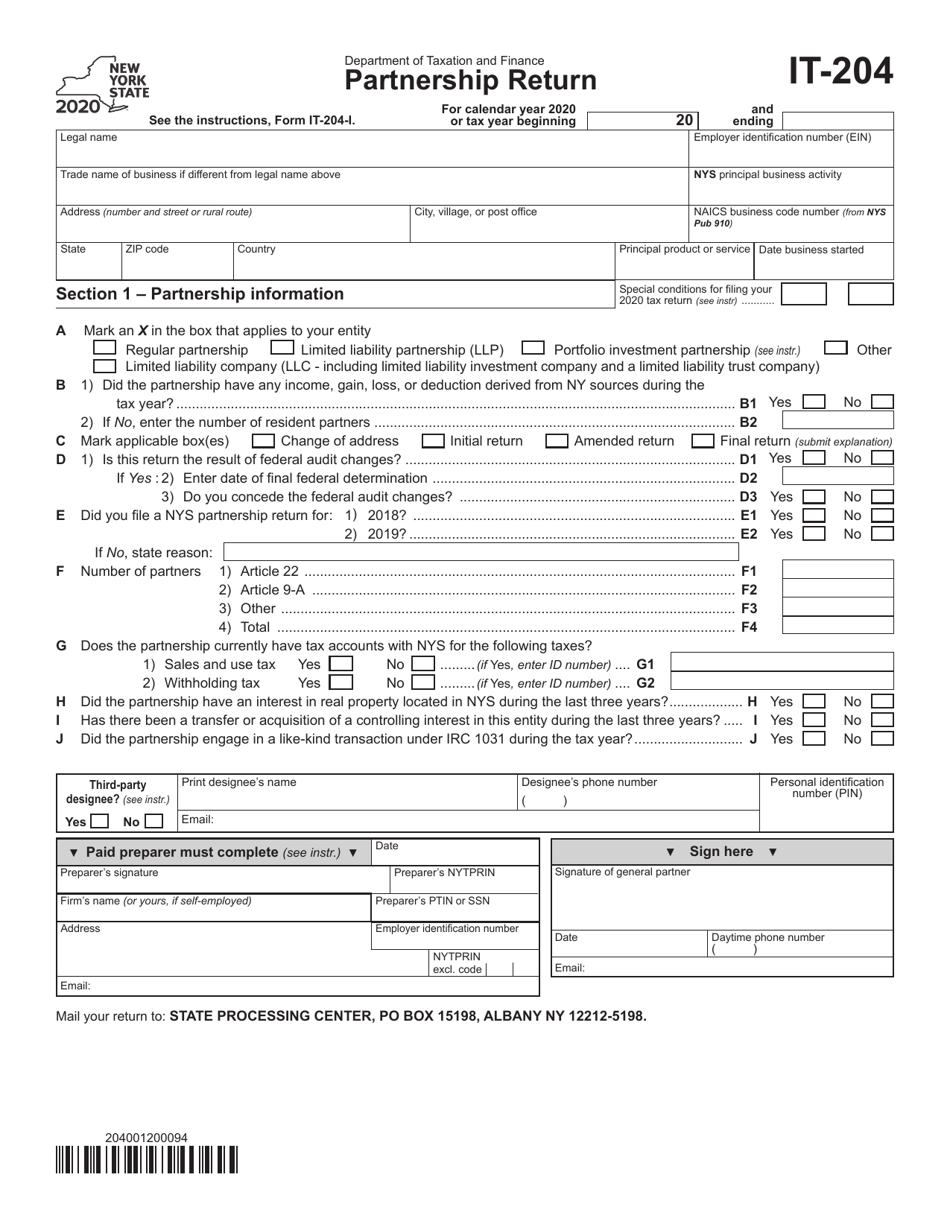

Form IT204 Download Fillable PDF or Fill Online Partnership Return

Used to report income, deductions, gains, losses and credits from the operation of a partnership. You as a partner are liable for tax on your share of the partnership income, whether or not distributed. Verify the file this return electronically box is checked on the federal elf screen in the electronic filing folder. Enter identifying information on the federal idauth.

Form IT204 Download Fillable PDF or Fill Online Partnership Return

Prepare tax documents themselves, without the assistance of a tax professional; Every llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; Verify the file this return electronically box is checked on the federal elf screen in the electronic filing folder. Used to report income, deductions, gains,.

Enter Identifying Information On The Federal Idauth Screen In The Electronic Filing Folder, If Applicable.

Returns for calendar year 2022 are due march 15, 2023. You as a partner are liable for tax on your share of the partnership income, whether or not distributed. Used to report income, deductions, gains, losses and credits from the operation of a partnership. Verify the file this return electronically box is checked on the federal elf screen in the electronic filing folder.

Prepare Tax Documents Themselves, Without The Assistance Of A Tax Professional;

Every llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources;