Form It 204

Form It 204 - Please see turbotax business forms availability. Web 19 rows partnership return; See employer in the instructions. This form is for income earned in tax year 2022, with tax returns. You as a partner are liable for tax on your share of the partnership income, whether or not distributed. The worksheet on page 4 and the charts beginning on page 5, used to compute withholding allowances or to enter an additional. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Web 8 rows form number. February 21, 2021 10:12 am. That's true, but turbotax business did.

Returns for calendar year 2022 are due march 15,. Web copy of this form to new york state. We last updated the new. This form is for dealing with taxes associated with having corporate partners. You as a partner are liable for tax on your share of the partnership income, whether or not distributed. Partnerships are not subject to personal income tax. But every partnership having either (1) at least one partner who is an individual,. Web 8 rows form number. Web 19 rows partnership return; Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue.

Please see turbotax business forms availability. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. The worksheet on page 4 and the charts beginning on page 5, used to compute withholding allowances or to enter an additional. Web 19 rows partnership return; Web copy of this form to new york state. But every partnership having either (1) at least one partner who is an individual,. Web 8 rows form number. February 21, 2021 10:12 am. This form is for income earned in tax year 2022, with tax returns. Partnerships are not subject to personal income tax.

How To Calculate Tax Estimate For Cp204 How to Calculate Land Value

Returns for calendar year 2022 are due march 15,. Douglas, suite 400 wichita, ks 67207: This form is for income earned in tax year 2022, with tax returns. We last updated the new. Wolters kluwer, cch 9111 e.

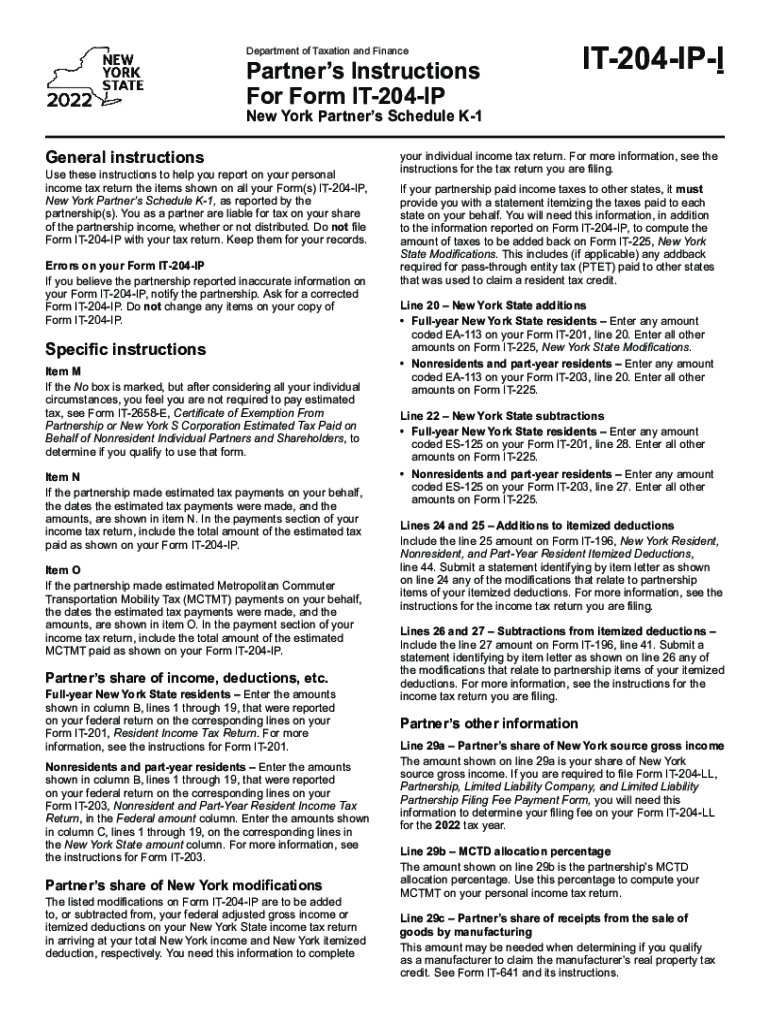

It 204 Ip Instructions Fill Out and Sign Printable PDF Template signNow

Web 19 rows partnership return; Returns for calendar year 2022 are due march 15,. This form is for income earned in tax year 2022, with tax returns. Please see turbotax business forms availability. You can download or print current or past.

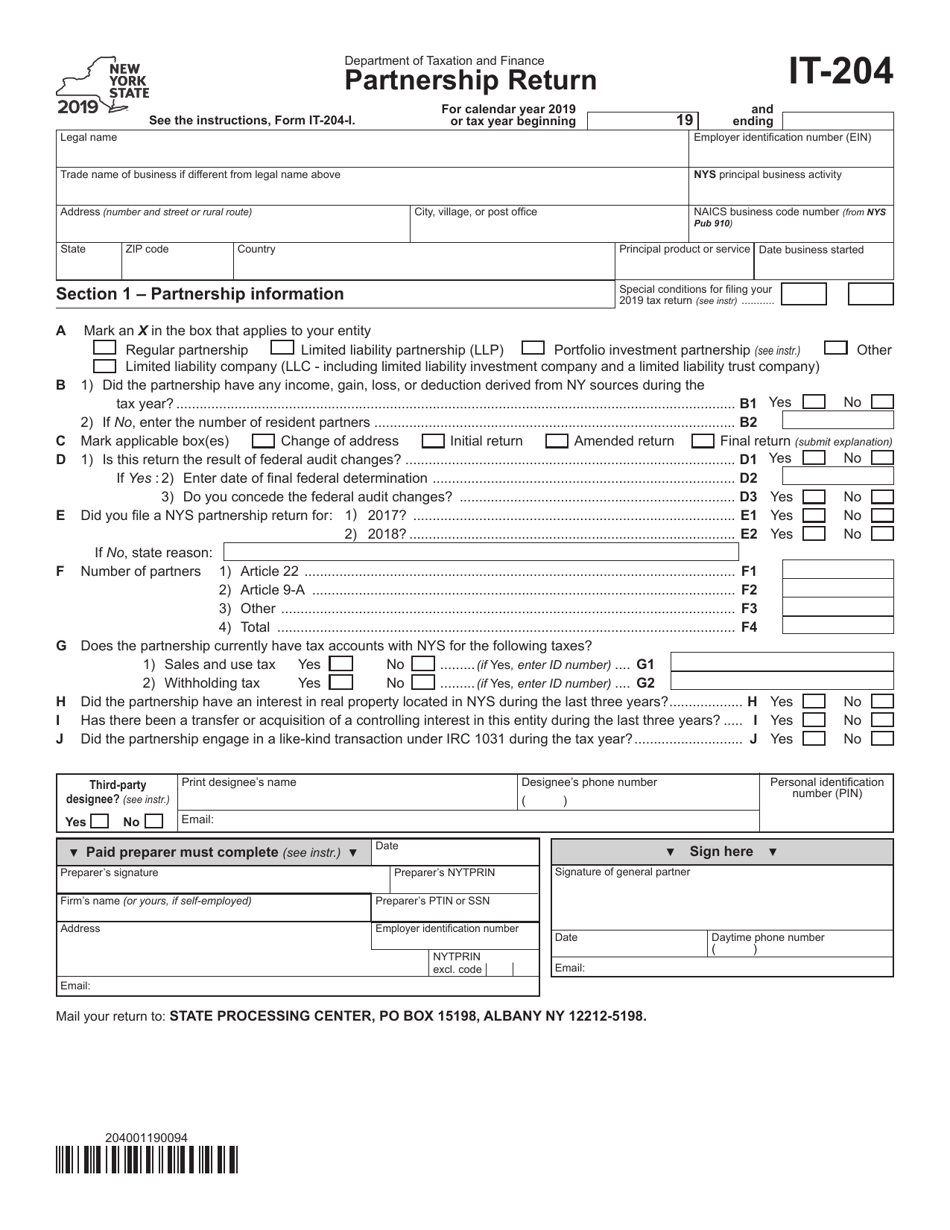

Form IT204 Download Fillable PDF or Fill Online Partnership Return

Web copy of this form to new york state. This form is for income earned in tax year 2022, with tax returns. Web 19 rows partnership return; The worksheet on page 4 and the charts beginning on page 5, used to compute withholding allowances or to enter an additional. Please see turbotax business forms availability.

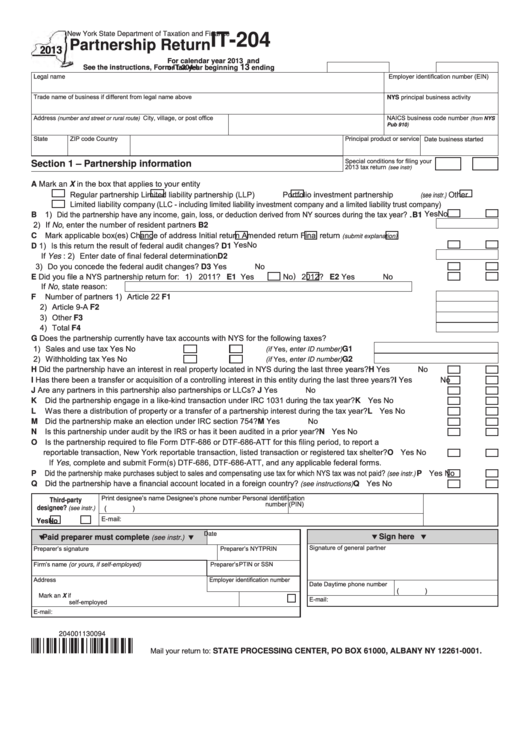

Fillable Form It204 Partnership Return 2013 printable pdf download

That's true, but turbotax business did. This form is for income earned in tax year 2022, with tax returns. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. This form is for dealing with taxes associated with having corporate partners. But every partnership having either (1) at least one partner.

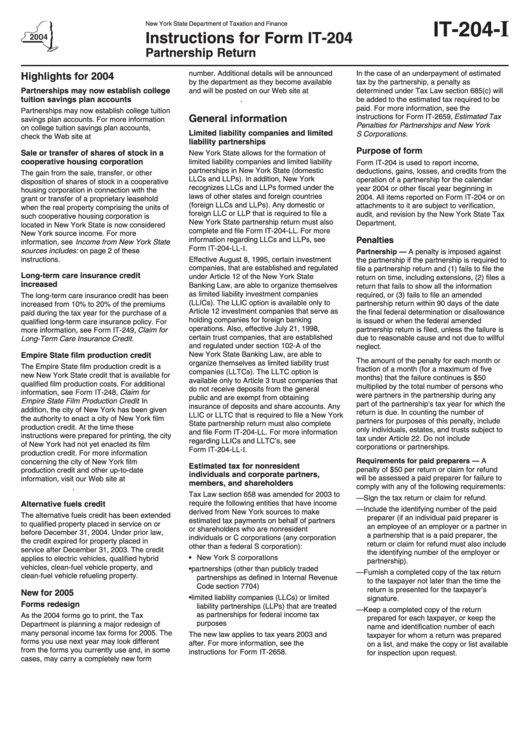

Instructions For Form It204 Partnership Return New York State

You can download or print current or past. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. This form is for income earned in tax year 2022, with tax returns. That's true, but turbotax business did. Partnerships are not subject to personal income tax.

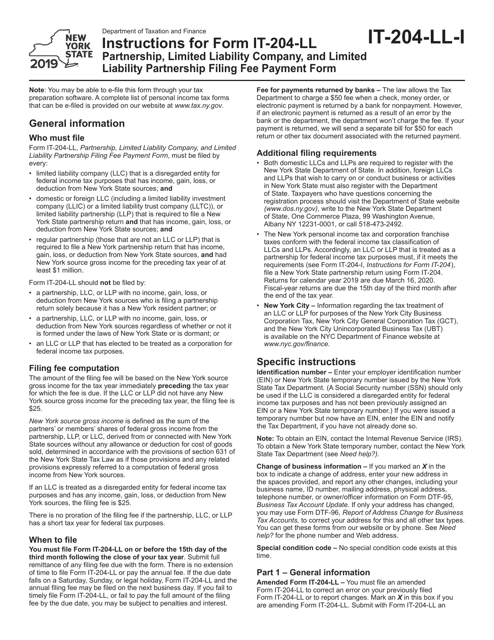

Download Instructions for Form IT204LL Partnership, Limited Liability

But every partnership having either (1) at least one partner who is an individual,. Web 8 rows form number. You can download or print current or past. Returns for calendar year 2022 are due march 15,. You as a partner are liable for tax on your share of the partnership income, whether or not distributed.

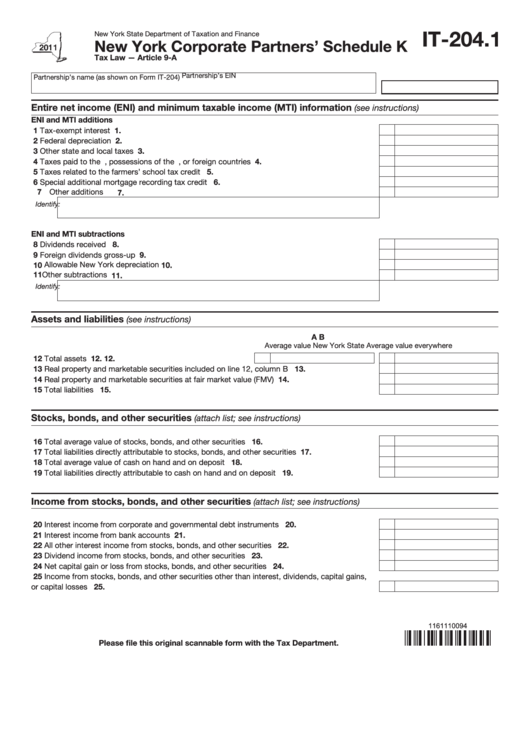

Fillable Form It204.1 New York Corporate Partners' Schedule K 2011

Wolters kluwer, cch 9111 e. Web copy of this form to new york state. The worksheet on page 4 and the charts beginning on page 5, used to compute withholding allowances or to enter an additional. Partnerships are not subject to personal income tax. We last updated the new.

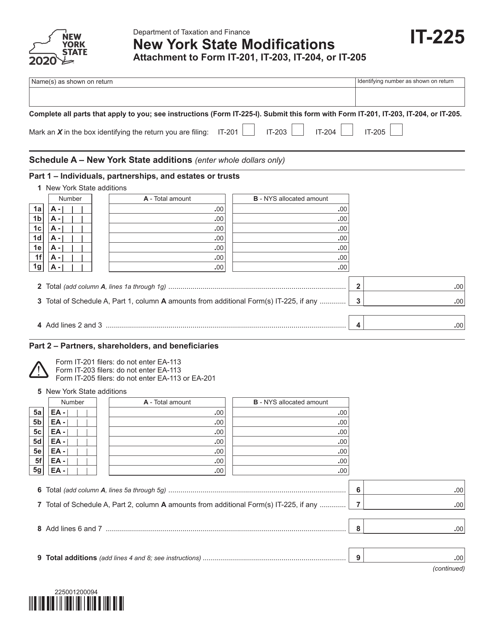

Form IT225 Download Fillable PDF or Fill Online New York State

You can download or print current or past. Web 8 rows form number. Web copy of this form to new york state. This form is for dealing with taxes associated with having corporate partners. But every partnership having either (1) at least one partner who is an individual,.

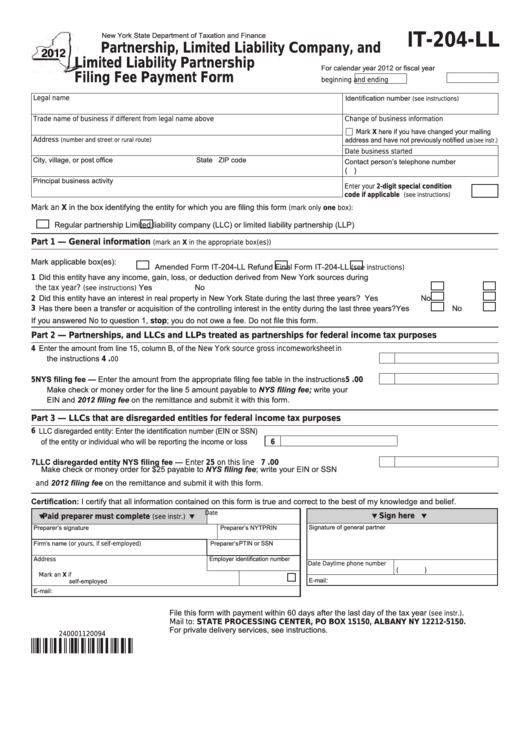

Fillable Form It204Ll Partnership, Limited Liability Company, And

You as a partner are liable for tax on your share of the partnership income, whether or not distributed. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. February 21, 2021 10:12 am. This form is for dealing with taxes associated with having corporate partners. Web 8 rows form number.

But Every Partnership Having Either (1) At Least One Partner Who Is An Individual,.

Partnerships are not subject to personal income tax. You can download or print current or past. See employer in the instructions. Douglas, suite 400 wichita, ks 67207:

Web 8 Rows Form Number.

This form is for dealing with taxes associated with having corporate partners. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Returns for calendar year 2022 are due march 15,. This form is for income earned in tax year 2022, with tax returns.

Wolters Kluwer, Cch 9111 E.

That's true, but turbotax business did. You as a partner are liable for tax on your share of the partnership income, whether or not distributed. February 21, 2021 10:12 am. Web copy of this form to new york state.

Web 19 Rows Partnership Return;

We last updated the new. Please see turbotax business forms availability. The worksheet on page 4 and the charts beginning on page 5, used to compute withholding allowances or to enter an additional.