Form K-40 Svr

Form K-40 Svr - Your kansas filing status must be the same as your federal filing status. If your federal filing status is qualifying widow(er) with. Web filing information filing status: Kansas income tax, kansas dept. This allows a property tax refund for senior citizens or disabled veterans, which is. Web what do i need to file? Web enter the result here and on line 18 of this form: You can prepare a 2022 kansas tax amendment form on efile.com, however you can not submit it. Why does the schedule s not display in webfile? You can download or print current.

You can download or print current. Web enter the result here and on line 18 of this form: Why does the schedule s not display in webfile? Kansas income tax, kansas dept. If your federal filing status is qualifying widow(er) with. Mailing address (number and street, including rural route) city, town, or post. What should i do if my address changed since i filed my last kansas tax form? This allows a property tax refund for senior citizens or disabled veterans, which is. This allows a property tax refund for senior citizens or disabled veterans, which is. Your kansas filing status must be the same as your federal filing status.

This allows a property tax refund for senior citizens or disabled veterans, which is. Web enter the result here and on line 18 of this form: You can download or print current. Web filing information filing status: Your kansas filing status must be the same as your federal filing status. Web what do i need to file? Why does the schedule s not display in webfile? Kansas income tax, kansas dept. Then you prepare your mo return as a resident, and fill out. This allows a property tax refund for senior citizens or disabled veterans, which is.

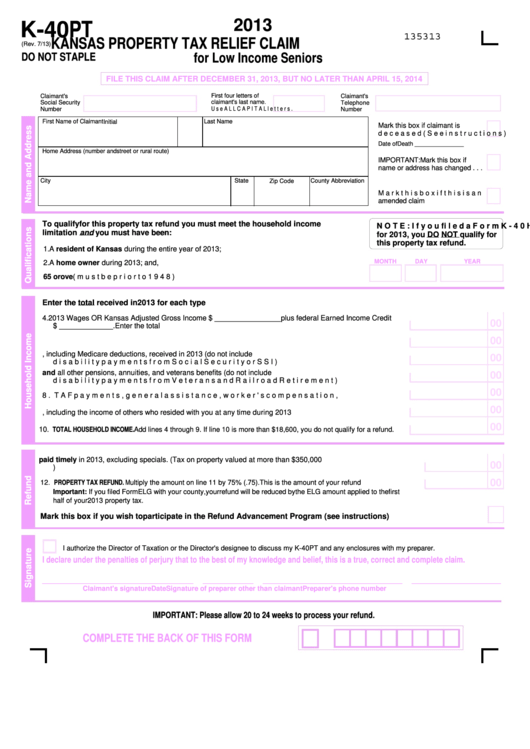

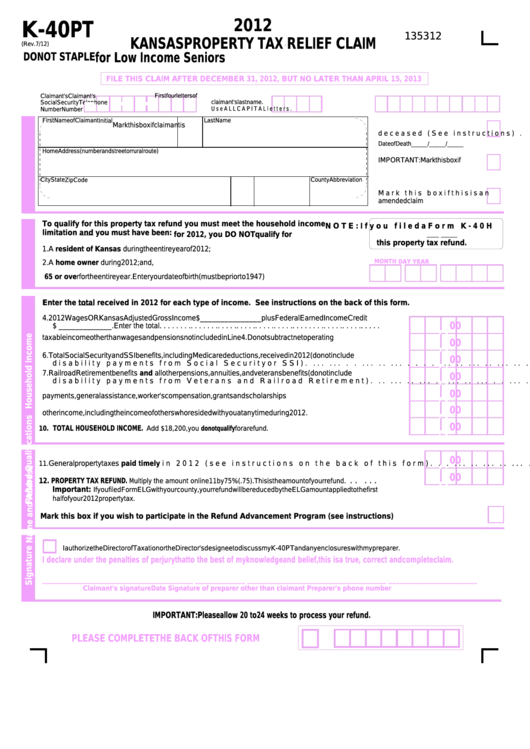

Fillable Form K40pt Kansas Property Tax Relief Claim For Low

Web what do i need to file? If your federal filing status is qualifying widow(er) with. What should i do if my address changed since i filed my last kansas tax form? Then you prepare your mo return as a resident, and fill out. Web enter the result here and on line 18 of this form:

H&K USP Compact TwoTone 40S&W for sale

Mailing address (number and street, including rural route) city, town, or post. If your federal filing status is qualifying widow(er) with. This allows a property tax refund for senior citizens or disabled veterans, which is. Then you prepare your mo return as a resident, and fill out. Web filing information filing status:

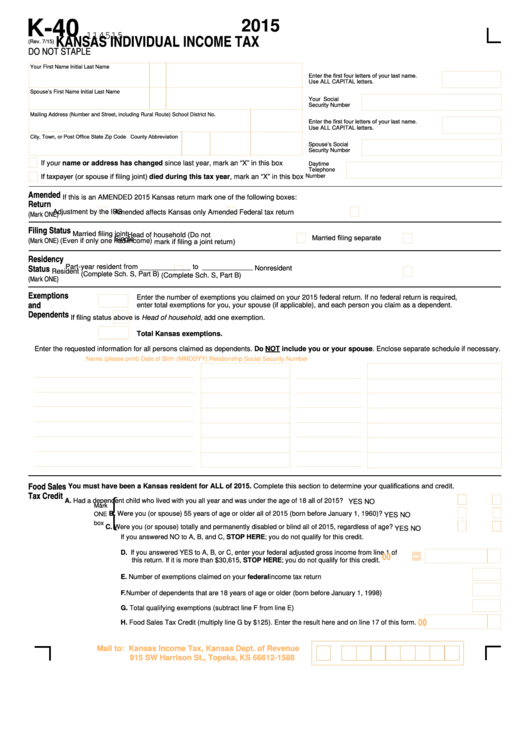

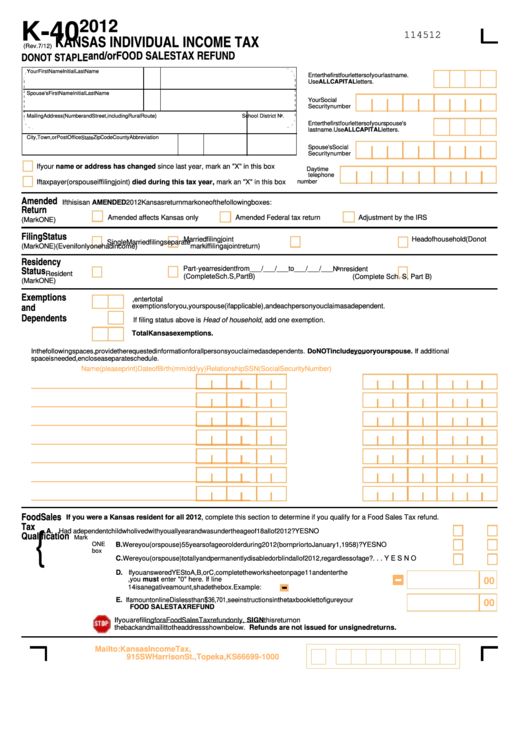

Fillable Form K40 Kansas Individual Tax Return 2015

Web filing information filing status: This allows a property tax refund for senior citizens or disabled veterans, which is. Then you prepare your mo return as a resident, and fill out. Web enter the result here and on line 18 of this form: Web what do i need to file?

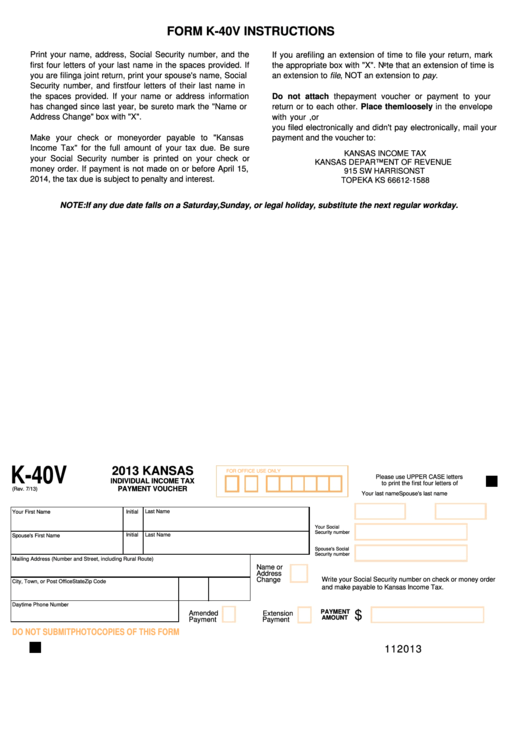

Fillable Form K40v Kansas Individual Tax Payment Voucher

Why does the schedule s not display in webfile? This allows a property tax refund for senior citizens or disabled veterans, which is. You can prepare a 2022 kansas tax amendment form on efile.com, however you can not submit it. This allows a property tax refund for senior citizens or disabled veterans, which is. Web enter the result here and.

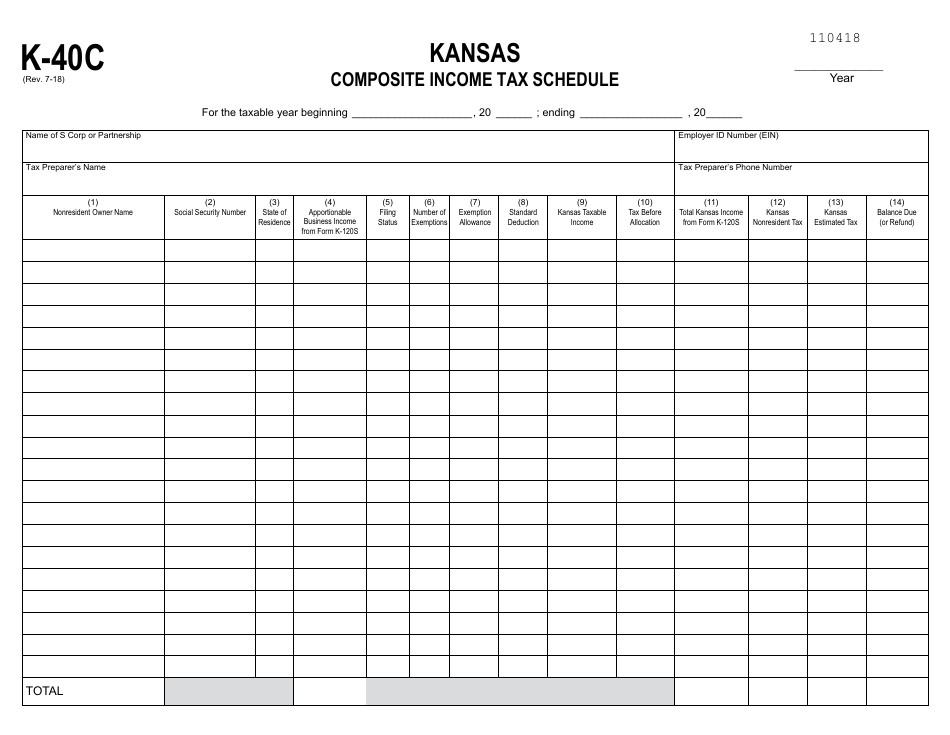

Form K40C Download Fillable PDF or Fill Online Composite Tax

Web filing information filing status: Web what do i need to file? Kansas income tax, kansas dept. Then you prepare your mo return as a resident, and fill out. You can prepare a 2022 kansas tax amendment form on efile.com, however you can not submit it.

2014 Form KS DoR K40 Fill Online, Printable, Fillable, Blank pdfFiller

Web what do i need to file? Web enter the result here and on line 18 of this form: This allows a property tax refund for senior citizens or disabled veterans, which is. Then you prepare your mo return as a resident, and fill out. Web filing information filing status:

Fillable Form K40 Pt Kansas Property Tax Relief Claim 2012

What should i do if my address changed since i filed my last kansas tax form? Web enter the result here and on line 18 of this form: Why does the schedule s not display in webfile? Kansas income tax, kansas dept. You can download or print current.

K40 2012 Kansas Individual Tax printable pdf download

Then you prepare your mo return as a resident, and fill out. Why does the schedule s not display in webfile? Mailing address (number and street, including rural route) city, town, or post. Web enter the result here and on line 18 of this form: This allows a property tax refund for senior citizens or disabled veterans, which is.

37 FREE DOWNLOAD K40 TAX FORM PDF DOC AND VIDEO TUTORIAL * Tax Form

Mailing address (number and street, including rural route) city, town, or post. Kansas income tax, kansas dept. You can prepare a 2022 kansas tax amendment form on efile.com, however you can not submit it. Your kansas filing status must be the same as your federal filing status. Why does the schedule s not display in webfile?

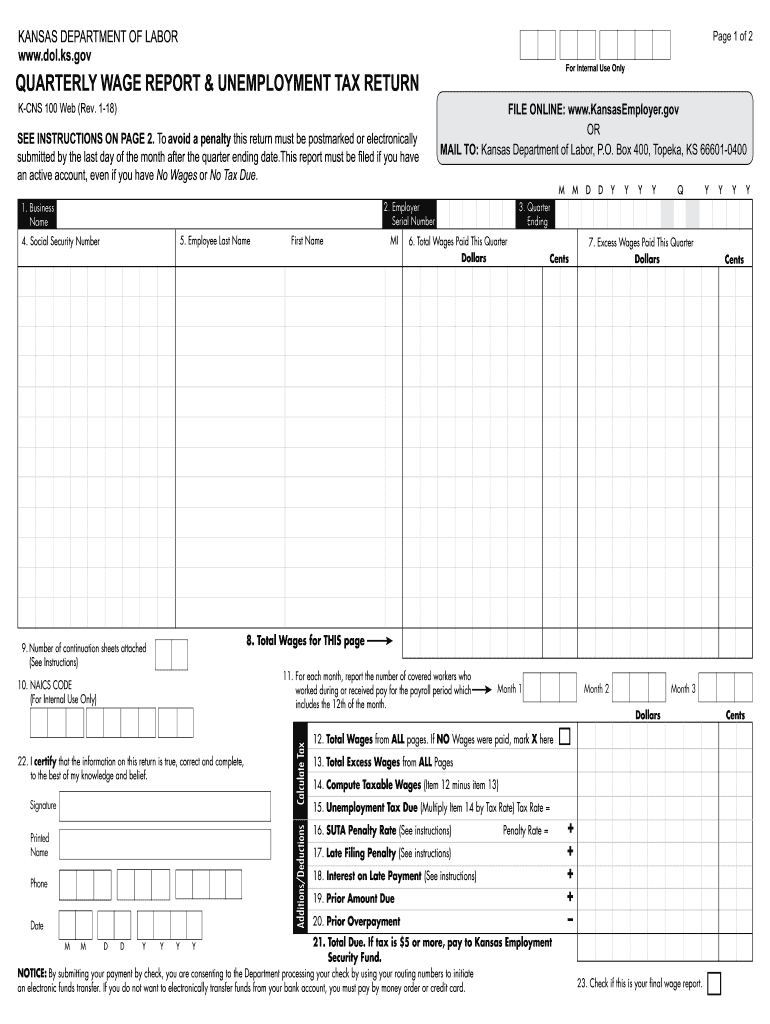

20182021 Form KS KCNS 100 Fill Online, Printable, Fillable, Blank

Mailing address (number and street, including rural route) city, town, or post. This allows a property tax refund for senior citizens or disabled veterans, which is. Kansas income tax, kansas dept. Mailing address (number and street, including rural route) city, town, or post. Then you prepare your mo return as a resident, and fill out.

Then You Prepare Your Mo Return As A Resident, And Fill Out.

Kansas income tax, kansas dept. Web what do i need to file? Why does the schedule s not display in webfile? Web filing information filing status:

This Allows A Property Tax Refund For Senior Citizens Or Disabled Veterans, Which Is.

Mailing address (number and street, including rural route) city, town, or post. You can prepare a 2022 kansas tax amendment form on efile.com, however you can not submit it. Your kansas filing status must be the same as your federal filing status. Web enter the result here and on line 18 of this form:

This Allows A Property Tax Refund For Senior Citizens Or Disabled Veterans, Which Is.

You can download or print current. Mailing address (number and street, including rural route) city, town, or post. If your federal filing status is qualifying widow(er) with. What should i do if my address changed since i filed my last kansas tax form?