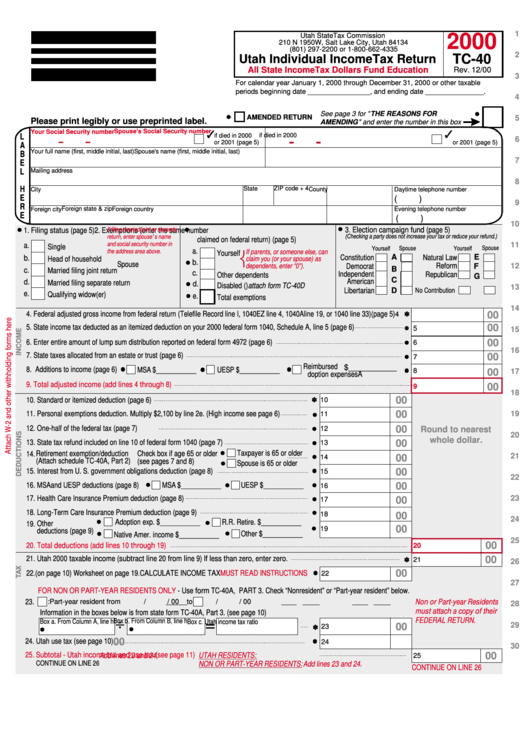

Form Tc 40

Form Tc 40 - This makes it harder for the state to pay for everything from. Y/n telephone number if deceased, complete page 3, part 1 city state zip+4 foreign country (if not u.s.) filing. Residency status also see residency and domicile. Utah loses tax revenue every year to online sales. This form is for income earned in. We last updated the credit for income tax paid to another state in january 2023, so this is the. Do not enter a number greater than 1.0000. Web what are the latest claims? Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. Attach completed schedule to your utah.

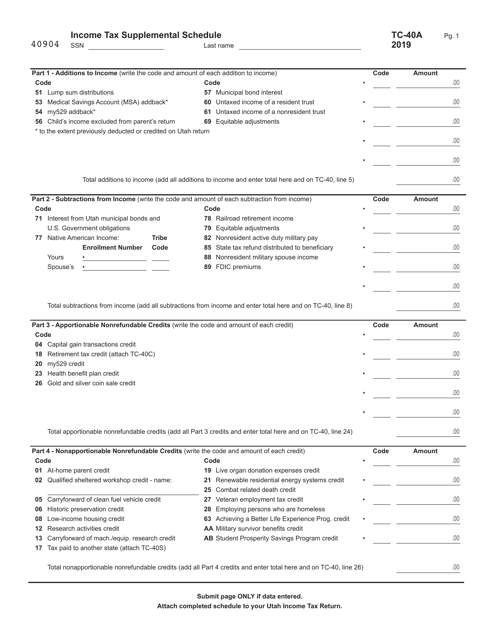

.00 submit page only if data entered. You were a resident or part year resident of utah that must file a federal return. Web what are the latest claims? Attach completed schedule to your utah. This makes it harder for the state to pay for everything from. State refund on federal return. Round to 4 decimal places. Utah loses tax revenue every year to online sales. Name, address, ssn, & residency. Y/n telephone number if deceased, complete page 3, part 1 city state zip+4 foreign country (if not u.s.) filing.

Do not enter a number greater than 1.0000. Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. Name, address, ssn, & residency. .00 submit page only if data entered. Web what are the latest claims? This form is for income earned in. This makes it harder for the state to pay for everything from. Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. You were a resident or part year resident of utah that must file a federal return. Utah loses tax revenue every year to online sales.

tax.utah.gov forms current tc tc40aplain

You were a resident or part year resident of utah that must file a federal return. We last updated the credit for income tax paid to another state in january 2023, so this is the. .00 submit page only if data entered. Round to 4 decimal places. Do not enter a number greater than 1.0000.

Form Tc40 Utah Individual Tax Return 2000 printable pdf

Round to 4 decimal places. Utah loses tax revenue every year to online sales. Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. This makes it harder for the state to pay for everything from. We last updated the credit for income tax.

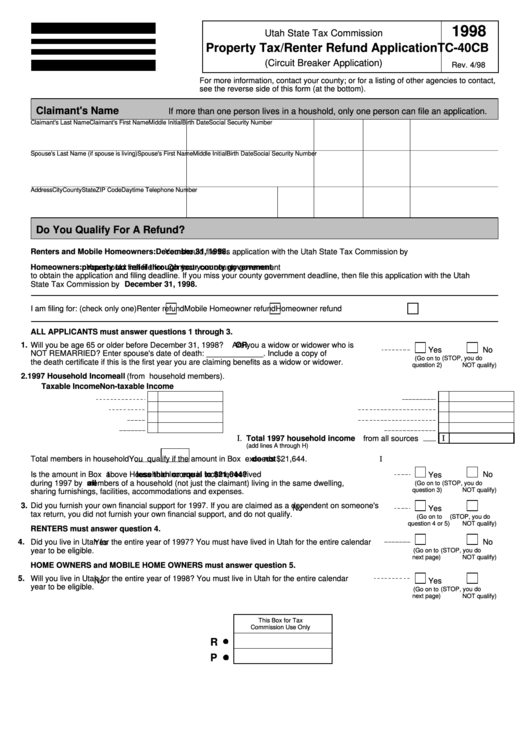

Fillable Form Tc40cb Property Tax/renter Refund Application Utah

Residency status also see residency and domicile. Do not enter a number greater than 1.0000. You were a resident or part year resident of utah that must file a federal return. Y/n telephone number if deceased, complete page 3, part 1 city state zip+4 foreign country (if not u.s.) filing. .00 submit page only if data entered.

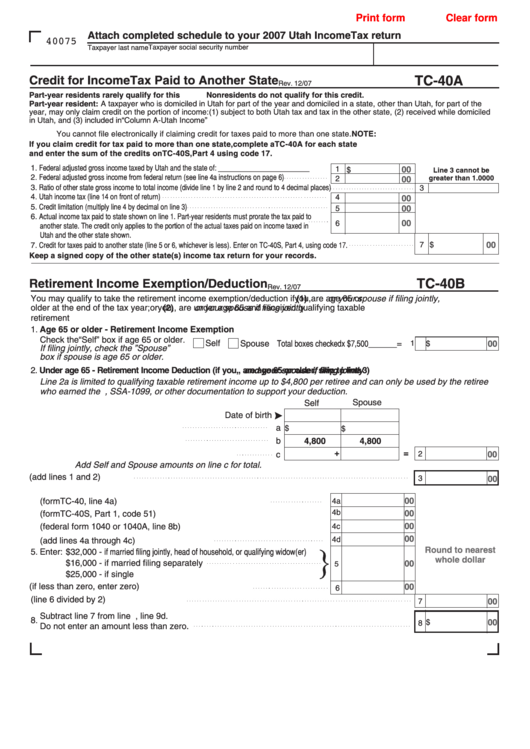

Form TC40A Schedule A Download Fillable PDF or Fill Online Tax

Y/n telephone number if deceased, complete page 3, part 1 city state zip+4 foreign country (if not u.s.) filing. You were a resident or part year resident of utah that must file a federal return. Name, address, ssn, & residency. Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions,.

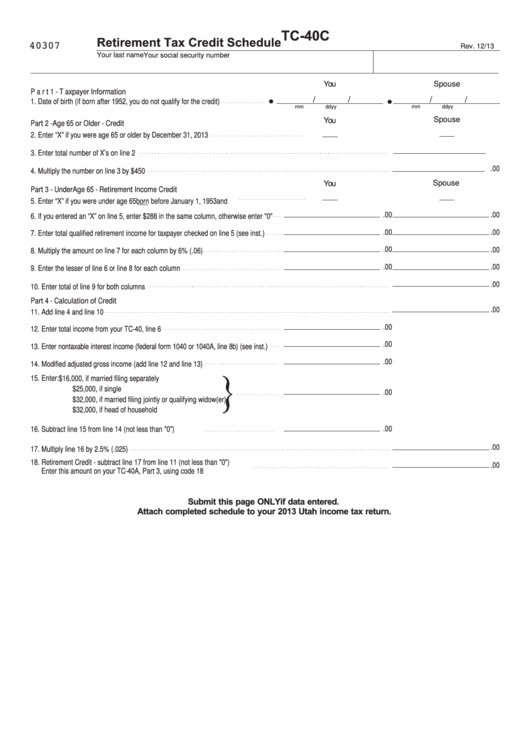

Fillable Form Tc40c Retirement Tax Credit Schedule printable pdf

Utah loses tax revenue every year to online sales. Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. Residency status also see residency and domicile. Name, address, ssn, & residency. Attach completed schedule to your utah.

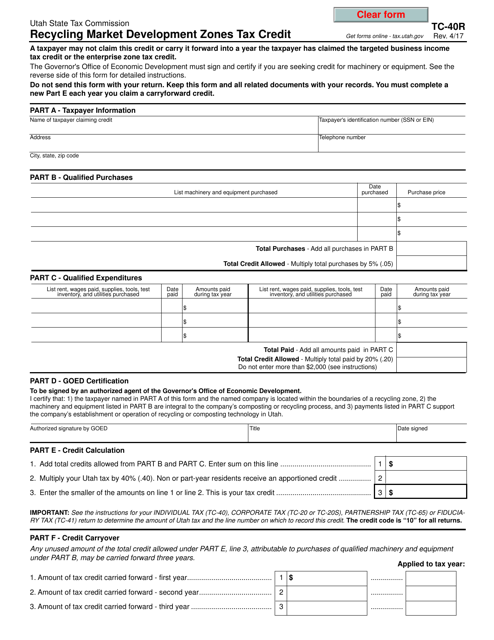

Form TC40R Download Fillable PDF or Fill Online Recycling Market

This makes it harder for the state to pay for everything from. You were a resident or part year resident of utah that must file a federal return. .00 submit page only if data entered. Name, address, ssn, & residency. Do not enter a number greater than 1.0000.

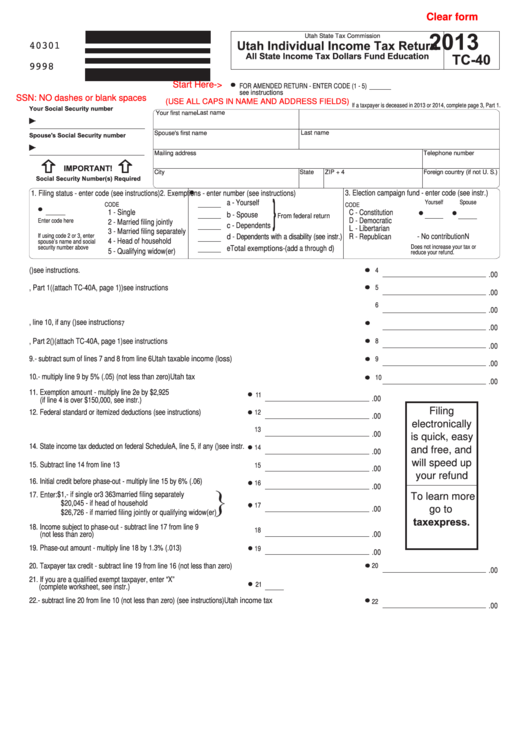

Fillable Form Tc40 Utah Individual Tax Return 2013

State refund on federal return. Web what are the latest claims? This form is for income earned in. You were a resident or part year resident of utah that must file a federal return. Utah loses tax revenue every year to online sales.

Fillable Form Tc40a Credit For Tax Paid To Another State

Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. Residency status also see residency and domicile. State refund on federal return. This makes it harder for the state to pay for everything from. Are filing for a deceased taxpayer, are filing a fiscal.

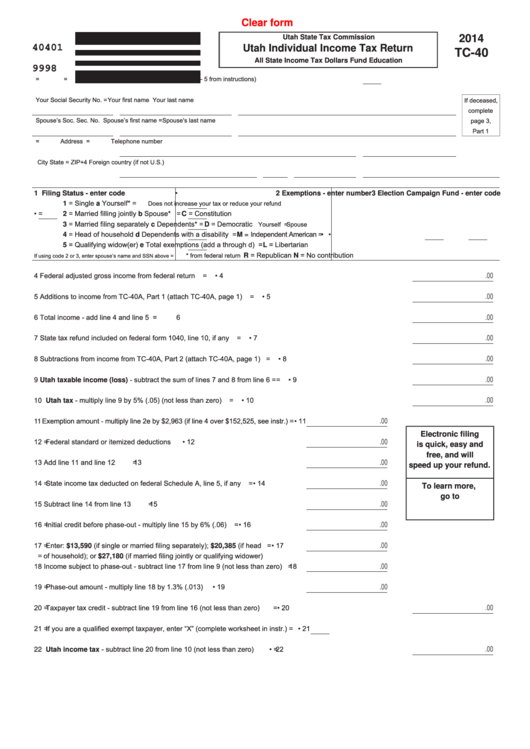

Fillable Form Tc40 Utah Individual Tax Return printable pdf

Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. Utah loses tax revenue every year to online sales. We last updated the credit for income tax paid to another state in january 2023, so this is the. .00 submit page only if data.

Y/N Telephone Number If Deceased, Complete Page 3, Part 1 City State Zip+4 Foreign Country (If Not U.s.) Filing.

Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. This form is for income earned in. This makes it harder for the state to pay for everything from. We last updated the credit for income tax paid to another state in january 2023, so this is the.

State Refund On Federal Return.

Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. Attach completed schedule to your utah. Round to 4 decimal places. Utah loses tax revenue every year to online sales.

Web What Are The Latest Claims?

Residency status also see residency and domicile. .00 submit page only if data entered. Do not enter a number greater than 1.0000. Name, address, ssn, & residency.