Form W 4P Instructions

Form W 4P Instructions - Select one withholding method of your choice: Web if you elect federal withholding, you are an iowa resident, and your benefit is more than $6,000 per year ($12,000 if married), withholding for iowa income tax is required, unless. Section references are to the internal revenue. Web form w‐4p is for u.s. If you do not want any. Web pages 2 and 3. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. It will walk you through each step and explain how to complete each data entry field on the. Your previously filed form w‐4p will remain in effect if you don’t file a form w‐4p for 2019. Web applicable form instructions and publications will be updated with this information for 2023.

It will walk you through each step and explain how to complete each data entry field on the. Use the form below to notify the railroad retirement. Web applicable form instructions and publications will be updated with this information for 2023. Web if you elect federal withholding, you are an iowa resident, and your benefit is more than $6,000 per year ($12,000 if married), withholding for iowa income tax is required, unless. Your previously filed form w‐4p will remain in effect if you don’t file a form w‐4p for 2019. For the latest information about any future developments related to irs. Section references are to the internal revenue. Web general instructions part of your railroad retirement benefits may be subject to federal income tax withholding. Web general instructions section references are to the internal revenue code. Select one withholding method of your choice:

Web the method and rate of withholding depend on (a) the kind of payment you receive; Use the form below to notify the railroad retirement. Return the completed form to the division of retirement. Select one withholding method of your choice: It will walk you through each step and explain how to complete each data entry field on the. Web if you elect federal withholding, you are an iowa resident, and your benefit is more than $6,000 per year ($12,000 if married), withholding for iowa income tax is required, unless. Web form w‐4p is for u.s. It is used by a payee to change the default withholding election on ineligible. If you do not want any. Web general instructions section references are to the internal revenue code.

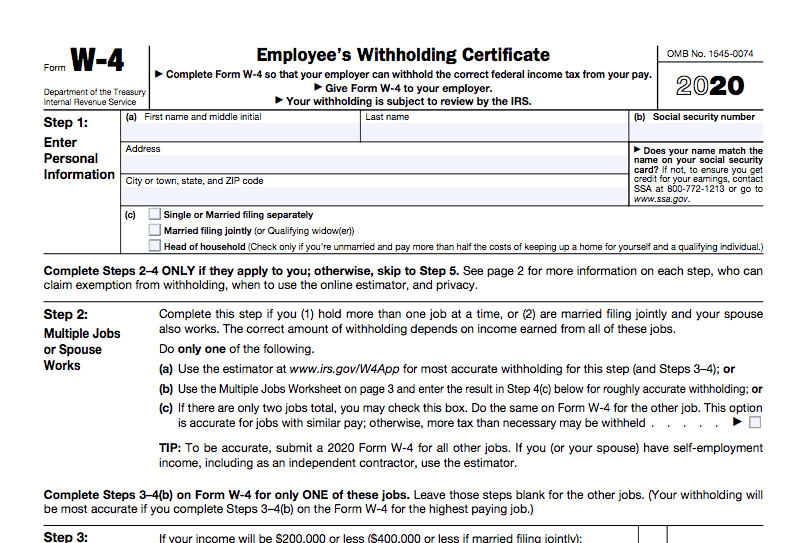

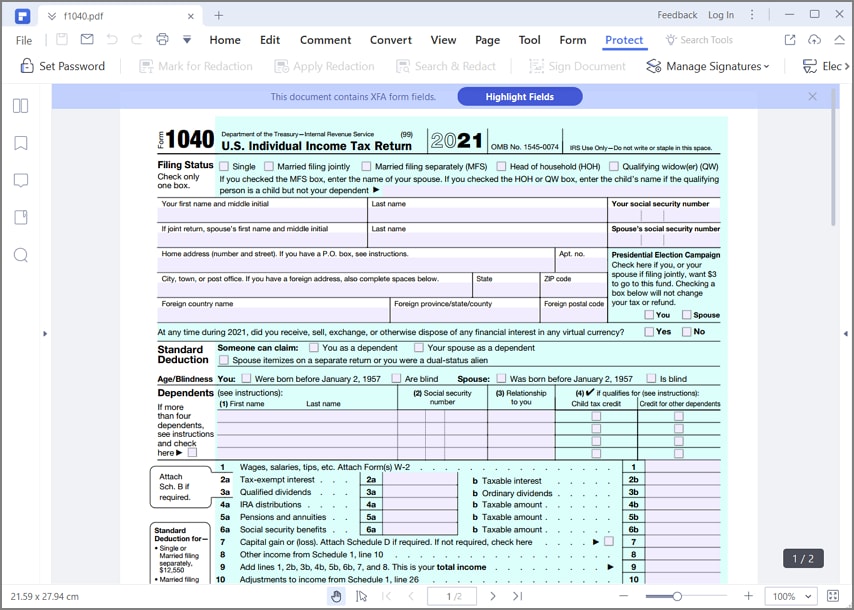

2020 Form W4P. Withholding Certificate For Pension Or Annuity Payments

Web general instructions part of your railroad retirement benefits may be subject to federal income tax withholding. It will walk you through each step and explain how to complete each data entry field on the. Web form w‐4p is for u.s. For the latest information about any future developments related to irs. Select one withholding method of your choice:

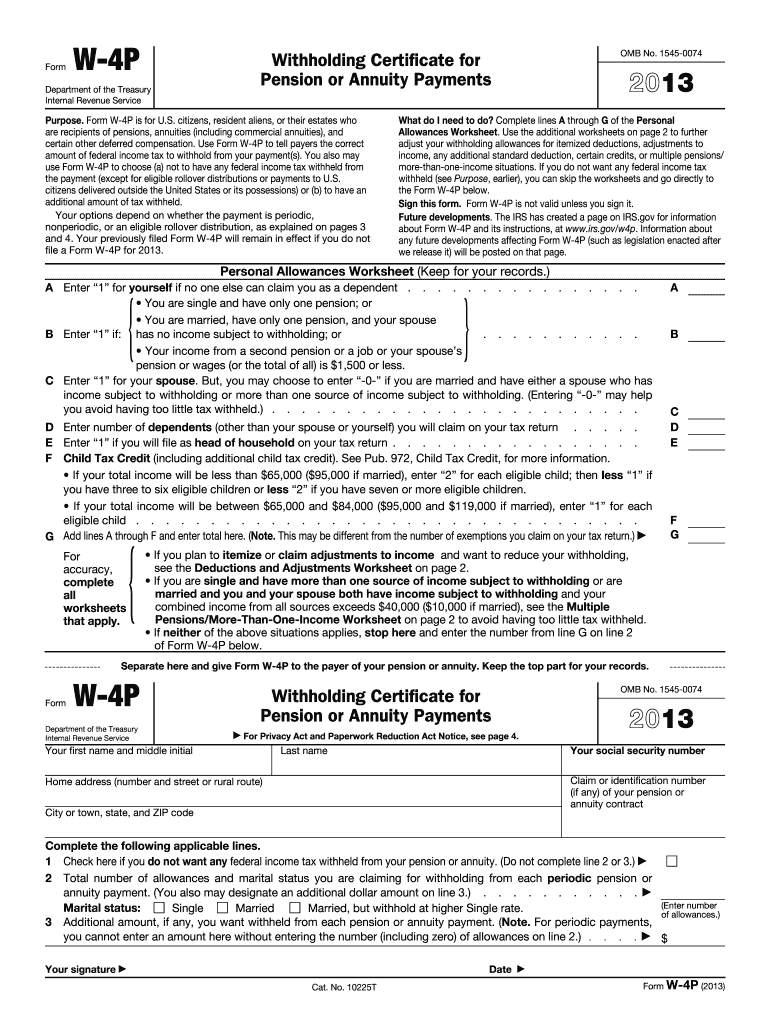

2013 Form IRS W4P Fill Online, Printable, Fillable, Blank pdfFiller

Web form w‐4p is for u.s. For the latest information about any future developments related to irs. Use the form below to notify the railroad retirement. It is used by a payee to change the default withholding election on ineligible. We have combined income from no jobs.

Blank W 4 2020 2022 W4 Form

For the latest information about any future developments related to irs. It will walk you through each step and explain how to complete each data entry field on the. Web if you elect federal withholding, you are an iowa resident, and your benefit is more than $6,000 per year ($12,000 if married), withholding for iowa income tax is required, unless..

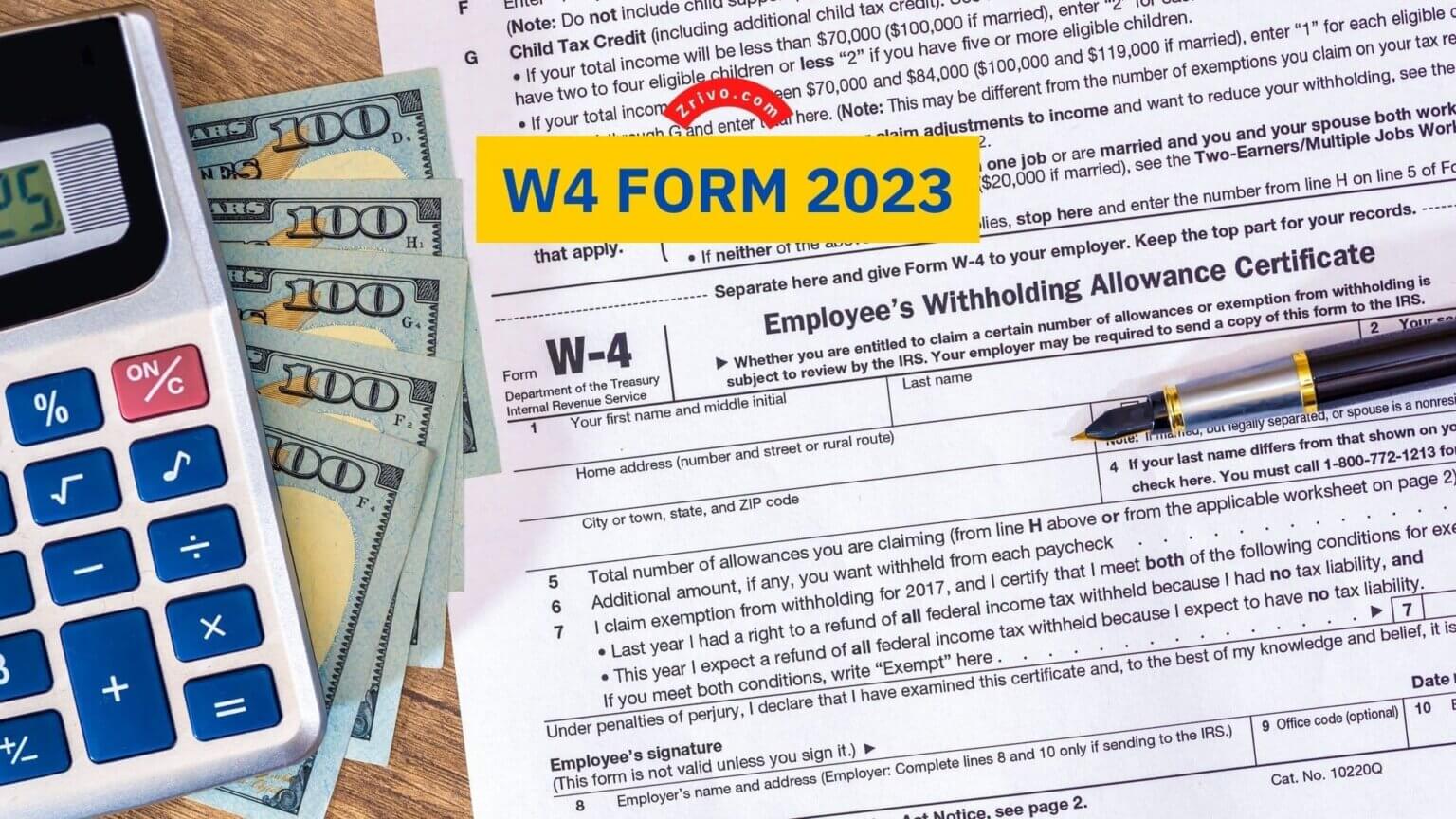

W4 Form 2023

For the latest information about any future developments related to irs. Web applicable form instructions and publications will be updated with this information for 2023. Your previously filed form w‐4p will remain in effect if you don’t file a form w‐4p for 2019. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain.

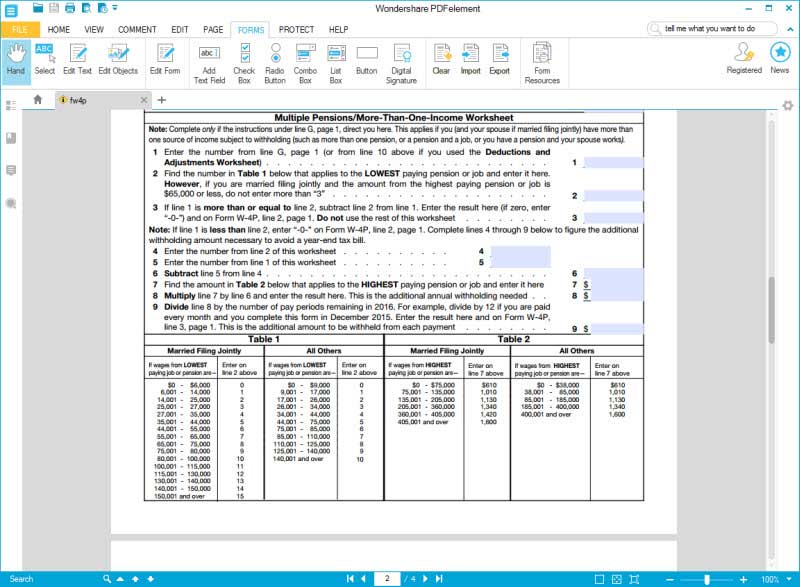

IRS Form W4P Fill it out in an Efficient Way

Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. Web the method and rate of withholding depend on (a) the kind of payment you receive; Web applicable form instructions and publications will be updated with this information for 2023. Web pages 2 and 3. (b) whether the payments are to.

IRS Form W4P Fill it out in an Efficient Way

Web pages 2 and 3. It will walk you through each step and explain how to complete each data entry field on the. It is used by a payee to change the default withholding election on ineligible. Web the method and rate of withholding depend on (a) the kind of payment you receive; Select one withholding method of your choice:

Owe the IRS? Got a big refund? Adjust your withholding Don't Mess

Your previously filed form w‐4p will remain in effect if you don’t file a form w‐4p for 2019. If you do not want any. (b) whether the payments are to be delivered outside the united states or its. Select one withholding method of your choice: Web general instructions section references are to the internal revenue code.

W4 Form 2022 Instructions

Web the method and rate of withholding depend on (a) the kind of payment you receive; Web general instructions part of your railroad retirement benefits may be subject to federal income tax withholding. Web if you elect federal withholding, you are an iowa resident, and your benefit is more than $6,000 per year ($12,000 if married), withholding for iowa income.

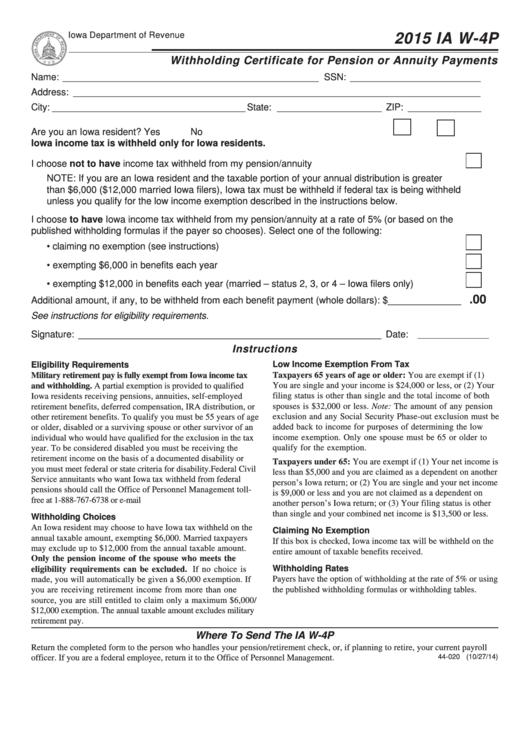

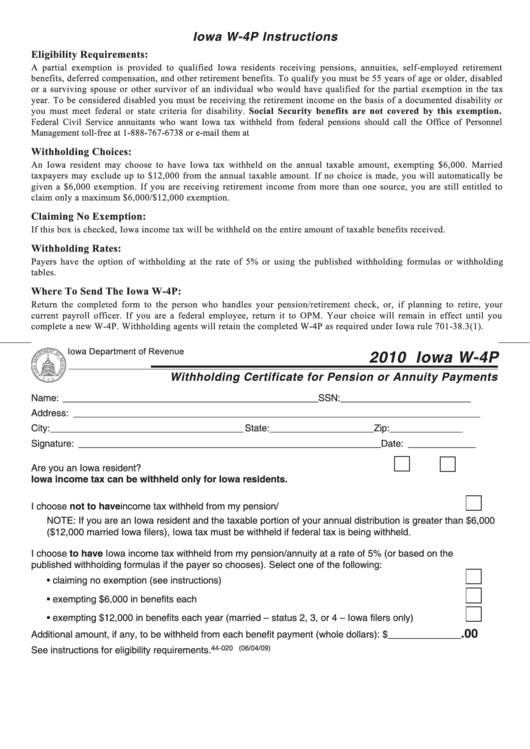

Fillable Iowa Form W4p Withholding Certificate For Pension Or

Web if you elect federal withholding, you are an iowa resident, and your benefit is more than $6,000 per year ($12,000 if married), withholding for iowa income tax is required, unless. Section references are to the internal revenue. For the latest information about any future developments related to irs. Web form w‐4p is for u.s. Return the completed form to.

Form Iowa W4p Withholding Certificate For Pension Or Annuity

Web general instructions section references are to the internal revenue code. Web pages 2 and 3. For the latest information about any future developments related to irs. Web general instructions part of your railroad retirement benefits may be subject to federal income tax withholding. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and.

We Have Combined Income From No Jobs.

It is used by a payee to change the default withholding election on ineligible. If you do not want any. Return the completed form to the division of retirement. Web if you elect federal withholding, you are an iowa resident, and your benefit is more than $6,000 per year ($12,000 if married), withholding for iowa income tax is required, unless.

For The Latest Information About Any Future Developments Related To Irs.

Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. Your previously filed form w‐4p will remain in effect if you don’t file a form w‐4p for 2019. Use the form below to notify the railroad retirement. Web general instructions part of your railroad retirement benefits may be subject to federal income tax withholding.

Web The Method And Rate Of Withholding Depend On (A) The Kind Of Payment You Receive;

Section references are to the internal revenue. Web general instructions section references are to the internal revenue code. Web pages 2 and 3. (b) whether the payments are to be delivered outside the united states or its.

It Will Walk You Through Each Step And Explain How To Complete Each Data Entry Field On The.

Web form w‐4p is for u.s. Web applicable form instructions and publications will be updated with this information for 2023. Select one withholding method of your choice: