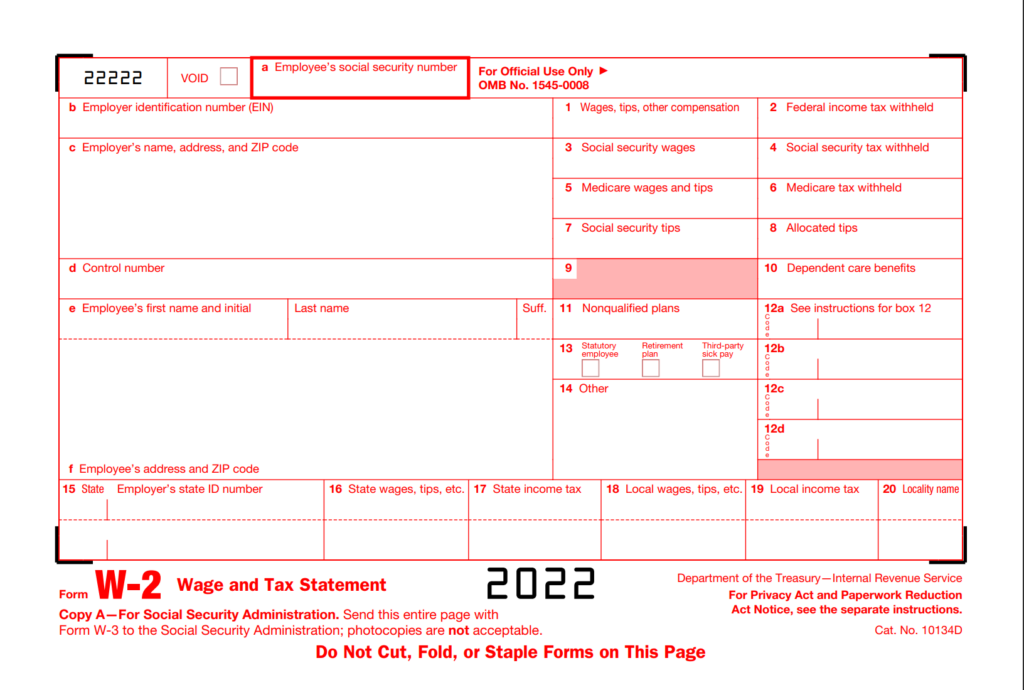

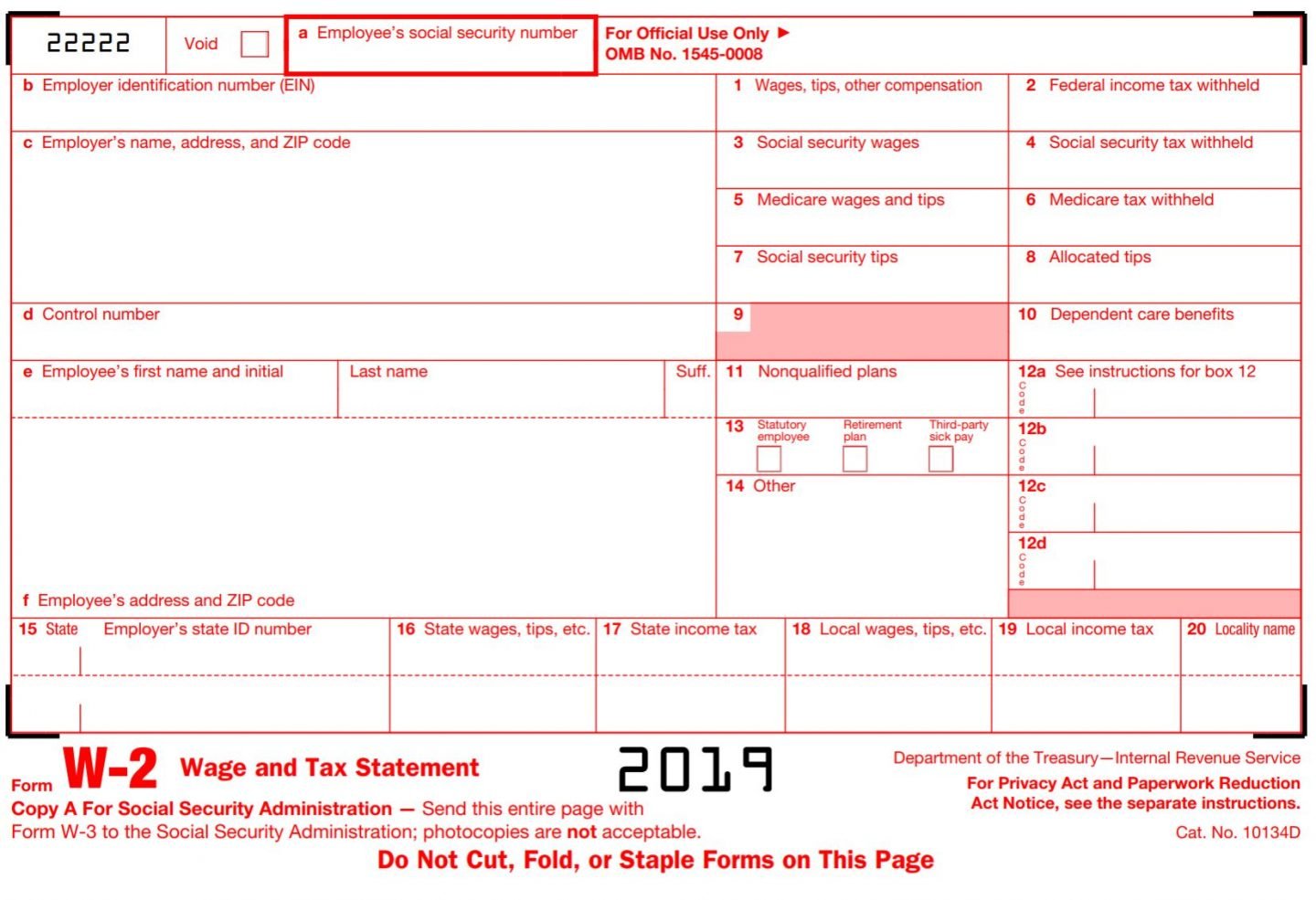

Form W2 Code Dd

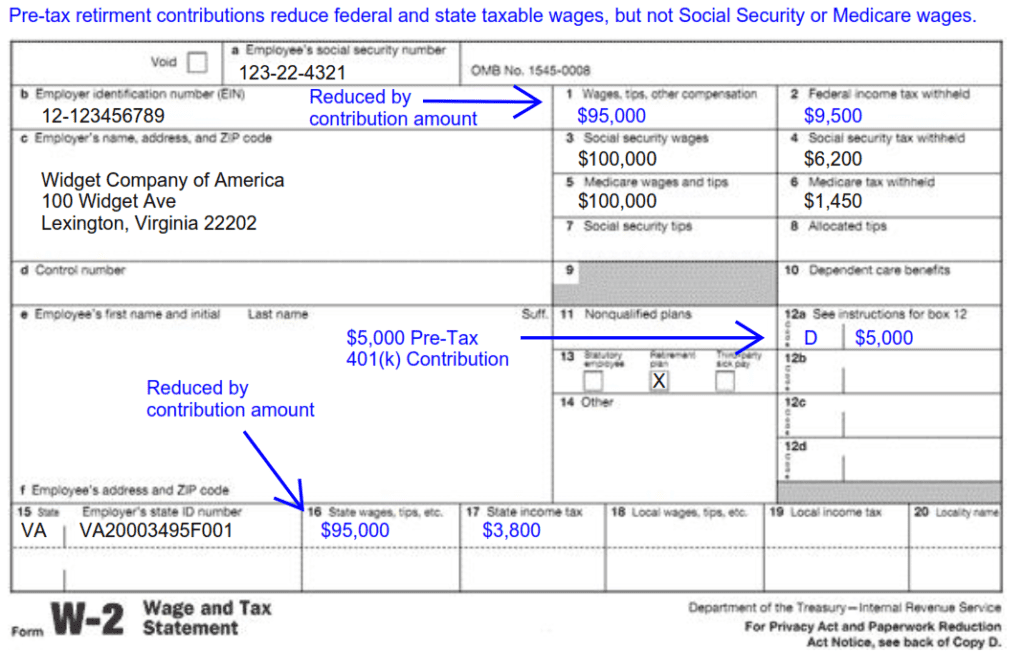

Form W2 Code Dd - Reporting the cost of group health insurance. Web 22222 employer identification number (ein) omb no. Web dd is the code for how much your employer paid for your medical insurance. The w2 form is an essential document for both employers and employees in the united states. This code indicates the amount of money spent by an employer on health coverage for. Copy 1—for state, city, or local tax department 2020 copy b—to be filed with employee’s. It's an informational number and does not affect your return. Web how to calculate the amount for code dd. This won’t change the tax return address. You may need this information to complete the tax return.

Web how to calculate the amount for code dd. Web 22222 employer identification number (ein) omb no. Military spouses residency relief act (msrra). Copy 1—for state, city, or local tax department 2020 copy b—to be filed with employee’s. This won’t change the tax return address. This code indicates the amount of money spent by an employer on health coverage for. You may need this information to complete the tax return. Web dd is the code for how much your employer paid for your medical insurance. The purpose of this report is to inform the employees about their health. Reporting the cost of group health insurance.

Uncollected social security or rrta tax on tips. Military spouses residency relief act (msrra). june 1, 2019 8:26 am Web dd is the code for how much your employer paid for your medical insurance. The purpose of this report is to inform the employees about their health. Copy 1—for state, city, or local tax department 2020 copy b—to be filed with employee’s. This won’t change the tax return address. Web 22222 employer identification number (ein) omb no. This code indicates the amount of money spent by an employer on health coverage for. It's an informational number and does not affect your return.

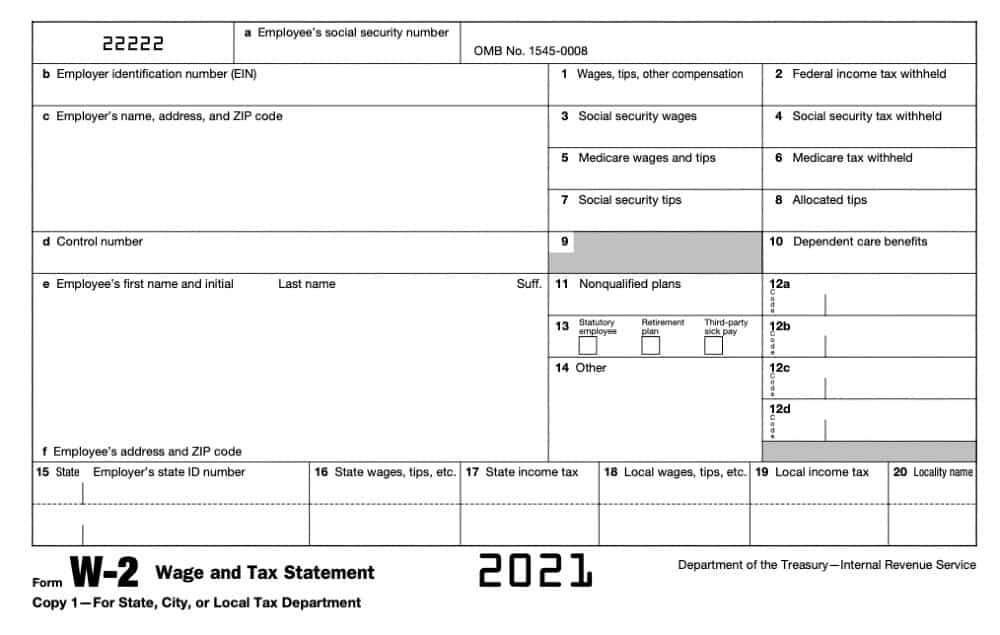

W2 Form 2021

Uncollected social security or rrta tax on tips. You may need this information to complete the tax return. The w2 form is an essential document for both employers and employees in the united states. Military spouses residency relief act (msrra). Copy 1—for state, city, or local tax department 2020 copy b—to be filed with employee’s.

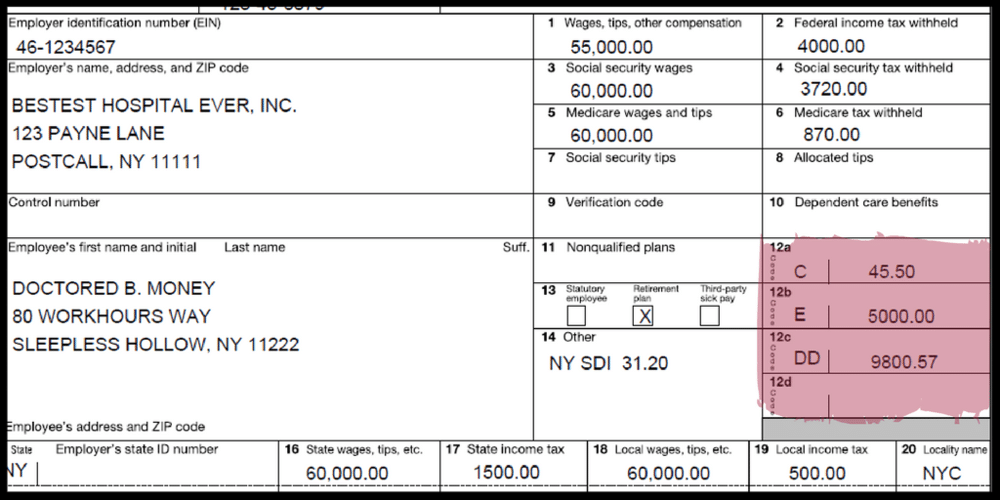

The Cleaning Authority Employee W2 Form W2 Form 2023

Military spouses residency relief act (msrra). It's an informational number and does not affect your return. Copy 1—for state, city, or local tax department 2020 copy b—to be filed with employee’s. Reporting the cost of group health insurance. Web 22222 employer identification number (ein) omb no.

W2 Worksheet Balancing Equations Worksheet

june 1, 2019 8:26 am Web dd is the code for how much your employer paid for your medical insurance. Copy 1—for state, city, or local tax department 2020 copy b—to be filed with employee’s. Web how to calculate the amount for code dd. It's an informational number and does not affect your return.

Form W2 Everything You Ever Wanted To Know

june 1, 2019 8:26 am Web how to calculate the amount for code dd. Uncollected social security or rrta tax on tips. Military spouses residency relief act (msrra). It's an informational number and does not affect your return.

An Employer’s Guide to Easily Completing a W2 Form Gift CPAs

This code indicates the amount of money spent by an employer on health coverage for. It's an informational number and does not affect your return. Military spouses residency relief act (msrra). Reporting the cost of group health insurance. Web 22222 employer identification number (ein) omb no.

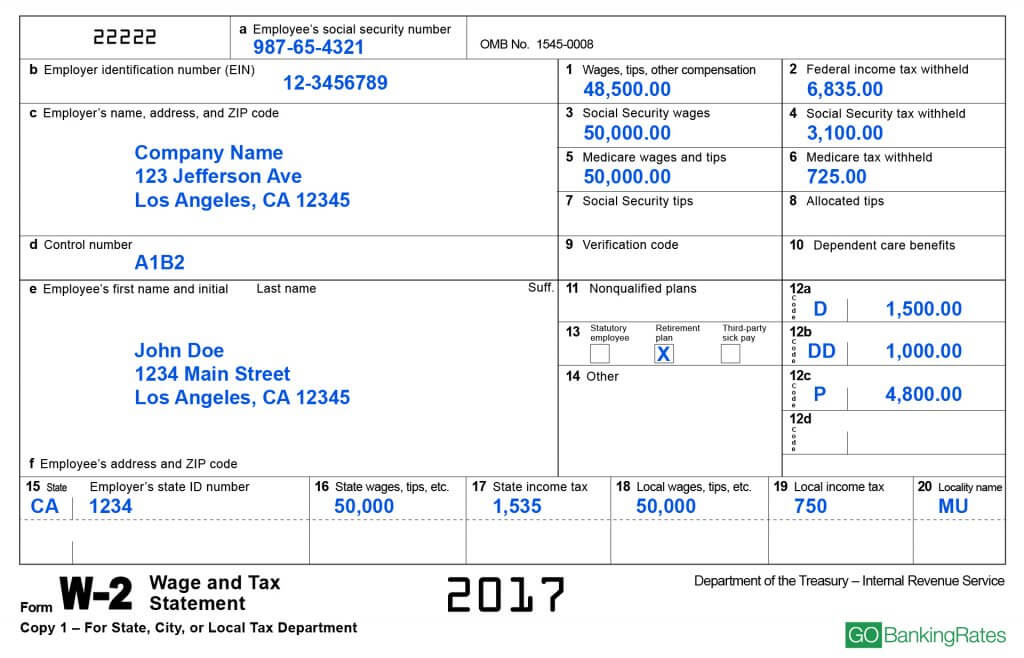

How to Fill Out a W2 Form

It's an informational number and does not affect your return. This code indicates the amount of money spent by an employer on health coverage for. june 1, 2019 8:26 am You may need this information to complete the tax return. Web dd is the code for how much your employer paid for your medical insurance.

The Main Differences Between Forms W2 and W4 Chamber of Commerce

The purpose of this report is to inform the employees about their health. Copy 1—for state, city, or local tax department 2020 copy b—to be filed with employee’s. It's an informational number and does not affect your return. Web 22222 employer identification number (ein) omb no. The w2 form is an essential document for both employers and employees in the.

What Is a W2 Form? GOBankingRates

It's an informational number and does not affect your return. Copy 1—for state, city, or local tax department 2020 copy b—to be filed with employee’s. june 1, 2019 8:26 am Reporting the cost of group health insurance. This code indicates the amount of money spent by an employer on health coverage for.

Form W2 Understanding How It Works & How to Get a Copy NerdWallet

It's an informational number and does not affect your return. The w2 form is an essential document for both employers and employees in the united states. june 1, 2019 8:26 am You may need this information to complete the tax return. This won’t change the tax return address.

Understanding Tax Season Form W2 Remote Financial Planner

The w2 form is an essential document for both employers and employees in the united states. This code indicates the amount of money spent by an employer on health coverage for. Web how to calculate the amount for code dd. Web 22222 employer identification number (ein) omb no. june 1, 2019 8:26 am

Copy 1—For State, City, Or Local Tax Department 2020 Copy B—To Be Filed With Employee’s.

Web dd is the code for how much your employer paid for your medical insurance. Uncollected social security or rrta tax on tips. The purpose of this report is to inform the employees about their health. Reporting the cost of group health insurance.

Web How To Calculate The Amount For Code Dd.

The w2 form is an essential document for both employers and employees in the united states. Web 22222 employer identification number (ein) omb no. This code indicates the amount of money spent by an employer on health coverage for. june 1, 2019 8:26 am

You May Need This Information To Complete The Tax Return.

This won’t change the tax return address. Military spouses residency relief act (msrra). It's an informational number and does not affect your return.