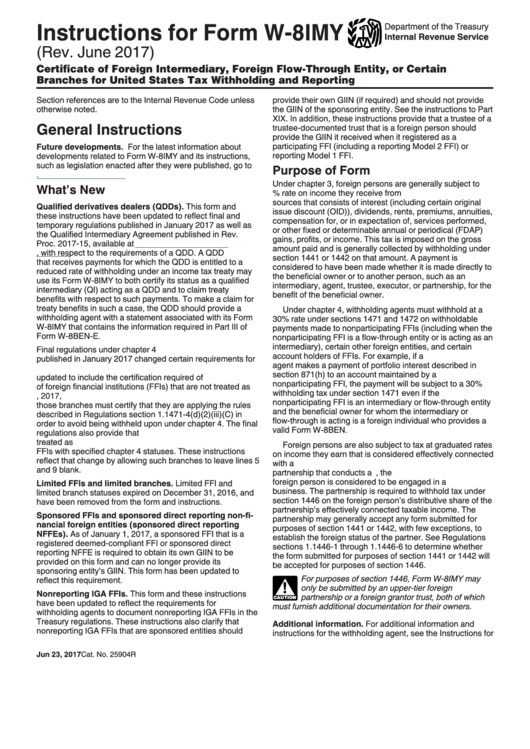

Form W8Imy Instructions

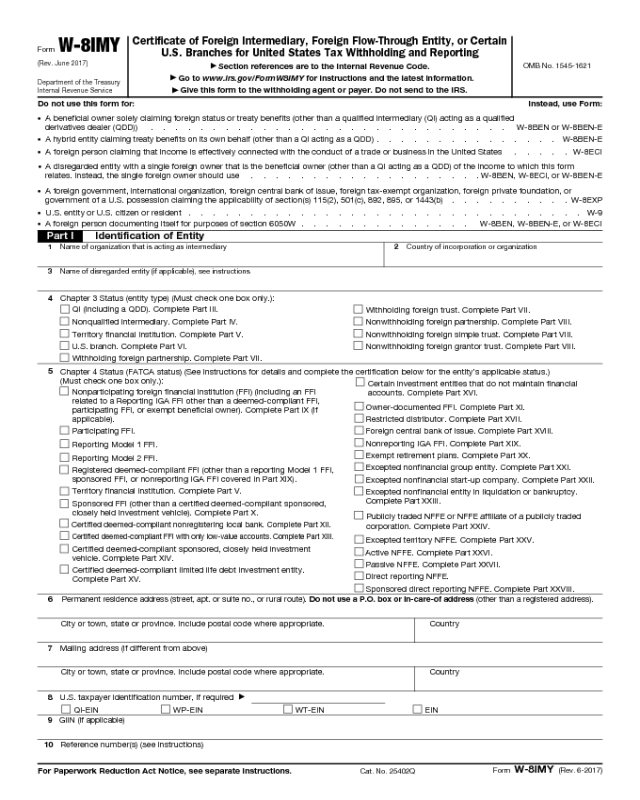

Form W8Imy Instructions - For a sole proprietorship, list the business owner’s name line 2: The updates were necessary, in part, due to the 2017 tax law (pub. October 2021) to allow an nqi that is to provide alternative withholding statements and beneficial owner withholding certificates for payments associated with this form to represent on the form that the information on the withholding certificates will be verified for consistency as. October 2021) department of the treasury internal revenue service. Branches for united states tax withholding and reporting and its associated instructions. Branches for united states tax withholding and reporting. Branches for united states tax withholding and reporting. Represent that a foreign person is a qualified intermediary or nonqualified. List the full legal name on your income tax return; Qi/wp or wt ein must match the number on line 8 of the form.

The updates were necessary, in part, due to the 2017 tax law (pub. Branches for united states tax withholding and reporting and its associated instructions. List the full name of the entity that is the beneficial owner Section references are to the internal revenue code. Represent that a foreign person is a qualified intermediary or nonqualified. October 2021) to allow an nqi that is to provide alternative withholding statements and beneficial owner withholding certificates for payments associated with this form to represent on the form that the information on the withholding certificates will be verified for consistency as. Branches for united states tax withholding and reporting. Qi/wp or wt ein must match the number on line 8 of the form. For a sole proprietorship, list the business owner’s name line 2: October 2021) department of the treasury internal revenue service.

List the full legal name on your income tax return; Branches for united states tax withholding and reporting. Qi/wp or wt ein must match the number on line 8 of the form. The updates were necessary, in part, due to the 2017 tax law (pub. Branches for united states tax withholding and reporting and its associated instructions. October 2021) to allow an nqi that is to provide alternative withholding statements and beneficial owner withholding certificates for payments associated with this form to represent on the form that the information on the withholding certificates will be verified for consistency as. This form may serve to establish foreign status for purposes of. Represent that a foreign person is a qualified intermediary or nonqualified. Branches for united states tax withholding and reporting. October 2021) department of the treasury internal revenue service.

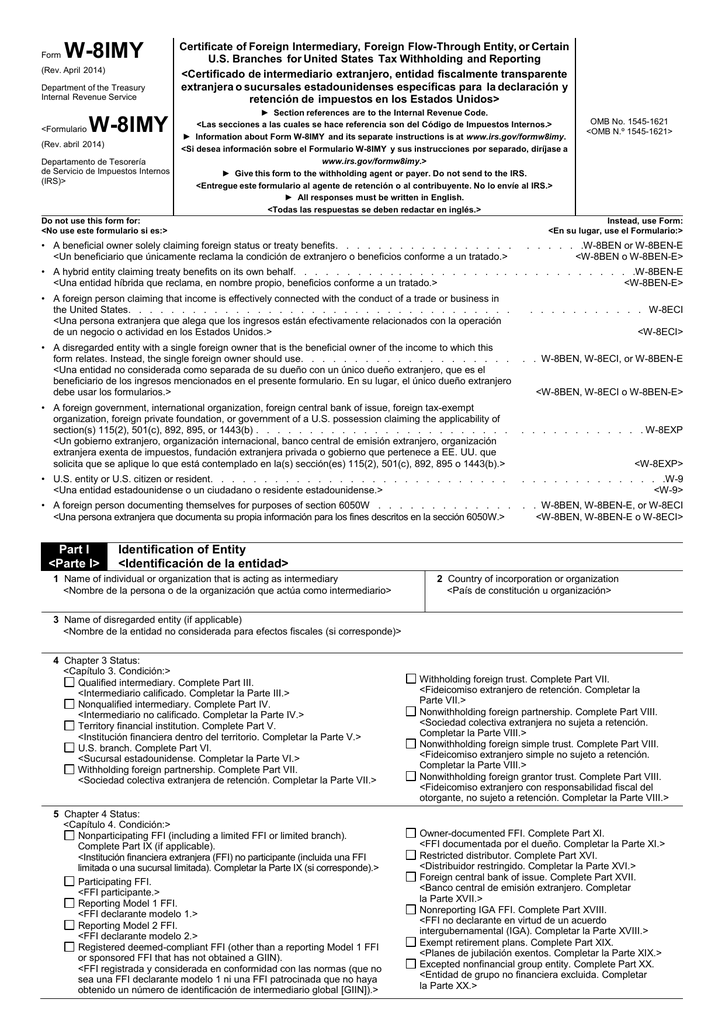

Form W8IMY Certificate of Foreign Intermediary, Foreign Flowthrough

This form may serve to establish foreign status for purposes of. For a sole proprietorship, list the business owner’s name line 2: Branches for united states tax withholding and reporting and its associated instructions. Branches for united states tax withholding and reporting. The updates were necessary, in part, due to the 2017 tax law (pub.

Form W 8imy Instructions

Qi/wp or wt ein must match the number on line 8 of the form. For a sole proprietorship, list the business owner’s name line 2: Branches for united states tax withholding and reporting. Branches for united states tax withholding and reporting. Section references are to the internal revenue code.

Form W8IMY Edit, Fill, Sign Online Handypdf

Section references are to the internal revenue code. List the full legal name on your income tax return; Branches for united states tax withholding and reporting. Qi/wp or wt ein must match the number on line 8 of the form. The updates were necessary, in part, due to the 2017 tax law (pub.

Form W8IMY Certificate of Foreign Intermediary, Foreign FlowThrough

This form may serve to establish foreign status for purposes of. Qi/wp or wt ein must match the number on line 8 of the form. The updates were necessary, in part, due to the 2017 tax law (pub. October 2021) to allow an nqi that is to provide alternative withholding statements and beneficial owner withholding certificates for payments associated with.

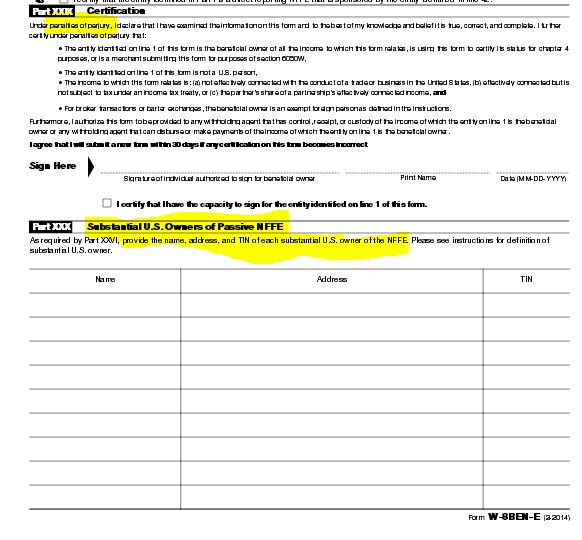

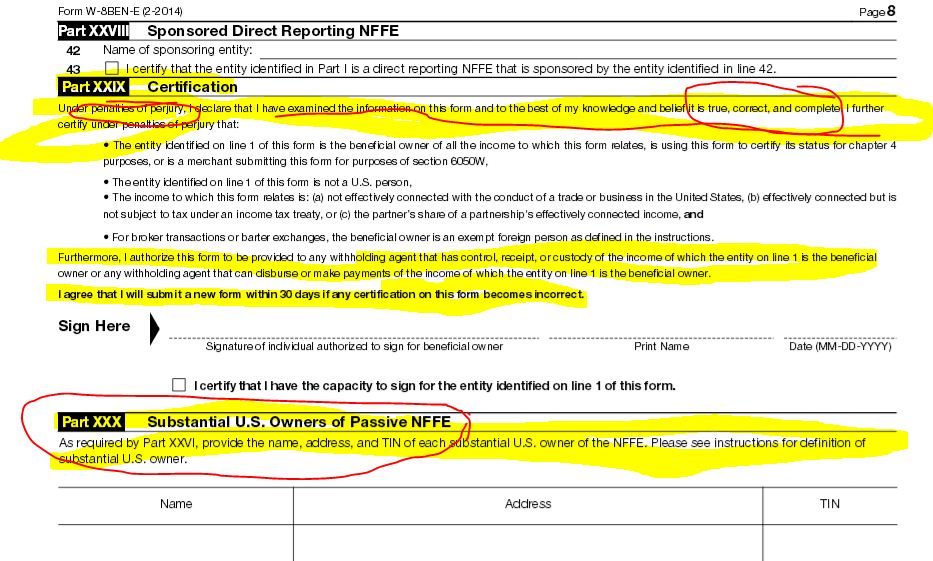

W 8ben E Instructions

The updates were necessary, in part, due to the 2017 tax law (pub. For a sole proprietorship, list the business owner’s name line 2: Section references are to the internal revenue code. List the full legal name on your income tax return; Represent that a foreign person is a qualified intermediary or nonqualified.

What Is Form W8imy Charles Leal's Template

Represent that a foreign person is a qualified intermediary or nonqualified. This form may serve to establish foreign status for purposes of. List the full legal name on your income tax return; The updates were necessary, in part, due to the 2017 tax law (pub. Section references are to the internal revenue code.

W8 imy instructions tikloodd

Branches for united states tax withholding and reporting. October 2021) department of the treasury internal revenue service. Qi/wp or wt ein must match the number on line 8 of the form. For a sole proprietorship, list the business owner’s name line 2: The updates were necessary, in part, due to the 2017 tax law (pub.

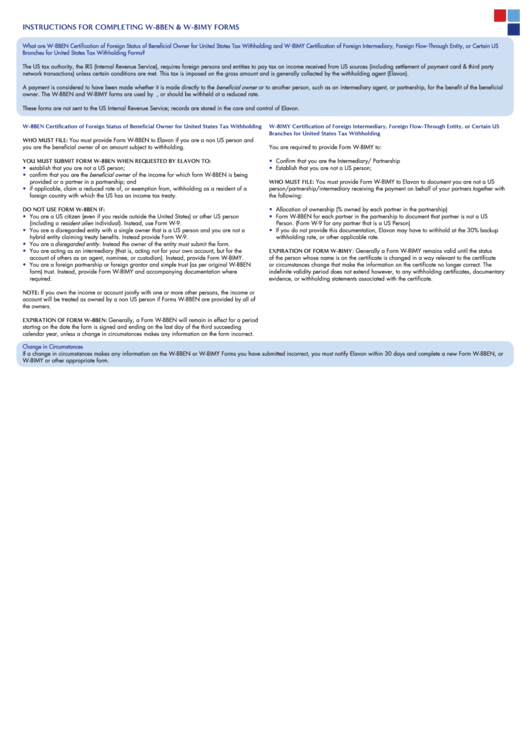

Instructions For Completing W8ben & W8imy Forms printable pdf download

Qi/wp or wt ein must match the number on line 8 of the form. Branches for united states tax withholding and reporting and its associated instructions. Section references are to the internal revenue code. Branches for united states tax withholding and reporting. Represent that a foreign person is a qualified intermediary or nonqualified.

W 8imy Instructions 2016

Branches for united states tax withholding and reporting. Represent that a foreign person is a qualified intermediary or nonqualified. This form may serve to establish foreign status for purposes of. List the full name of the entity that is the beneficial owner For a sole proprietorship, list the business owner’s name line 2:

Form W8IMY Edit, Fill, Sign Online Handypdf

Section references are to the internal revenue code. Branches for united states tax withholding and reporting. Represent that a foreign person is a qualified intermediary or nonqualified. List the full legal name on your income tax return; This form may serve to establish foreign status for purposes of.

October 2021) Department Of The Treasury Internal Revenue Service.

Branches for united states tax withholding and reporting. Branches for united states tax withholding and reporting and its associated instructions. Represent that a foreign person is a qualified intermediary or nonqualified. October 2021) to allow an nqi that is to provide alternative withholding statements and beneficial owner withholding certificates for payments associated with this form to represent on the form that the information on the withholding certificates will be verified for consistency as.

Qi/Wp Or Wt Ein Must Match The Number On Line 8 Of The Form.

List the full name of the entity that is the beneficial owner Section references are to the internal revenue code. List the full legal name on your income tax return; Branches for united states tax withholding and reporting.

This Form May Serve To Establish Foreign Status For Purposes Of.

For a sole proprietorship, list the business owner’s name line 2: The updates were necessary, in part, due to the 2017 tax law (pub.