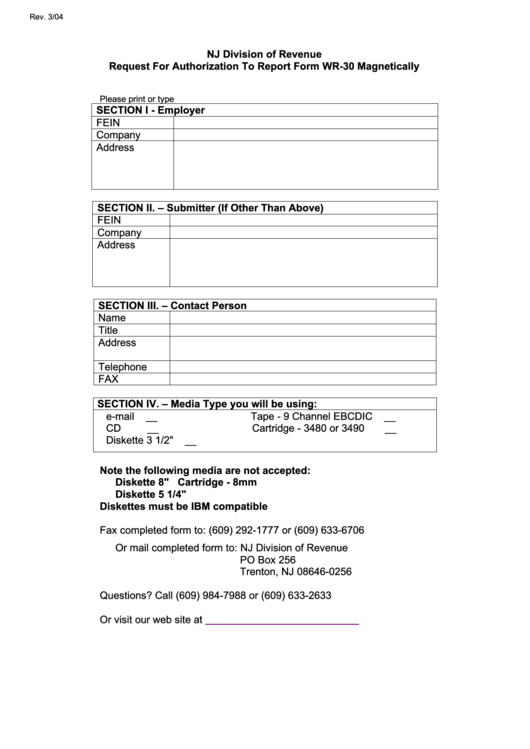

Form Wr-30

Form Wr-30 - Web employer payroll tax electronic filing and reporting options. Companies must get approval from the new jersey division of revenue if they develop: For the first section, you will need to enter the names and social security numbers for each of your employees, along with their base week and salary information. Use this option to fill in and electronically file the following form (s): Penalties range from $5.00 to $25.00 per employee record error. Nj division of revenue and.

For the first section, you will need to enter the names and social security numbers for each of your employees, along with their base week and salary information. Use this option to fill in and electronically file the following form (s): Nj division of revenue and. Penalties range from $5.00 to $25.00 per employee record error. Companies must get approval from the new jersey division of revenue if they develop: Web employer payroll tax electronic filing and reporting options.

Nj division of revenue and. Web employer payroll tax electronic filing and reporting options. Use this option to fill in and electronically file the following form (s): Penalties range from $5.00 to $25.00 per employee record error. For the first section, you will need to enter the names and social security numbers for each of your employees, along with their base week and salary information. Companies must get approval from the new jersey division of revenue if they develop:

Form WR82 Download Fillable PDF or Fill Online Permit Application Form

For the first section, you will need to enter the names and social security numbers for each of your employees, along with their base week and salary information. Use this option to fill in and electronically file the following form (s): Web employer payroll tax electronic filing and reporting options. Nj division of revenue and. Penalties range from $5.00 to.

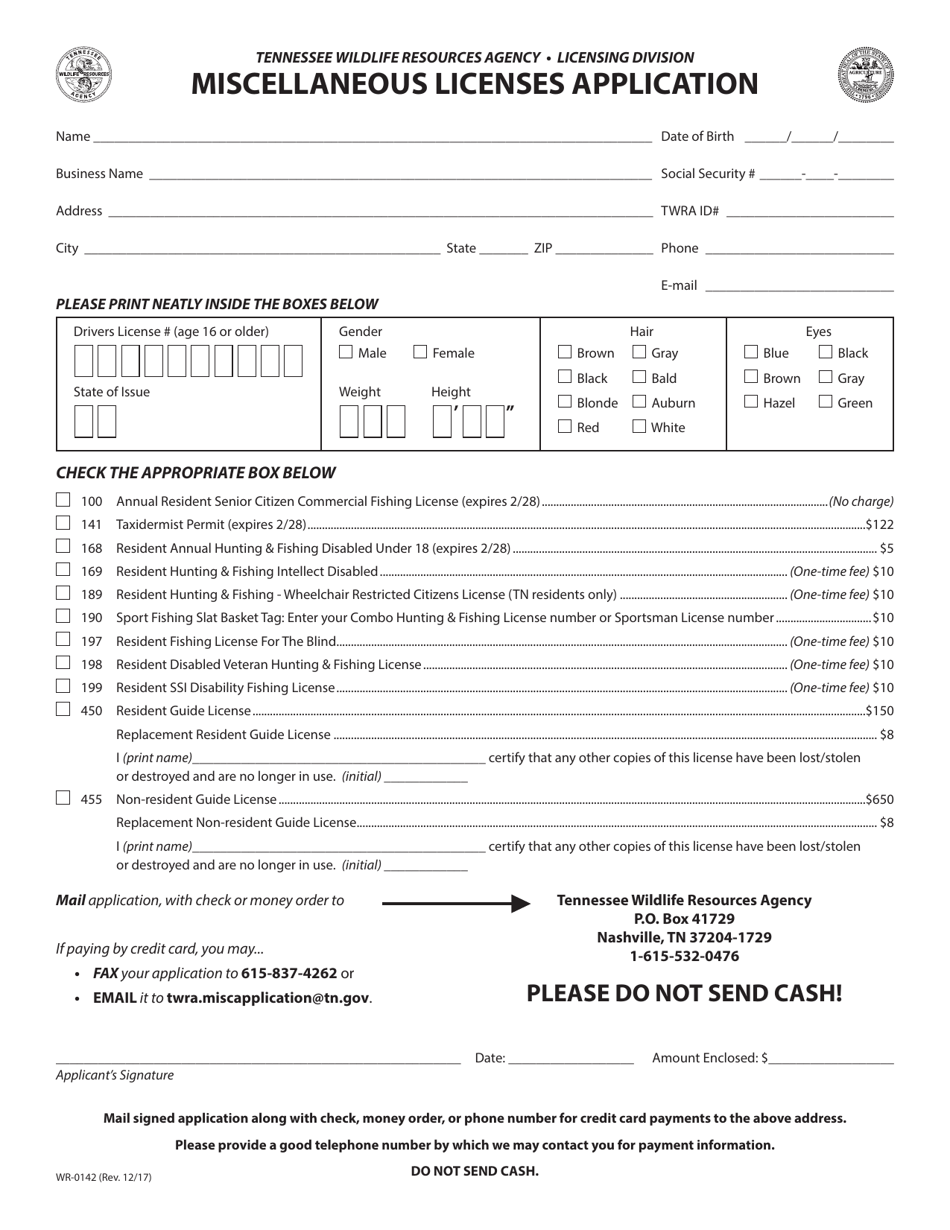

Form WR0142 Download Printable PDF or Fill Online Miscellaneous

Penalties range from $5.00 to $25.00 per employee record error. Companies must get approval from the new jersey division of revenue if they develop: For the first section, you will need to enter the names and social security numbers for each of your employees, along with their base week and salary information. Nj division of revenue and. Use this option.

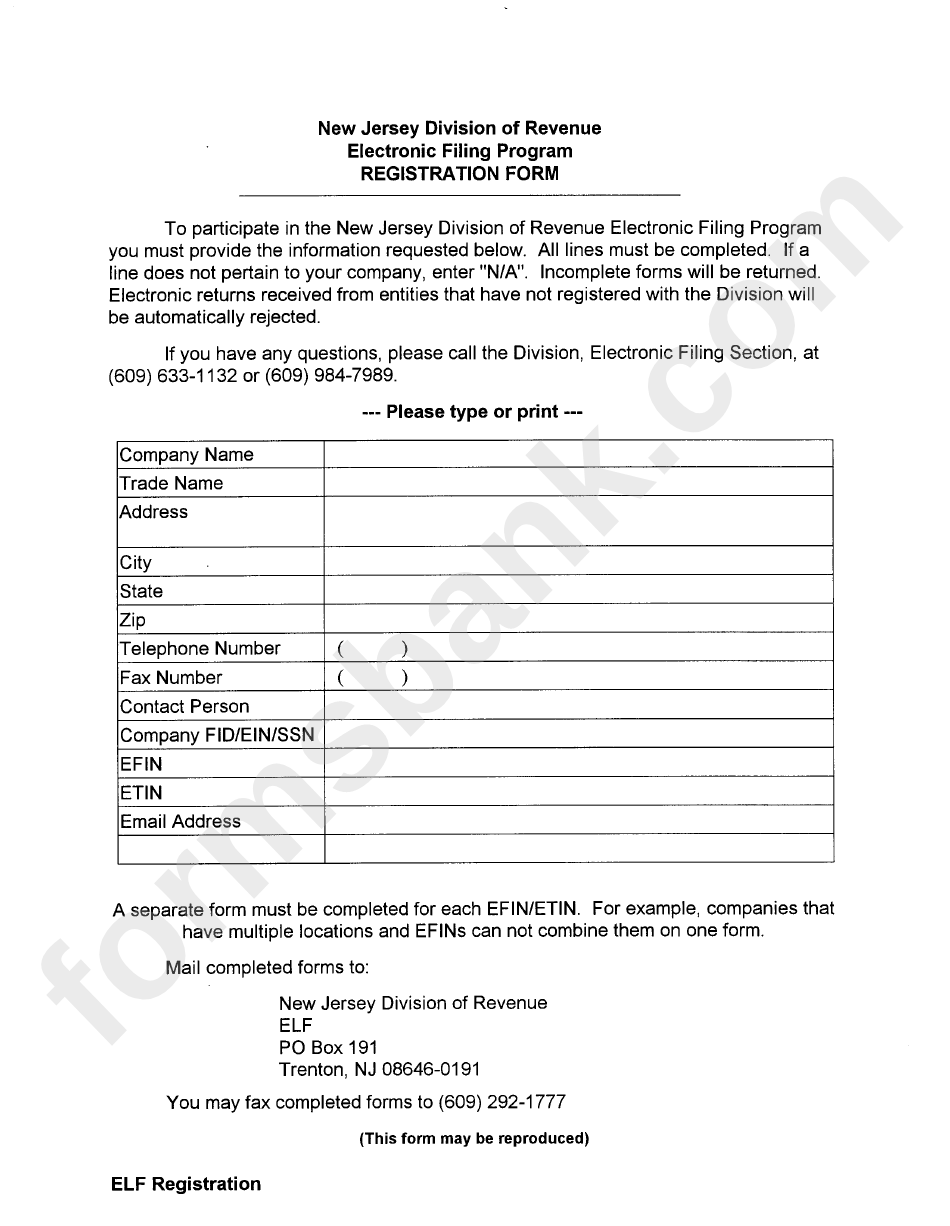

Registration Form Electronic Filing Program New Jersey Department

Penalties range from $5.00 to $25.00 per employee record error. Web employer payroll tax electronic filing and reporting options. Nj division of revenue and. Use this option to fill in and electronically file the following form (s): Companies must get approval from the new jersey division of revenue if they develop:

WR30TR

Web employer payroll tax electronic filing and reporting options. Nj division of revenue and. For the first section, you will need to enter the names and social security numbers for each of your employees, along with their base week and salary information. Companies must get approval from the new jersey division of revenue if they develop: Penalties range from $5.00.

NJ WR30 Fill out Tax Template Online US Legal Forms

For the first section, you will need to enter the names and social security numbers for each of your employees, along with their base week and salary information. Penalties range from $5.00 to $25.00 per employee record error. Web employer payroll tax electronic filing and reporting options. Nj division of revenue and. Companies must get approval from the new jersey.

What Does a WR30 Look Like & How Do I Do It? Paladini Law

Web employer payroll tax electronic filing and reporting options. Use this option to fill in and electronically file the following form (s): Nj division of revenue and. For the first section, you will need to enter the names and social security numbers for each of your employees, along with their base week and salary information. Companies must get approval from.

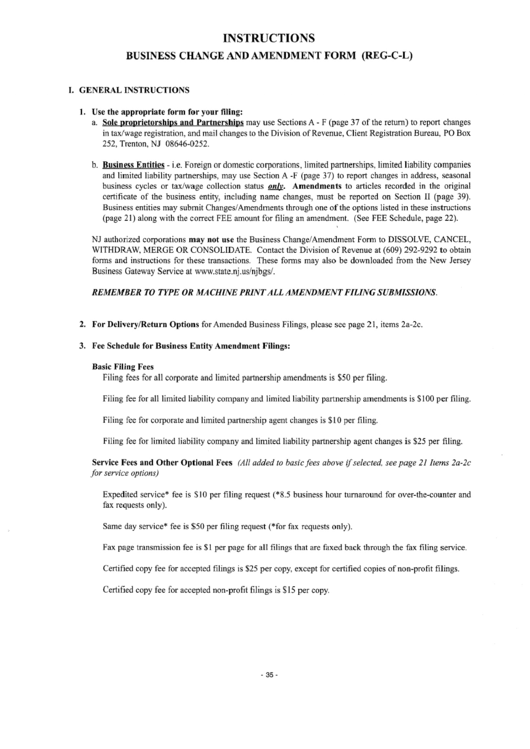

Instructions For Business Change And Amendment Form (RegCL) New

For the first section, you will need to enter the names and social security numbers for each of your employees, along with their base week and salary information. Use this option to fill in and electronically file the following form (s): Penalties range from $5.00 to $25.00 per employee record error. Companies must get approval from the new jersey division.

2014 Form OR ORWR Fill Online, Printable, Fillable, Blank pdfFiller

Companies must get approval from the new jersey division of revenue if they develop: Use this option to fill in and electronically file the following form (s): For the first section, you will need to enter the names and social security numbers for each of your employees, along with their base week and salary information. Web employer payroll tax electronic.

Fillable Request For Authorization To Report Form Wr30

Companies must get approval from the new jersey division of revenue if they develop: For the first section, you will need to enter the names and social security numbers for each of your employees, along with their base week and salary information. Penalties range from $5.00 to $25.00 per employee record error. Nj division of revenue and. Web employer payroll.

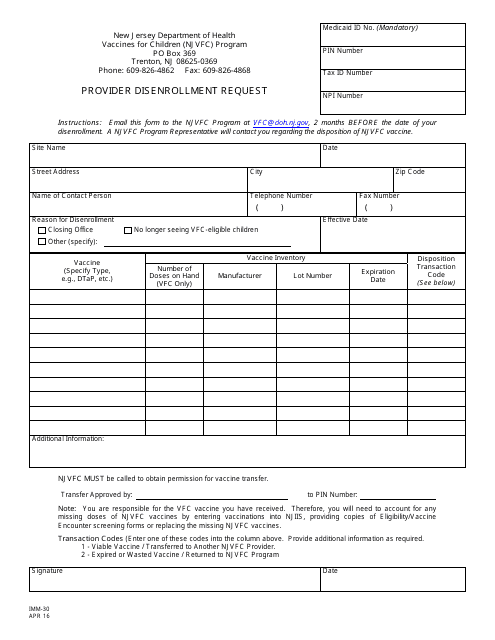

Form IMM30 Download Printable PDF or Fill Online Provider

Use this option to fill in and electronically file the following form (s): Nj division of revenue and. Penalties range from $5.00 to $25.00 per employee record error. Web employer payroll tax electronic filing and reporting options. For the first section, you will need to enter the names and social security numbers for each of your employees, along with their.

Nj Division Of Revenue And.

Web employer payroll tax electronic filing and reporting options. Penalties range from $5.00 to $25.00 per employee record error. Use this option to fill in and electronically file the following form (s): Companies must get approval from the new jersey division of revenue if they develop: