Free 8962 Form

Free 8962 Form - You have to include form 8962 with your tax return if: This form is only used by taxpayers who. Find a tax software program to help you prepare your taxes; Upload, modify or create forms. See if you qualify today. Web this is to establish residency. Web download or print the 2022 federal form 8962 (premium tax credit) for free from the federal internal revenue service. Form 8962 is used either (1) to reconcile a premium tax. Try it for free now! Learn about the irs free file and related services;

Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Try it for free now! Over 12m americans filed 100% free with turbotax® last year. This form is required when someone on your tax return had health insurance in 2022 through. Web this is to establish residency. Enjoy smart fillable fields and interactivity. The marketplace sends this, and if you haven’t received it by. The american rescue plan, signed into law on march 11, 2021, includes a provision that eliminates the requirement. Form 8962 is used either (1) to reconcile a premium tax. Protect yourself from tax scams;

Web ★ 4.8 satisfied 59 votes how to fill out and sign form 8962 online? Ad access irs tax forms. Web this page specifically covers form 8962 which is used for the premium tax credit (ptc). Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Web this is to establish residency. This form is only used by taxpayers who. Ad get ready for tax season deadlines by completing any required tax forms today. Web download or print the 2022 federal form 8962 (premium tax credit) for free from the federal internal revenue service. The ptc is a refundable tax credit that can be claimed by eligible. Web starting with tax year 2021, electronically filed tax returns will be rejected if the taxpayer is required to reconcile advance payments of the premium tax credit (aptc) on form 8962, premium tax credit (ptc), but does not attach the form to the tax return.

8962 Form App for iPhone Free Download 8962 Form for iPhone & iPad at

Learn about the irs free file and related services; Upload, modify or create forms. Get your online template and fill it in using progressive features. Ad access irs tax forms. Find out where to get free volunteer tax help;

8962 Form App for iPhone Free Download 8962 Form for iPhone & iPad at

Web ★ 4.8 satisfied 59 votes how to fill out and sign form 8962 online? Enjoy smart fillable fields and interactivity. Web the internal revenue service (irs) has introduced a number of essential tax forms to accommodate the aca: Get your online template and fill it in using progressive features. See if you qualify today.

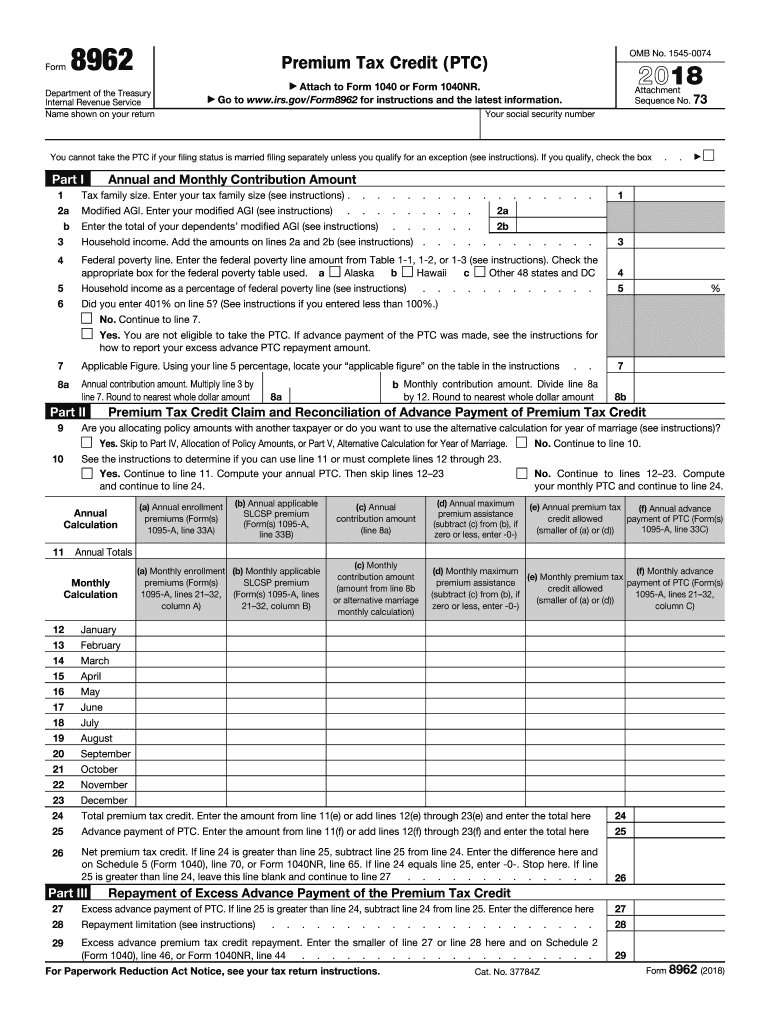

Form 8962 Fill Out and Sign Printable PDF Template signNow

Get ready for tax season deadlines by completing any required tax forms today. Over 12m americans filed 100% free with turbotax® last year. Find a tax software program to help you prepare your taxes; Web the internal revenue service (irs) has introduced a number of essential tax forms to accommodate the aca: Learn about the irs free file and related.

Irs form 8962 Fillable Irs form 8962 Instruction for How to Fill It

Web this page specifically covers form 8962 which is used for the premium tax credit (ptc). Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. The american rescue plan, signed into law on march 11, 2021, includes a provision that eliminates the requirement. Form 8962 is used either (1) to.

Form 8962 Edit, Fill, Sign Online Handypdf

Web this is to establish residency. Over 12m americans filed 100% free with turbotax® last year. Web the internal revenue service (irs) has introduced a number of essential tax forms to accommodate the aca: Try it for free now! The marketplace sends this, and if you haven’t received it by.

Form 8962 Edit, Fill, Sign Online Handypdf

Complete, edit or print tax forms instantly. Web the internal revenue service (irs) has introduced a number of essential tax forms to accommodate the aca: Ad get ready for tax season deadlines by completing any required tax forms today. Find a tax software program to help you prepare your taxes; Upload, modify or create forms.

Irs form 8962 Aca Irs form 8962 for ‘premium Tax Credits’ Successfully

Web this page specifically covers form 8962 which is used for the premium tax credit (ptc). The marketplace sends this, and if you haven’t received it by. This form is only used by taxpayers who. Ad free for simple tax returns only with turbotax® free edition. Find out where to get free volunteer tax help;

Fillable Tax Form 8962 Universal Network

Web starting with tax year 2021, electronically filed tax returns will be rejected if the taxpayer is required to reconcile advance payments of the premium tax credit (aptc) on form 8962, premium tax credit (ptc), but does not attach the form to the tax return. Learn about the irs free file and related services; This form is required when someone.

IRS 8962 2014 Fill and Sign Printable Template Online US Legal Forms

Form 8962 is used either (1) to reconcile a premium tax. This form is only used by taxpayers who. Ad get ready for tax season deadlines by completing any required tax forms today. The american rescue plan, signed into law on march 11, 2021, includes a provision that eliminates the requirement. Complete, edit or print tax forms instantly.

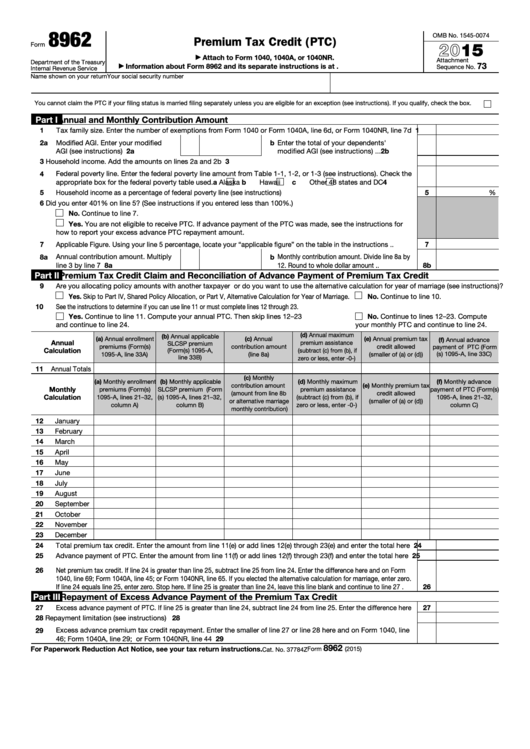

Fillable Form 8962 Premium Tax Credit (Ptc) 2015 printable pdf download

Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year. Form 8962 is used either (1) to reconcile a premium tax. Protect yourself from tax scams; Web ★ 4.8 satisfied 59 votes how to fill out and sign.

Web Form 8962 Is Used To Figure The Amount Of Premium Tax Credit And Reconcile It With Any Advanced Premium Tax Credit Paid.

Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year. See if you qualify today. Learn about the irs free file and related services; Web ★ 4.8 satisfied 59 votes how to fill out and sign form 8962 online?

Web Starting With Tax Year 2021, Electronically Filed Tax Returns Will Be Rejected If The Taxpayer Is Required To Reconcile Advance Payments Of The Premium Tax Credit (Aptc) On Form 8962, Premium Tax Credit (Ptc), But Does Not Attach The Form To The Tax Return.

Complete, edit or print tax forms instantly. Web this is to establish residency. Web this page specifically covers form 8962 which is used for the premium tax credit (ptc). Web the internal revenue service (irs) has introduced a number of essential tax forms to accommodate the aca:

This Form Is Only Used By Taxpayers Who.

Find a tax software program to help you prepare your taxes; You have to include form 8962 with your tax return if: Ad access irs tax forms. Protect yourself from tax scams;

Over 12M Americans Filed 100% Free With Turbotax® Last Year.

Upload, modify or create forms. Web download or print the 2022 federal form 8962 (premium tax credit) for free from the federal internal revenue service. The marketplace sends this, and if you haven’t received it by. This form is required when someone on your tax return had health insurance in 2022 through.