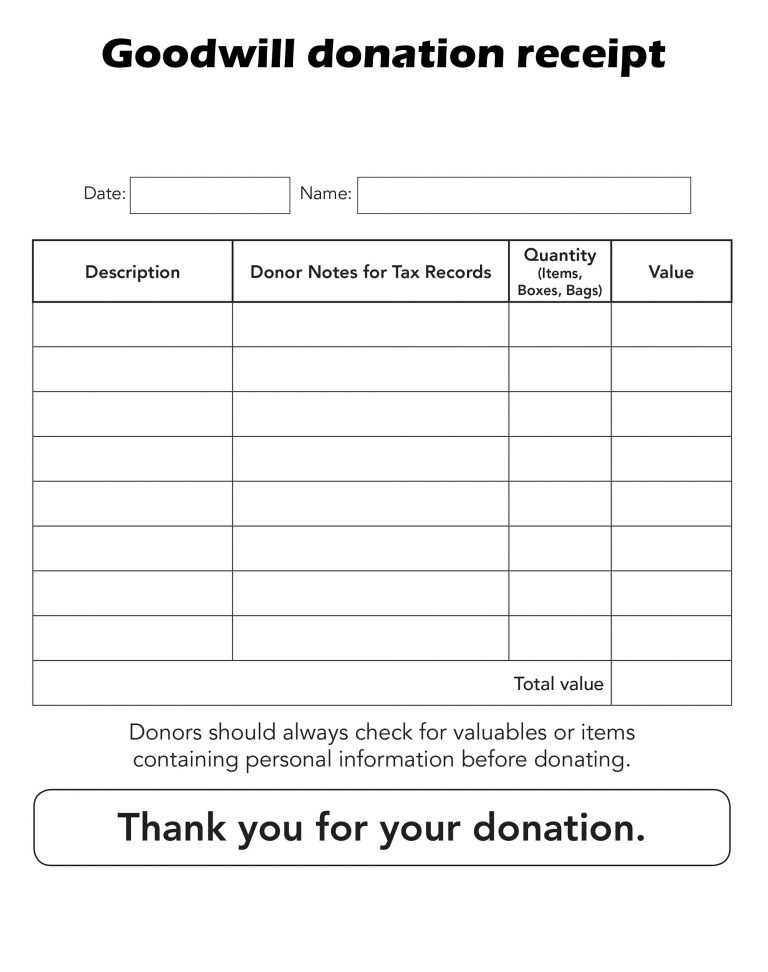

Goodwill Tax Receipt Form

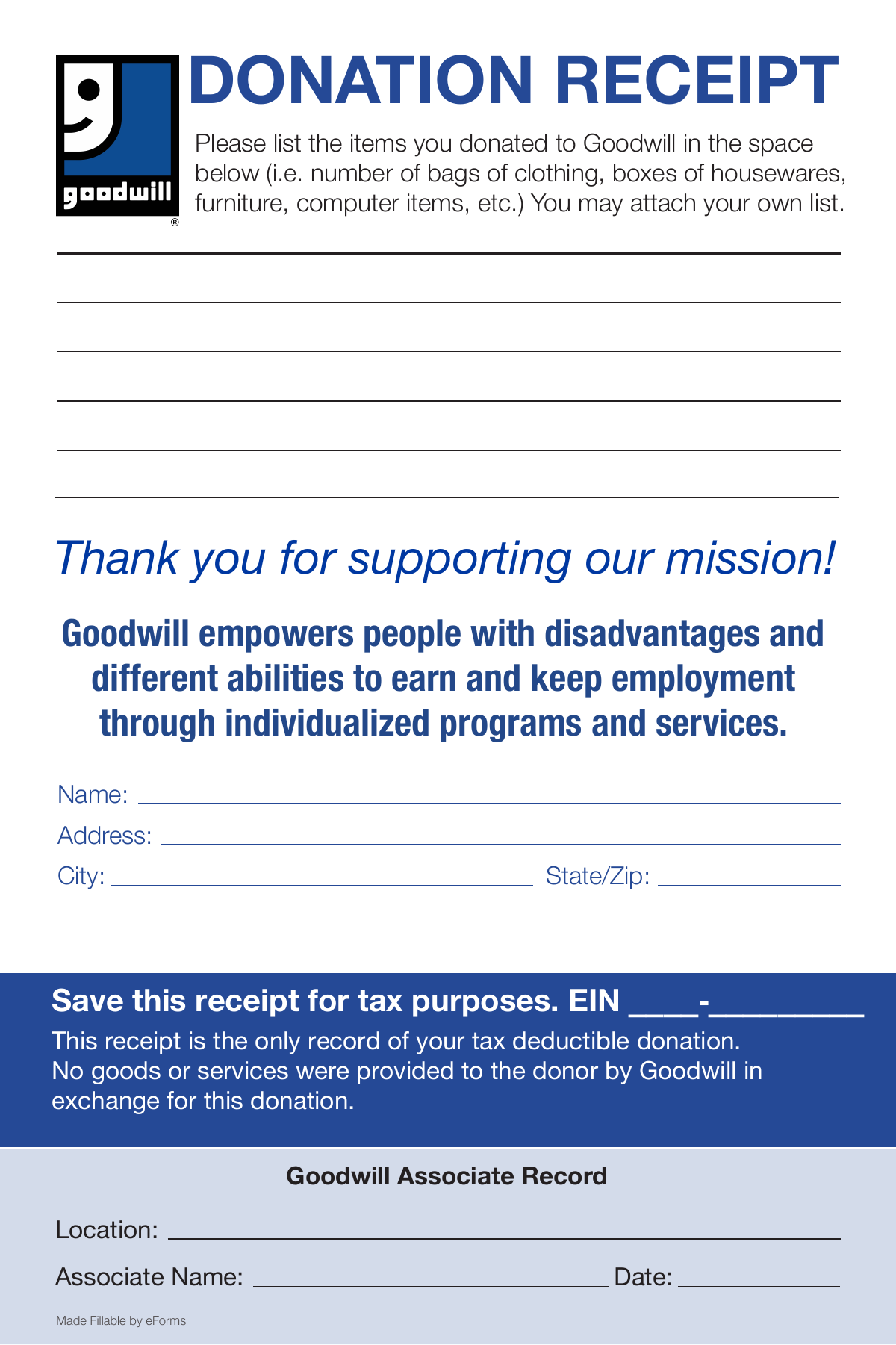

Goodwill Tax Receipt Form - Web please list the items you donated to goodwill in the space below (i.e. At the end of the year, if you itemize deductions on your taxes, you can claim a tax deduction for clothing and. Web a limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax purposes. For information on donating to charities visit www.irs.gov. Tax benefits are available to taxpayers that itemize deductions. A goodwill donation receipt is used to claim a tax deduction for clothing and household property that are itemized on an individual’s taxes. Web thanks for donating to goodwill. The donor determines the fair market value of an item. Use this receipt when filing your taxes. Goods or services were not exchanged for this contribution and no personal benefit was incurred by it, so it is entirely deductible to the extent allowable by the law.

Web when you drop off your donations at goodwill, you’ll receive a receipt from a donation attendant. Find the document you require in our collection of legal templates. Hang on to this receipt. If you donated to a goodwill in the following areas and need to obtain your donation receipt, please use. Web a limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax purposes. Web thanks for donating to goodwill. Web goodwill donation receipt template. Goodwill does not retain a copy of the tax receipt. Goodwill has not provided any goods or. Goods or services were not exchanged for this contribution and no personal benefit was incurred by it, so it is entirely deductible to the extent allowable by the law.

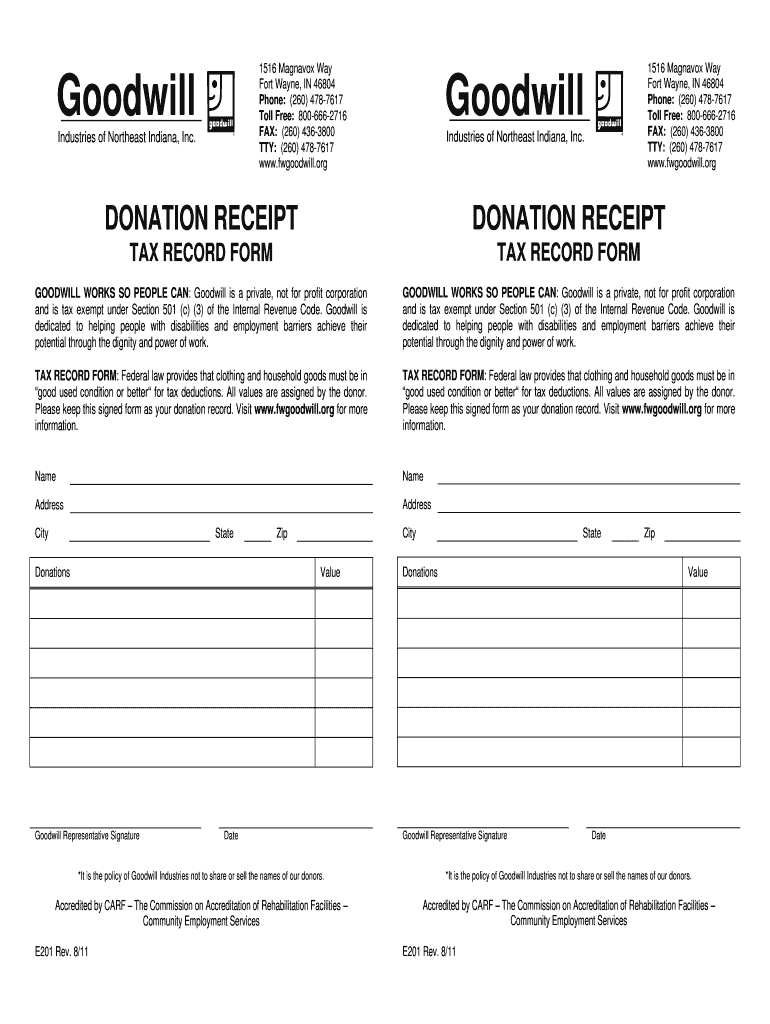

The donor determines the fair market value of an item. Web download our tax receipt (as pdf) goodwill is a qualified tax exempt public charity under section 501 (c) (3) of the internal revenue code. Goodwill has not provided any goods or. If you donated to a goodwill in the following areas and need to obtain your donation receipt, please use. Internal revenue service, establishing a dollar value on donated items is the responsibility of the donor. Web goodwill donation receipt template. Open the template in the online editing tool. Please keep your receipt for tax purposes and note that goodwill of south central wisconsin does not retain a copy. At the end of the year, if you itemize deductions on your taxes, you can claim a tax deduction for clothing and. Goodwill does not retain a copy of the tax receipt.

Free Goodwill Donation Receipt Template PDF eForms

Goodwill does not retain a copy of the tax receipt. Web please list the items you donated to goodwill in the space below (i.e. Goods or services were not exchanged for this contribution and no personal benefit was incurred by it, so it is entirely deductible to the extent allowable by the law. Tax benefits are available to taxpayers that.

Goodwill Tax Receipt Form Word in 2021 Donation letter template

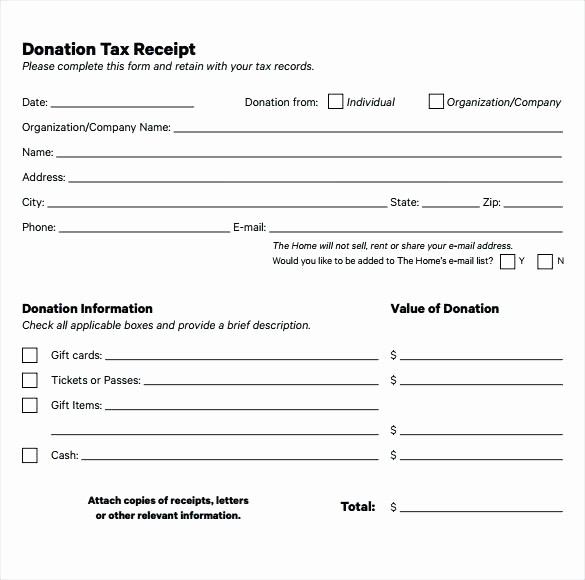

Goods or services were not exchanged for this contribution and no personal benefit was incurred by it, so it is entirely deductible to the extent allowable by the law. A goodwill donation receipt is used to claim a tax deduction for clothing and household property that are itemized on an individual’s taxes. Please keep your receipt for tax purposes and.

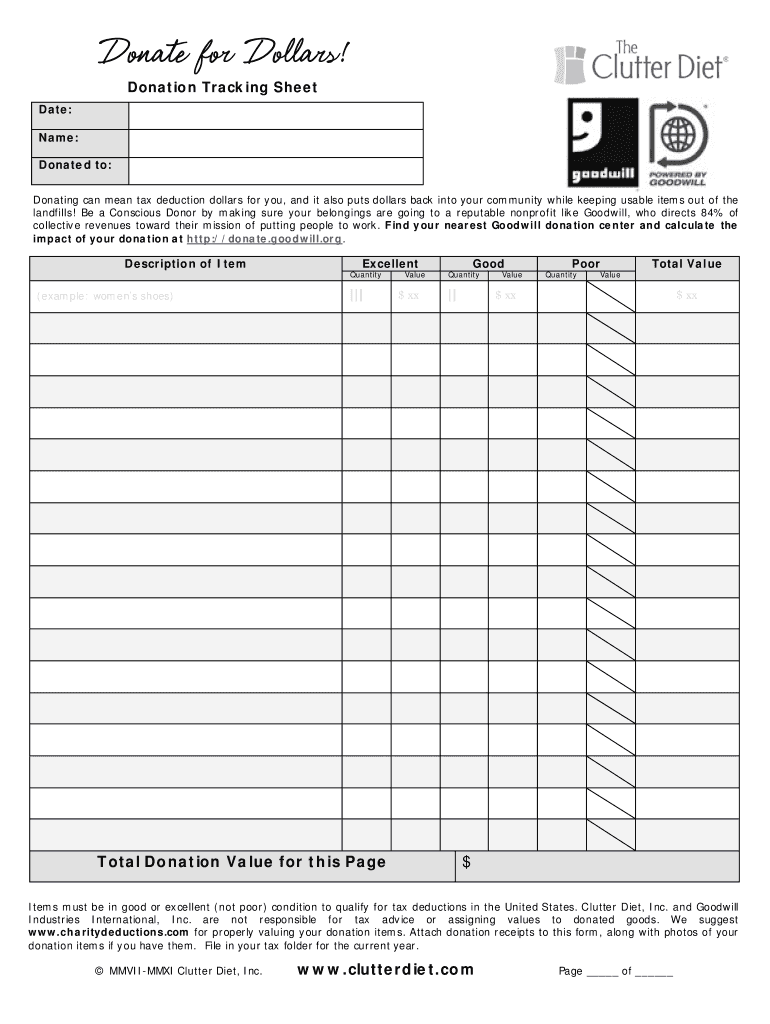

Goodwill Donation Spreadsheet Template —

Number of bags of clothing, boxes of housewares, furniture, computer items, etc.) you may attach your own list. Web when you drop off your donations at goodwill, you’ll receive a receipt from a donation attendant. Goodwill does not retain a copy of the tax receipt. Tax benefits are available to taxpayers that itemize deductions. Find the document you require in.

50 Donation form for Tax Purposes Template

If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. Please keep your receipt for tax purposes and note that goodwill of south central wisconsin does not retain a copy. Find the document you require in our collection of legal templates. Number of bags of clothing, boxes of housewares,.

Goodwill Donation Receipt Fill Online Printable Fillable —

Web goodwill donation receipt template. A goodwill donation receipt is used to claim a tax deduction for clothing and household property that are itemized on an individual’s taxes. If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. Goods or services were not exchanged for this contribution and no.

Find Your Local Goodwill Goodwill Industries International Goodwill

Please keep your receipt for tax purposes and note that goodwill of south central wisconsin does not retain a copy. Web please list the items you donated to goodwill in the space below (i.e. Goods or services were not provided in exchange for the donation. For information on donating to charities visit www.irs.gov. Web a limited number of local goodwill.

Goodwilljax Org Fill Online, Printable, Fillable, Blank pdfFiller

Web download our tax receipt (as pdf) goodwill is a qualified tax exempt public charity under section 501 (c) (3) of the internal revenue code. Goods or services were not exchanged for this contribution and no personal benefit was incurred by it, so it is entirely deductible to the extent allowable by the law. Use this receipt when filing your.

Free Sample Printable Donation Receipt Template Form

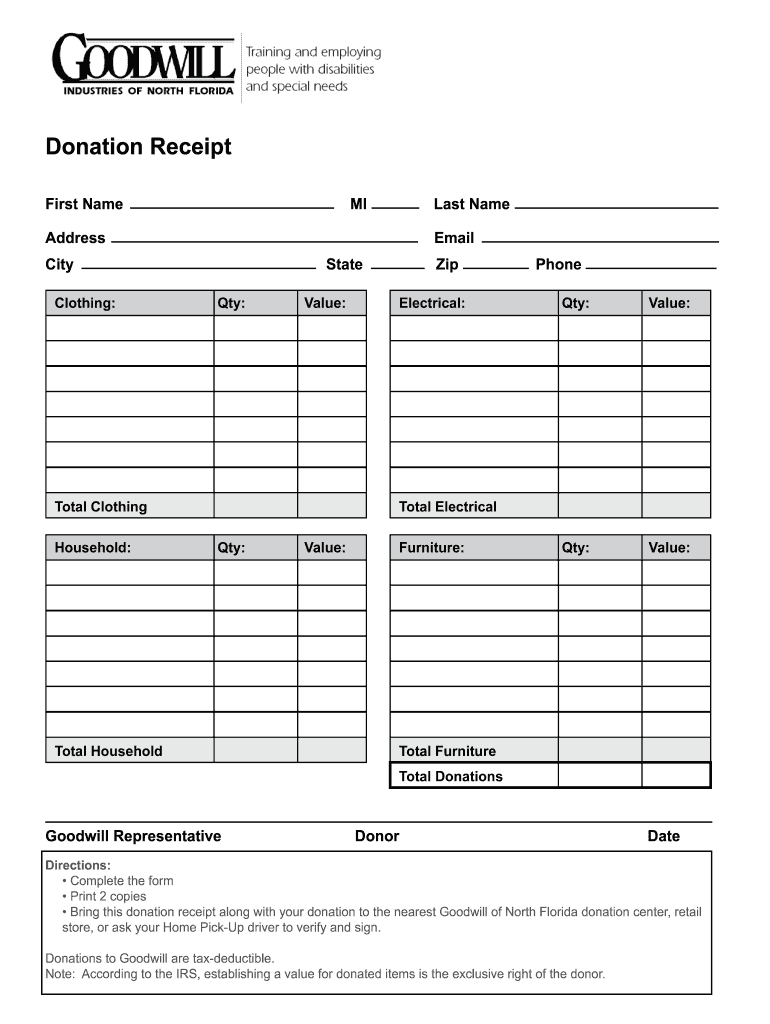

Number of bags of clothing, boxes of housewares, furniture, computer items, etc.) you may attach your own list. Web please list the items you donated to goodwill in the space below (i.e. Please keep your receipt for tax purposes and note that goodwill of south central wisconsin does not retain a copy. It is the responsibility of the donor to.

6 Tax Donation Receipt Template SampleTemplatess SampleTemplatess

If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. Goods or services were not provided in exchange for the donation. Web please list the items you donated to goodwill in the space below (i.e. A goodwill donation receipt is used to claim a tax deduction for clothing and.

Goodwill Itemized Donation Form Fill Out and Sign Printable PDF

Use this receipt when filing your taxes. Please keep your receipt for tax purposes and note that goodwill of south central wisconsin does not retain a copy. Web please list the items you donated to goodwill in the space below (i.e. Web stick to these simple guidelines to get goodwill donation receipt completely ready for submitting: The donor determines the.

It Is The Responsibility Of The Donor To Determine Fair Market Value Of The Items Donated.

Look through the recommendations to determine which information you must give. For information on donating to charities visit www.irs.gov. Open the template in the online editing tool. The donor determines the fair market value of an item.

Number Of Bags Of Clothing, Boxes Of Housewares, Furniture, Computer Items, Etc.) You May Attach Your Own List.

Hang on to this receipt. Web goodwill donation receipt template. Goodwill does not retain a copy of the tax receipt. Web please list the items you donated to goodwill in the space below (i.e.

Web Stick To These Simple Guidelines To Get Goodwill Donation Receipt Completely Ready For Submitting:

Goods or services were not exchanged for this contribution and no personal benefit was incurred by it, so it is entirely deductible to the extent allowable by the law. If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. Internal revenue service, establishing a dollar value on donated items is the responsibility of the donor. Tax benefits are available to taxpayers that itemize deductions.

No Goods Or Services Were Provided To The Donor By Goodwill Of Southwestern Pennsylvania In Exchange For This Donation.

Please keep your receipt for tax purposes and note that goodwill of south central wisconsin does not retain a copy. Web when you drop off your donations at goodwill, you’ll receive a receipt from a donation attendant. A goodwill donation receipt is used to claim a tax deduction for clothing and household property that are itemized on an individual’s taxes. Web a limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax purposes.