How To Amend Form 941 For Employee Retention Credit

How To Amend Form 941 For Employee Retention Credit - Ad we take the confusion out of erc funding and specialize in working with small businesses. Up to $26,000 per employee. Claim your ercs with confidence today. Check to see if you qualify. Ad stentam is the nations leading tax technology firm.

Ad stentam is the nations leading tax technology firm. Ad we take the confusion out of erc funding and specialize in working with small businesses. Check to see if you qualify. Up to $26,000 per employee. Claim your ercs with confidence today.

Ad we take the confusion out of erc funding and specialize in working with small businesses. Up to $26,000 per employee. Ad stentam is the nations leading tax technology firm. Check to see if you qualify. Claim your ercs with confidence today.

How To Amend 941 For Employee Retention Credit

Ad we take the confusion out of erc funding and specialize in working with small businesses. Up to $26,000 per employee. Check to see if you qualify. Claim your ercs with confidence today. Ad stentam is the nations leading tax technology firm.

StepbyStep How to Guide to Filing Your 941X ERTC Baron Payroll

Ad stentam is the nations leading tax technology firm. Ad we take the confusion out of erc funding and specialize in working with small businesses. Up to $26,000 per employee. Check to see if you qualify. Claim your ercs with confidence today.

Guidance About Amended 941 Form for Claiming Employee Retention Credit

Ad we take the confusion out of erc funding and specialize in working with small businesses. Ad stentam is the nations leading tax technology firm. Claim your ercs with confidence today. Check to see if you qualify. Up to $26,000 per employee.

How To Amend Form 941 For ERTC Live Rank Sniper

Claim your ercs with confidence today. Ad stentam is the nations leading tax technology firm. Ad we take the confusion out of erc funding and specialize in working with small businesses. Up to $26,000 per employee. Check to see if you qualify.

StepbyStep How to Guide to Filing Your 941X ERTC Baron Payroll

Ad stentam is the nations leading tax technology firm. Claim your ercs with confidence today. Up to $26,000 per employee. Ad we take the confusion out of erc funding and specialize in working with small businesses. Check to see if you qualify.

How to Amend Form 941 for Employee Retention Credit (ERC) StenTam

Ad stentam is the nations leading tax technology firm. Up to $26,000 per employee. Ad we take the confusion out of erc funding and specialize in working with small businesses. Claim your ercs with confidence today. Check to see if you qualify.

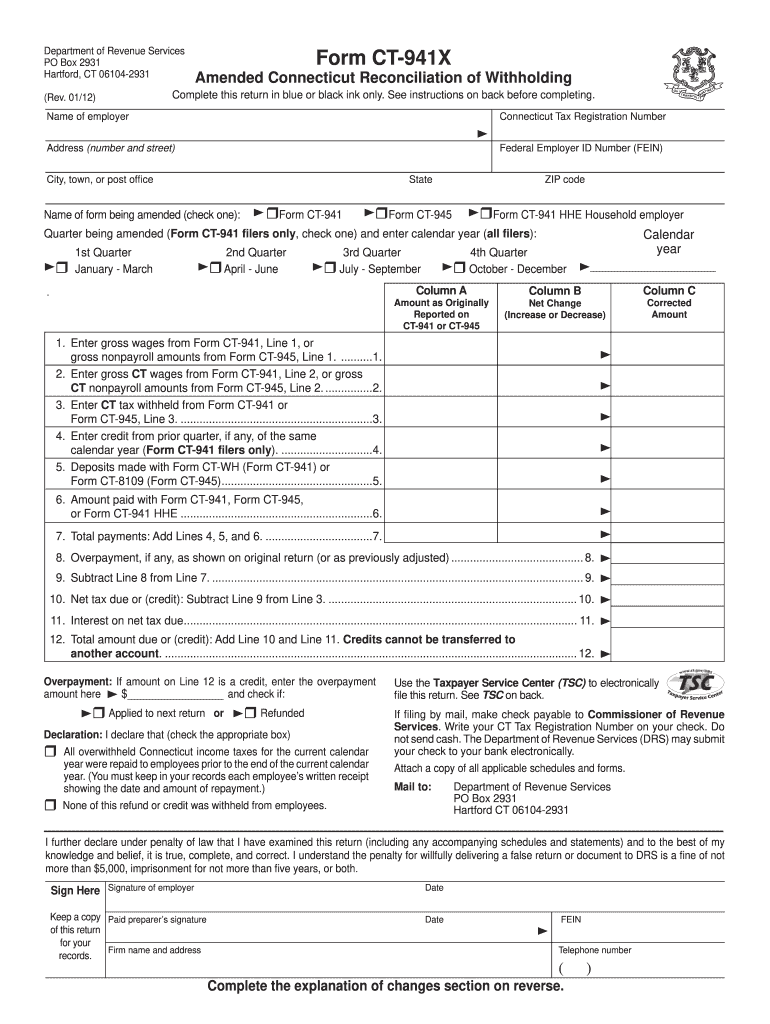

941 Amended Return Fill Out and Sign Printable PDF Template signNow

Claim your ercs with confidence today. Ad stentam is the nations leading tax technology firm. Up to $26,000 per employee. Check to see if you qualify. Ad we take the confusion out of erc funding and specialize in working with small businesses.

StepbyStep How to Guide to Filing Your 941X ERTC Baron Payroll

Claim your ercs with confidence today. Ad stentam is the nations leading tax technology firm. Ad we take the confusion out of erc funding and specialize in working with small businesses. Check to see if you qualify. Up to $26,000 per employee.

How to Claim the Employee Retention Credit (ERC) Using Form 941x ERC

Check to see if you qualify. Up to $26,000 per employee. Ad stentam is the nations leading tax technology firm. Claim your ercs with confidence today. Ad we take the confusion out of erc funding and specialize in working with small businesses.

Ad We Take The Confusion Out Of Erc Funding And Specialize In Working With Small Businesses.

Up to $26,000 per employee. Ad stentam is the nations leading tax technology firm. Check to see if you qualify. Claim your ercs with confidence today.