How To File Form 3520

How To File Form 3520 - Person to file a form 3520 to report the transactions. Web information reporting form 3520 in general, a form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts is required. Web if you have to file form 3520 this year (annual return to report transactions with foreign trusts and receipt of certain foreign gifts), you can do that manually, by. The form provides information about the foreign trust, its u.s. Owner, including recent updates, related forms and instructions on how to file. Note that the irs may recharacterize purported gifts from foreign corporations or foreign partnerships. Try it for free now! If you receive distributions from the foreign trust, you may also need to complete lines 15 through 18 of part i if you answered “no” to line 3, and. Person receives a gift from a foreign person, the irs may require the u.s. Web what is form 3520?

Web the form is due when a person’s tax return is due to be filed. Person receives a gift from a foreign person, the irs may require the u.s. Web you must separately identify each gift and the identity of the donor. Learn the filing process fill out form 3520 and file it separately from your income tax return. The form provides information about the foreign trust, its u.s. Note that the irs may recharacterize purported gifts from foreign corporations or foreign partnerships. Person to file a form 3520 to report the transactions. This information includes its u.s. Complete, edit or print tax forms instantly. Even if the person does not have to file a tax return, they still must submit the form 3520, if applicable.

This information includes its u.s. Web what is form 3520? The form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from certain. Upload, modify or create forms. Person receives a gift from a foreign person, the irs may require the u.s. Web the form is due when a person’s tax return is due to be filed. Web the penalty for filing a delinquent form 3520 is 5% of the value of the unreported gift for each month that passes after its due date. Complete, edit or print tax forms instantly. Try it for free now! Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances valued at over $100,000.

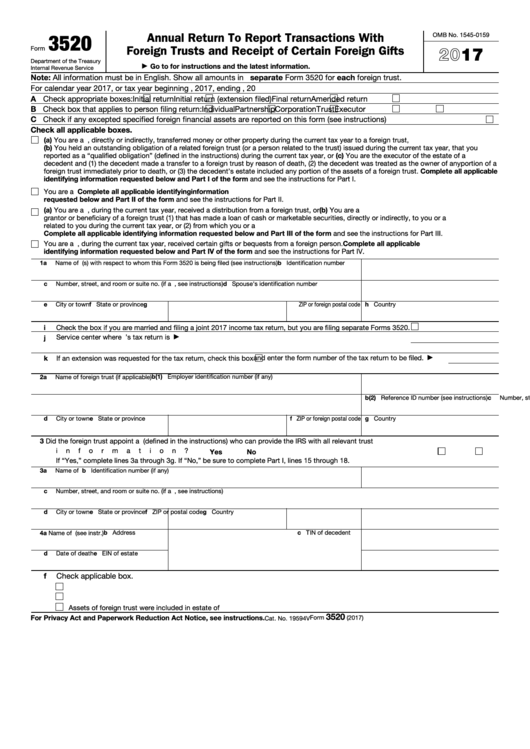

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Web information reporting form 3520 in general, a form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts is required. Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to. Upload, modify or create forms. Persons are.

Form 3520 Examples and a HowTo Guide to Filing for Americans Living Abroad

Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to. Try it for free now! Web see the instructions for part ii. This information includes its u.s. Even if the person does not have to file a tax return, they still must submit.

Hecht Group Inheriting Property From A Foreigner What You Need To

Owner, including recent updates, related forms and instructions on how to file. Upload, modify or create forms. Ad register and subscribe now to work on your irs form 3520 & more fillable forms. The form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from certain. Web if you.

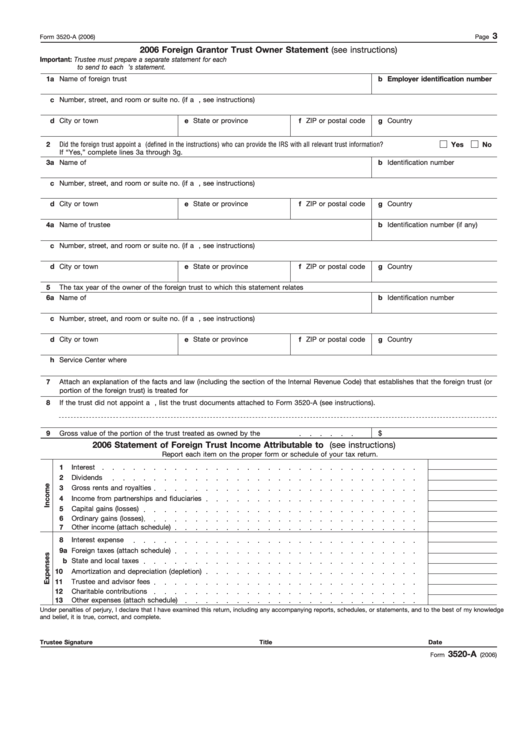

Fillable Form 3520A 2006 Foreign Grantor Trust Owner Statement

Web the form is due when a person’s tax return is due to be filed. Try it for free now! Web information reporting form 3520 in general, a form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts is required. This information includes its u.s. Person receives a gift from a foreign person, the.

Do I need to file IRS Form 3520 and 3520A for my TFSA and RESP?

Person receives a gift from a foreign person, the irs may require the u.s. Learn the filing process fill out form 3520 and file it separately from your income tax return. The form provides information about the foreign trust, its u.s. Web information reporting form 3520 in general, a form 3520, annual return to report transactions with foreign trusts and.

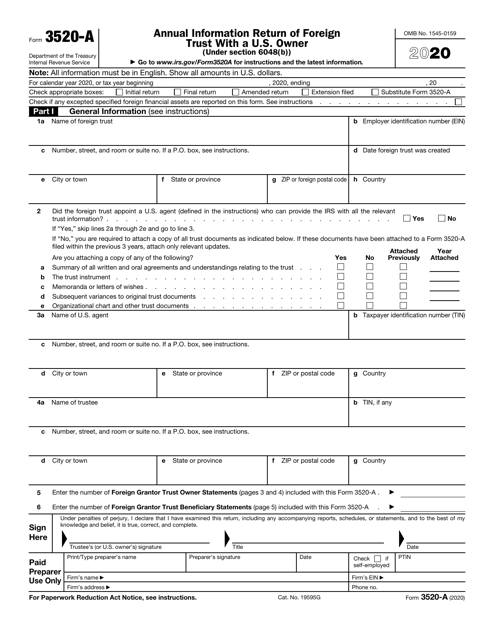

IRS Form 3520A Download Fillable PDF or Fill Online Annual Information

Owner, including recent updates, related forms and instructions on how to file. Even if the person does not have to file a tax return, they still must submit the form 3520, if applicable. Be aware of filing dates and deadlines for individuals, form 3520. Web you must separately identify each gift and the identity of the donor. Web the form.

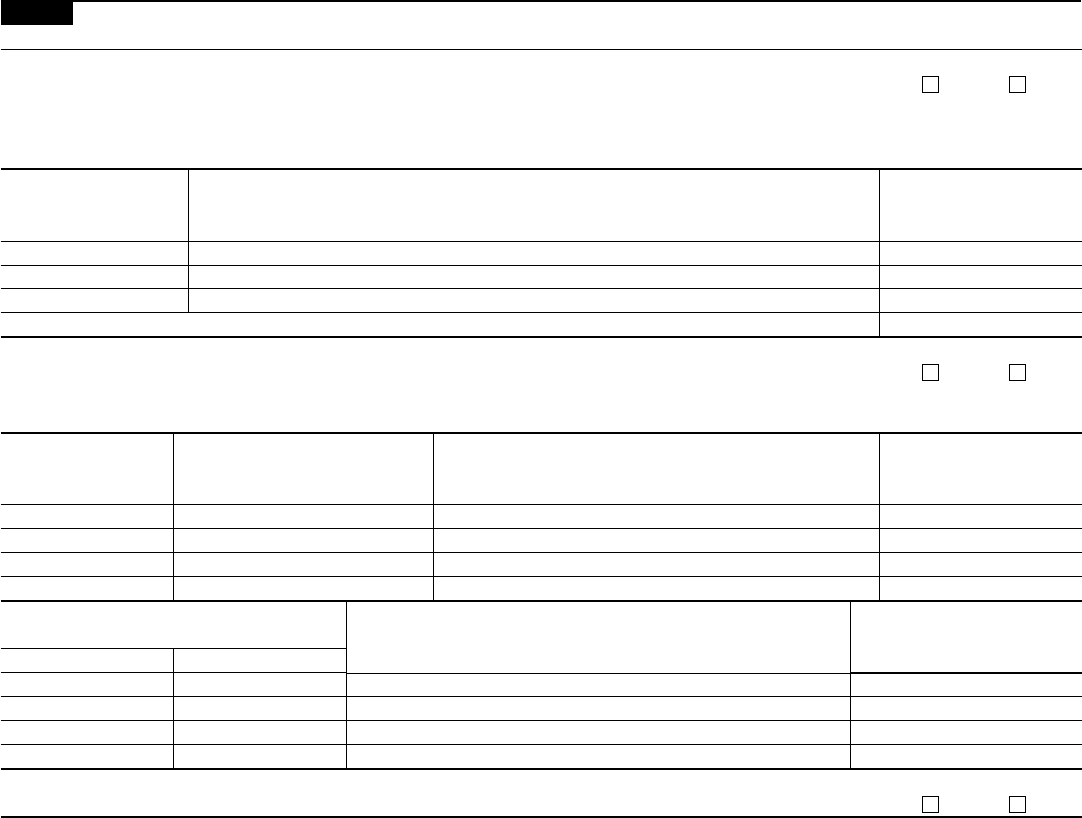

Form 3520 2012 Edit, Fill, Sign Online Handypdf

This information includes its u.s. Even if the person does not have to file a tax return, they still must submit the form 3520, if applicable. Web what is form 3520? The maximum penalty is 25% of the amount. Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances.

Fillable Form 3520A Annual Information Return Of Foreign Trust With

Web information reporting form 3520 in general, a form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts is required. Web the penalty for filing a delinquent form 3520 is 5% of the value of the unreported gift for each month that passes after its due date. Upload, modify or create forms. Be aware.

Fillable Form 3520 Annual Return To Report Transactions With Foreign

Web the form is due when a person’s tax return is due to be filed. Web information reporting form 3520 in general, a form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts is required. Ad register and subscribe now to work on your irs form 3520 & more fillable forms. Web the penalty.

When to File Form 3520 Gift or Inheritance From a Foreign Person

The form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from certain. Even if the person does not have to file a tax return, they still must submit the form 3520, if applicable. Person to file a form 3520 to report the transactions. Learn the filing process fill.

The Form 3520 Is An Informational Return Used To Report Certain Transactions With Foreign Trusts, Ownership Of Foreign Trusts, Or Large Gifts From Certain.

There are certain filing threshold. Even if the person does not have to file a tax return, they still must submit the form 3520, if applicable. The form provides information about the foreign trust, its u.s. Person to file a form 3520 to report the transactions.

Learn The Filing Process Fill Out Form 3520 And File It Separately From Your Income Tax Return.

Owner, including recent updates, related forms and instructions on how to file. Upload, modify or create forms. If you receive distributions from the foreign trust, you may also need to complete lines 15 through 18 of part i if you answered “no” to line 3, and. Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances valued at over $100,000.

Web Information Reporting Form 3520 In General, A Form 3520, Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts Is Required.

Try it for free now! Web if you have to file form 3520 this year (annual return to report transactions with foreign trusts and receipt of certain foreign gifts), you can do that manually, by. Web what is form 3520? The due date for filing form 3520 is april and the due.

Ad Register And Subscribe Now To Work On Your Irs Form 3520 & More Fillable Forms.

Web you must separately identify each gift and the identity of the donor. The maximum penalty is 25% of the amount. Web the form is due when a person’s tax return is due to be filed. Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to.