How To Fill Out A Payment To Avoid Garnishment Form

How To Fill Out A Payment To Avoid Garnishment Form - This must be done within 15 days of receiving the “notice of court proceedings to collect debt,” a trustee is a person who will collect the portion of your wages that will be garnished and divide it between your creditors until your debts are paid off. Web whenever the creditor does get an judgment negative you, within 15 days of welcome the “notice by legal proceedings to collect debt have your employer complete the payment to avoid garnishment form and refund it to your creditor with the monthly payment due. If paid monthly, enter one hundred thirty(130) times the current fede. Web to avoid garnishment, apply to your local municipal court for the appointment of a trustee. Web if the creditor does get a judgment against you, within 15 days of receiving the “notice of court proceedings to collect debt have your employer complete the payment to avoid garnishment form and returning it to my creditor with the monthly payment due. Web if you are paid weekly, enter thirty (30) times the current federal minimum hourly wage; If you do, the garnishment amount will be reduced or eliminated, depending on state law. Challenge the wage garnishment in court. Try to negotiate a payment plan with your creditor (s) or settle your debt. Web you fill out a claim of exemption form stating why you believe that exemption applies to you and file it with the court issuing the order allowing the garnishment.

Fill out the payment form. Challenge the wage garnishment in court. This must be done within 15 days of receiving the “notice of court proceedings to collect debt,” a trustee is a person who will collect the portion of your wages that will be garnished and divide it between your creditors until your debts are paid off. Web if you are paid weekly, enter thirty (30) times the current federal minimum hourly wage; File for bankruptcy to stop the garnishment fast. If you do, the garnishment amount will be reduced or eliminated, depending on state law. Web there are four direct ways you can take action to stop a wage garnishment: Web whenever the creditor does get an judgment negative you, within 15 days of welcome the “notice by legal proceedings to collect debt have your employer complete the payment to avoid garnishment form and refund it to your creditor with the monthly payment due. Reach out to a nonprofit to ask for financial assistance. If paid monthly, enter one hundred thirty(130) times the current fede.

Web there are four direct ways you can take action to stop a wage garnishment: If you do, the garnishment amount will be reduced or eliminated, depending on state law. Web if you are paid weekly, enter thirty (30) times the current federal minimum hourly wage; Web wage garnishment is a legal procedure in which a person's earnings are required by court order to be withheld by an employer for the payment of a debt such as child support. If paid monthly, enter one hundred thirty(130) times the current fede. Web if some or all of your income — such as social security — is exempt from garnishment, if you already paid the debt or if it was discharged in a bankruptcy, you’ll have to back up your claim with. This must be done within 15 days of receiving the “notice of court proceedings to collect debt,” a trustee is a person who will collect the portion of your wages that will be garnished and divide it between your creditors until your debts are paid off. Reach out to a nonprofit to ask for financial assistance. Try to negotiate a payment plan with your creditor (s) or settle your debt. Web you fill out a claim of exemption form stating why you believe that exemption applies to you and file it with the court issuing the order allowing the garnishment.

3 Ways to Avoid Wage Garnishment wikiHow

Web if you are paid weekly, enter thirty (30) times the current federal minimum hourly wage; Web wage garnishment is a legal procedure in which a person's earnings are required by court order to be withheld by an employer for the payment of a debt such as child support. If paid monthly, enter one hundred thirty(130) times the current fede..

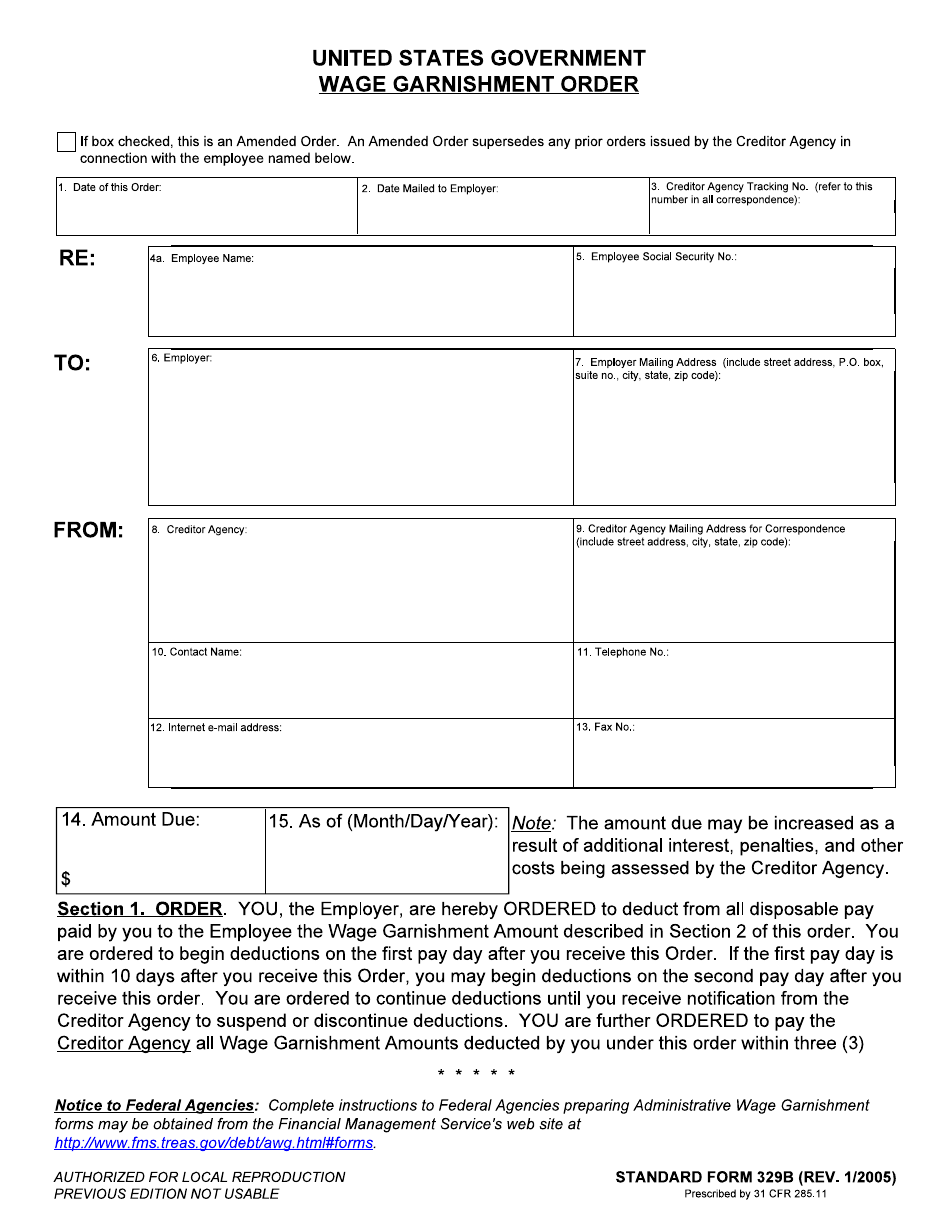

Form SF329B Download Fillable PDF or Fill Online Wage Garnishment

Fill out the payment form. If paid monthly, enter one hundred thirty(130) times the current fede. Web whenever the creditor does get an judgment negative you, within 15 days of welcome the “notice by legal proceedings to collect debt have your employer complete the payment to avoid garnishment form and refund it to your creditor with the monthly payment due..

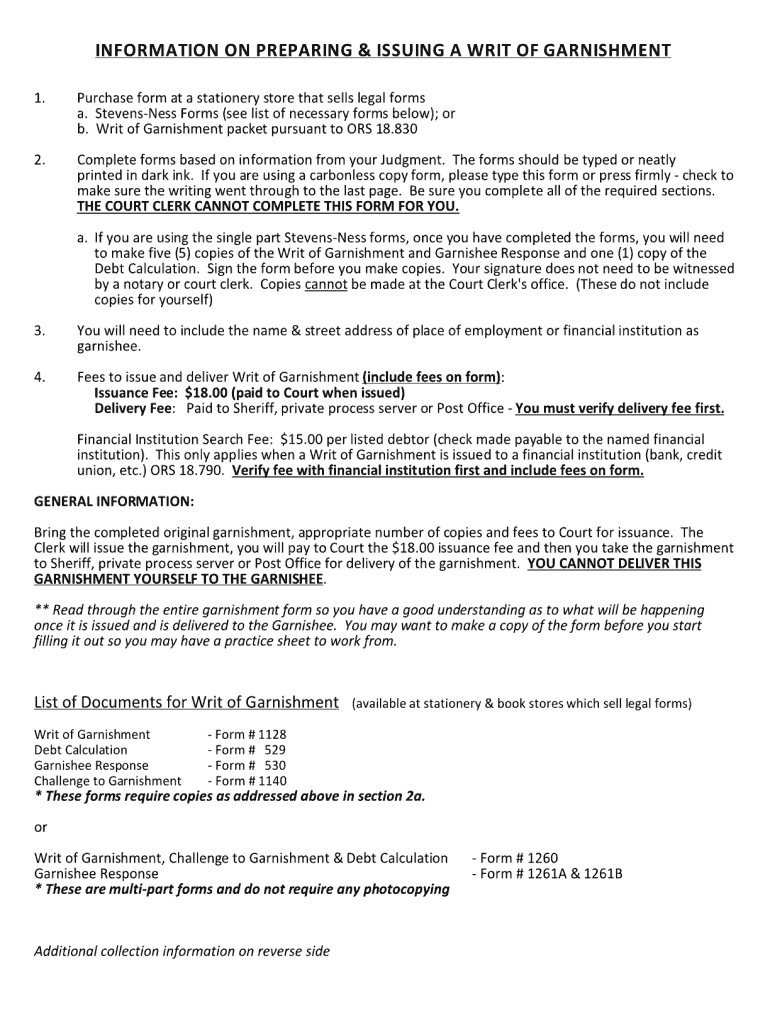

Garnishment Oregon Fill Out and Sign Printable PDF Template signNow

Reach out to a nonprofit to ask for financial assistance. File for bankruptcy to stop the garnishment fast. If you do, the garnishment amount will be reduced or eliminated, depending on state law. If paid monthly, enter one hundred thirty(130) times the current fede. Web if some or all of your income — such as social security — is exempt.

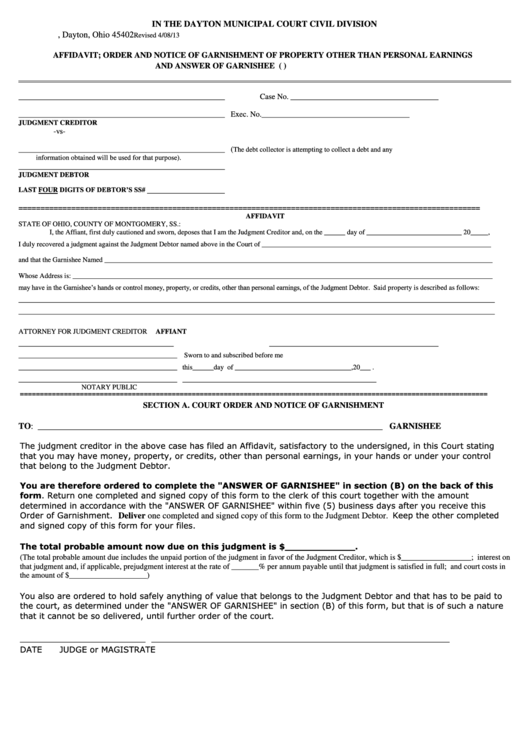

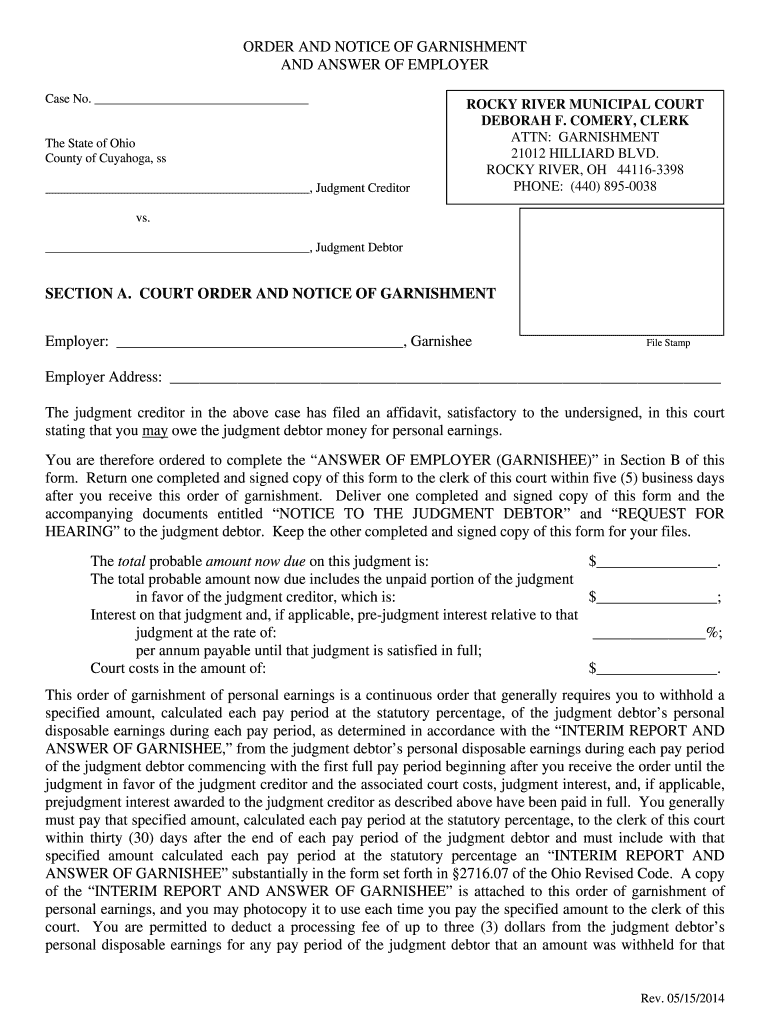

Order And Notice Of Garnishment Of Property Other Form (2013) printable

Fill out the payment form. Try to negotiate a payment plan with your creditor (s) or settle your debt. If paid monthly, enter one hundred thirty(130) times the current fede. Web you fill out a claim of exemption form stating why you believe that exemption applies to you and file it with the court issuing the order allowing the garnishment..

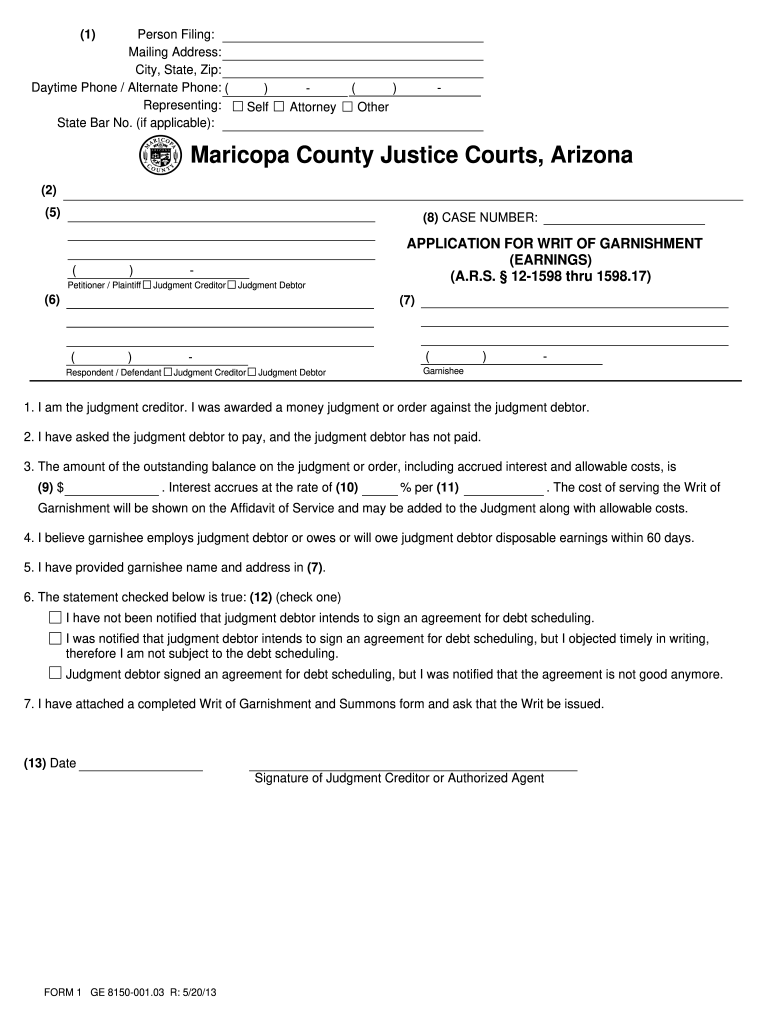

Earnings Writ Fill Out and Sign Printable PDF Template signNow

If paid monthly, enter one hundred thirty(130) times the current fede. Web you fill out a claim of exemption form stating why you believe that exemption applies to you and file it with the court issuing the order allowing the garnishment. Web to avoid garnishment, apply to your local municipal court for the appointment of a trustee. Web the notice.

Fillable Online azcourts wage garnishment answers forms Fax Email Print

Fill out the payment form. The judge will determine if you qualify for that particular exemption. Web wage garnishment is a legal procedure in which a person's earnings are required by court order to be withheld by an employer for the payment of a debt such as child support. Reach out to a nonprofit to ask for financial assistance. Web.

Garnishment Letter Fill Online, Printable, Fillable, Blank pdfFiller

File for bankruptcy to stop the garnishment fast. Challenge the wage garnishment in court. Web to avoid garnishment, apply to your local municipal court for the appointment of a trustee. Web you fill out a claim of exemption form stating why you believe that exemption applies to you and file it with the court issuing the order allowing the garnishment..

Pin on Budgeting 101

If you do, the garnishment amount will be reduced or eliminated, depending on state law. Fill out the payment form. Reach out to a nonprofit to ask for financial assistance. File for bankruptcy to stop the garnishment fast. Web to avoid garnishment, apply to your local municipal court for the appointment of a trustee.

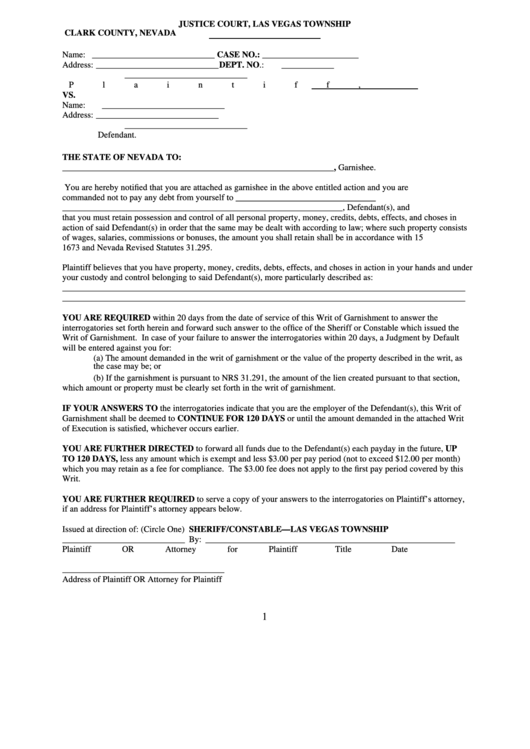

Fillable Writ Of Garnishment printable pdf download

Web whenever the creditor does get an judgment negative you, within 15 days of welcome the “notice by legal proceedings to collect debt have your employer complete the payment to avoid garnishment form and refund it to your creditor with the monthly payment due. File for bankruptcy to stop the garnishment fast. Web wage garnishment is a legal procedure in.

Youtube How To Fill Out Paper Work To Garnish Wedge Oh Fill Out and

Web you fill out a claim of exemption form stating why you believe that exemption applies to you and file it with the court issuing the order allowing the garnishment. Challenge the wage garnishment in court. Try to negotiate a payment plan with your creditor (s) or settle your debt. File for bankruptcy to stop the garnishment fast. Web if.

Web You Fill Out A Claim Of Exemption Form Stating Why You Believe That Exemption Applies To You And File It With The Court Issuing The Order Allowing The Garnishment.

Web if you are paid weekly, enter thirty (30) times the current federal minimum hourly wage; Web wage garnishment is a legal procedure in which a person's earnings are required by court order to be withheld by an employer for the payment of a debt such as child support. If you do, the garnishment amount will be reduced or eliminated, depending on state law. File for bankruptcy to stop the garnishment fast.

Challenge The Wage Garnishment In Court.

Web to avoid garnishment, apply to your local municipal court for the appointment of a trustee. Web whenever the creditor does get an judgment negative you, within 15 days of welcome the “notice by legal proceedings to collect debt have your employer complete the payment to avoid garnishment form and refund it to your creditor with the monthly payment due. Web the notice should include a form titled payment to avoid garnishment. if you intend to use this method to stop wage garnishment, you must complete the form and return it to the creditor within 15 days of the date on the letter or notice to which the form was attached. Web there are four direct ways you can take action to stop a wage garnishment:

Web If The Creditor Does Get A Judgment Against You, Within 15 Days Of Receiving The “Notice Of Court Proceedings To Collect Debt Have Your Employer Complete The Payment To Avoid Garnishment Form And Returning It To My Creditor With The Monthly Payment Due.

Try to negotiate a payment plan with your creditor (s) or settle your debt. This must be done within 15 days of receiving the “notice of court proceedings to collect debt,” a trustee is a person who will collect the portion of your wages that will be garnished and divide it between your creditors until your debts are paid off. Web if some or all of your income — such as social security — is exempt from garnishment, if you already paid the debt or if it was discharged in a bankruptcy, you’ll have to back up your claim with. The judge will determine if you qualify for that particular exemption.

Fill Out The Payment Form.

Reach out to a nonprofit to ask for financial assistance. If paid monthly, enter one hundred thirty(130) times the current fede.