How To Fill Out A Texas Homestead Exemption Form

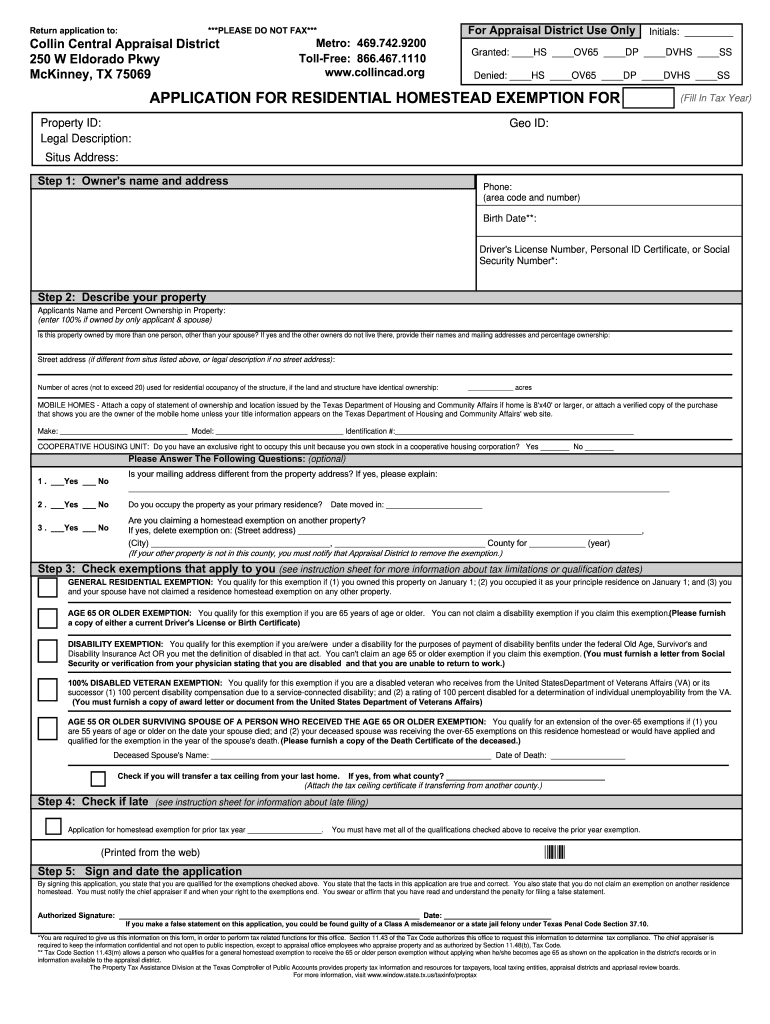

How To Fill Out A Texas Homestead Exemption Form - The typical deadline for filing a county appraisal district. Web how do i get a general $40,000 residence homestead exemption? Web you must apply with your county appraisal district to apply for a homestead exemption. For homestead exemptions other than the age 65 and over or disabled person homestead exemptions provided in tax code §11.13(c) and (d), you. Web first, fill out the application specific to your county appraisal district, then mail all of the documents to the appraisal district for your county. The application for residence homestead exemption is required to apply for a homestead exemption. Web how do you apply for a homestead exemption in texas? What is the deadline for filing a residence homestead exemption? Web first, you should check for specific instructions on your local county's tax appraisal website. This form also allows for an exemption from the homestead.

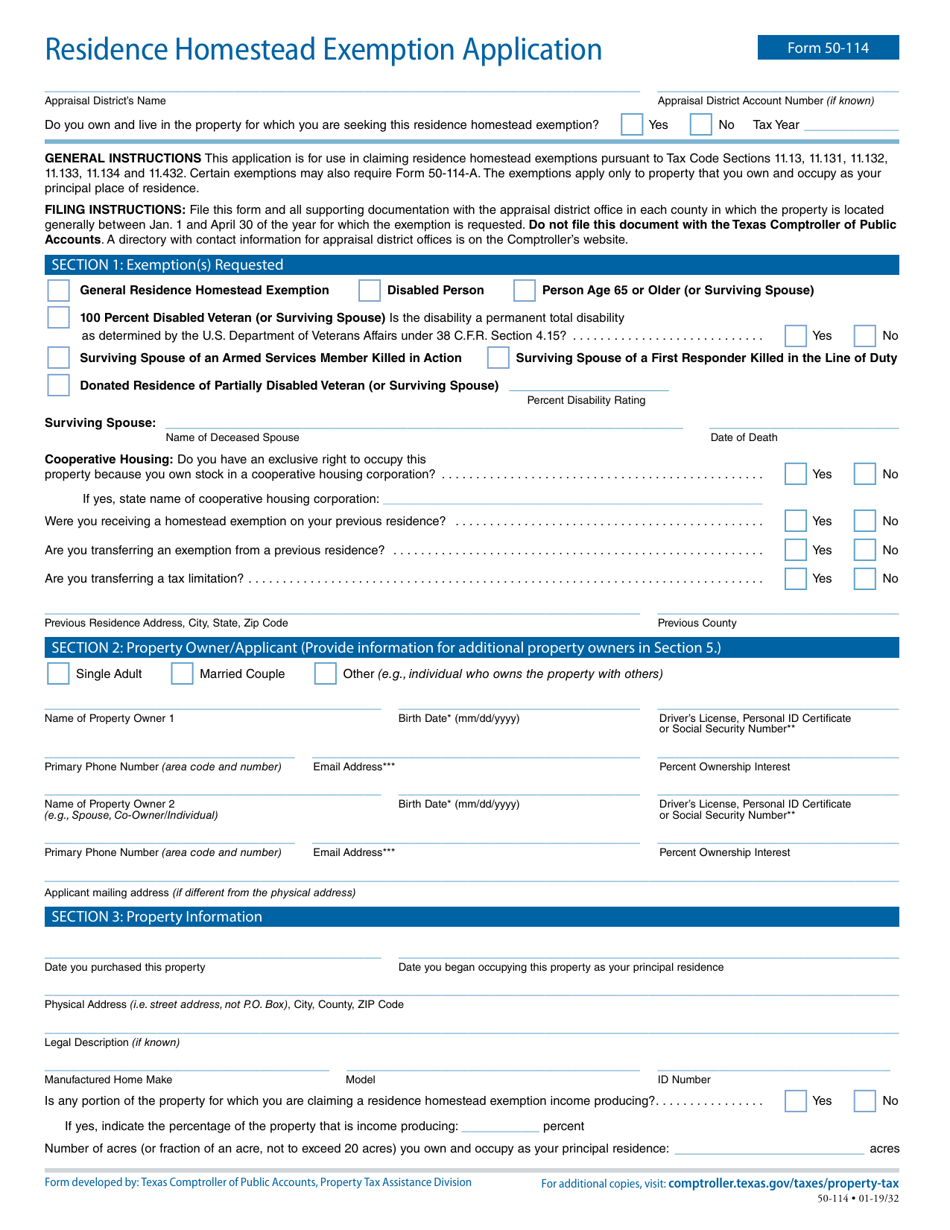

To apply for a homestead exemption, fill out of a copy of the homestead exemption application form and mail it, as well as copies of. Web start by requesting the application form from your county appraisal district, your mortgage company, or by downloading it yourself from texas’s comptroller website. This form also allows for an exemption from the homestead. Web the forms listed below are pdf files. Web you must apply with your county appraisal district to apply for a homestead exemption. Web how to fill out homestead exemption form in texas | homestead exemption harris county | houston texas in order to lower. Web applying for a homestead exemption. For homestead exemptions other than the age 65 and over or disabled person homestead exemptions provided in tax code §11.13(c) and (d), you. Web how do i get a general $40,000 residence homestead exemption? Web how to fill out a homestead exemption form?

Complete, edit or print tax forms instantly. Web residence homestead exemption application. For homestead exemptions other than the age 65 and over or disabled person homestead exemptions provided in tax code §11.13(c) and (d), you. Web how do i get a general $40,000 residence homestead exemption? Web bought a primary residence within the past year in texas? May i continue to receive the residence. Web 1.17k subscribers subscribe 224 share 22k views 5 years ago if you bought a home last year don’t forget to fill out your homestead exemption to lower your annual. Web this form allows for exemption from property tax to some extent depending on the individual circumstances. Web start by requesting the application form from your county appraisal district, your mortgage company, or by downloading it yourself from texas’s comptroller website. Web how to fill out a homestead exemption form?

Form 50114 Download Fillable PDF or Fill Online Residence Homestead

Web you must apply with your county appraisal district to apply for a homestead exemption. The application for residence homestead exemption is required to apply for a homestead exemption. Web start by requesting the application form from your county appraisal district, your mortgage company, or by downloading it yourself from texas’s comptroller website. Web how to fill out homestead exemption.

How to Fill Out Homestead Exemption Form Texas Homestead Exemption

Web how do i get a general $40,000 residence homestead exemption? Web start by requesting the application form from your county appraisal district, your mortgage company, or by downloading it yourself from texas’s comptroller website. The typical deadline for filing a county appraisal district. Go to your county's appraisal district. This form also allows for an exemption from the homestead.

Brazos County Homestead Exemption Fill Online, Printable, Fillable

This form also allows for an exemption from the homestead. Web the homestead exemption allows homeowners to exempt a portion of the appraised value of their primary residence from taxation, so their tax burden is lower. The application for residence homestead exemption is required to apply for a homestead exemption. Web how to fill out a homestead exemption form? Complete,.

Texas Homestead Tax Exemption Form

May i continue to receive the residence. Web how to fill out a homestead exemption form? Web bought a primary residence within the past year in texas? Web a qualified texas homeowner can file for the homestead exemption by filing the form that can be downloaded below. To apply for a homestead exemption, fill out of a copy of the.

How to File for Homestead Exemption in Texas, Houston, Harris County

Web 1.17k subscribers subscribe 224 share 22k views 5 years ago if you bought a home last year don’t forget to fill out your homestead exemption to lower your annual. Web how do you apply for a homestead exemption in texas? Web start by requesting the application form from your county appraisal district, your mortgage company, or by downloading it.

Designation Of Homestead Request Form Texas

Web you must apply with your county appraisal district to apply for a homestead exemption. They include graphics, fillable form fields, scripts and functionality that work best with the free adobe reader. Web download the application from the denton countyappraisal district’s website. Then, download the texas residence homestead exemption. Web how do i get a general $40,000 residence homestead exemption?

Deadline to file homestead exemption in Texas is April 30

Web the forms listed below are pdf files. For homestead exemptions other than the age 65 and over or disabled person homestead exemptions provided in tax code §11.13(c) and (d), you. What is the deadline for filing a residence homestead exemption? To apply for a homestead exemption, fill out of a copy of the homestead exemption application form and mail.

What is the Homestead Exemption in Texas? Facing Foreclosure Houston

Web you must apply with your county appraisal district to apply for a homestead exemption. It’s time to file for your texas homestead exemption. To apply for a homestead exemption, fill out of a copy of the homestead exemption application form and mail it, as well as copies of. Then, download the texas residence homestead exemption. What is the deadline.

TEXAS HOMESTEAD EXEMPTION What You Need to Know YouTube

1 and april 30 of the. Web how to fill out homestead exemption form in texas | homestead exemption harris county | houston texas in order to lower. Web start by requesting the application form from your county appraisal district, your mortgage company, or by downloading it yourself from texas’s comptroller website. Web the texas homestead exemption form or tex4141.

How to fill out your Texas homestead exemption form YouTube

Web how do i get a general $40,000 residence homestead exemption? Web this form allows for exemption from property tax to some extent depending on the individual circumstances. Web the forms listed below are pdf files. Web first, you should check for specific instructions on your local county's tax appraisal website. For homestead exemptions other than the age 65 and.

Texas Homestead Exemption Application Deadline Supporting Documents For Homestead Exemption Heir.

Web first, fill out the application specific to your county appraisal district, then mail all of the documents to the appraisal district for your county. Web start by requesting the application form from your county appraisal district, your mortgage company, or by downloading it yourself from texas’s comptroller website. Web you must apply with your county appraisal district to apply for a homestead exemption. Go to your county's appraisal district.

What Is The Deadline For Filing A Residence Homestead Exemption?

The typical deadline for filing a county appraisal district. Web how to fill out a homestead exemption form? Web how do i get a general $40,000 residence homestead exemption? Web a qualified texas homeowner can file for the homestead exemption by filing the form that can be downloaded below.

Web This Form Allows For Exemption From Property Tax To Some Extent Depending On The Individual Circumstances.

May i continue to receive the residence. Web bought a primary residence within the past year in texas? For homestead exemptions other than the age 65 and over or disabled person homestead exemptions provided in tax code §11.13(c) and (d), you. Web download the application from the denton countyappraisal district’s website.

Web Applying For A Homestead Exemption.

Complete, edit or print tax forms instantly. 1 and april 30 of the. It’s time to file for your texas homestead exemption. For filing with the appraisal district office in each county in which the property is located generally between jan.