How To Fill Out Form 941 For Employee Retention Credit

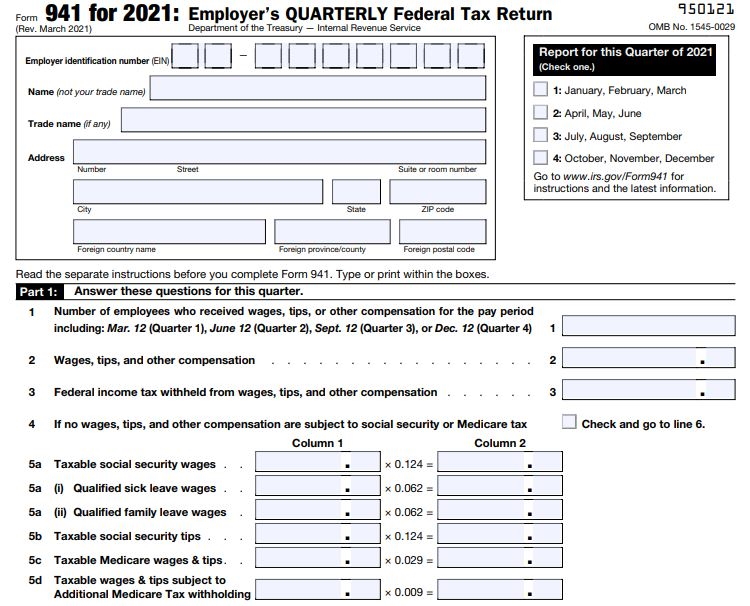

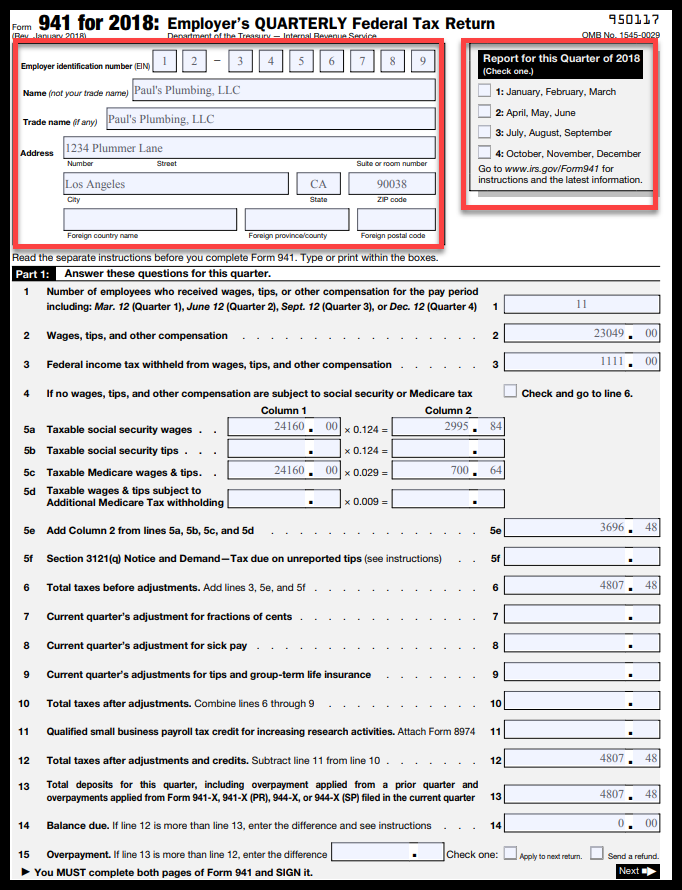

How To Fill Out Form 941 For Employee Retention Credit - Please remember, this article was written as a general guide, and is not meant to replace consulting with tax experts. Check to see if you qualify. Claim your ercs with confidence today. Web the employer's employee retention credit on form 941, line 16, month 3, or, if a semiweekly schedule depositor, on schedule b (form 941) for the applicable day or days in december (month 3) for the fourth quarter of 2021. Ad stentam is the nations leading tax technology firm. Fill in the required details on the page header, such as the ein number, quarter, company name, and year. Ad we take the confusion out of erc funding and specialize in working with small businesses. Determine if you had a qualifying closure. Utilize the worksheet to calculate the tax credit. See if you do in 2 min

Web employee retention credit worksheet calculation. Claim your ercs with confidence today. Web do it yourself. Work with an experienced professional. Check part 1, box 2 b. Companies qualify to get up to $26,000 per employee. Fill in the required details on the page header, such as the ein number, quarter, company name, and year. Utilize the worksheet to calculate the tax credit. Calculate the erc for your business. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction

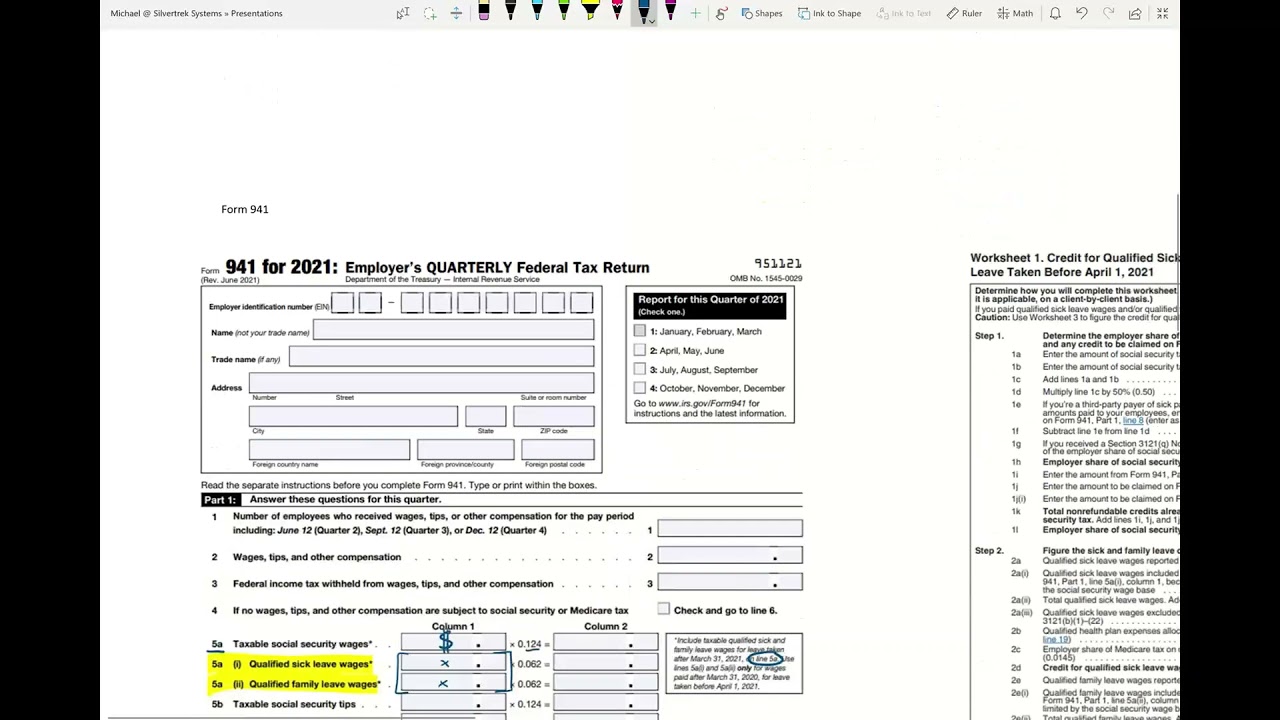

Web employee retention credit worksheet calculation. Determine if you had a qualifying closure. Web do it yourself. See if you do in 2 min Utilize the worksheet to calculate the tax credit. Up to $26,000 per employee. Ad stentam is the nations leading tax technology firm. To claim the employee retention credit, utilize line 11c in form 941, and worksheet 1 that it references is on the last page of the form 941 instructions. Check to see if you qualify. Ad we take the confusion out of erc funding and specialize in working with small businesses.

Updated 941 and Employee Retention Credit in Vista YouTube

For more information, see the line 16 instructions, later. Ad there is no cost to you until you receive the funds from the irs. Companies qualify to get up to $26,000 per employee. Find which payroll quarters in 2020 and 2021 your association was qualified for. Up to $26,000 per employee.

Employee Retention Credit Form MPLOYME

Web irs form 941 is the form you regularly file quarterly with your payroll. Ad there is no cost to you until you receive the funds from the irs. Utilize the worksheet to calculate the tax credit. Get the maximum tax benefit for your business with our assistance. Work with an experienced professional.

How To Fill Out Form 941 X For Employee Retention Credit In 2020

Web the employer's employee retention credit on form 941, line 16, month 3, or, if a semiweekly schedule depositor, on schedule b (form 941) for the applicable day or days in december (month 3) for the fourth quarter of 2021. For more information, see the line 16 instructions, later. Ad we take the confusion out of erc funding and specialize.

How to Fill Out 941X for Employee Retention Credit? by Employee

Work with an experienced professional. See if you do in 2 min Utilize the worksheet to calculate the tax credit. Web do it yourself. Web irs form 941 is the form you regularly file quarterly with your payroll.

Easy Instructions to Prepare Form 941

Ad there is no cost to you until you receive the funds from the irs. Determine if you had a qualifying closure. Web irs form 941 is the form you regularly file quarterly with your payroll. Please remember, this article was written as a general guide, and is not meant to replace consulting with tax experts. Calculate the erc for.

941 X Form Fill Out and Sign Printable PDF Template signNow

Web irs form 941 is the form you regularly file quarterly with your payroll. Assess your qualified wages for each year. Up to $26,000 per employee. See if you do in 2 min Companies qualify to get up to $26,000 per employee.

How To Fill Out Form 941 X For Employee Retention Credit

Claim your ercs with confidence today. Web irs form 941 is the form you regularly file quarterly with your payroll. Up to $26,000 per employee. Web do it yourself. Utilize the worksheet to calculate the tax credit.

How to Fill out IRS Form 941 Nina's Soap

Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction Work with an experienced professional. Ad stentam is the nations leading tax technology firm. Web irs form 941 is the form you regularly file quarterly with your payroll. Ad there is no cost to you until you receive.

Form Bavar 2018 941 for 2018 Employer's QUARTERLY

Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction Up to $26,000 per employee. Web do it yourself. Find which payroll quarters in 2020 and 2021 your association was qualified for. Web irs form 941 is the form you regularly file quarterly with your payroll.

10 Form Irs 10 10 Secrets About 10 Form Irs 10 That Has Never Been

Check to see if you qualify. Ad get tax credit directly from the irs with our streamlined erc services. Web irs form 941 is the form you regularly file quarterly with your payroll. Ad stentam is the nations leading tax technology firm. Web if you claimed the employee retention credit for wages paid after june 30, 2021, and before january.

Companies Qualify To Get Up To $26,000 Per Employee.

Please remember, this article was written as a general guide, and is not meant to replace consulting with tax experts. For more information, see the line 16 instructions, later. Web employee retention credit worksheet calculation. Ad there is no cost to you until you receive the funds from the irs.

Therefore, You May Need To Amend Your Income Tax Return (For Example, Forms 1040, 1065, 1120, Etc.) To Reflect That Reduced Deduction

Calculate the erc for your business. Ad stentam is the nations leading tax technology firm. Ad we take the confusion out of erc funding and specialize in working with small businesses. Web if you claimed the employee retention credit for wages paid after june 30, 2021, and before january 1, 2022, and you make any corrections on form 941‐x to amounts used to figure this credit, you'll need to refigure the amount of this credit using worksheet 4.

Complete The Company Information On Each Page, The “Return You’re Correcting” Information In The Upper Right Corner And Enter The Date You Discovered The Errors.

Up to $26,000 per employee. Claim your ercs with confidence today. Fill in the required details on the page header, such as the ein number, quarter, company name, and year. Web do it yourself.

Check To See If You Qualify.

Check part 1, box 2 b. See if you do in 2 min Utilize the worksheet to calculate the tax credit. Web the employer's employee retention credit on form 941, line 16, month 3, or, if a semiweekly schedule depositor, on schedule b (form 941) for the applicable day or days in december (month 3) for the fourth quarter of 2021.

:max_bytes(150000):strip_icc()/scan0001-57aa87625f9b58974a2c7f97.jpg)