How To Fill Out Tax Form 5695

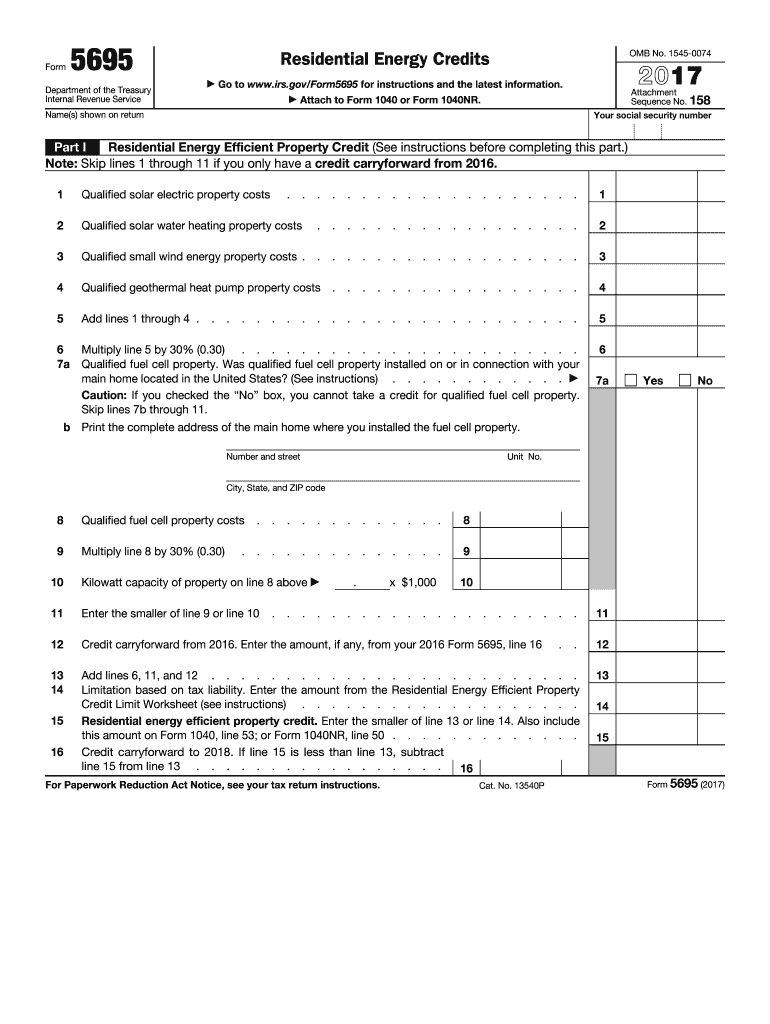

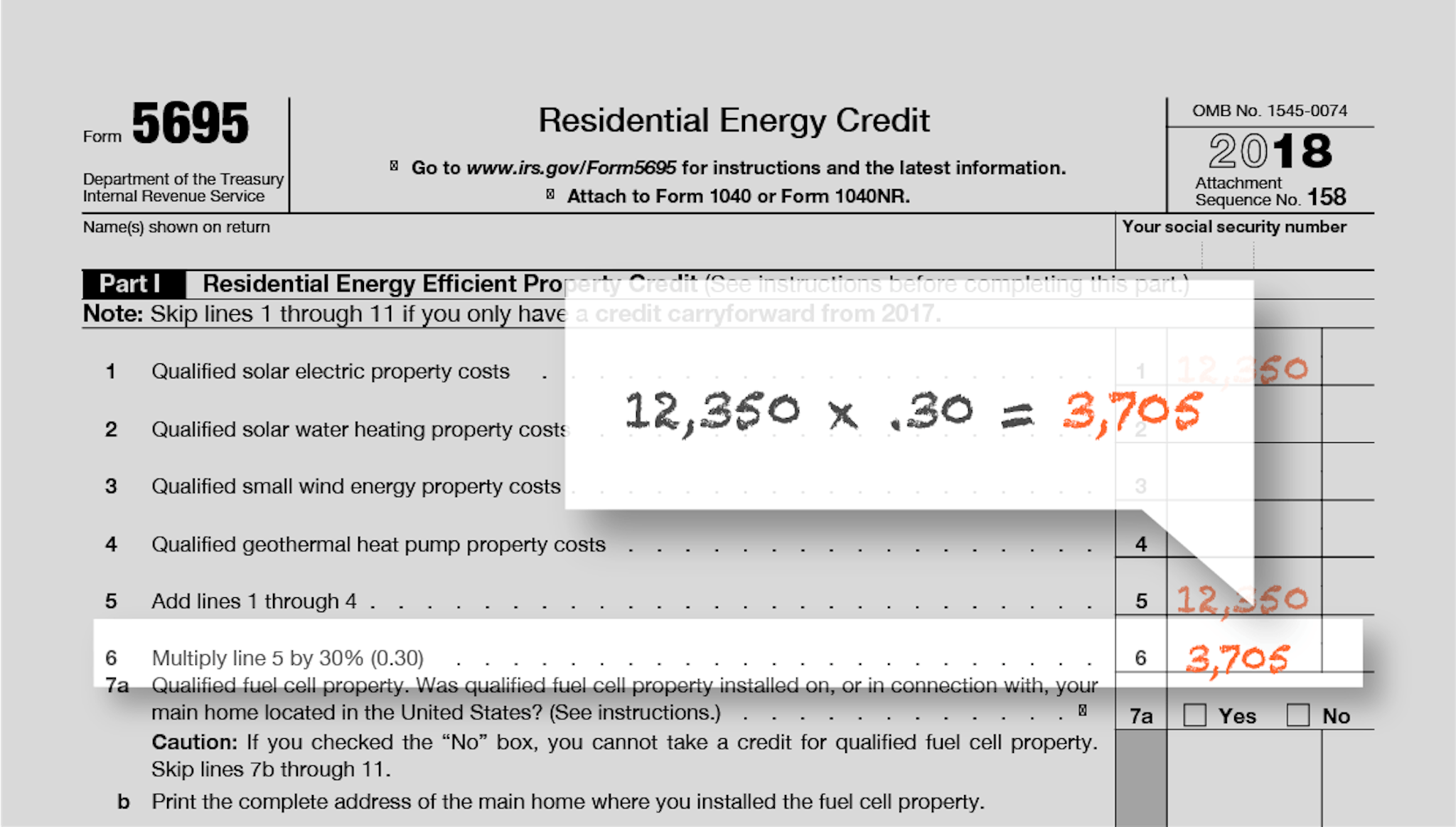

How To Fill Out Tax Form 5695 - In the topic box, highlight 5695, residential energy credit, then click go. Irs form 5695 has a total of two parts in two pages. Web form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. Web use form 5695 to figure and take your residential energy credits. Web form 5695 is what you need to fill out to calculate your residential energy tax credits. You need to submit it alongside form 1040. For updates on the 2022 versions of form 5695, see the following playlist: Web all you need to do is complete irs form 5695, “residential energy credits,” and include the final result of that form on irs form 1040. Web get answers to frequently asked questions about entering information from form 5695, residential energy credits, in the individual module of intuit proconnect. Web up to $40 cash back fill missouri tax form 5695, edit online.

Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Web learn about claiming residential energy credits using form 5695 here. To add or remove this. Web forms and manuals find your form. Form 5695 calculates tax credits for a variety. Web all you need to do is complete irs form 5695, “residential energy credits,” and include the final result of that form on irs form 1040. Web up to $40 cash back fill missouri tax form 5695, edit online. The residential clean energy credit, and the energy efficient home. You need to submit it alongside form 1040. Web department of the treasury internal revenue service residential energy credits go to www.irs.gov/form5695 for instructions and the latest information.

Web get answers to frequently asked questions about entering information from form 5695, residential energy credits, in the individual module of intuit proconnect. Web home forms and instructions about form 5695, residential energy credits about form 5695, residential energy credits use form 5695 to figure and take your. Web form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Web department of the treasury internal revenue service residential energy credits go to www.irs.gov/form5695 for instructions and the latest information. Web form 5695 is what you need to fill out to calculate your residential energy tax credits. Web department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information. You need to submit it alongside form 1040. Web all you need to do is complete irs form 5695, “residential energy credits,” and include the final result of that form on irs form 1040. In the topic box, highlight 5695, residential energy credit, then click go.

5695 form Fill out & sign online DocHub

Web department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information. You need to submit it alongside form 1040. Web use form 5695 to figure and take your residential energy credits. The residential energy credits are: To add or remove this.

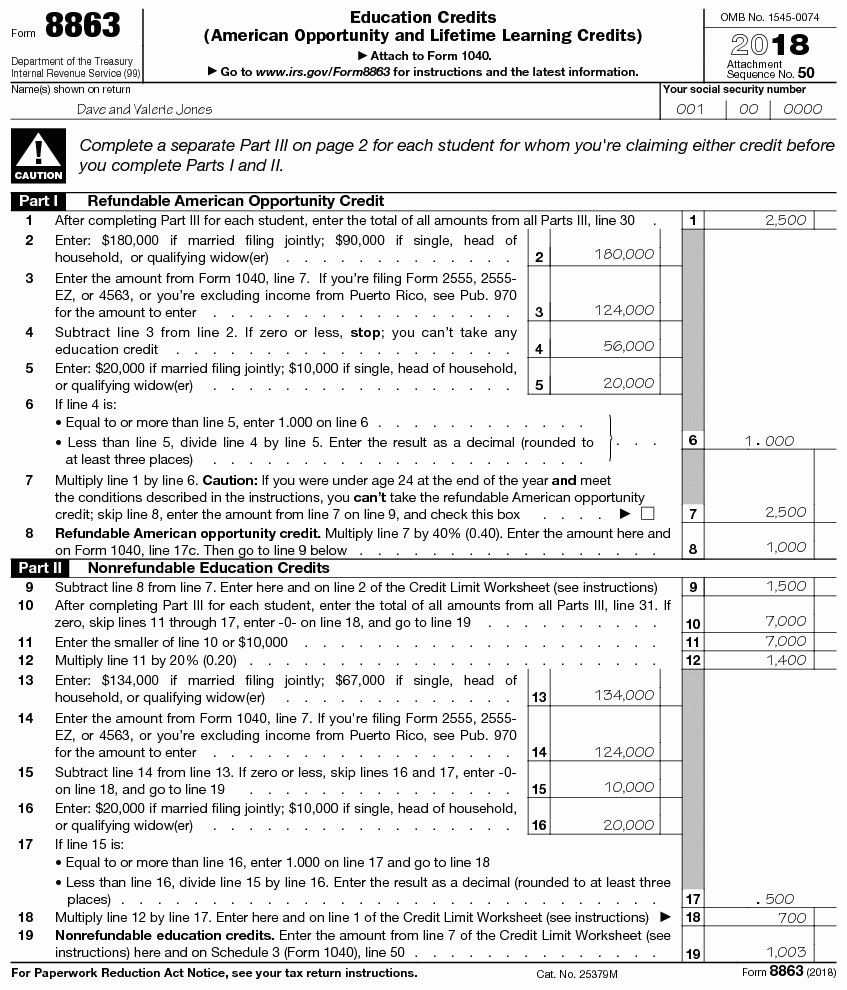

What is an Air Conditioner Tax Credit? (with pictures)

Web department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information. To add or remove this. The residential energy credits are: Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Web up to $40 cash back fill missouri tax form 5695, edit online.

Form 5695 Instructions Information On Form 5695 —

In the topic box, highlight 5695, residential energy credit, then click go. The residential energy credits are: Web learn about claiming residential energy credits using form 5695 here. In the search bar, type 5695. You need to submit it alongside form 1040.

Ev Federal Tax Credit Form

The residential energy credits are: Web forms and manuals find your form. Web all you need to do is complete irs form 5695, “residential energy credits,” and include the final result of that form on irs form 1040. In the search bar, type 5695. Web department of the treasury internal revenue service residential energy credits go to www.irs.gov/form5695 for instructions.

How to File IRS Form 5695 To Claim Your Renewable Energy Credits

To add or remove this. Web learn about claiming residential energy credits using form 5695 here. Form 5695 calculates tax credits for a variety. Web up to $40 cash back fill missouri tax form 5695, edit online. Web get answers to frequently asked questions about entering information from form 5695, residential energy credits, in the individual module of intuit proconnect.

Form Instructions Is Available For How To File 5695 2018 —

You just have to complete the section concerning to the types of credits you need to claim. Web form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. Web department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information. You need to submit it alongside.

How to file for the solar tax credit IRS Form 5695 instructions (2023)

Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. The residential energy credits are: Web all you need to do is complete irs form 5695, “residential energy credits,” and include the final result of that form on irs form 1040. In the topic box, highlight 5695, residential energy credit, then click go. You just have to.

Tax Form 5695 Stock Photo Download Image Now iStock

In the search bar, type 5695. The residential clean energy credit, and the energy efficient home. Web department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information. Web department of the treasury internal revenue service residential energy credits go to www.irs.gov/form5695 for instructions and the latest information. Web forms and manuals find your form.

Image tagged in scumbag,old fashioned Imgflip

You just have to complete the section concerning to the types of credits you need to claim. You need to submit it alongside form 1040. To add or remove this. Web learn about claiming residential energy credits using form 5695 here. Web home forms and instructions about form 5695, residential energy credits about form 5695, residential energy credits use form.

Tax 2022 Irs Latest News Update

Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. In the topic box, highlight 5695, residential energy credit, then click go. Web department of the treasury internal revenue service residential energy credits go to www.irs.gov/form5695 for instructions and the latest information. In the search bar, type 5695. Web form 5695 (residential energy credits) is used to.

The Residential Clean Energy Credit, And The Energy Efficient Home.

In the topic box, highlight 5695, residential energy credit, then click go. Web up to $40 cash back fill missouri tax form 5695, edit online. The residential energy credits are: Web all you need to do is complete irs form 5695, “residential energy credits,” and include the final result of that form on irs form 1040.

Web Department Of The Treasury Internal Revenue Service Go To Www.irs.gov/Form5695 For Instructions And The Latest Information.

Web get answers to frequently asked questions about entering information from form 5695, residential energy credits, in the individual module of intuit proconnect. In the search bar, type 5695. Web department of the treasury internal revenue service residential energy credits go to www.irs.gov/form5695 for instructions and the latest information. Web learn about claiming residential energy credits using form 5695 here.

Irs Form 5695 Has A Total Of Two Parts In Two Pages.

You need to submit it alongside form 1040. For updates on the 2022 versions of form 5695, see the following playlist: Web form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. Web home forms and instructions about form 5695, residential energy credits about form 5695, residential energy credits use form 5695 to figure and take your.

Form 5695 Calculates Tax Credits For A Variety.

Web forms and manuals find your form. Web use form 5695 to figure and take your residential energy credits. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Web form 5695 is what you need to fill out to calculate your residential energy tax credits.