How To Form A Real Estate Investment Group

How To Form A Real Estate Investment Group - Assign each investor a real estate sector to follow, i.e., office, storage, retail, industrial. Learn about the purpose and structure of existing clubs. Reit must be formed in one of the 50 states or the district of columbia as an entity taxable for federal purposes as a corporation. That's why putting together an investment group is a smart idea if you're going to buy an income generating property or multiple investment properties over the years. Web how to start a real estate investment club. Open a bank account in the name of your legal entity. In a typical real estate investment. Before we dive into the things you shouldn’t do, let’s first establish a few essential steps you should take to start an investment group. There is no such thing as an original idea! Web in the long run, these real estate experts will save you money.

How to start a real estate investment group. Learn how to analyze real estate investments; Web in the long run, these real estate experts will save you money. In a typical real estate investment. Open a bank account in the name of your legal entity. Invest in different property types and across different locations Learn about the purpose and structure of existing clubs. This entity will hold the real estate investment property or properties. You should consider factors such as location, market conditions, cash flow, appreciation potential, risk level, and exit strategy. Assign each investor a real estate sector to follow, i.e., office, storage, retail, industrial.

How to start a real estate investment group. In a typical real estate investment. Here are a few tips on how to form a real estate investment group: Before we dive into the things you shouldn’t do, let’s first establish a few essential steps you should take to start an investment group. Web how to start an investment group: Web those with high skills focus on the overall situation and seek the overall situation. A reig is a group of private investors who invest primarily in real estate by pooling money, knowledge, and/or time to acquire properties that. The first step to building a successful investment group is. Look for other real estate investors online or through agents; That's why putting together an investment group is a smart idea if you're going to buy an income generating property or multiple investment properties over the years.

How to Start a Real Estate Investment Group in 2020 Real estate

.0075 and reached 270% intraday. Web find and analyze deals you will need to research and evaluate potential property investment opportunities based on your criteria and objectives. Web how to start an investment group: Attend a few meetings to get a feel for how they operate. Open a bank account in the name of your legal entity.

Understanding The Permit Process Meetup

How to start a real estate investment group. Web how to start an investment group: Assign each investor a real estate sector to follow, i.e., office, storage, retail, industrial. Invest in different property types and across different locations Web in the long run, these real estate experts will save you money.

Pin on RSN Property Group

Before we dive into the things you shouldn’t do, let’s first establish a few essential steps you should take to start an investment group. In a typical real estate investment. There is no such thing as an original idea! It must be governed by directors or trustees and its shares must be transferable. Assign each investor a real estate sector.

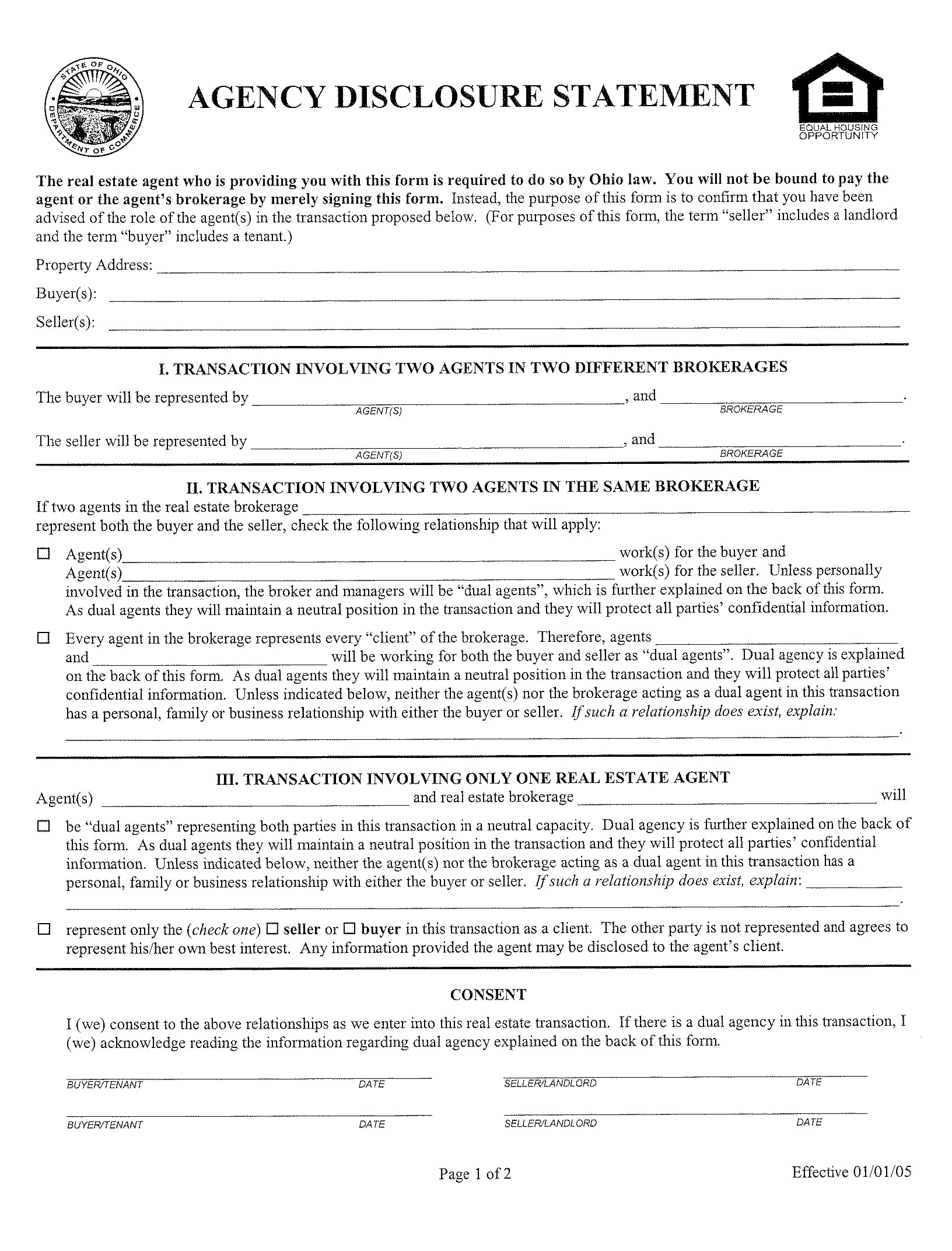

Real Estate Investment Form

How to start a real estate investment group. Web find and analyze deals you will need to research and evaluate potential property investment opportunities based on your criteria and objectives. Think about being a real estate investor as being a jack of all trades, master of none. You should consider factors such as location, market conditions, cash flow, appreciation potential,.

realestatebestinvestment MoneyMiniBlog

That's why putting together an investment group is a smart idea if you're going to buy an income generating property or multiple investment properties over the years. Web key takeaways a real estate investment group (reig) can be any entity with multiple partners that focuses the majority of its business on real estate. Select an appropriate legal structure, such as.

How to Start a Real Estate Investment Group Real estate investment

Here are a few tips on how to form a real estate investment group: Web find and analyze deals you will need to research and evaluate potential property investment opportunities based on your criteria and objectives. Think about being a real estate investor as being a jack of all trades, master of none. Web how to start an investment group:.

How to Start a Real Estate Investment Group [3 bonus strategies] YouTube

Select an appropriate legal structure, such as an llc, partnership, or corporation, to form your investment group. Assign each investor a real estate sector to follow, i.e., office, storage, retail, industrial. Think about being a real estate investor as being a jack of all trades, master of none. Getty images what is a reig? This entity will hold the real.

How to Start a Real Estate Investment Group Whistler Real Estate News

Learn how to analyze real estate investments; That's why putting together an investment group is a smart idea if you're going to buy an income generating property or multiple investment properties over the years. This entity will hold the real estate investment property or properties. Web how to start an investment group: It must be governed by directors or trustees.

The ABCs of Determining Multifamily Investment Property Class Page

Reit must be formed in one of the 50 states or the district of columbia as an entity taxable for federal purposes as a corporation. Learn about the purpose and structure of existing clubs. Before we dive into the things you shouldn’t do, let’s first establish a few essential steps you should take to start an investment group. Getty images.

FREE 18+ Real Estate Contract and Agreement Forms in PDF Ms Word Excel

That's why putting together an investment group is a smart idea if you're going to buy an income generating property or multiple investment properties over the years. This entity will hold the real estate investment property or properties. Invest in different property types and across different locations Reit must be formed in one of the 50 states or the district.

Before We Dive Into The Things You Shouldn’t Do, Let’s First Establish A Few Essential Steps You Should Take To Start An Investment Group.

Attend a few meetings to get a feel for how they operate. Web find and analyze deals you will need to research and evaluate potential property investment opportunities based on your criteria and objectives. See what you would like to emulate and what you would do differently. There is no such thing as an original idea!

.0075 And Reached 270% Intraday.

Here are a few tips on how to form a real estate investment group: You should consider factors such as location, market conditions, cash flow, appreciation potential, risk level, and exit strategy. In a typical real estate investment. Think about being a real estate investor as being a jack of all trades, master of none.

Web Those With High Skills Focus On The Overall Situation And Seek The Overall Situation.

Select an appropriate legal structure, such as an llc, partnership, or corporation, to form your investment group. This entity will hold the real estate investment property or properties. It must be governed by directors or trustees and its shares must be transferable. Web how to start a real estate investment club.

Web In The Long Run, These Real Estate Experts Will Save You Money.

Web choose a legal entity: How must a real estate company be organized to qualify as a reit? A reig is a group of private investors who invest primarily in real estate by pooling money, knowledge, and/or time to acquire properties that. How to start a real estate investment group.

![How to Start a Real Estate Investment Group [3 bonus strategies] YouTube](https://i.ytimg.com/vi/kMez73xQVXU/maxresdefault.jpg)