How To Form A Sole Proprietorship In Illinois

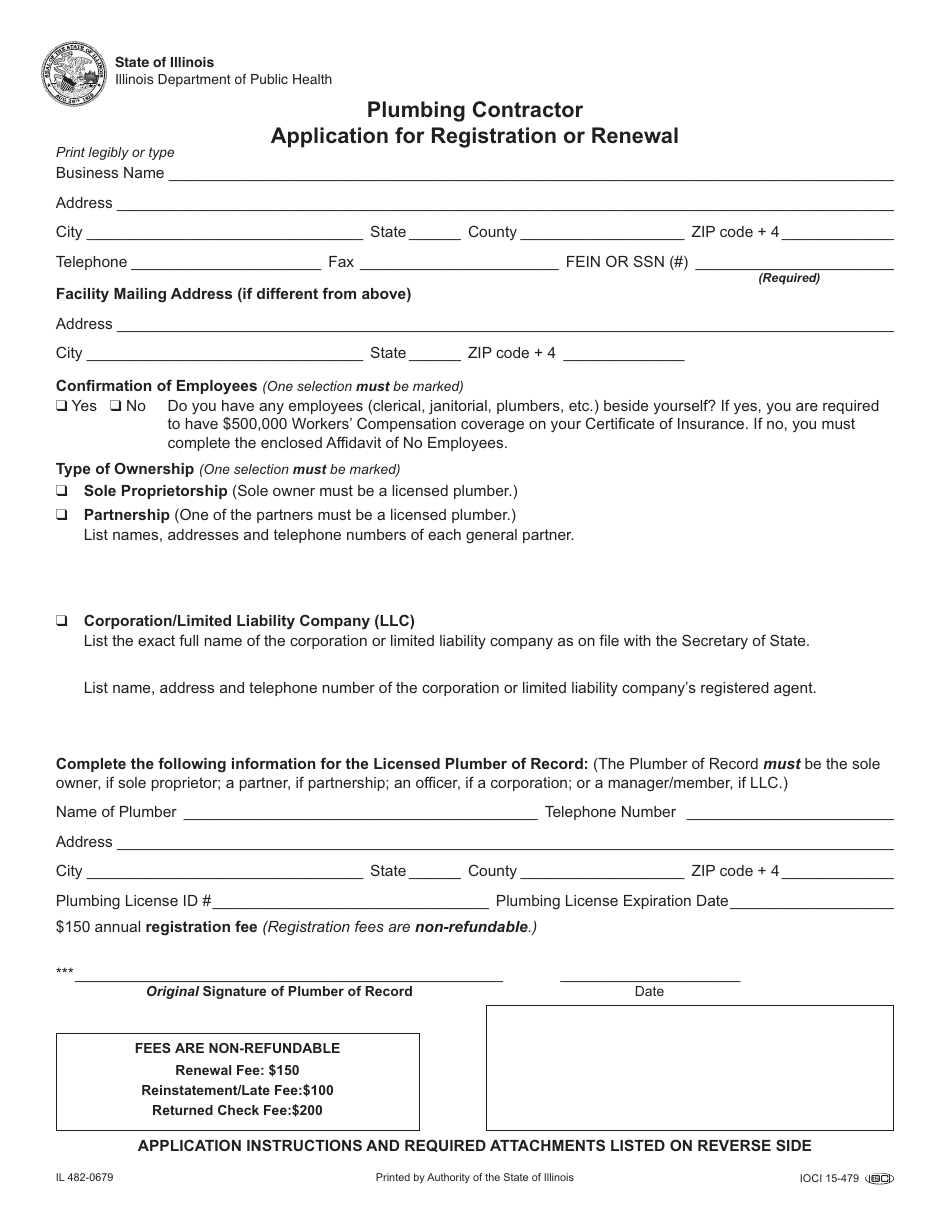

How To Form A Sole Proprietorship In Illinois - Web a sole proprietor is an individual who owns an unincorporated business that is not registered as a corporation or limited liability company. Plus, get a registered agent, bylaws, tax id/ein, business license, and more. If you are the only owner of the business, you are a sole proprietor. Web you will need to register with the illinois department of revenue business registration. The business owner puts in all the money, makes all decisions, pays federal income tax on net income using schedule c to form. Web learn about hide what is a sole proprietorship? This guide assumes you have selected. After you obtain the name certificate, the next step sole proprietors need to. Choose a business name for your sole proprietorship and check for availability. Check with your county recorder's office to determine filing requirements.

Web considerations control do you feel the need to have total control of your business? Plus, get a registered agent, bylaws, tax id/ein, business license, and more. Web sole proprietorships are filed only at the county level. Get started today w/ us. Select an appropriate business name a sole proprietor in illinois can use his/her own given name or may opt for a trade or assumed business. Web the most common forms today are sole proprietorship, partnership, limited partnership, limited liability company and corporation. When a business name is different from the owner (s) full legal name (s), the illinois assumed name act requires sole. Web businesses business registration you must register with the illinois department of revenue if you conduct business in illinois, or with illinois customers. Web sole proprietorship and general partnership. Web illinois secretary of state securities department 421 e.

When a business name is different from the owner (s) full legal name (s), the illinois assumed name act requires sole. Get started today w/ us. For more information on corporations and not for. Web how to start an illinois sole proprietorship. Web learn about hide what is a sole proprietorship? If you are the only owner of the business, you are a sole proprietor. Web 7 steps to start a sole proprietorship bottom line frequently asked questions (faqs) if you’ve been feeling an inner pull to start your own business, then. This guide assumes you have selected. Web considerations control do you feel the need to have total control of your business? Web illinois secretary of state securities department 421 e.

Form Sole Proprietorship Illinois Armando Friend's Template

Select an appropriate business name a sole proprietor in illinois can use his/her own given name or may opt for a trade or assumed business. Web you will need to register with the illinois department of revenue business registration. Web the simplest form is a sole proprietorship. This is a business entity that doesn’t elect to separate business finances and.

Form Sole Proprietorship Illinois Armando Friend's Template

After you obtain the name certificate, the next step sole proprietors need to. Sole proprietorship advantages sole proprietorship disadvantages how to start an illinois sole. This guide assumes you have selected. Web sole proprietorship and general partnership. The requirements are similar to federal income tax procedures, including withholding and payments of estimated tax.

Form Sole Proprietorship Illinois Armando Friend's Template

Web a sole proprietor is an individual who owns an unincorporated business that is not registered as a corporation or limited liability company. It is the simplest form of. The business owner puts in all the money, makes all decisions, pays federal income tax on net income using schedule c to form. Web you can apply for an ein online.

How To A Sole Proprietor In Illinois

Web how to start an illinois sole proprietorship. Sole proprietorship provides you with complete authority over the. For more information on corporations and not for. Please see our section on choosing and checking the availability of a name for your small. Web illinois secretary of state securities department 421 e.

Form Sole Proprietorship Illinois Armando Friend's Template

Web you will need to register with the illinois department of revenue business registration. After you obtain the name certificate, the next step sole proprietors need to. Web locate registered business names. If you are the only owner of the business, you are a sole proprietor. Web the most common forms today are sole proprietorship, partnership, limited partnership, limited liability.

Choosing the Best Legal Structure for Your Business Gentle Care

Web sole proprietorships are filed only at the county level. There is usually no government filing or approval required to operate your business as a. Get started today w/ us. Sole proprietorship advantages sole proprietorship disadvantages how to start an illinois sole. Please see our section on choosing and checking the availability of a name for your small.

Form Sole Proprietorship Illinois Armando Friend's Template

Please see our section on choosing and checking the availability of a name for your small. Web how to start an illinois sole proprietorship. The requirements are similar to federal income tax procedures, including withholding and payments of estimated tax. Web businesses business registration you must register with the illinois department of revenue if you conduct business in illinois, or.

Form Sole Proprietorship Illinois Armando Friend's Template

Web considerations control do you feel the need to have total control of your business? Web businesses business registration you must register with the illinois department of revenue if you conduct business in illinois, or with illinois customers. Web step 1 #1: Web the most common forms today are sole proprietorship, partnership, limited partnership, limited liability company and corporation. Sole.

Sole Proprietorship In Delhi Process Documents Require

Sole proprietorship provides you with complete authority over the. Check with your county recorder's office to determine filing requirements. After you obtain the name certificate, the next step sole proprietors need to. Web sole proprietorships are filed only at the county level. Ad have plans to get investors & go public?

How to an Illinois Sole Proprietorship in 2022

There is usually no government filing or approval required to operate your business as a. Check with your county recorder's office to determine filing requirements. Once you have a business idea and have decided to operate as a sole. Sole proprietorship advantages sole proprietorship disadvantages how to start an illinois sole. It is the simplest form of.

When A Business Name Is Different From The Owner (S) Full Legal Name (S), The Illinois Assumed Name Act Requires Sole.

This is a business entity that doesn’t elect to separate business finances and liabilities from the business owner’s personal matters. Web you will need to register with the illinois department of revenue business registration. Web how to start an illinois sole proprietorship. There is usually no government filing or approval required to operate your business as a.

Web Sole Proprietorships Are Filed Only At The County Level.

Ad have plans to get investors & go public? Web locate registered business names. Choose a business name for your sole proprietorship and check for availability. Web considerations control do you feel the need to have total control of your business?

Sole Proprietorship Advantages Sole Proprietorship Disadvantages How To Start An Illinois Sole.

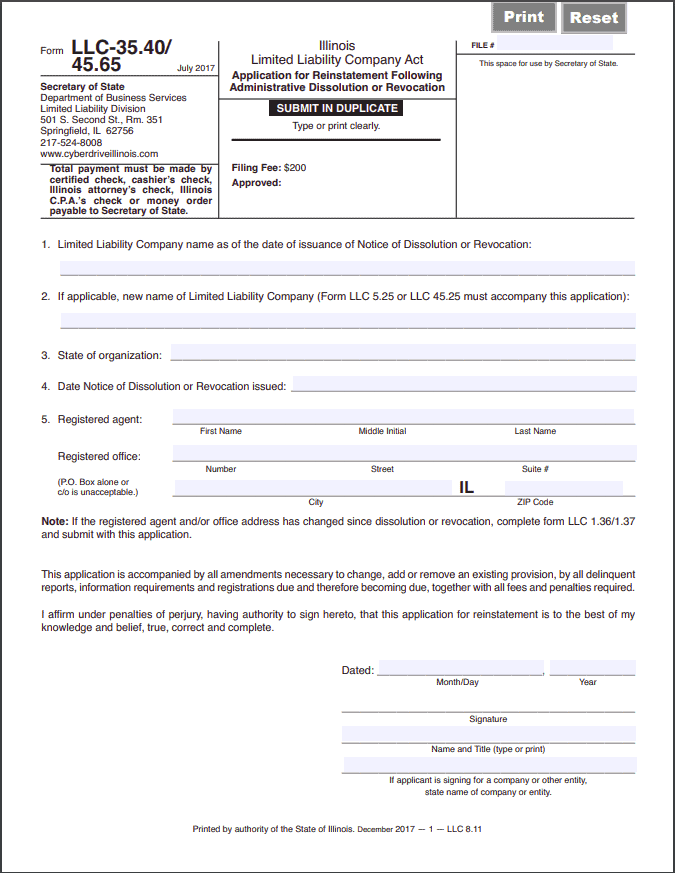

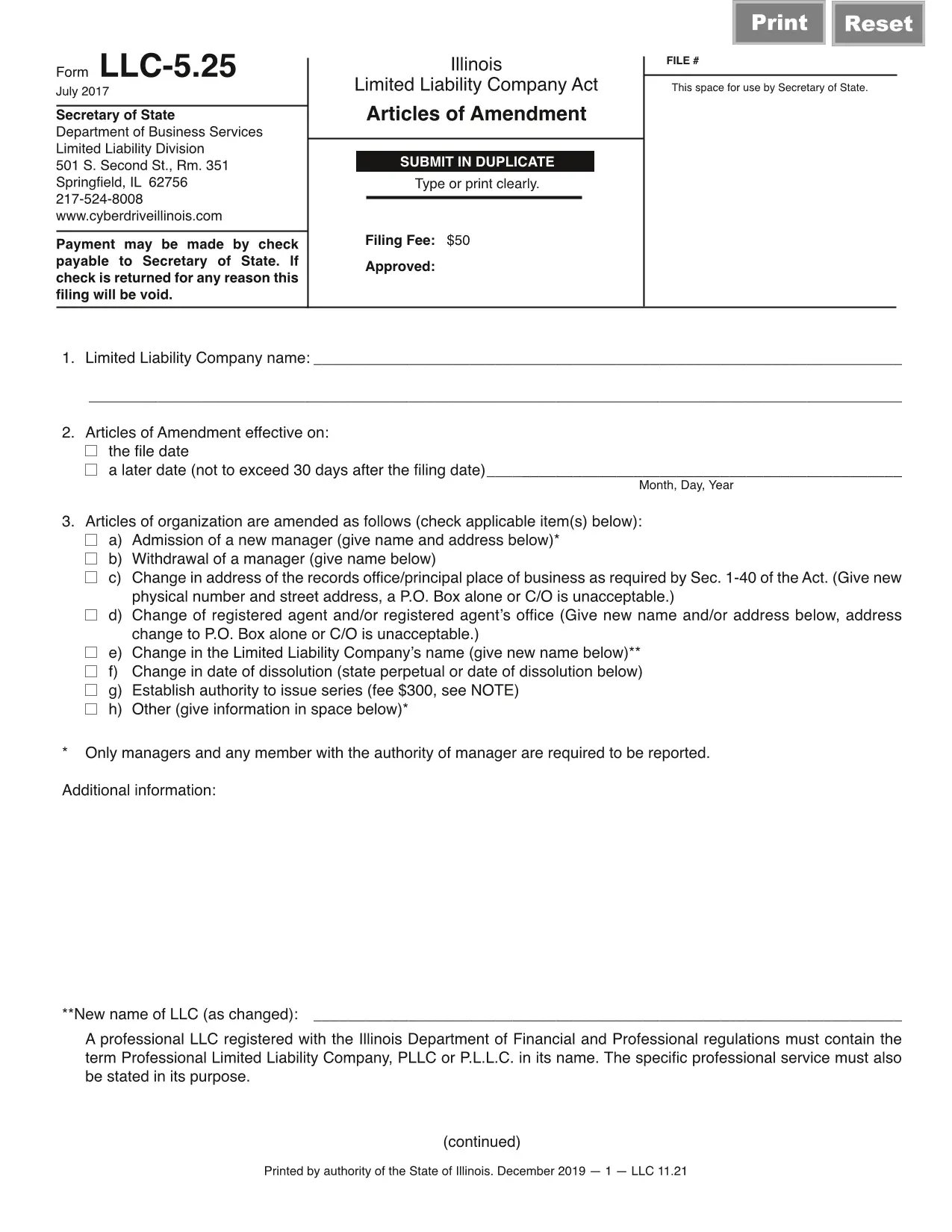

Web start an llc ready to form an llc? Web step 1 #1: Web filing & payment requirements. Once you have a business idea and have decided to operate as a sole.

Web A Sole Proprietor Is An Individual Who Owns An Unincorporated Business That Is Not Registered As A Corporation Or Limited Liability Company.

After you obtain the name certificate, the next step sole proprietors need to. Check with your county recorder's office to determine filing requirements. Web learn about hide what is a sole proprietorship? The business owner puts in all the money, makes all decisions, pays federal income tax on net income using schedule c to form.