How To Report Form 3922 On Tax Return

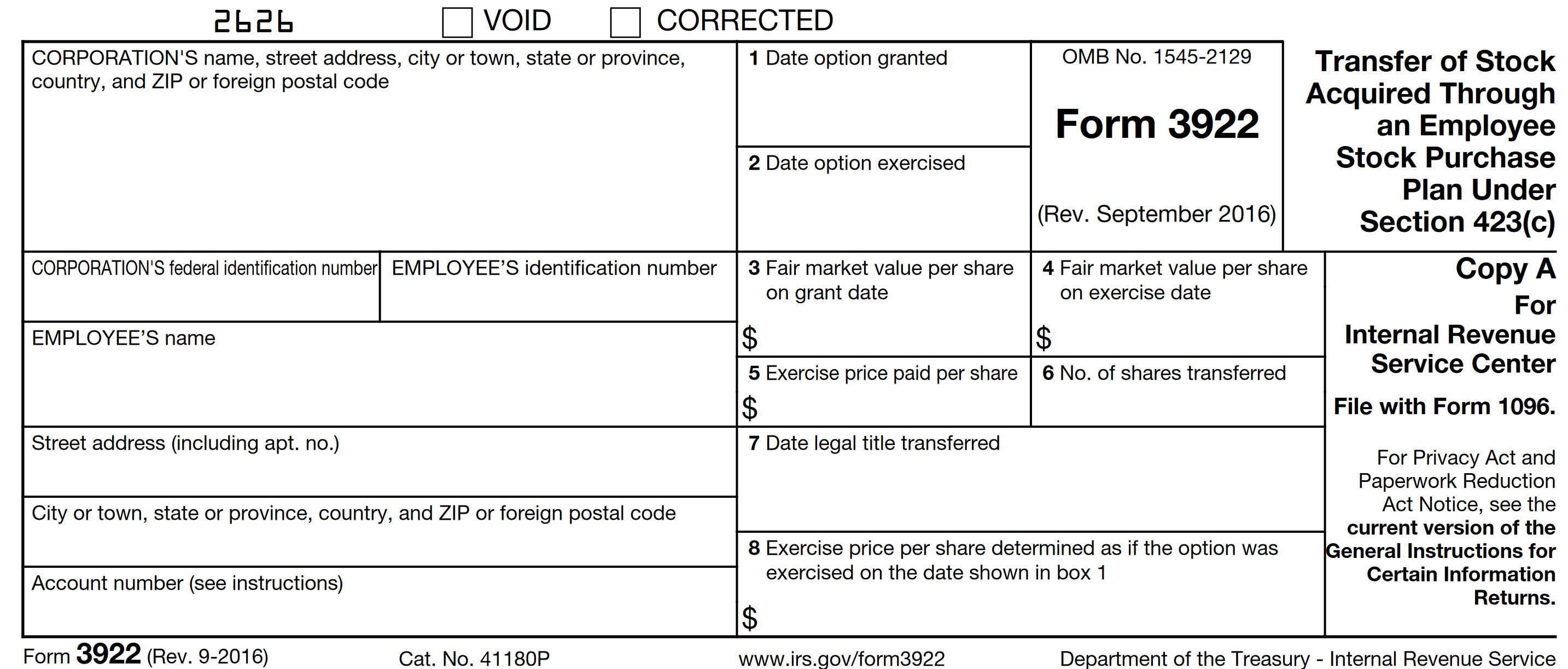

How To Report Form 3922 On Tax Return - Web solved • by intuit • 415 • updated july 14, 2022. The information on form 3922 will help determine your cost or other basis, as well as your holding period. Web this needs to be reported on your tax return. The information on form 3922 will help determine your cost or other basis, as well as your holding period. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and is not. Web taxes 8 minute read file for less and get more. Web recognize (report) gain or loss on your tax return for the year in which you sell or otherwise dispose of the stock. Web 1 best answer helenac new member if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee. Get started for free stock options and stock purchase plans are a popular way for employers. Web step by step guidance if you participate in an employee stock purchase plan, you probably will receive irs form 3922 from your employer at the end of the tax.

Your max tax refund is guaranteed. The information on form 3922 will help determine your cost or other basis, as well as your holding period. Web irs form 3922 is for informational purposes only and isn't entered into your return. Web this needs to be reported on your tax return. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Keep the form for your records because you’ll need the information when you sell, assign, or. Web date of grant), must, for that calendar year, file form 3922 for each transfer made during that year. Web taxes 8 minute read file for less and get more. Web when you acquire stock through an employee stock purchase plan, you must report the transaction on irs form 3922. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates,.

Your max tax refund is guaranteed. Form 3922 is an informational statement and would not be entered into the tax return. Web step by step guidance if you participate in an employee stock purchase plan, you probably will receive irs form 3922 from your employer at the end of the tax. Web 1 best answer irenes intuit alumni if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee. Web date of grant), must, for that calendar year, file form 3922 for each transfer made during that year. Complete, edit or print tax forms instantly. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates,. Web irs form 3922 is for informational purposes only and isn't entered into your return. Web this needs to be reported on your tax return. Web this needs to be reported on your tax return.

Tax Reporting For Stock Compensation Understanding Form W2, Form 3922

Web when you acquire stock through an employee stock purchase plan, you must report the transaction on irs form 3922. Web 1 best answer helenac new member if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee. Keep the form for your records because you’ll need the information when you sell,.

W2 diagram If I make a disqualifying disposition with my ESPP stock

Web date of grant), must, for that calendar year, file form 3922 for each transfer made during that year. Web when you acquire stock through an employee stock purchase plan, you must report the transaction on irs form 3922. Web 1 9 8,977 reply bookmark icon 1 best answer tomyoung level 13 when you sell stocks that you've acquired via.

ez1099 Software How to Print or eFile Form 3922, Transfer of Stock

Web 1 9 8,977 reply bookmark icon 1 best answer tomyoung level 13 when you sell stocks that you've acquired via an espp, such a sale can create compensation. Web recognize (report) gain or loss on your tax return for the year in which you sell or otherwise dispose of the stock. This form is used by corporations to report.

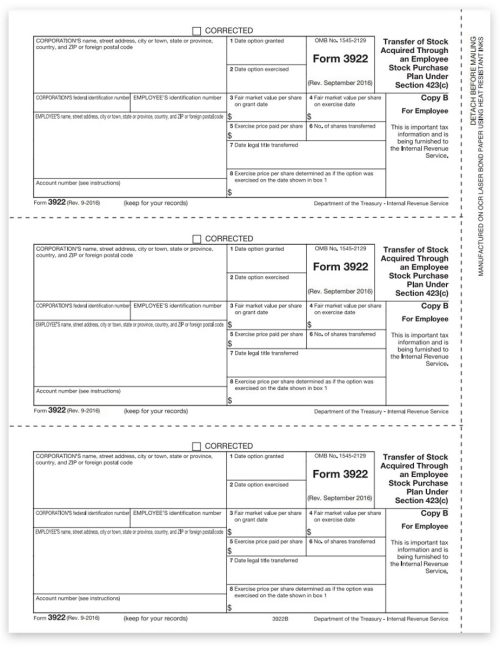

3922 Forms, Employee Stock Purchase, Employee Copy B DiscountTaxForms

Web 1 9 8,977 reply bookmark icon 1 best answer tomyoung level 13 when you sell stocks that you've acquired via an espp, such a sale can create compensation. Your max tax refund is guaranteed. Web 1 best answer helenac new member if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an.

Documents to Bring To Tax Preparer Tax Documents Checklist

Web this needs to be reported on your tax return. Web this needs to be reported on your tax return. Web 1 best answer helenac new member if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee. Web recognize (report) gain or loss on your tax return for the year in.

Form 5330 Return of Excise Taxes Related to Employee Benefit Plans

Web easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile now more salient. Web taxes 8 minute read file for less and get more. A return is required by reason of a transfer described in section 6039(a)(2). Web solved • by intuit • 415 • updated july 14, 2022..

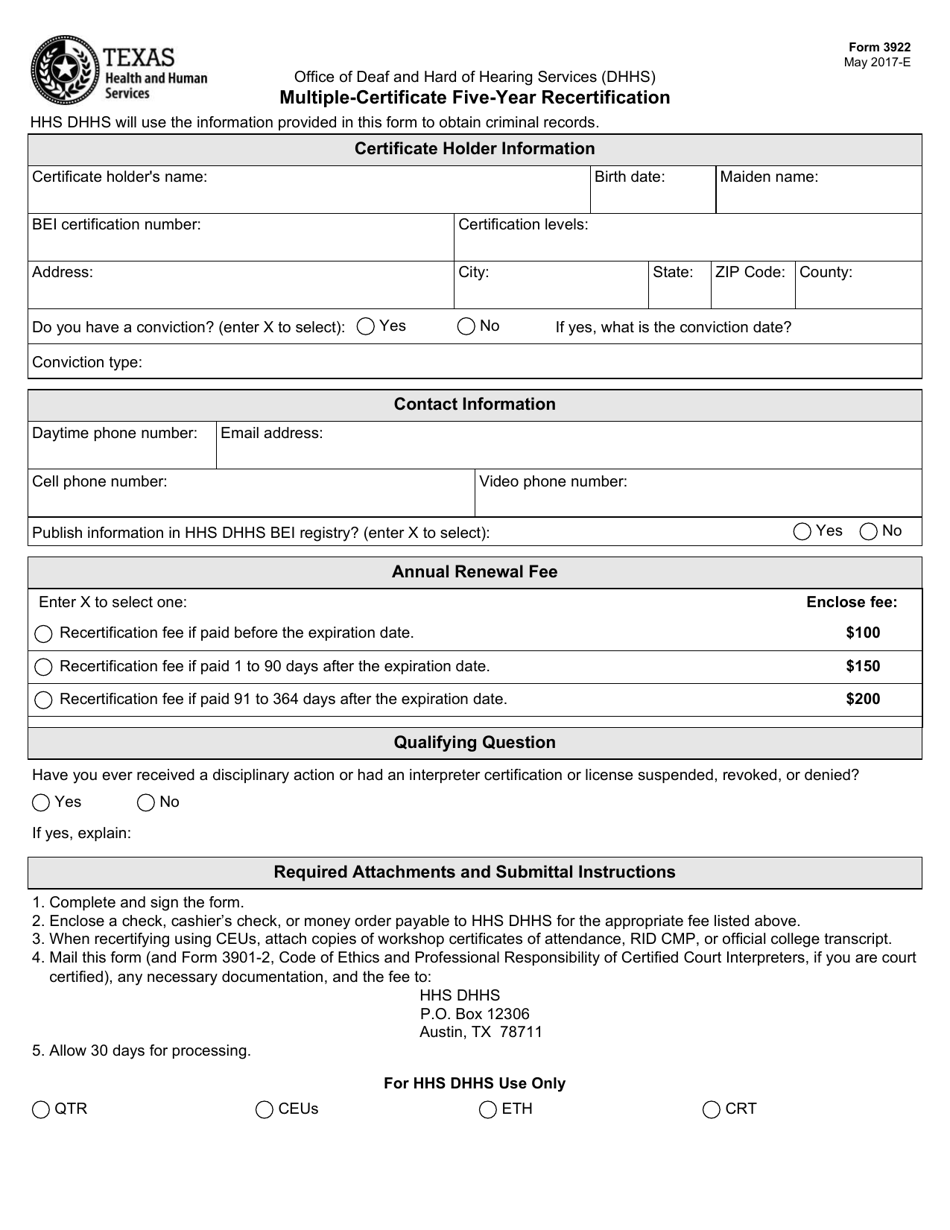

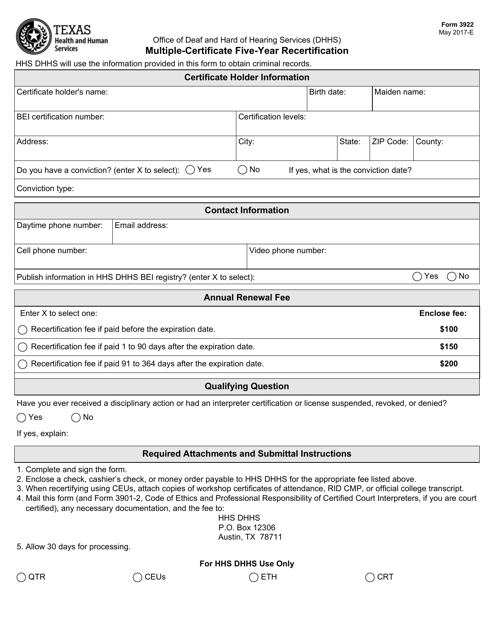

Form 3922 Download Fillable PDF or Fill Online MultipleCertificate

Web you should have received form 3922 when you exercised your stock options. Web 1 9 8,977 reply bookmark icon 1 best answer tomyoung level 13 when you sell stocks that you've acquired via an espp, such a sale can create compensation. Web when you acquire stock through an employee stock purchase plan, you must report the transaction on irs.

How to report company stock options on tax return

This form is used by corporations to report stock. Get started for free stock options and stock purchase plans are a popular way for employers. Keep this form and use it to figure the gain or loss. The information on form 3922 will help determine your cost or other basis, as well as your holding period. A return is required.

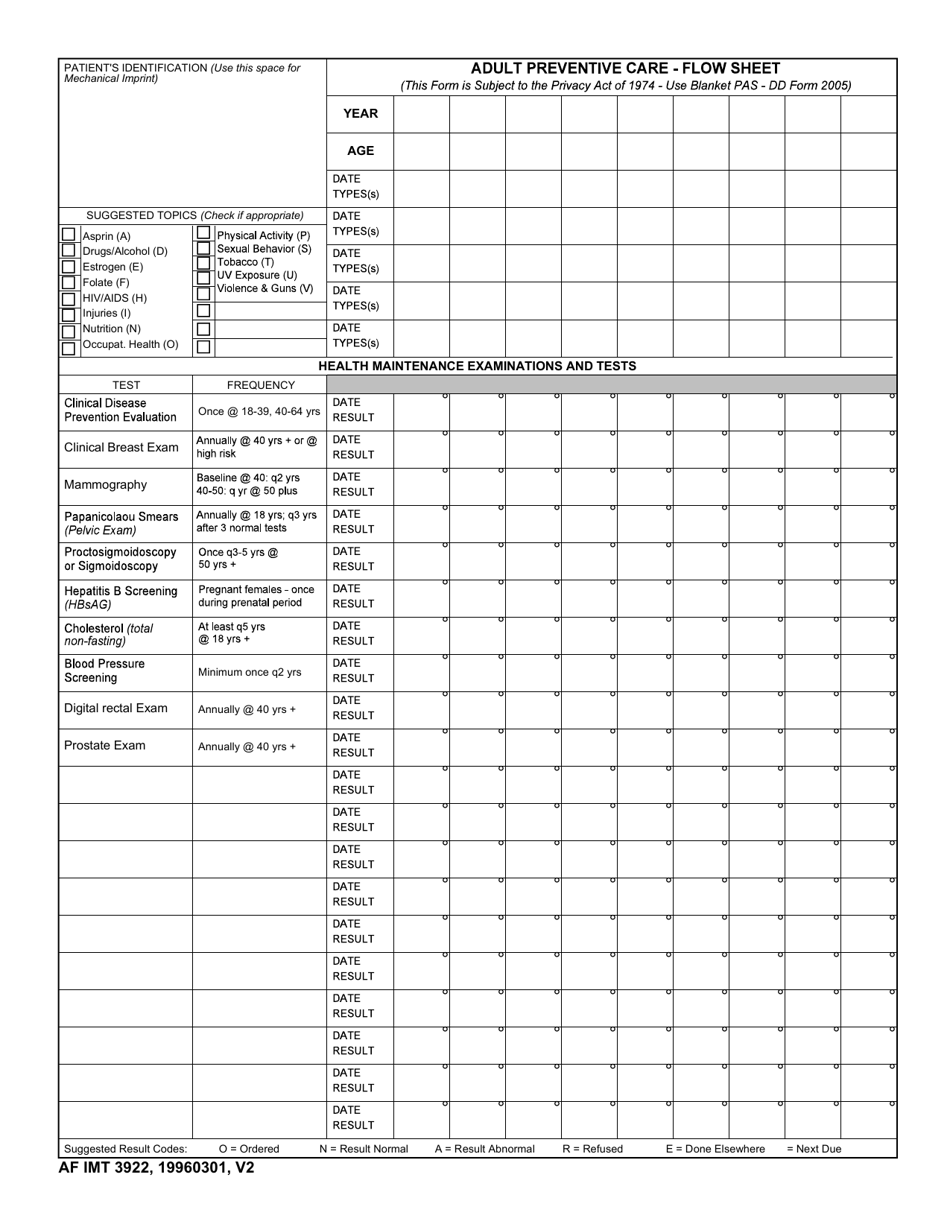

AF IMT Form 3922 Download Fillable PDF or Fill Online Adult Preventive

Web easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile now more salient. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and is not. Web to get or to order these instructions, go to.

Form 3922 Download Fillable PDF or Fill Online MultipleCertificate

Get started for free stock options and stock purchase plans are a popular way for employers. Web this needs to be reported on your tax return. Web this needs to be reported on your tax return. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web solved • by intuit • 415 • updated july 14, 2022. Web taxes 8 minute read file for less and get more. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates,. A return is required by reason of a transfer described in section 6039(a)(2).

Web Form 3922 Transfer Of Stock Acquired Through An Employee Stock Purchase Plan Under Section 423 (C) Is For Informational Purposes Only And Isn't Entered Into Your Return.

The information on form 3922 will help determine your cost or other basis, as well as your holding period. Your max tax refund is guaranteed. Web this needs to be reported on your tax return. Web date of grant), must, for that calendar year, file form 3922 for each transfer made during that year.

Keep The Form For Your Records Because You’ll Need The Information When You Sell, Assign, Or.

Keep this form and use it to figure the gain or loss. Web 1 best answer irenes intuit alumni if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee. Web step by step guidance if you participate in an employee stock purchase plan, you probably will receive irs form 3922 from your employer at the end of the tax. Web you should have received form 3922 when you exercised your stock options.

Web 1 9 8,977 Reply Bookmark Icon 1 Best Answer Tomyoung Level 13 When You Sell Stocks That You've Acquired Via An Espp, Such A Sale Can Create Compensation.

Complete, edit or print tax forms instantly. Web to get or to order these instructions, go to www.irs.gov/form3922. Get started for free stock options and stock purchase plans are a popular way for employers. Web this needs to be reported on your tax return.