How To Report Third Party Sick Pay On Form 941

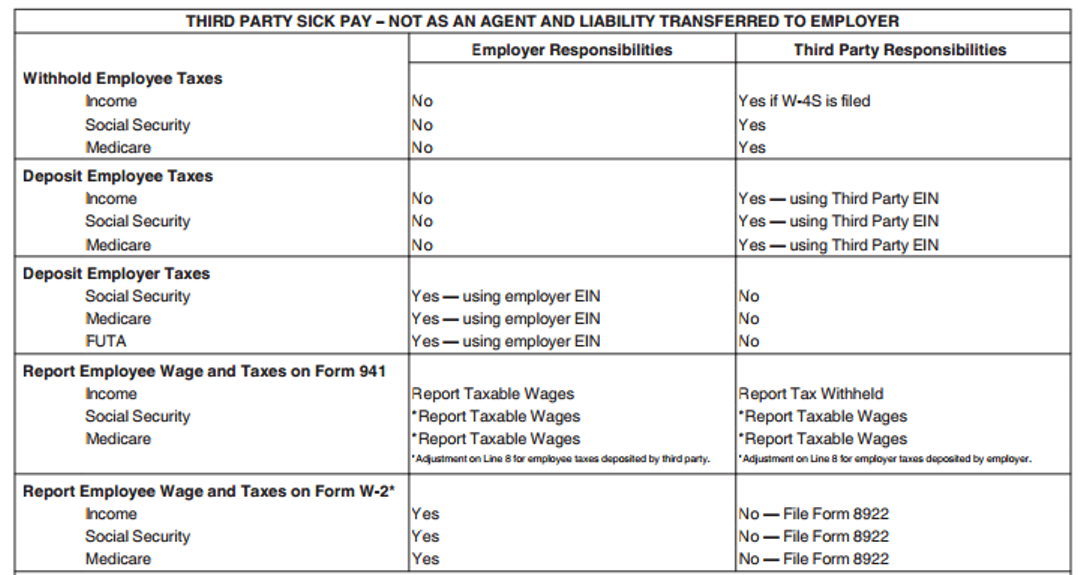

How To Report Third Party Sick Pay On Form 941 - Web to report third party sick pay on 941 form: Web use form 941 to report: You will need to report both the employer and the employee parts for. Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share of. Use this form to reconcile. Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share of. On line 8, manually enter the amount for the employee. Report both the employer and employee shares of social security and medicare taxes for sick pay on lines 6b and 7b of form 941. Official site | smart tools. This info is required by the irs for reporting purposes.

Official site | smart tools. Use this form to reconcile. Web to report third party sick pay on 941 form: Report both the employer and employee shares of social security and medicare taxes for sick pay on lines 6b and 7b of form 941. Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share of. Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share of. This info is required by the irs for reporting purposes. Web use form 941 to report: You will need to report both the employer and the employee parts for. On line 8, manually enter the amount for the employee.

Web use form 941 to report: Follow steps in related article below, how to print 941 and schedule b forms; On line 8, manually enter the amount for the employee. Report both the employer and employee shares of social security and medicare taxes for sick pay on lines 6b and 7b of form 941. This info is required by the irs for reporting purposes. You will need to report both the employer and the employee parts for. Use this form to reconcile. Official site | smart tools. Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share of. Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share of.

Is Third Party Sick Pay Taxable PEO Guide (2022)

On line 8, manually enter the amount for the employee. You will need to report both the employer and the employee parts for. Follow steps in related article below, how to print 941 and schedule b forms; Use this form to reconcile. Official site | smart tools.

How to account for Third Party Sick Pay on W2 and 941 tax forms for

This info is required by the irs for reporting purposes. Web to report third party sick pay on 941 form: Web use form 941 to report: Official site | smart tools. On line 8, manually enter the amount for the employee.

Third Party Sick Pay W2 slidesharetrick

Use this form to reconcile. Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share of. You will need to report both the employer and the employee parts for. Web qualified sick leave wages and qualified family leave wages.

Third Party Sick Pay slidesharetrick

Web to report third party sick pay on 941 form: Official site | smart tools. Report both the employer and employee shares of social security and medicare taxes for sick pay on lines 6b and 7b of form 941. Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and.

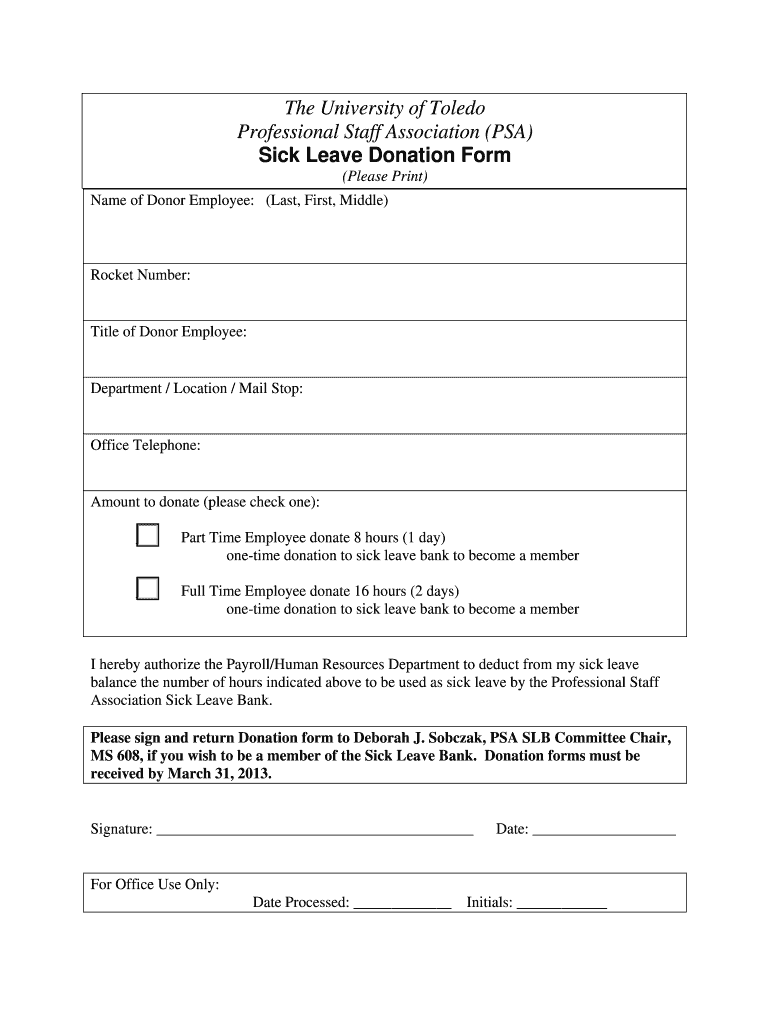

Sick Leave Form Template Fill Out and Sign Printable PDF Template

Web to report third party sick pay on 941 form: Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share of. Web use form 941 to report: You will need to report both the employer and the employee parts.

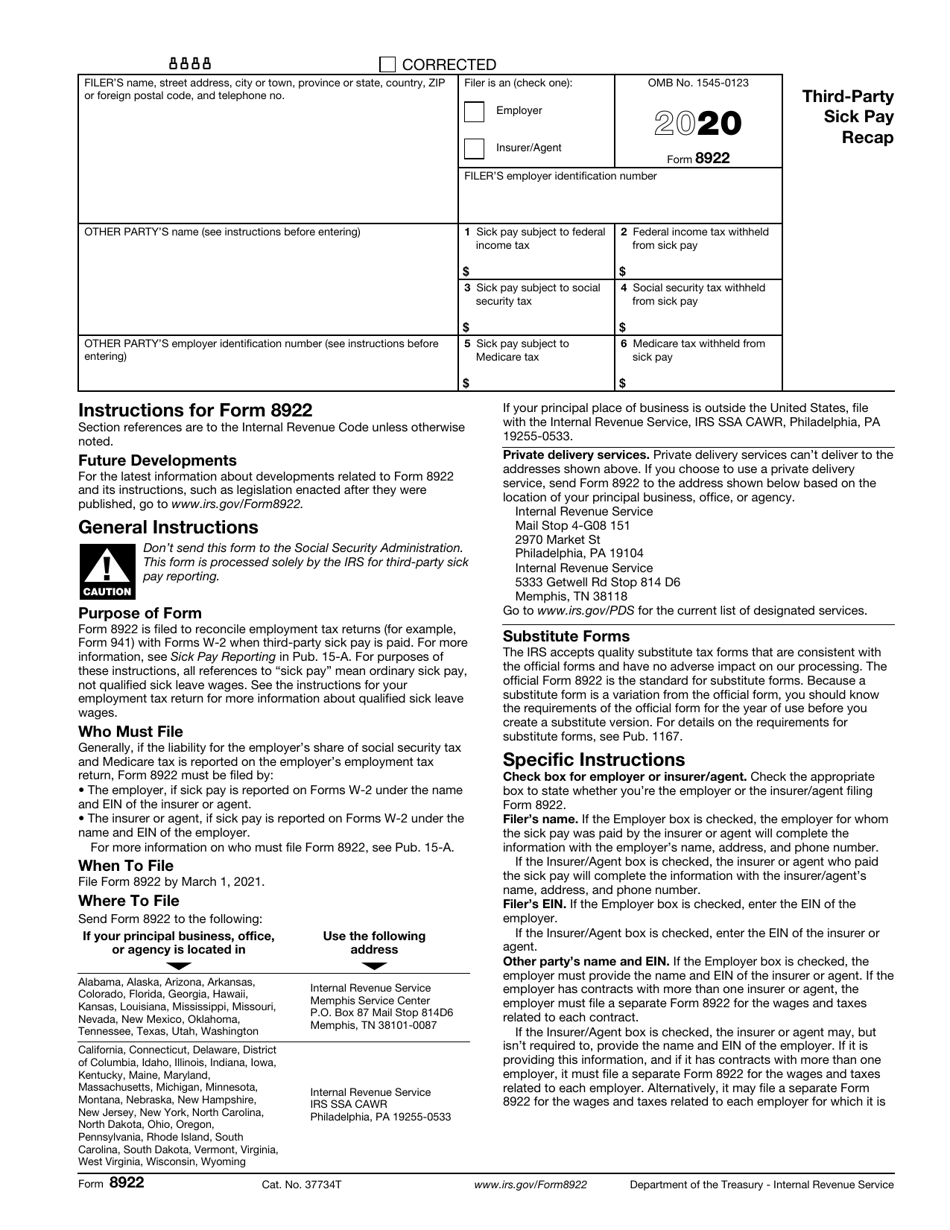

IRS Form 8922 Download Fillable PDF or Fill Online ThirdParty Sick Pay

Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share of. You will need to report both the employer and the employee parts for. This info is required by the irs for reporting purposes. Web use form 941 to.

Is Third Party Sick Pay Taxable PEO Guide (2022)

Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share of. On line 8, manually enter the amount for the employee. Use this form to reconcile. You will need to report both the employer and the employee parts for..

Is Third Party Sick Pay Taxable PEO Guide

Web to report third party sick pay on 941 form: Follow steps in related article below, how to print 941 and schedule b forms; Official site | smart tools. You will need to report both the employer and the employee parts for. Report both the employer and employee shares of social security and medicare taxes for sick pay on lines.

Third Party Sick Payment Notification Example NWOCA Fiscal Services

Use this form to reconcile. On line 8, manually enter the amount for the employee. Official site | smart tools. Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share of. This info is required by the irs for.

Third Party Sick Pay W2 slidesharetrick

Report both the employer and employee shares of social security and medicare taxes for sick pay on lines 6b and 7b of form 941. Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share of. Follow steps in related.

Use This Form To Reconcile.

Follow steps in related article below, how to print 941 and schedule b forms; Web to report third party sick pay on 941 form: This info is required by the irs for reporting purposes. You will need to report both the employer and the employee parts for.

Report Both The Employer And Employee Shares Of Social Security And Medicare Taxes For Sick Pay On Lines 6B And 7B Of Form 941.

Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share of. Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share of. Web use form 941 to report: Official site | smart tools.